Bitcoin Fundamentals – Briefing April 2019

So, it is time to update our fundamental and sentiment background on cryptocurrencies market in general and on Bitcoin in particular. First, I want to be honest with you as with my family doctor – April is the most boring and chary month on fundamental events on Bitcoin. Thus our April update indeed will be brief.

The price action of Bitcoin tells the same. After the solid rally on 10th of April, it seemed – “that’s it,” Fire in the hole!” etc. But, nope – as the rally has stopped at major daily resistance (we cover this moment in our daily BTC videos), Bitcoin price is coiling around the 3rd week in a row already. Now, our major task is to provide a view of this event and what it still means, whether it has any importance.

For truth sake, there are few who tries to answer this question. Now there is too many analysis on BTC and opinions where it should go next.

At the beginning of our report we have to attract your attention to the thought, that at first glance looks obvious, but, somehow it is not widely observed in media for some reason. We think that this moment is extremely important.

Where is all news, talks, and rumors about cryptocurrencies ETF’s for institutional investors, talks of big banks on cryptocurrencies adopting, launching of big projects of cryptocurrencies future, etc?

As it was widely expected that particular institutional investors’ money should become a major driving factor of cryptocurrencies in this year and nearest perspective in general. There was so many information on this subject in the first quarter of the year, and it almost totally disappears in April. Hardly this is an occasion. Taking in consideration how difficult was the process of involving big banks, Management companies, government authorities in this sphere, it leads us to one major conclusion – it is no real success in this sphere by far.

Of course, this is not a final judgment yet. But, tactically, this is a temporal defeat. As no solution was found fast and “off-hand,” the overall process is promised to be hard and long-term. And this definitely plays not in favor of cryptocurrencies. At least it deprives market anticipated depth, liquidity and everything that we call as “easy money” (which was expected to be really big).

This moment has passed quiet guys, but we think that it will make a long-lasting impact on market sentiment. And our opinion value of this event for the whole crypto market is highly undervalued.

10th of April Bitcoin Rally

This is the next big event on our table. In our previous reports, we’ve many times pointed on a significant drop in the liquidity of Bitcoin market. This is the reason why whenever I see big rally (or collapse), I’m watching for its durability. Previous experience teaches us that strong action on bitcoin absolutely not necessary means the global change of sentiment and starting of big tendency as it stands on other traditional markets. There are so many different technical features that could drive the market, many specific nuances of trading BTC process and so thin market that we have to doubt and wait for some time. This time is not an exception as well, guys.

Indeed, there was a lot of rush and pure fascination after a big jump, but, what we see now? Those of you who follow our daily videos knows that Bitcoin stands at major daily resistance with the bearish pattern on the back and flirting with the same level for three weeks in a row.

The lack of information leads to appearing of big amount of opposite forecasts and opinions that we take a look a bit later in this report. Right now, let’s see what experts tell about the rally.

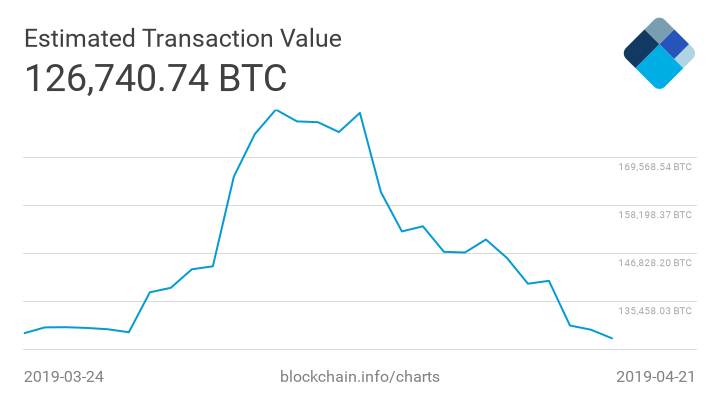

“Bitcoin is being manipulated.” This is one opinion that is worthy of our attention, we think. Indeed, as it shows statistics at Blockchain.com. Right after the active phase of the rally was over and BTC has hit ~ 5050$ area, on a retracement back to 4840$ the total amount of transactions has dropped drastically:

