Stavro D'Amore

Former FPA Special Consultant

- Messages

- 547

Hello FPA members

We have US existing hom,e sales coming out at 10:00AM sharp, This is a major report and should not be missed.

US Existing Home Sales

Forecast 4.75M

Previous 4.67M

Pair to trade: EUR/USD

Triggers we need: BUY EUR/USD 4.35M

SELL EUR/USD 5.15M

Economical Impact: Extremely Critical

Typical Result: Good for currency

Occurrence: Released monthly, about 23 days after the month ends

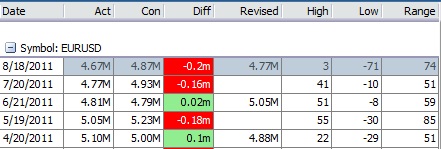

Previous Results Table

Looking at the previous results table below, if my analysis is correct we should see another drop in Home Sales showing another negative number.

Average Pip Range

About our Triggers:

US Housing sector forecasted to arrive at 4.75M. We are looking for a deviation on this trade of 400K either way. This is a very critical news release as many traders and economists will be focusing on this news release. Should this trade deviate, we will see major volatility in all US pairs. We can expect to see about 45pips on the initial spike, before another 20 pips on a double spike, before we see our required retrace.

What is it? Why does the market care?

The Existing Home Sales measures the annualized number of existing residential buildings that were sold during the previous month. This report helps to analyze the strength of the US housing market, which helps to analysis the economy as a whole. While this is monthly data, it is reported in an annualized format (monthly figure x12). Existing homes make up the majority of total sales and therefore tend to have more impact than New Home Sales.

It's a leading indicator of economic health because the sale of a home triggers a wide-reaching ripple effect. For example, renovations are done by the new owners, a mortgage is sold by the financing bank, and brokers are paid to execute the transaction. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Method I use to trade this:

Stavro D’Amore Trading Method

Approximately 15 minutes prior to the news release, I will be looking for a short term LONG position in EUR/USD.

I would be out of this LONG trade 2 minutes before the actual release, or to avoid any spreads that should widen.

I will look for a 30-50% retracement in the original spike before entering a trade; I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at entry price. My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame.

I do recommend spike trading as an option when

Historical Chart and Data for US Existing Home Sales

All the best

Stavro D’Amore

We have US existing hom,e sales coming out at 10:00AM sharp, This is a major report and should not be missed.

US Existing Home Sales

Forecast 4.75M

Previous 4.67M

Pair to trade: EUR/USD

Triggers we need: BUY EUR/USD 4.35M

SELL EUR/USD 5.15M

Economical Impact: Extremely Critical

Typical Result: Good for currency

Occurrence: Released monthly, about 23 days after the month ends

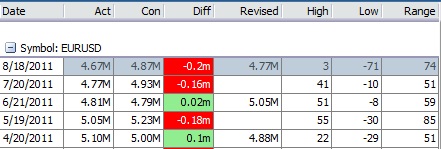

Previous Results Table

Looking at the previous results table below, if my analysis is correct we should see another drop in Home Sales showing another negative number.

Average Pip Range

About our Triggers:

US Housing sector forecasted to arrive at 4.75M. We are looking for a deviation on this trade of 400K either way. This is a very critical news release as many traders and economists will be focusing on this news release. Should this trade deviate, we will see major volatility in all US pairs. We can expect to see about 45pips on the initial spike, before another 20 pips on a double spike, before we see our required retrace.

What is it? Why does the market care?

The Existing Home Sales measures the annualized number of existing residential buildings that were sold during the previous month. This report helps to analyze the strength of the US housing market, which helps to analysis the economy as a whole. While this is monthly data, it is reported in an annualized format (monthly figure x12). Existing homes make up the majority of total sales and therefore tend to have more impact than New Home Sales.

It's a leading indicator of economic health because the sale of a home triggers a wide-reaching ripple effect. For example, renovations are done by the new owners, a mortgage is sold by the financing bank, and brokers are paid to execute the transaction. A higher than expected reading should be taken as positive/bullish for the USD, while a lower than expected reading should be taken as negative/bearish for the USD.

Method I use to trade this:

Stavro D’Amore Trading Method

Approximately 15 minutes prior to the news release, I will be looking for a short term LONG position in EUR/USD.

I would be out of this LONG trade 2 minutes before the actual release, or to avoid any spreads that should widen.

I will look for a 30-50% retracement in the original spike before entering a trade; I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at entry price. My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame.

I do recommend spike trading as an option when

Historical Chart and Data for US Existing Home Sales

All the best

Stavro D’Amore

Last edited by a moderator: