Sive Morten

Special Consultant to the FPA

- Messages

- 18,621

You can follow these trades here.

Sive Morten Signals - Forex Trading Signals Test by Forex Peace Army

Buy EUR/USD 1.4800 s/l- t/p 1.4840 (1.0 lot).

Result : manual close at 1.4770 “-301$”

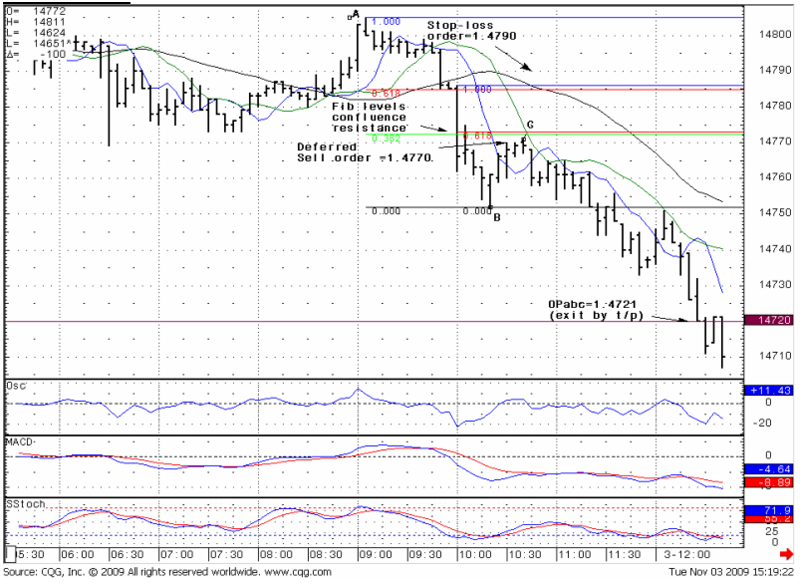

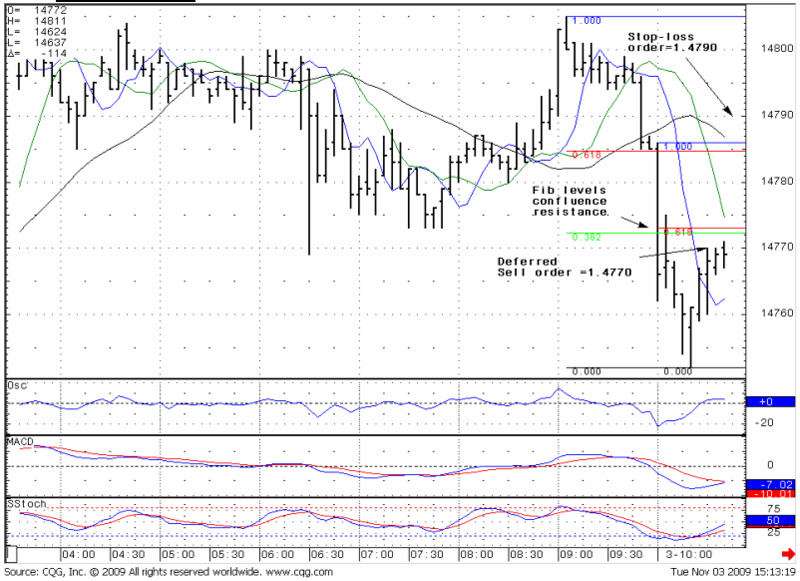

Sell EUR/USD 1.4770 s/l 1.4790 t/p 1.4720 (0.85 lot).

Result : t/p “425$”

Net result “125$”

Actually, I would like to describe another trade first, but this one is much more interesting to discuss. As a many traders I have a trade journal, where I record all trades that I’ve made. I make an analysis of them, trying to find mistakes that lead me to lose money. I hate to lose money, I think you also do not like to lose money. That’s why it a great stimulus to make this work – search for mistakes. I’ll try to point out my mistakes in this trade and how I can creep out with profit from this teeth crushing trade. This trade is also interesting, because here you can see two quite different trades – how I shouldn’t trade and how I should.

This was a 1 Hour context 5 min enter trading. Let’s go through it…

FIRST LEG OF THE DEAL

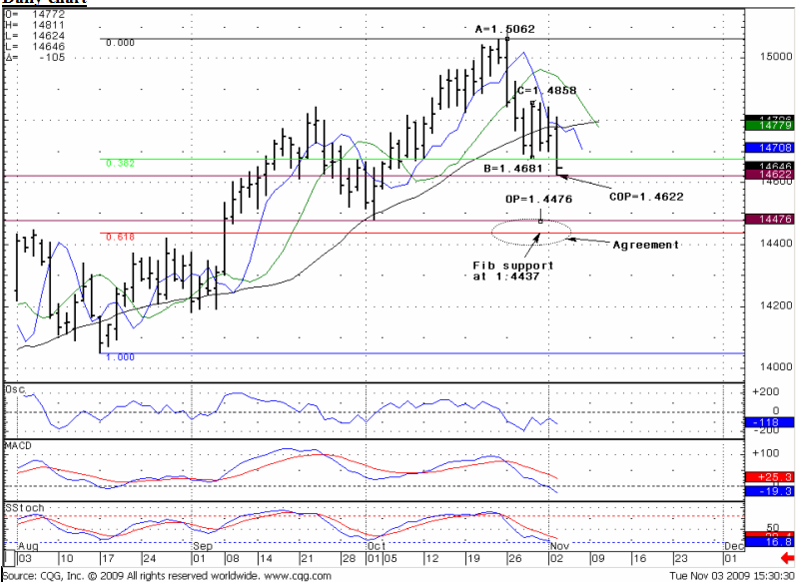

1. Context

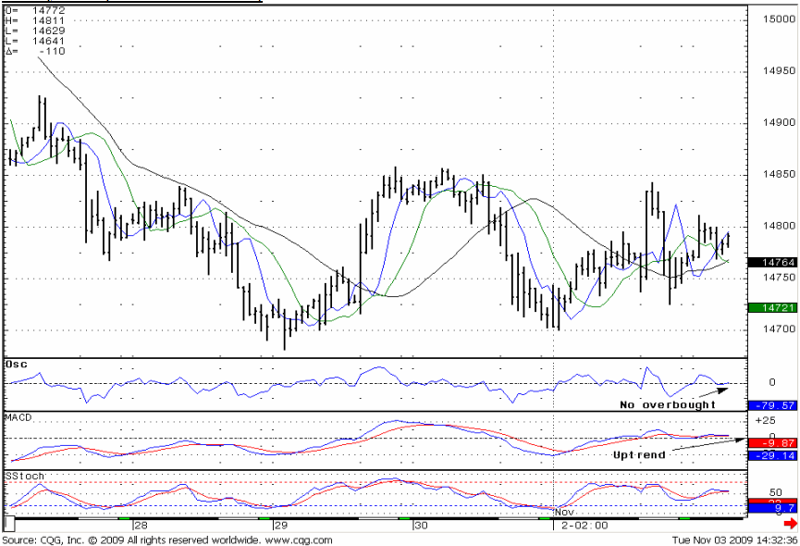

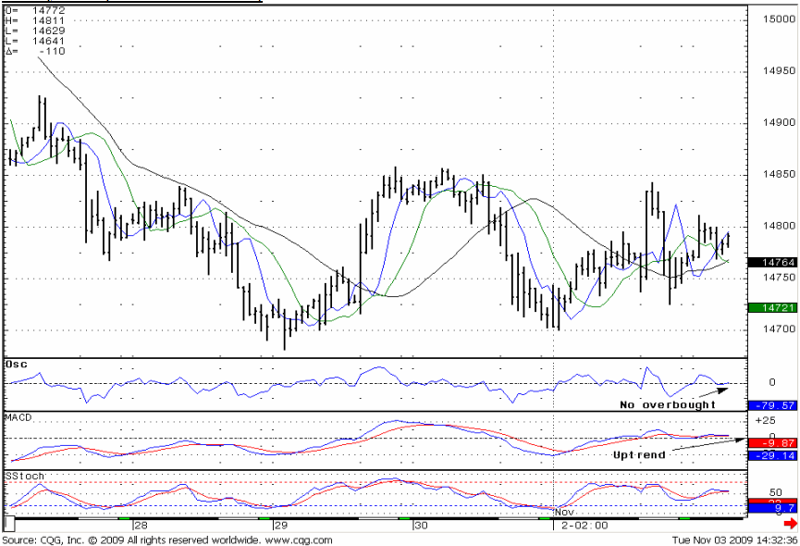

When I’ve looked at hourly chart, trends were up, so I’ve decided to look for opportunity for short-term long trade. There was no overbought level.

Hourly chart (when I looked at it)

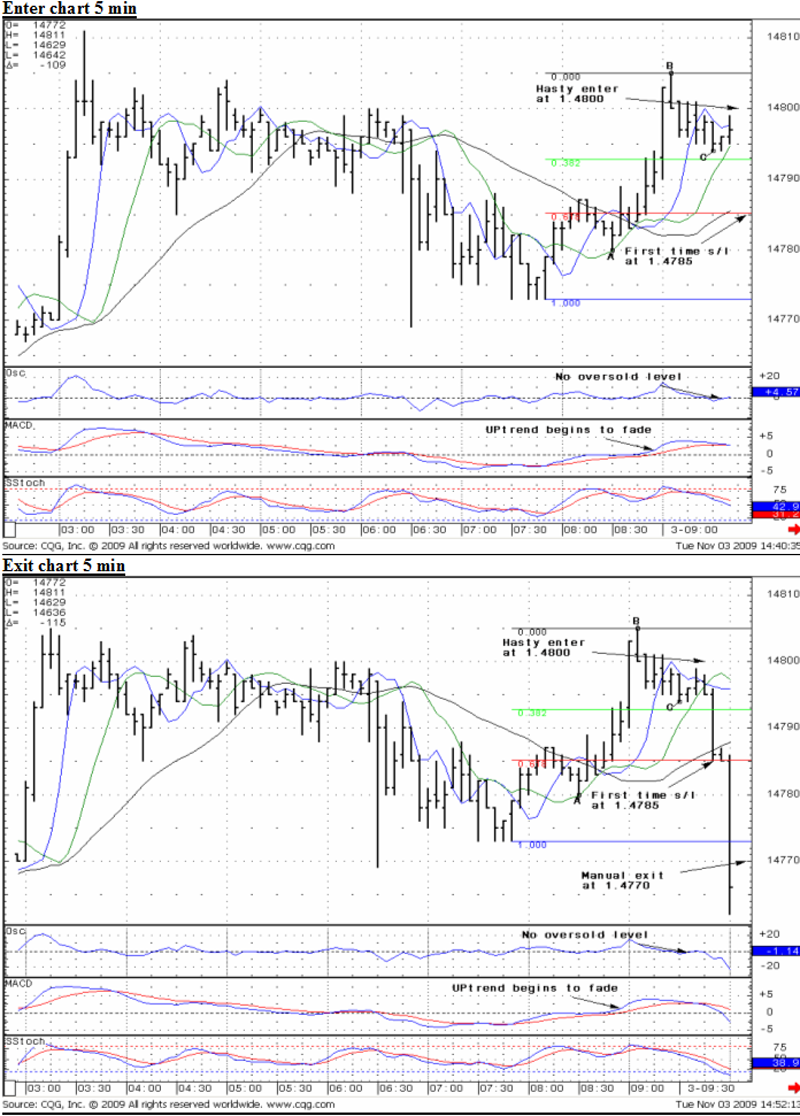

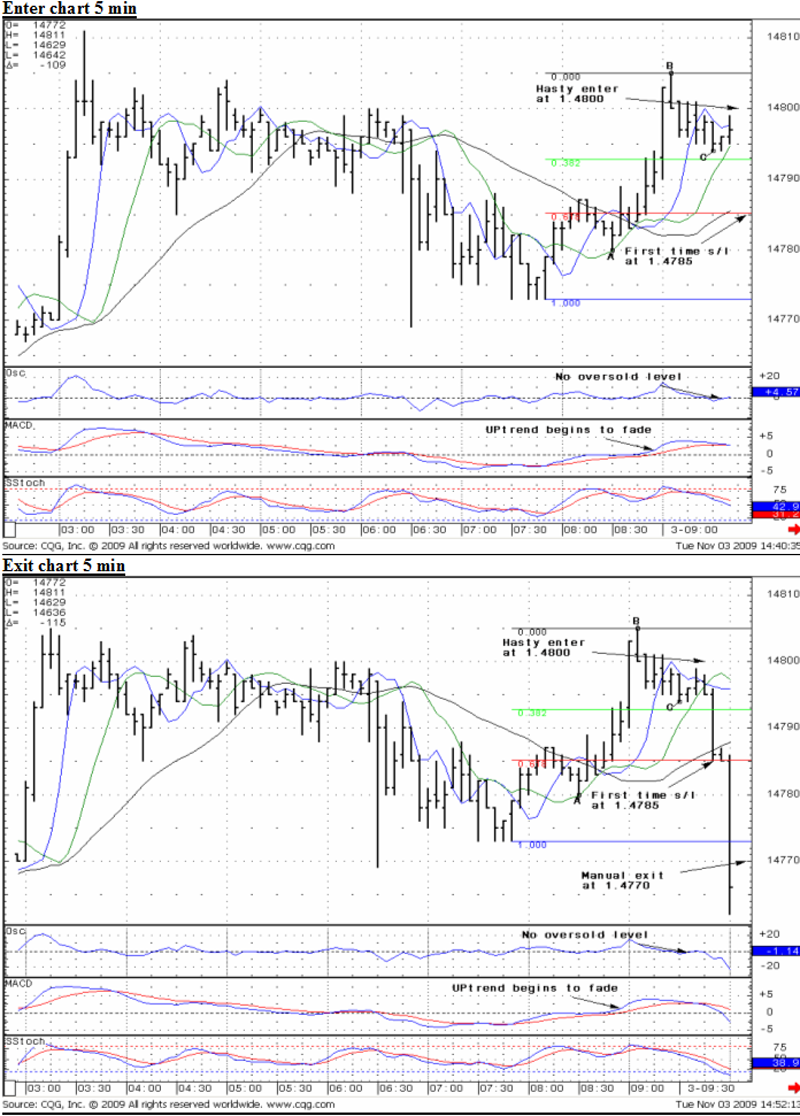

5 minute enter chart

When I’ve looked at this one, I saw beginning of an upside move from the nearest 0.382 Fib. level. Hourly trends were up, so I’ve “jumped” in the market. My first stop was just under 0.618 Fib level. After that a strong reversal move began. It was very quick. But this has happened before and very often, so I’ve decided to cancel my s/l and wait for Oversold on the 5 min chart that should appear near 0.618 level. I’ve calculated objective points for target and have choose an OP =1.4840, because it coincided with strong hourly resistance level(1.4840). Then, I’ve expected the up move should start but, as it happened, surely it didn’t start. The market broke 0.618 and I had to close the position rapidly fixing -30 pips instead of -10. It was very disappointing moment, the market was very fast. And I also experienced slippage, that added some pips to the loss. I have to pay for mistakes and buy an experience. The hourly trends have broken down.

So, it was a terrible trade, but they happen not too often, fortunately.

What mistakes I have made?

1. Never cancel the stop-loss - only with replacement and on the calm market.

2. I should have waited for when 5-min trends will turn in the same direction as an hourly trends, but I entered without confirmation of hourly trend with 5-min trend. As we see then there was no confirmation at all and the hourly trend turned bearish.

3. I should not have entered the market by jumping in it, but on the retracement from the move up from Fib support. If I had followed this rule, I wouldn't have entered the market at all, because when it has happened, hourly trends were already bearish.

I try always following rules, but from time to time these kind of trades could happen even with most professional traders (I’m speaking not about myself now)– if you loose concentration a bit, or are just tired. That’s why we should take periodic pause in trading and rest some days, especially if you are intraday trader.