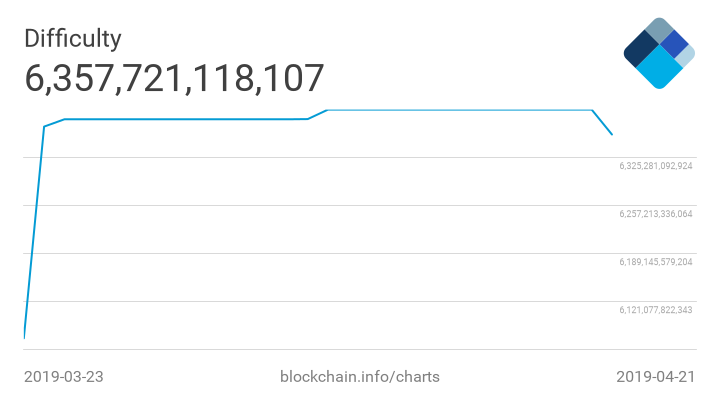

But what is really interesting guys, we do not see any drop in difficulty:

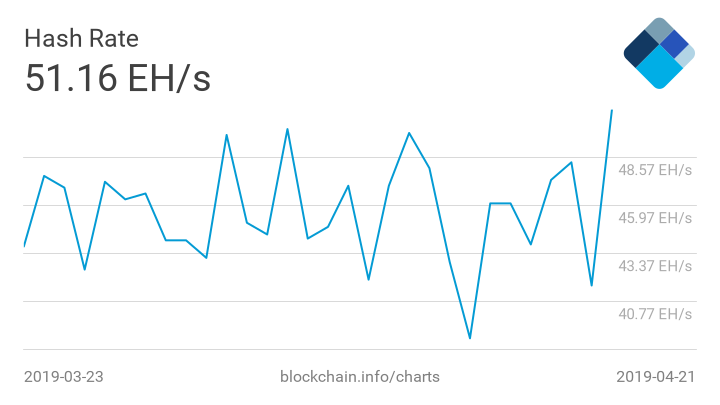

… and the hash rate, it also stands the same after retracement has started.

Combination of these factors, by expert opinion, tells, that BTC price could be manipulated. It is suggested that it could be a DDOS attack on Blockchain to artificially increase statistics and show the effect of rising demand on Bitcoin and trading activity.

As we’ve mentioned in the March report, by Blockchain Transparency Institute research, only 3 of the 25 largest trading exchanges provide real trading volumes. Thus, we can’t exclude the chance that this is true and indeed, somehow, the big rush on Bitcoin was created artificially. Of course, this is not purely technological intruding. Technology, code programmers could act together with big holders of Bitcoins.

The second hypothesis is stop-orders cascade execution.

Indeed, there are a lot of stops on a bearish position around 5000$ level, and all of them were hit. Market indirectly confirms this theory, because price stands flat around the top and shows no drop but fluctuates around it. This could be treated as the sign of preparation to breakout and building an energy action.

The second explanation has one important weakness – it is a consequence of upside action and, in fact, is a result of rally, but not the reason. Yes, stop triggering makes rally faster and stronger but this is just a technical execution and reaction on upside action that already has started.

Today, guys, we’ve prepared BTC video analysis, where we said that technically BTC comes to the point of exhausting. Upward action stands very slow, and technically it looks weak. It means that rally on BTC could happen only by some external impact. Anyway, in the nearest time, we expect strong action that should clarify the future perspectives of BTC and gives us the answer what was that – artificial spike or a real change of sentiment on the market.

As a result, market analysts show no consensus on future direction at this moment.

Adamant capital has released a big report, dedicated to Bitcoin perspectives.

They provide a lot of interesting stuff and analysis. In general, their position could be described as follows:

Sentiment on the BTC market starts to change, and it turns to “accumulation” phase when price holds in range of 3000-6000$ for a considerable period of time while the background for the real bull market will be cemented. Among the major reasons for starting of the bull market they see:

– accumulation by “Big whales”;

– significant parallels with the 2014-2015 bear market;

– extremely low volatility tells about retail and speculative apathy, market bottoming;

– demand shock are still possible due exchange hacks, miners capitulation;

– strong fundamentals of bitcoin.

Other opinions are not as long-term as Adamant capital and mostly focused on the short-term perspective.

Thus, Jesse Feinberg or Darth Crypto (depending on his mood, presumably) sees BTC running to $5600 – 5760 as long as we break through resistance at $5300. However, rejection of this level, would, in this trader’s view, means a correction, possibly a fairly harsh one to around $4400. However, that is the worst-case scenario, and as Feinberg follows up, there is a fair amount of support stopping BTC from causing too much damage.

Next analyst, Josh Rager, suggests that this constant oscillation between $5000 – $5200 is actually gaining BTC further support; caveating that this fluctuation also creates stronger resistance, which may see BTC move sideways for a few weeks…

Chepicap’s own resident Technical analysis expert, David Borman also eyes this key level of resistance. First giving the bear case, Borman suggests that sentiment is still too strong to break through this psychological level. However, ruling nothing out, he states that $4500 may be the next level BTC arrives at should 5k break, due to resistance from rising 200 moving average providing support around that level.

Onto the upside, Borman sees the next target at around 5500, a level at which a previous test failed.

Borman asserts that we could get rejected off these levels thanks to the 50-week MA, adding that a breakthrough this resistance level could bring us nicely to $6k, a level at which many have suggested will signify the true end of the crypto winter.

So, the consensus seems to be leaning for a fairly bullish move up provided we break through the aforementioned key levels. The good news is that any rejection is likely to be supported with a fair bit of cushioning on the way down.

Brazil Trades Over 100,000 Bitcoin in 24 Hours

Cointrader Monitor, a monitoring tool that analyzes Bitcoin price movements in Brazil, announced that Brazilian cryptocurrency exchanges traded over 100,000 BTC on April 10, 2019. This spike in the volume of bitcoins traded coincides with recent increases in Bitcoin values, surpassing the BRL 20,000 price mark. As a result, on April 10th, the total amount of transacted was over BRL 2 Billion.

Market loses $6 billion during Easter Sunday, Litecoin and BNB down 7%

The last few hours had seen the largest losses in the last six days when cryptocurrency prices had been rising, and the global market cap had taken a grip over the $170 billion price area.

At writing time, the same number has gone down to about $167 billion, with all but a handful of projects in the top 100 cryptos in the red, according to data extracted from Tradingview, just like the rest of the numbers in this piece.

Finally, we would like to share with some news that makes an impact on the infrastructure of the Bitcoin market.

Cointelegraph delists Bitcoin Cash and Bitcoin SV

Japanese financial services giant SBI Holdings says the removal of bitcoin cash (BCH) from its exchange this week was not a result of the other deslistings involving bitcoin SV (BSV), Cointelegraph Japan reported April 19.

Over the last few months, the team behind Bitcoin SV have engaged in behavior completely antithetical to everything we at Kraken and the wider crypto community stands for. It started with fraudulent claims, escalating to threats and legal action, with the BSV team suing a number of people speaking out against them. The threats made last week to individual members of the community were the last straw.

Сoncluding remarks

So, as you can see, we indeed do not have a lot of events this month. We have shared with you the most important and interesting April events, by our opinion that should have a long-lasting impact on the market.

Speaking on major April events, the rally of 10th of April, we follow pragmatic view. Long-term major tendency still stands intact, and it is bearish. By technical picture, the market has to move above at least 6500$, better above 8500$ to bring clear signs of long-term tendency crack. We have bearish patterns in place as well.

The fundamental background shows no positive breakthrough by far and stands mostly neutral with the same rustle around hacking, forking, etc.

Our suggestion is the market will drop under the weight of its own burden. Thus, to show rally, it needs an external impact of some driving factor, whatever it will be. Bitcoin has no its own, intrinsic power to continue upside action.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

2179 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023