You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What is a retracement in forex?

- Thread starter PIPruit

- Start date

Solution

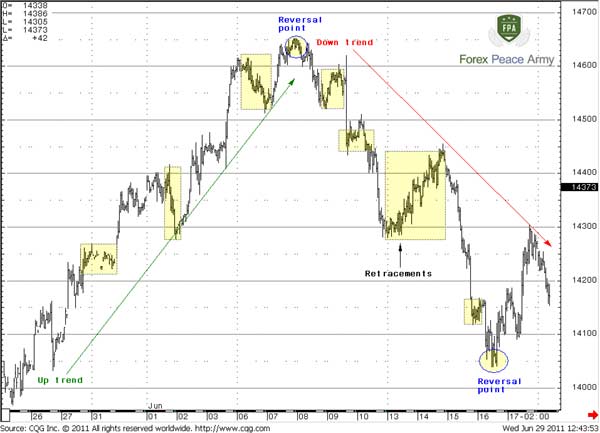

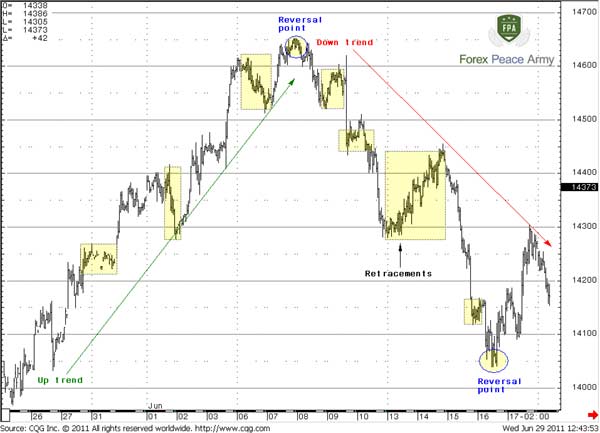

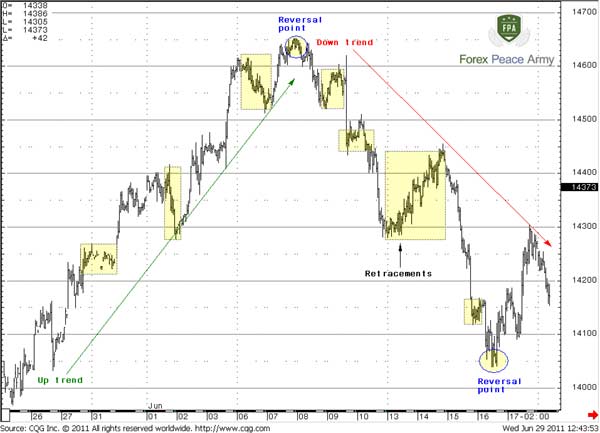

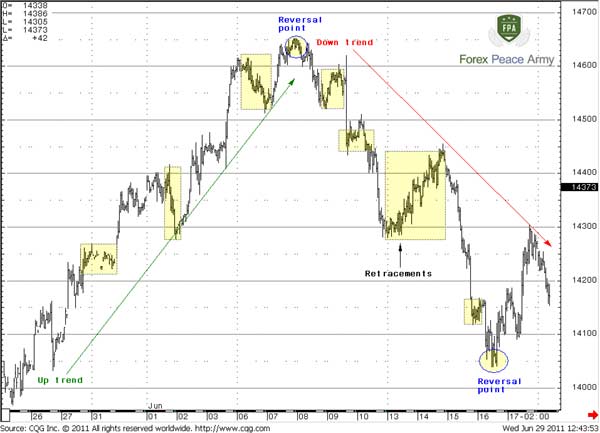

A retracement is when a currency pair reverses its direction and moves in the opposite direction of a previous trend.

Forex pairs usually move in trends or sideways. That is, sometimes, buyers or sellers prevail, and the market is predominantly one-sided and moves in one direction. In such a case, the market is moving in a trend.

Despite this, markets hardly move in a straight line. They usually move in zigzag shapes or waves. Thus, even in an uptrend, you see some downwards pull back movements. This happens because even if the buyers are prevailing, there will be some sellers from time to time, and people have different convictions about where the...

Forex pairs usually move in trends or sideways. That is, sometimes, buyers or sellers prevail, and the market is predominantly one-sided and moves in one direction. In such a case, the market is moving in a trend.

Despite this, markets hardly move in a straight line. They usually move in zigzag shapes or waves. Thus, even in an uptrend, you see some downwards pull back movements. This happens because even if the buyers are prevailing, there will be some sellers from time to time, and people have different convictions about where the...

Akwin

Private, 1st Class

- Messages

- 49

Thank you for your explanation, I just want to ask if it can be measured with the use of an exact percentage?A retracement is when a currency pair reverses its direction and moves in the opposite direction of a previous trend.