So, the context of trading has changed, what do we do now? We should to change our trading plan accordingly. We need to go short…

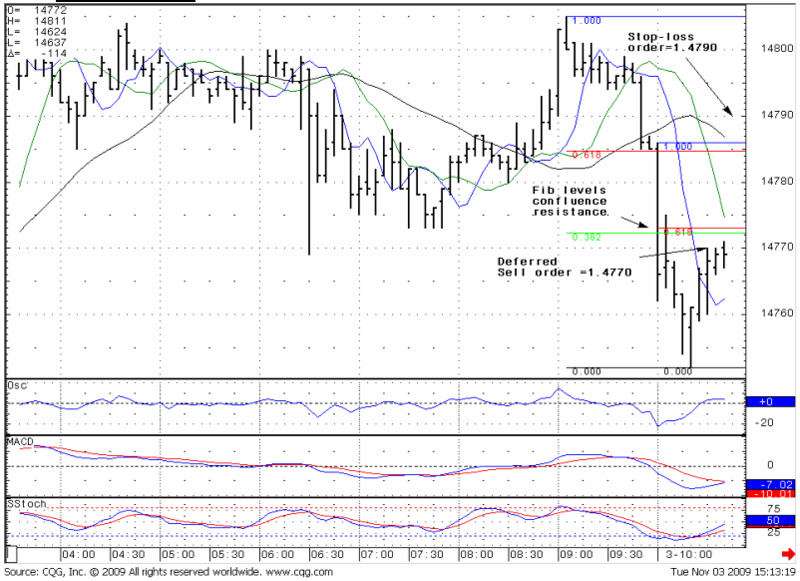

PROCEEDING WITH TRADE (SECOND LEG OF THE DEAL)

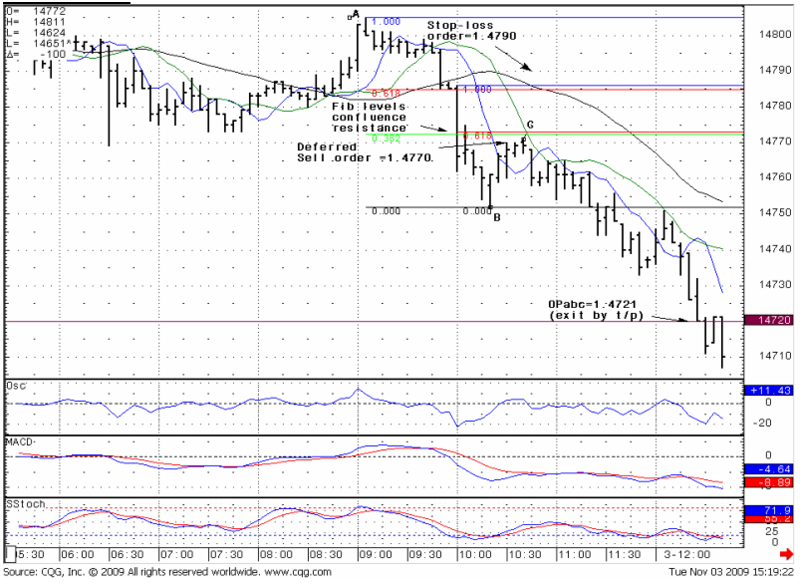

To enter on short side, I also need a retracement higher. Taking into consideration the strong thrusting down move, this retracement shouldn’t be deep. I’ve thought that it should be the nearest confluence area of Fib. levels. Soon, the retracement had started, and I’ve placed a deferred order with sell price a bit lower than the Fib. confluence resistance and s/l a bit higher than 0.618 level from the maximum of the move.

5 min chart Enter

I entered, my stop was untouched and the trade started. When the high point of retracement from which I entered appeared, I calculated a target for the trade, and also choose an OP=1.4720. First, because 1.4710 level gave me an extreme oversold on hourly chart. Second, because 1.4786-1.4707 is a strong daily support.

Then it hit my t/p order and the market went further. This exit was absolutely correct, because this was an hourly, not a daily trade.

5 min Exit chart

As a result, I got 125$ net profit, even when we take into consideration that I’ve made a terrible trade first with a lot of mistakes. The main thing in this trade description is that your mind should be very flexible and can switch as a relay if the context changes rapidly when it is really necessary. This is even more important for intraday trading.

Sive Morten Signals - Forex Trading Signals Test by Forex Peace Army

Buy EUR/USD 1.4800 s/l- t/p 1.4840 (1.0 lot).

Result : manual close at 1.4770 “-301$”

Sell EUR/USD 1.4770 s/l 1.4790 t/p 1.4720 (0.85 lot).

Result : t/p “425$”

Net result “125$”

Actually, I would like to describe another trade first, but this one is much more interesting to discuss. As a many traders I have a trade journal, where I record all trades that I’ve made. I make an analysis of them, trying to find mistakes that lead me to lose money. I hate to lose money, I think you also do not like to lose money. That’s why it a great stimulus to make this work – search for mistakes. I’ll try to point out my mistakes in this trade and how I can creep out with profit from this teeth crushing trade. This trade is also interesting, because here you can see two quite different trades – how I shouldn’t trade and how I should.

This was a 1 Hour context 5 min enter trading. Let’s go through it…

FIRST LEG OF THE DEAL

1. Context

When I’ve looked at hourly chart, trends were up, so I’ve decided to look for opportunity for short-term long trade. There was no overbought level.

Hourly chart (when I looked at it)

5 minute enter chart

When I’ve looked at this one, I saw beginning of an upside move from the nearest 0.382 Fib. level. Hourly trends were up, so I’ve “jumped” in the market. My first stop was just under 0.618 Fib level. After that a strong reversal move began. It was very quick. But this has happened before and very often, so I’ve decided to cancel my s/l and wait for Oversold on the 5 min chart that should appear near 0.618 level. I’ve calculated objective points for target and have choose an OP =1.4840, because it coincided with strong hourly resistance level(1.4840). Then, I’ve expected the up move should start but, as it happened, surely it didn’t start. The market broke 0.618 and I had to close the position rapidly fixing -30 pips instead of -10. It was very disappointing moment, the market was very fast. And I also experienced slippage, that added some pips to the loss. I have to pay for mistakes and buy an experience. The hourly trends have broken down.

So, it was a terrible trade, but they happen not too often, fortunately.

What mistakes I have made?

1. Never cancel the stop-loss - only with replacement and on the calm market.

2. I should have waited for when 5-min trends will turn in the same direction as an hourly trends, but I entered without confirmation of hourly trend with 5-min trend. As we see then there was no confirmation at all and the hourly trend turned bearish.

3. I should not have entered the market by jumping in it, but on the retracement from the move up from Fib support. If I had followed this rule, I wouldn't have entered the market at all, because when it has happened, hourly trends were already bearish.

I try always following rules, but from time to time these kind of trades could happen even with most professional traders (I’m speaking not about myself now)– if you loose concentration a bit, or are just tired. That’s why we should take periodic pause in trading and rest some days, especially if you are intraday trader.

So, the context of trading has changed, what do we do now? We should to change our trading plan accordingly. We need to go short…

PROCEEDING WITH TRADE (SECOND LEG OF THE DEAL)

To enter on short side, I also need a retracement higher. Taking into consideration the strong thrusting down move, this retracement shouldn’t be deep. I’ve thought that it should be the nearest confluence area of Fib. levels. Soon, the retracement had started, and I’ve placed a deferred order with sell price a bit lower than the Fib. confluence resistance and s/l a bit higher than 0.618 level from the maximum of the move.

5 min chart Enter

I entered, my stop was untouched and the trade started. When the high point of retracement from which I entered appeared, I calculated a target for the trade, and also choose an OP=1.4720. First, because 1.4710 level gave me an extreme oversold on hourly chart. Second, because 1.4786-1.4707 is a strong daily support.

Then it hit my t/p order and the market went further. This exit was absolutely correct, because this was an hourly, not a daily trade.

5 min Exit chart

As a result, I got 125$ net profit, even when we take into consideration that I’ve made a terrible trade first with a lot of mistakes. The main thing in this trade description is that your mind should be very flexible and can switch as a relay if the context changes rapidly when it is really necessary. This is even more important for intraday trading.