Trade View Investments

Trade View Investments Representative

- Messages

- 0

Trade View Investments is an Algorithmic Proprietary Trading Firm based in Melbourne, Australia.

www.tradeview.com.au

WEEKLY MARKET BRIEF - 23rd August 2015

This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes.

For a more detailed day-to-day overview of the markets and trade opportunities you need to go to our LIVE CHAT ROOM.

We may take multiple trades throughout the week and discuss in our LIVE CHAT ROOM.

Trade View has entered the weekend Net Long.

FOREX

AUD.USD – 7312 ( - 61 or - 0.83% )

Another sideways move for the AUD. These are the time you cannot be complacent

As always BE PREPARED.

If we are to see a continuation of last weeks up move then 7407 needs to hold as a strong level of support. Once this occurs then 7494 could be see. If the momentum is strong then we could see 7635 which would complete the range.

If we see a quick reversal back down past 7407 and a downside move starts then we need to see an early long down bar reaching 7263 followed by 7116 which is now in line with levels back in early 2009.

EUR.USD – 11388 ( + 278 or + 2.50% )

After a slow start the EUR moved higher once again. The sell off in equity markets probably helped.

If the EUR continues this week as it did last, then we need to see a strong long up bar break and close past our FICM level of 11395. Once this occurs we could see 11471 reached. If the upward momentum is strong then the EUR could push towards 11666 very quickly.

If the EUR cannot get past 11395 early in the week and we see a leg back down then we would like to see tit break past 11315 before reaching 11166. Once this occurs then 11038 could be next to fall before reaching our downside FICM level of 10925.

GBP.USD – 15694 ( + 46 or + 0.29% )

The GBP is in a sideways move at the moment with a slight upside bias, but many of the levels discuss will be the same.

For the GBP to restart its run higher we would like to see 15644 hold as a strong level of support before before reaching our FICM level of 15744. If the upward momentum is strong then 15834 could be seen.

For the down move to continue we would like to see a strong break past 15591 before reaching 15549. Once this occurs then we could see our FICM level of 15458 reached very quickly where we could see some temporary support.

USD.JPY – 12205 ( - 225 or - 1.81% )

As the equity markets fell the USD also fell away with GOLD rallying. It is an Interesting time for the FED as it is caught between a rock and a hard place.

Raise rates - risk of complete market meltdown

Keep rates on hold - high possibility of (dare I say it) QE4?

For the USD to restart its move higher we would like to see our FICM level of 12151 hold as a strong level of support before push back above 12225. Once this occurs then 12275 could be seen on its way up before 12332 is reached. We would then need to see a long up bar break and close past 12332 if the USD has any chance of a continued move higher.

For this pair to continue lower we would like to see a strong break and close past 12151 before reaching 12064 and possibly the July 2015 low of 12041. If this occurs and the momentum is still strong then we will discuss further downside levels on our website.

COMMODITIES

GOLD – 1160 ( + 46 or + 4.13% )

Who said GOLD was no longer a safe haven play?

“Gold is moving sideways at the moment. Be Prepared for the next strong move.”

For the upward move to continue we would like to see a strong push past 1167 before reaching 1177. 1177 will then need to be broken with a long up bar before completing the range at 1192. But if the equity markets pile off and traders buy GOLD then we could see a over extension towards 1216 and possibly 1226.

For GOLD to come back down, equities need to rally and 1149 needs to be broken leading down towards 1134. Once 1134 is broken then 1103 here we come.

AUSTRALASIA

ASX – 5099 ( - 257 or - 4.80% )

Another down leg by the ASX, this time very aggressive breaks reaching the Oct 2014 lows. The ASX is now 15.12% off from its highs.

CAUTION SHOULD BE OBSERVED AT THESE LEVELS.

For the upmove to restart we need to see a strong up bar break and close back above 5150 which will bring the ASX back inside the Standard Deviation Channel. Once this occurs we would like to see 5217 broken reaching 5270. If the upward momentum is strong then the area between 5312 - 18 needs to be broken with a long up bar before reaching 5367. Once this level is reached then we will discuss further levels on our website.

