4hr Anchor Currency Map Building The Case

Timeless Trading

Hello, My name is Kasim and I am a Sniper Jar head Swing Trader.

I am imploying this method of trading to improve my Timing, patience and management of each trade.

I am using the Daily but Mainly 240min Time Frame as an Anchor. As a Sniper we must be quietly patient. Therefore there may not be many signals as i look for intraday set up's that complement my

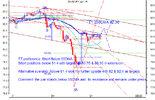

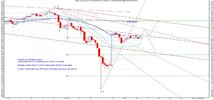

4hr outlook of the 6 Currencies ( GBPUSD, EURUSD,AUDUSD,USDCHF,USDJPY,USDCAD are all dollar based. Therefore, I will be analysing and monitoring the Dollar index and gold,oil for clues. The strategy is to build a case for each currency and try to spot the best Low risk High Probability Trades that I recognize.

In each chart there is a 'Blue Print' of what I think might happen with alternative scenarios. Depending on whether Mr prices breaks or respects certain junctions I will act accordingly following Price behaviour with news.

In 90% of cases we are bullish above the 55DMA and bearish Below the 55DMA always going with the trend.Comments are welcome

[/LEFT]

Arsenal of Skill

Harmoincs

Poseidon (Andrews Pitchfork)

Elliot wave

Speed Line. Trend line breaks

News to match Techincals outlook

Technique

DMA(Day Moving average )

Bollinger bands (21)

8DMA Cross Momentum

55DMA Bullish above Bearish Below

90DMA,200DMA Trend indicator

4hr Stochastics

MAC/D

RSI

I would just like to add this is my personal journal so that i may improve my Forex Military Rank. So comments welcome

You can also vist my blog to see charts at Timelesstrading.blogspot.com

but the signal shall be posted here