Forex pairs usually move in trends or sideways. That is, sometimes, buyers or sellers prevail, and the market is predominantly one-sided and moves in one direction. In such a case, the market is moving in a trend.

Despite this, markets hardly move in a straight line. They usually move in zigzag shapes or waves. Thus, even in an uptrend, you see some downwards pull back movements. This happens because even if the buyers are prevailing, there will be some sellers from time to time, and people have different convictions about where the market is heading usually.

After a trend, the market usually reverses some or all of that movement. Traders often call that reversal a retracement. Sometimes this happens because some of the traders exit their earlier positions and book some profits.

It is typical for markets to retrace 23.6 percent, 38.2, 50 percent, or 61.8 of their earlier movements. Thus, traders often find the Fibonacci retracement tool to be handy in identifying those levels.

There are two ways to trade retracements: either with the original trend or against it.

To learn more about retracements and reversals read this chapter of FPA Forex School

- Those who want to trade with the original trend assume that the price action will resume the earlier trend after a retracement. They wait for the price to bounce off of one of the retracement levels mentioned above (often the 50 percent level) and then enter a position. Here, there is a risk that the price does not continue in the direction of the original trend and continues its reversal.

- Those who want to trade against the original trend, i.e. with the retracement, assume the earlier trend won’t last. They use the retracement levels as support or resistance levels and enter a position when the price has displayed some sideways movement then continued in the direction of the retracement (i.e. broke out). Traders then assume that the momentum of the original trend has waned, and a new trend is in the making.

Talar

Recruit

- Messages

- 112

This is a great answer. IMHO it answers all the possible questions at once. Well done!A retracement is when a currency pair reverses its direction and moves in the opposite direction of a previous trend.

Forex pairs usually move in trends or sideways. That is, sometimes, buyers or sellers prevail, and the market is predominantly one-sided and moves in one direction. In such a case, the market is moving in a trend.

Despite this, markets hardly move in a straight line. They usually move in zigzag shapes or waves. Thus, even in an uptrend, you see some downwards pull back movements. This happens because even if the buyers are prevailing, there will be some sellers from time to time, and people have different convictions about where the market is heading usually.

After a trend, the market usually reverses some or all of that movement. Traders often call that reversal a retracement. Sometimes this happens because some of the traders exit their earlier positions and book some profits.

It is typical for markets to retrace 23.6 percent, 38.2, 50 percent, or 61.8 of their earlier movements. Thus, traders often find the Fibonacci retracement tool to be handy in identifying those levels.

There are two ways to trade retracements: either with the original trend or against it.

To learn more about retracements and reversals read this chapter of FPA Forex School

- Those who want to trade with the original trend assume that the price action will resume the earlier trend after a retracement. They wait for the price to bounce off of one of the retracement levels mentioned above (often the 50 percent level) and then enter a position. Here, there is a risk that the price does not continue in the direction of the original trend and continues its reversal.

- Those who want to trade against the original trend, i.e. with the retracement, assume the earlier trend won’t last. They use the retracement levels as support or resistance levels and enter a position when the price has displayed some sideways movement then continued in the direction of the retracement (i.e. broke out). Traders then assume that the momentum of the original trend has waned, and a new trend is in the making.

However, as I see it from my point of view and considering my attitude to the market - this is the most difficult task to distinguish where the retracement is finished and the reversal has started

perryjohn765

Private

- Messages

- 213

the first explanation is very nice and detailed. it exactly means when it move towards the opposite direction.

FriendlyFX

Master Sergeant

- Messages

- 282

It's a reversal on price where which usually form the LH and LL in downward momentum and the reverse in a bullish trend

FriendlyFX

Master Sergeant

- Messages

- 282

I always state this fact demo demo and demo some more .It's definitely a great way to learn trading when you are new into it. Demo forex is just like free training for trading that will help you get familiar with the trading platform so that you can have the understanding how decisions are made in trading. Making mistakes is a part of learning. It will get you prepared to enter into real trading.

It's free and where you can make mistakes without paying a harsh price

Gholis

Recruit

- Messages

- 50

Often the word retracement is related to the fibonacci levels or fibonacci retracements, you can find this word in such contexts. Actually it's a temporary reversal in price within a major price trend. Here, the word "within" matters a lot mostly because it determines the difference between reversals and retracements. A reversal is the end of the price trend and either in the beginning of a new one or the beginning of a period of consolidation. Retracement is just a temporary interruption. If you're quite experienced or just look at the forex charts you will notice that the market always moves in this general manner.

Kirstysingy

Recruit

- Messages

- 75

Retracement means it’s gone back the other way. A bit like going back over your footsteps

Similar threads

- Replies

- 0

- Views

- 4

- Replies

- 0

- Views

- 8

- Replies

- 0

- Views

- 11

- Replies

- 0

- Views

- 12