Bitcoin Fundamentals – Briefing December 2018

Welcome to our monthly briefing, where we comment on the most important events in the cryptocurrency sector with a focus on Bitcoin, analyzing them, and speculating on their possible impact, as well as on what to expect in the long-term.

We should begin by clarifying that our analysis is centered mostly on the prevailing sentiment rather than on fundamentals per se. This is common in any discussion of cryptocurrencies, due to the specific features and qualities of these assets.

We will attempt to assess the positive and negative factors driving the market to determine which appear stronger at the moment.

So, let’s begin.

The positive factors

At first glance, finding something positive appears challenging at this time. Bitcoin has lost more than 80% of its market capitalization, and the overall sentiment is a far cry from the euphoria of less than one year ago. Nevertheless, things are not as bad as they look.

Our analysis shows two strong factors, which have the potential of drastically changing the situation. Since they are long-term, we should not expect to see results soon – on the other hand, the fact that they are long-term bolsters our confidence that they could dramatically shift the market to a positive direction.

The first factor is robust activity in the crypto sphere by massive financial entities. “Whales” such as Fidelity, NASDAQ, ICE, Goldman Sachs, and Morgan Stanley would not be getting involved if they did not see potential, especially since they are all turning toward crypto at the same time. They intend to enter the crypto market in 2019. Since this is likely to change the situation dramatically, the price of Bitcoin is expected to rise sharply again, according to many well-known experts, such as Thomas Lee, the founder of the Fundstrat, and head of Galaxy Digital Mike Novogratz among others.

But let’s start with the facts before we provide our analysis:

- Bloomberg reports that NASDAQ is moving ahead with a plan to list Bitcoin futures. According to two sources, it’s betting on sustained interest despite the cryptocurrency’s plunge over the past year. NASDAQ has been working toward satisfying the concerns of the US’s main swaps regulator, the Commodity Futures Trading Commission (CFTC), before launching the contracts. NASDAQ futures will be based on Bitcoin’s price on numerous spot exchanges, as compiled by VanEck Associates Corp., one source said.

- New York Stock Exchange owner Intercontinental Exchange Inc. said it would launch its contracts on January 24, 2019. We remind our readers that spoke briefly about this in our previous report in November.

- Fidelity, one of the five largest financial service providers in the world with $7.2 trillion in client assets, is launching a crypto trading and storage platform. They announced that Fidelity Digital Asset Services will provide cryptocurrency custody and trading services to enterprise clients. Tom Jessup, who is heading up the new division, announced the platform at Bloomberg’s Institutional Crypto event. The platform hopes to draw institutional investors, including hedge funds, family offices, and market intermediaries. “Those efforts have been successful in helping us understand and advance our thinking around cryptocurrencies. The creation of Fidelity Digital Assets is the first step in a long-term vision to create a full-service, enterprise-grade platform for digital assets,” he said. “In our conversations with institutions, they tell us that, in order to engage with digital assets in a meaningful way, they need a trusted platform provider to enter this space. These institutions require a sophisticated level of service and security, equal to the experience they’re used to when trading stocks or bonds.”

- While Goldman Sachs may not directly offer a service for storing client coins, they have made efforts to enter the market – despite the murky legal landscape – by investing in custodial service provider BitGo Holdings Inc. in October 2018. Also, Goldman Sachs was one of the first to clear Bitcoin futures offered by Cboe Global Markets Inc. and the CME Group Inc., showing some inclination to wade into the cryptocurrency space, even with prices in their present spiral.

- Morgan Stanley is reportedly preparing to offer Bitcoin swap trading to clients, joining other top banks in a sector-wide effort to explore digital currencies. Traders will have the choice to go either “long” or “short” using the so-called “price return swaps.” Morgan Stanley will charge a spread for each transaction, the source told Bloomberg.

Why such anticipation for the big banks to enter the crypto market? The most important consideration is the influx of new, big money, which would bring substantial liquidity to the sector. Here are some statements and comments on this topic:

- “The current bear markets are the ‘golden time’ to be in crypto,” said Wall Street crypto-bull and co-founder of Fundstrat Global Advisors Tom Lee, on Nov. 28, during his speech at BlockShow Asia 2018.

Lee attributed the recent crypto market collapse to the following three events: Bitcoin Cash’s (BCH) contentious hard fork, the regulatory actions of the Securities and Exchange Commission (SEC) forcing Initial Coin Offerings (ICOs) to return funds to investors, and the “terrible” condition of global markets, which have dropped by approximately 10% in October and November. “[We] have a price correction taking place, which has caused the price to fall even below its 200-day [a popular technical indicator used by investors to analyze price trends], but if you’ve got time, it will rise. It will not happen within three months, or one year, but in two to three years, and this is the golden time to be in crypto. As soon as Bitcoin crosses its 200-day, we know there will be a flood of money coming. […] The only time the return is better than 7% is when you buy at a bear market […] Bitcoin may have downsides in the near term, but this doesn’t change the fact we are still in the earliest days of crypto, and it’s about to become an emerging asset class.”