If the traders panic this week and the down move continues then a solid break past 5050 will see the ASX near 4976 and 4922 very quickly. If the downward momentum is strong then 4863 will be a spectator as the ASX fall to 5754. One thing to note is that if the ASX overextends this down move then 4599 might not be out of the question.

EUROPE

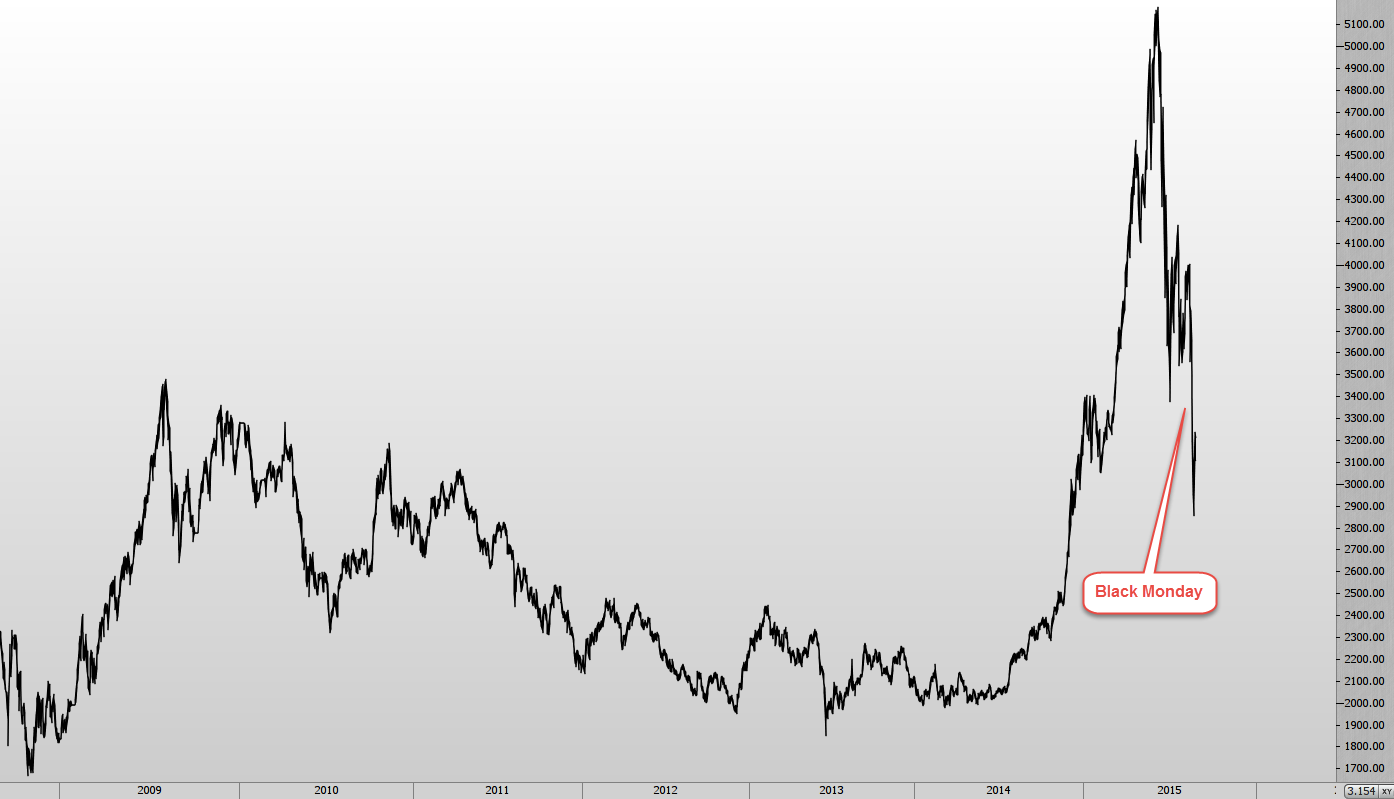

DAX – 10025 ( - 1023 or - 9.26% )

The DAX just collapsed, not much more to say.

The DAX is now 19.14% off from its highs.

If the DAX is to have any chance of reversing back up again we would then like to see a strong break and close above 10258 before reaching 10473. Once this occurs we could see 10684 reached before another strong push past 10793 and finally reaching 10868.

If the DAX is continues its aggressive down leg then a strong break through 10000 could see 9896 followed by 9829 finally reaching 9745 before taking its first breather. Once this level is reached and if the momentum continues strong then 9672 and 9589 might provide some resistance, if they don't then we could be in another FREE FALL scenario. If this occurs then we will discuss downside levels on our website.

US

S&P – 1972 ( - 122 or -5.83% )

Ping Pong over.

The S&P is now 7.68% off from its highs. The DOW is now 10.27% off from its highs.

For the upward move to restart we would like to see a strong long up bar break and close back above both 1981 and 2010. Once this occurs we could see a push back towards 2049.

If the S&P finds it hard to break back above 1981 and another downleg occurs we would see the area between 1957 - 47 broken early in the week followed by a strong push down towards 1927. If this level is also broken then we will discuss further downside levels on our website.

DISCLAIMER

The views represented on this website do not contain (and should not be construed as containing) financial advice, recommendations, opinions in relation to acquiring, holding or disposing of a financial product of any kind, or a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Trade View Investments accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of the above information. Consequently any person acting on it does so entirely at his or her own risk. The research does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

TRADE VIEW MAY CHANGE THE VIEW PRESENTED AT ANY TIME AND WILL NOT PUBLISH ANY UPDATE TO THAT EFFECT.

This communication must not be reproduced or further distributed.

www.tradeview.com.au

WEEKLY MARKET BRIEF - 23rd August 2015

This market brief is an overview of the week ahead and some of the events we see as being important to the markets.

Please be aware that our views may change throughout the course of the week, and we do not publish updates of such changes.

For a more detailed day-to-day overview of the markets and trade opportunities you need to go to our LIVE CHAT ROOM.

We may take multiple trades throughout the week and discuss in our LIVE CHAT ROOM.

Trade View has entered the weekend Net Long.

FOREX

AUD.USD – 7312 ( - 61 or - 0.83% )

Another sideways move for the AUD. These are the time you cannot be complacent

As always BE PREPARED.

If we are to see a continuation of last weeks up move then 7407 needs to hold as a strong level of support. Once this occurs then 7494 could be see. If the momentum is strong then we could see 7635 which would complete the range.

If we see a quick reversal back down past 7407 and a downside move starts then we need to see an early long down bar reaching 7263 followed by 7116 which is now in line with levels back in early 2009.

EUR.USD – 11388 ( + 278 or + 2.50% )

After a slow start the EUR moved higher once again. The sell off in equity markets probably helped.

If the EUR continues this week as it did last, then we need to see a strong long up bar break and close past our FICM level of 11395. Once this occurs we could see 11471 reached. If the upward momentum is strong then the EUR could push towards 11666 very quickly.

If the EUR cannot get past 11395 early in the week and we see a leg back down then we would like to see tit break past 11315 before reaching 11166. Once this occurs then 11038 could be next to fall before reaching our downside FICM level of 10925.

GBP.USD – 15694 ( + 46 or + 0.29% )

The GBP is in a sideways move at the moment with a slight upside bias, but many of the levels discuss will be the same.

For the GBP to restart its run higher we would like to see 15644 hold as a strong level of support before before reaching our FICM level of 15744. If the upward momentum is strong then 15834 could be seen.

For the down move to continue we would like to see a strong break past 15591 before reaching 15549. Once this occurs then we could see our FICM level of 15458 reached very quickly where we could see some temporary support.

