WaveRider

Master Sergeant

- Messages

- 350

I created this thread out of frustration. I'd been hunting for holy grail indicators and read about moving average crosses and macd divergence and all sorts of silliness and nothing worked so I decided to stop chasing dreams and start trading and simplify. I've got a good strategy that works well for me now and has made me pip positive. This is part that takes patience and trust in your system. The psychological portion that all successful traders say is the hardest. This is a journal so I'll be posting losses and wins and how I screwed up as well as conquered the world. James16, Sive Morton's EUR/USD analysis (And Joe Dinapoli's book) and Inner Circle Trader are my sources. I took a break for a while from trading to care for personal stuff but I'm back. Page 8 on is the way I trade.

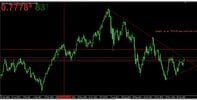

I use an indicator called sessions to mark out who is trading against me: Tokyo, London or NY. Another call sweetspots marking the 100's. I mark key support and resistance lines and I use 3 time frames - daily, 4h and 1h (sometimes the 15m). I take trades off the 1h and 4h charts. I look for one or two big trades per week. I trade the Fiber, Cable and sometimes some others. I've posted many of my favorite strategies in other threads. I use MT4 and Multi-Purpose Trade Manager to manage my open positions.

Stay away from EA's everybody. They are a scam.

Don't give up!

I use an indicator called sessions to mark out who is trading against me: Tokyo, London or NY. Another call sweetspots marking the 100's. I mark key support and resistance lines and I use 3 time frames - daily, 4h and 1h (sometimes the 15m). I take trades off the 1h and 4h charts. I look for one or two big trades per week. I trade the Fiber, Cable and sometimes some others. I've posted many of my favorite strategies in other threads. I use MT4 and Multi-Purpose Trade Manager to manage my open positions.

Stay away from EA's everybody. They are a scam.

Don't give up!

Last edited: