Ethereum, ICOs, and Smart Contracts

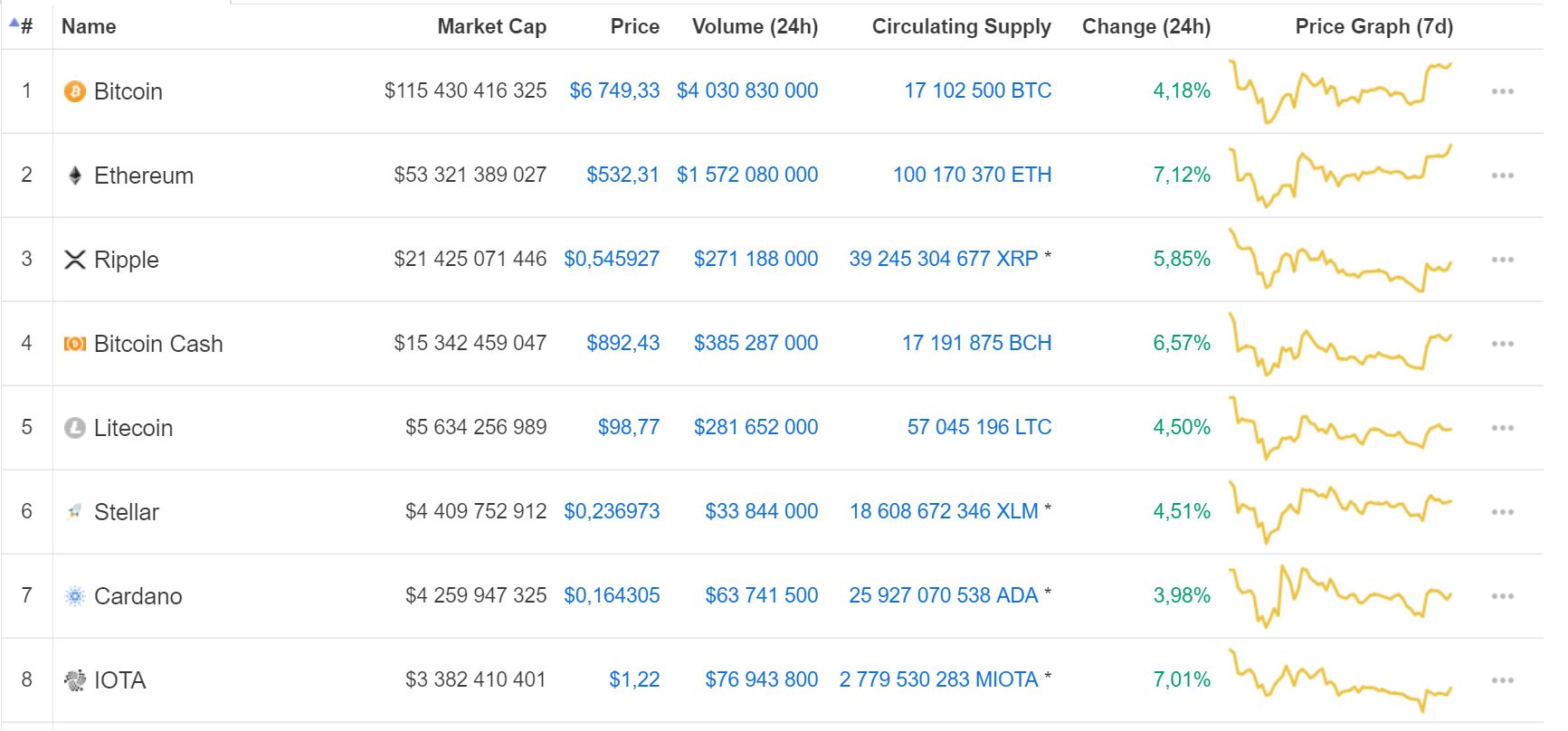

In the last few years, inspired by Bitcoin’s popularity, developers have not only been improving the existing algorithm but also inventing alternatives. As a result, many new cryptocurrencies have been created although Bitcoin remains #1 by far and Ethereum steadily holds second place.

Most improvements in blockchain technology and everything around it are closely related to new cryptocurrencies like Ethereum, Ripple, IOTA, and others. At present, there are more than 1000 alternative cryptocurrencies, which are collectively called “altcoins.”

Source: https://coinmarketcap.com/coins/

Ethereum’s market capitalization is twice the size of its closest rival Ripple and, for a brief time in 2017, it was close to Bitcoin’s. Now, its market capitalization is almost three times lower. Nevertheless, Ethereum remains the world’s second most popular cryptocurrency.

So what is the reason for its popularity, especially since it was launched as recently as 2015?

One reason is that Ethereum is the most frequently used currency for Initial Coin Offerings (ICOs). An ICO is the process of financing a new business venture, the modern equivalent of the IPO (Initial Public Offering) – when a privately owned company begins trading publically on a stock exchange.

Ethereum is the latest word in cryptocurrencies

Let’s start our look at Ethereum’s success by saying that its popularity is well-deserved because it’s based on its unique features. As mentioned in previous articles, bitcoin and blockchain technology has relatively simple structures and purposes. It enables the network’s members to make transactions safely among themselves. However, despite that the system is smart and decentralized, it is designed to perform “classic” tasks like sending and receiving funds.Of course, it would be very useful to have a system with expanded functionality, where special programs codes could manage wallets, accept wires, automatically send money, and so on. Staying true to the concept behind blockchain technology, all additional functions would have to be logged and transparent so that every network member can review them. Also, such program codes would have to be very well protected so that no one can crack them.

This is the idea behind Ethereum: the creation of program codes that automatically manage wallets, transfers, and other functions. Ethereum’s algorithm offers two types of wallets – those that are managed by human beings and those that are automatically managed by program codes.

These special program codes are called “smart contracts,” and they are a part of Ethereum’s blockchain. This means that a smart contract becomes a part of the blockchain, stays there forever, and everyone has a copy of it on his/her ledger. This feature enables any member to use a smart contract, which works the same way for everyone.

Although this feature is not groundbreaking, it has significantly expanded the applicability of cryptocurrencies.

What can smart contracts do?

Smart contracts can do almost anything. They can manage lotteries, auctions, sports and casino betting, polls, and even games. Let’s look at a sports bet as an example:- The smart contract would manage the input of the initial conditions, such as the time limit for placing bets, the minimum and maximum values of each bet, the different types of bets – the result (win/lose/draw), the number of goals (in soccer), bet coefficients, and so on.

- While betting is open, it would log bet sums and the wallets they came from, as well as the types of bets that were placed.

- When betting closes, it would stop accepting bets. Any bets received after the betting window closed would be sent back automatically.

- After the sports event finished, losing bets would be held, and winnings would be automatically paid to the wallets that placed them.

- The smart contract would manage the input stake/reward ratios (red/black), the particular number and multiple numbers.

- It would collect the stakes, keeping a log of the wallets that placed them.

- It would run a random number generator to produce the result.

- It would transfer the lost stakes into the casino’s wallet, and transfer the winnings to the wallets that placed them.

- Using a random number generator is difficult; there have been instances where players were able to calculate a jackpot.

- It’s difficult to hide certain information, for example, auction members or casino clients.

- The blockchain requires external data or information, for example, the current or final result of a sports event. A trustworthy person would have to input this information into the system.

- Unless you have Ethereum, it’s impossible to use smart contracts.

- Smart contracts are slow, performing only 3-5 transactions per hour. As already discussed in previous articles, this is a common weakness in blockchain technology.

- Smart contracts typically execute few operations because every member should be able to verify the result.

- If there is an error in the contract, it stays there forever. The only way to rectify is to shift to another smart contract. However, this is only possible if the original contract has built-in codes that allow for fund withdrawals and contract shifting. Typically, they do not.

- Smart contracts may work incorrectly if users do not fully understand the code. Like any other field, a lot depends on the programmers and their skills.

The main use of smart contracts

Everything that we’ve mentioned above – polls, lottery, bets, and so on – makes smart contract technology very attractive and convenient.At some point, it became clear that smart contracts were extremely useful in ICOs because they can automate all standard bookkeeping tasks, control how many shares are bought and by whom, process share trades, and so on. They do away with the need to manage addresses, credit cards, regulatory authorities, investors’ authorizations, taxes, and so on.

Moreover, they allow all users to see how many shares were issued and how they were distributed. The blockchain prevents the issuing of additional illegal shares or the duplication of shares already sold.

What is an ICO?

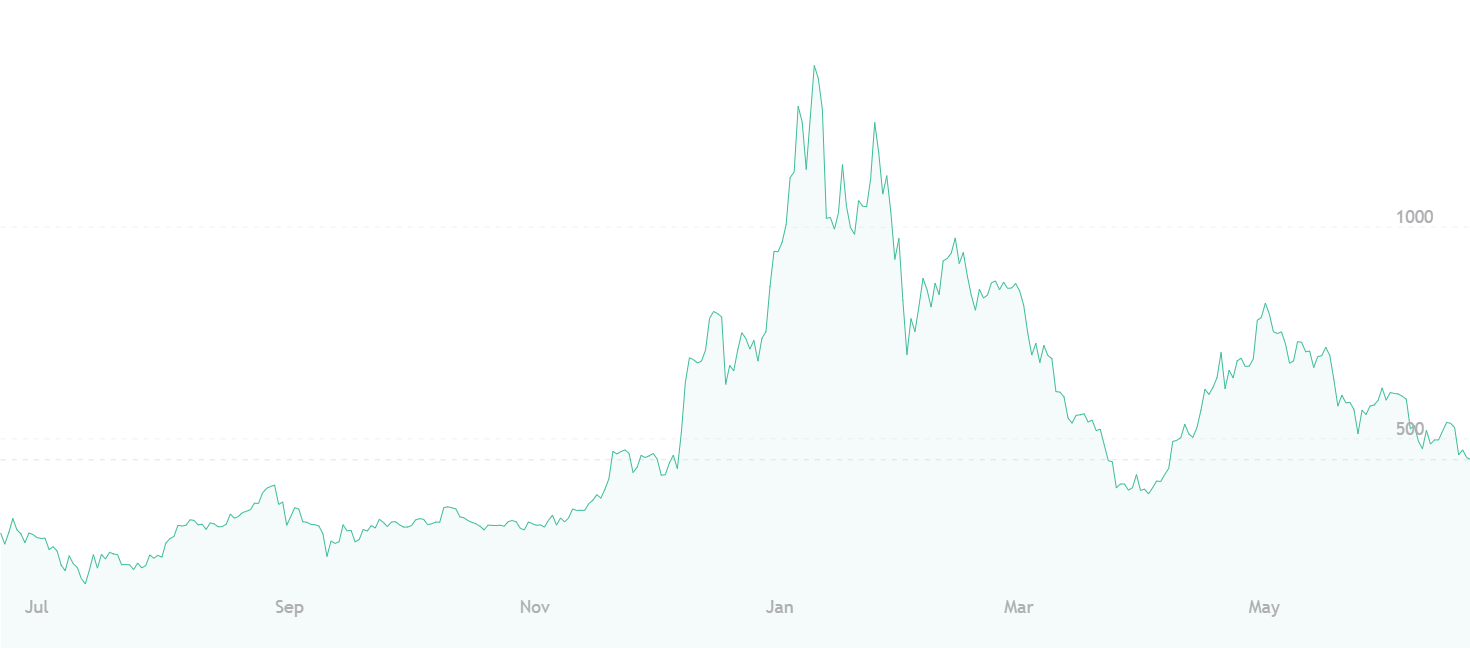

Smart contract technology was not invented in 2015 when Ethereum started, but a little later. Once people learned about this feature, the price of Ethereum skyrocketed from $8 in 2017 to almost $1400 one year later. One reason for the explosive demand was the large number of ICOs that were being offered at that time, especially since they were being managed by smart contracts. This significantly increased the demand for Ethereum itself.Source: https://www.tradingview.com

Let’s take a closer look at an ICO and its typical process map:

- You have an idea. Usually, this idea is related to cryptocurrencies and the blockchain (but not necessarily).

- You need money to finance your project.

- You publicize your project to potential investors and sell shares or tokens using smart contract technology.

- You raise the amount of funding that you require.

What is a token?

There’s one more thing we need to clarify: what are these so-called “tokens” that we keep hearing about?A token is the equivalent of a share in the standard financial market. When someone invests in a startup project, he/she must receive something in return that specifies his/her rights in the prospective business or revenue from the project. These rights are identified by tokens. In this case, tokens represent assets or utilities. They represent assets that are fundable and tradable.

The typical level of funding sought by ICO startups ranges between $10-20 million. This amount can be collected very quickly, from a few days to a few hours. Since ICOs have ceilings of time or funding level (the total sum of what they are looking to raise), investors often rush in.

Sometimes a buying frenzy is created that goes well beyond common sense. For example, since the blockchain can only process a few transactions per second, investors have been known to pay exorbitant transaction fees ($6000+) in their eagerness not to miss out. While this is an exception and not the rule, millions of dollars can be collected in seconds if an ICO is very attractive.

It is easy to invest, but what about the returns?

What happens after the investors have bought tokens depends on the conditions set by each project. In some cases, investors are paid dividends; in other cases, they accept tokens as payment for products/goods produced by the startup; there are also cases when startups promise nothing in return.As a rule, after an ICO ends, its coins/tokens are listed on various crypto exchanges, similar to how common shares are listed on stock exchanges. The speculators who bought tokens during the ICO hope to sell them on the exchanges at a profit. Those who did not buy tokens during the ICO can buy them from the exchange as longer-term investments.

Sometimes, ICOs are bubbles – the startup is just an idea and not a real product. Nevertheless, its token price can still rise explosively.

It’s important to note that crypto exchanges are not regulated by bodies such as the SEC (Securities and Exchange Commission) and the NFA (National Futures Association). That’s why the owner of a startup can buy back his/her tokens from an exchange (called a “buy back”), thereby artificially inflating the token’s price. While this is illegal in the stock market, it is possible on crypto exchanges.

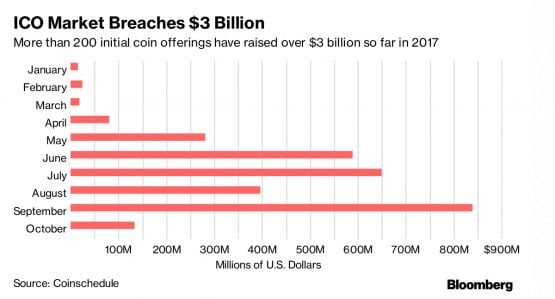

The ability of ICOs to turn enormous profits is certainly impressive. Since ICOs started being offered in 2017, investors had poured $3 billion into them by the end of the year. It should be said that, while raising startup funding is not that difficult, leading a venture to success certainly is.

Nevertheless, investors keep digging into their pockets and keeping their fingers crossed...