USD.JPY – 12205 ( - 225 or - 1.81% )

As the equity markets fell the USD also fell away with GOLD rallying. It is an Interesting time for the FED as it is caught between a rock and a hard place.

Raise rates - risk of complete market meltdown

Keep rates on hold - high possibility of (dare I say it) QE4?

For the USD to restart its move higher we would like to see our FICM level of 12151 hold as a strong level of support before push back above 12225. Once this occurs then 12275 could be seen on its way up before 12332 is reached. We would then need to see a long up bar break and close past 12332 if the USD has any chance of a continued move higher.

For this pair to continue lower we would like to see a strong break and close past 12151 before reaching 12064 and possibly the July 2015 low of 12041. If this occurs and the momentum is still strong then we will discuss further downside levels on our website.

COMMODITIES

GOLD – 1160 ( + 46 or + 4.13% )

Who said GOLD was no longer a safe haven play?

“Gold is moving sideways at the moment. Be Prepared for the next strong move.”

For the upward move to continue we would like to see a strong push past 1167 before reaching 1177. 1177 will then need to be broken with a long up bar before completing the range at 1192. But if the equity markets pile off and traders buy GOLD then we could see a over extension towards 1216 and possibly 1226.

For GOLD to come back down, equities need to rally and 1149 needs to be broken leading down towards 1134. Once 1134 is broken then 1103 here we come.

AUSTRALASIA

ASX – 5099 ( - 257 or - 4.80% )

Another down leg by the ASX, this time very aggressive breaks reaching the Oct 2014 lows. The ASX is now 15.12% off from its highs.

CAUTION SHOULD BE OBSERVED AT THESE LEVELS.

For the upmove to restart we need to see a strong up bar break and close back above 5150 which will bring the ASX back inside the Standard Deviation Channel. Once this occurs we would like to see 5217 broken reaching 5270. If the upward momentum is strong then the area between 5312 - 18 needs to be broken with a long up bar before reaching 5367. Once this level is reached then we will discuss further levels on our website.

If the traders panic this week and the down move continues then a solid break past 5050 will see the ASX near 4976 and 4922 very quickly. If the downward momentum is strong then 4863 will be a spectator as the ASX fall to 5754. One thing to note is that if the ASX overextends this down move then 4599 might not be out of the question.

EUROPE

DAX – 10025 ( - 1023 or - 9.26% )

The DAX just collapsed, not much more to say.

The DAX is now 19.14% off from its highs.

If the DAX is to have any chance of reversing back up again we would then like to see a strong break and close above 10258 before reaching 10473. Once this occurs we could see 10684 reached before another strong push past 10793 and finally reaching 10868.

If the DAX is continues its aggressive down leg then a strong break through 10000 could see 9896 followed by 9829 finally reaching 9745 before taking its first breather. Once this level is reached and if the momentum continues strong then 9672 and 9589 might provide some resistance, if they don't then we could be in another FREE FALL scenario. If this occurs then we will discuss downside levels on our website.

US

S&P – 1972 ( - 122 or -5.83% )

Ping Pong over.

The S&P is now 7.68% off from its highs. The DOW is now 10.27% off from its highs.

For the upward move to restart we would like to see a strong long up bar break and close back above both 1981 and 2010. Once this occurs we could see a push back towards 2049.

If the S&P finds it hard to break back above 1981 and another downleg occurs we would see the area between 1957 - 47 broken early in the week followed by a strong push down towards 1927. If this level is also broken then we will discuss further downside levels on our website.

DISCLAIMER

The views represented on this website do not contain (and should not be construed as containing) financial advice, recommendations, opinions in relation to acquiring, holding or disposing of a financial product of any kind, or a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. Trade View Investments accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of the above information. Consequently any person acting on it does so entirely at his or her own risk. The research does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication.

TRADE VIEW MAY CHANGE THE VIEW PRESENTED AT ANY TIME AND WILL NOT PUBLISH ANY UPDATE TO THAT EFFECT.

This communication must not be reproduced or further distributed.