According to Lee’s BlockShow speech, at present, crypto has only 50 million active wallets in contrast to the 254 million PayPal accounts in Q3 2018, and the 4.6 billion Visa and MasterCard accounts. Comparing Bitcoin to other payment systems in terms of social network value, Lee estimated that, in ten years, Bitcoin might be worth $10 million per coin.

- Chairman of the New York Stock Exchange Jeff Sprecher says that Bitcoin and other digital assets are here to stay. Sprecher is also CEO of Intercontinental Exchange, which is teaming up with Microsoft and Starbucks to launch Bakkt, a company that will begin facilitating Bitcoin futures in January 2019. “We’re creating infrastructure that doesn’t exist today, which – we think – is a big opportunity for institutional investors to come in.”

The second factor that promises a dramatic upswing in the long-term is the change in the market’s structure. Major drops of Bitcoin are taking place because of a massive restructuring of the market’s framework, of the algorithms that it works on, of the implementation of regulation, and so on. When the restructuring is over, a new upside cycle should start. At first glance, regulation creates negative moments, especially when the SEC intrudes, but this is a time of purification and evolution. Although the crypto market may cease to be the “Wild West” it has been thus far, it would certainly benefit from improving its approach to clients and from ensuring the safety of their money and transfers.

Let’s take a look at the facts:

- VanEck has been trying to win approval from the SEC for a crypto-based, exchange-traded fund. They have followed the pioneer in this sphere, SolidX, which applied to the SEC in March 2016. The SEC’s decision is expected in March 2019. According to VanEck’s manager Gabor Gurbacs, a new instrument may be approved shortly; the company has never been so close to a favorable decision – something that is not denied by SEC representative Hester Peirce, who believes that the agency should be more loyal to Bitcoin-ETF. Meanwhile, SEC Chairman Jay Clayton said that this would be possible once the problem of manipulations has been solved.

- The SEC in Colorado forced the allegedly fraudulent ICO startups of Global Pay Net, Cred LLC (Credits), CrowdShare Mining, and CyberSmart Coin to close.

- The SEC ruled that non-custodial cryptocurrency exchanges allowing users to trade are firmly within their scope. As a result, Aphelion disabled Mainnet DEX in November 2018.

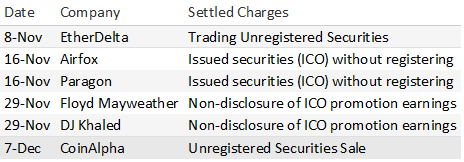

The following graphic shows recent actions taken by the SEC:

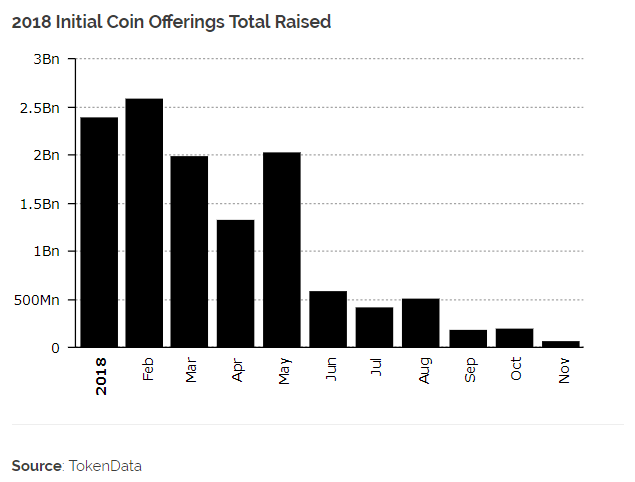

- Initial Coin Offerings (ICOs) are all but over with November seeing total raised funds of $65 million. While ICOs raised over $12.2 billion in 2018, they have petered out due to fears of regulatory backlash and the slow-down in the crypto market with plummeting token prices that have left retail investors with a bitter taste. In a speech, SEC Chairman Jay Clayton said that he believes that “ICOs can be effective ways for entrepreneurs and others to raise capital. However, the novel technological nature of an ICO does not change the fundamental point that, when a security is being offered, our securities laws must be followed.” It’s unlikely that the contentious fundraising mechanism, at least in its current unregulated form, will garner much interest moving forward with regulated tokenized securities platforms paving the way for new methods of raising capital.

The negative factors

So what do we have on the negative side? In a nutshell, the overall market drop and its impact on mining, the waning popularity of ICOs, hacking attacks, and the issues that the SEC is combating, as well as the short-term consequences of their actions. We should point out that, with the exception of SEC action, all other factors are mostly technical and certainly not new.

Let’s have a closer look:

- Coindesk analyst Omkar Godbole has expressed the opinion that Bitcoin could drop below $3K.

- Ethereum appears ready to resume selloff since it found resistance at the top of its descending channel.

- According to the third-largest mining pool F2Pool, between 600,000 and 800,000 Bitcoin miners have shut down operations since mid-November 2018 amid declines in price and hashrate across the network. Mao Shixing, founder of F2pool, said that multiple factors contributed to the shakeout including the recent market decline that followed the Bitcoin Cash hard fork of November 15, an increase in electricity costs in China, and Chinese manufacturers racing to upgrade their products, making older machines increasingly uncompetitive. “All these factors overlapping right now has led to this recent phenomenon,” Mao said.

- Bitcoin’s hashrate has fallen around 31% since the start of November 2018, the equivalent of around 1.3 million Bitmain S9 machines. So far, the price drop has caused two large downward difficulty adjustments of 7.4% and 15.1%, on November 16 and December 3 respectively. The 7.4% adjustment was the largest since January 2013, and the 15.1% adjustment was the largest since October 2011.

- The Norwegian government raised the power cost for miners by 34X.

- The “thin-air” Ethereum vulnerability of malicious GasToken minting. When ETH is sent to an address, that address is able to perform computations paid for by the originator of the transaction. This is a known vector for griefing. However, some at-risk systems like exchanges did not have proper protections in place. GasToken, which takes advantage of the refund mechanism on storage in Ethereum, allows users to store gas when the gas price is low and receive a refund when the gas price is high. By minting large amounts of GasToken when receiving ETH, the griefing vector becomes a profitable attack. Private disclosure was made to as many exchanges as possible, many of which were not at risk. It appears that all affected exchanges that received the disclosure have patched the vulnerability.

- Hackers steal approximately $1 billion in crypto assets. In the third quarter of 2018, the total amount of funds stolen from exchanges exceeded $927 million, according to a report by CipherTrace. In the first half of the year, hackers stole more money from the marketplaces than in the whole of 2017. In early 2018, criminals stole $533 million worth of crypto from the Japanese stock exchange Coincheck. Then, BitGrail clients suffered when $170 million was stolen. During the summer, hackers attacked South Korean exchanges Bithumb and Coinrail, after which the country significantly tightened regulations of the blockchain industry. In mid-October, analysts at Group-IB reported that, over the past year and a half, criminals hacked 14 large marketplaces. Experts believe that the number of thefts will increase next year.

Conclusion

Synthesizing all the above, we see two game-changing factors on the horizon for the cryptocurrency market: the widespread infusion of institutional capital and regulation.

As regards to the first factor, the process will be slow but, since it’s already underway, there is no reason why it should not continue. Once the ‘invasion’ of the market by major world exchanges and transnational banks begins, that will become the status quo. Such entities do not undertake investment sporadically or on a whim. They keep their noses to the wind and, the moment they smell money, they follow the scent.

What is more, the activity of big banks in this sphere answers the important question: What is the crypto phenomenon? Is it is an emerging market and a new asset class in the long-term, or a short-lived, modern curio? From where we stand at the moment, it’s quite clear that the former is a more accurate assessment than the latter. It also entails that somehow, perhaps slowly but on an ongoing basis, big investors will enter the market, thereby suggesting an upward market retracement within a year.

The second game-changing factor is regulation – a double-edged sword that will likely shift market participant demographics. The “Wild West” Bitcoin market is disappearing, replaced by the pragmatic features of exchange-traded products.

All the negative moments discussed in this briefing are short-term and mostly a result of technical growing pains common to the development of any new market. Issues like hacking attacks, drop in mining activity, and vulnerabilities in blockchain protocols, have to do with infrastructure nuances at this early development stage. With the advent of government regulation, some of the unique features of this new technology will likely be relegated to paper, in other words, they will there in theory but not in practice.

Without a doubt, regulation will bring centralization, safety, and strict controls. Bitcoin and the blockchain will lose decentralization and user-anonymity for the most part when 80% of trading is made through major exchanges or big banks by institutional or large investors. Then again, hacking attacks should decrease because it will become more difficult to steal coins from NASDAQ or ICE accounts. Moreover, the SEC will have a hand in everything, regulating ICOs and other processes.

In other words, Bitcoin will gradually become similar to traditional futures or commodities. Where will this lead the market? To a massive change in the participant contingent, we believe – those who need/want anonymity and decentralization will begin exiting the market or using the services of small agents. With that said, many criminal spheres utilize these features. However, mainstream small investors and traders who don’t care about those features may even see improvement by increased safety and liquidity in the market.

What is the bottom line? Our opinion that the market is very close to comeback is aligned with the assessment of Civic CEO Vinny Lingham, who predicted that Bitcoin would be in the $3-5K range in the next 3-6 months. In an interview with CNBC, he said that BTC’s exchange rate is unlikely to drop below the $3K area, since this is the active purchase range; however, if the bearish cycle does not end in the next one or two quarters, BTC may not be able to maintain this level and drop sharply in price.

Currently, we see a culmination point for Bitcoin investment, a kind of “pain or gain” situation. Our all-time low targets stand at $2900 and $1800 correspondingly. Buying around $3K brings the best risk/reward ratio. While it is safer to buy at $6K after the upside action has begun, the price will be less attractive. Considering the background that we see at present, the total destruction of cryptocurrencies is hardly a possibility. Even if we consider a drop to the $1,800-$2,900 range, investment at the current levels is still a good long-term strategy.

A simple comparison of 2014 and 2018 price action reveals similarities and suggests an analogous price action for 2018-2019; this assumes a final drop to $1,800 before the true rise from the ashes begins.

Source: rbc.ru

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

338 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023