Stavro D'Amore

Former FPA Special Consultant

- Messages

- 547

Hello members,

A more interesting report for today, we have CA CPI, please find my trade plan below.

CA Core CPI m/m

Forecast 0.1%

Previous 0.2%

Pair to trade: USD/CAD

Numbers we need: BUY USD/CAD -0.1%

SELL USD/CAD 0.3%

Economical Impact: Critical

Typical Result: Good for currency

Occurrence: monthly, about 20 days after the month ends

About our Triggers:

CA Core CPI is forecasted to arrive at 0.1%. We are looking for a deviation of 0.2% on this trade. If we get -0.1% or lower I will look to enter a LONG position on USD/CAD and if we get 0.3% or greater I will go SHORT on USD/CAD. Should this report be triggered, we can expect to see about 50pips on the initial spike. We also have CPI m/m due to come out the same time and I cannot see this being a conflict.

NOTE: we are trading Core CPI.

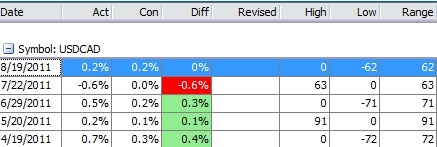

Results Table showing us Actual, Consensus, High, Low and Ranges

Average pip Range

What is it? Why does the market care?

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation in Canada.

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate. The common way to fight inflation is raising rates, which may attract foreign investment.

A higher than expected reading should be taken as positive/bullish for the CAD.

A lower than expected reading should be taken as negative/bearish for the CAD.

Method I use to trade this:

Stavro D’Amore Trading Method

I will look for a 30% retracement in the original spike before entering a trade; I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at entry price. My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame.

I do recommend spike trading as an option if you are using a reliable broker and an Auto clicker.

Historical Chart and Data for CA Core CPI m/m

All the best

Stavro D’Amore

A more interesting report for today, we have CA CPI, please find my trade plan below.

CA Core CPI m/m

Forecast 0.1%

Previous 0.2%

Pair to trade: USD/CAD

Numbers we need: BUY USD/CAD -0.1%

SELL USD/CAD 0.3%

Economical Impact: Critical

Typical Result: Good for currency

Occurrence: monthly, about 20 days after the month ends

About our Triggers:

CA Core CPI is forecasted to arrive at 0.1%. We are looking for a deviation of 0.2% on this trade. If we get -0.1% or lower I will look to enter a LONG position on USD/CAD and if we get 0.3% or greater I will go SHORT on USD/CAD. Should this report be triggered, we can expect to see about 50pips on the initial spike. We also have CPI m/m due to come out the same time and I cannot see this being a conflict.

NOTE: we are trading Core CPI.

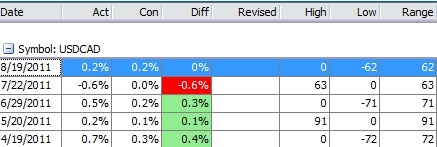

Results Table showing us Actual, Consensus, High, Low and Ranges

Average pip Range

What is it? Why does the market care?

The Core Consumer Price Index (CPI) measures the changes in the price of goods and services excluding food and energy. The CPI measures price change from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation in Canada.

Consumer prices account for a majority of overall inflation. Inflation is important to currency valuation because rising prices lead the central bank to raise interest rates out of respect for their inflation containment mandate. The common way to fight inflation is raising rates, which may attract foreign investment.

A higher than expected reading should be taken as positive/bullish for the CAD.

A lower than expected reading should be taken as negative/bearish for the CAD.

Method I use to trade this:

Stavro D’Amore Trading Method

I will look for a 30% retracement in the original spike before entering a trade; I will sell half my position as soon as I hit the original high point of the first initial spike and place a SL at entry price. My TP level would be just before a resistance level or if the chart decides to form a support level, looking at a 15 minute chart time frame.

I do recommend spike trading as an option if you are using a reliable broker and an Auto clicker.

Historical Chart and Data for CA Core CPI m/m

All the best

Stavro D’Amore

Last edited by a moderator: