Bitcoin Fundamentals Briefing, October 2020

October may end up being one the best months of 2020 for Bitcoin! Technical performance has been excellent, with all main indicators standing positive (hash rate, open interest, mining activity, transaction value, etc.). As a result of various factors, we have even had a major upside breakout over the 11-12K area, finally! Not only is short-term performance good, but also – and more importantly – the primary long-term drivers discussed (even as early as January) have yielded results.

Due to mining centralization and rising interest from institutional investors, we see explosive demand for crypto hedge funds like Glassnode. They are reporting record money inflows, while Bitcoin is performing better than both gold and stocks. In fact, we have a deficit of coins because all mined BTC is being bought up by hedge funds to satisfy growing institutional demand.

After a long wait, the crypto sphere has made a giant step toward a more ‘civilized’ and precisely regulated market. Companies are getting bank licenses, filing statements with the SEC and CFTC, and being listed on exchanges.

Fundamental driving factors

Still, Bitcoin cannot avoid being impacted by substantial drivers common to all markets in October and November. We are speaking, of course, about the US stimulus package and elections. Bitcoin has reacted to these factors in the past; for example, the 12K breakout was propelled by Paypal’s statement and news about the $2.2 trillion stimulus being discussed.

From the perspective of the next 2-3 weeks, despite its inner drivers, BTC can hardly remain unaffected by election results. It will probably move in the same direction as the other markets. In short, a Biden victory would support Bitcoin, while a Trump win will have a holding effect on the markets and lead to dollar appreciation in the short-term.

On October 25, we gave an in-depth analysis of how markets now “predict” results and how they would perform depending on the outcome. Election results could override BTC’s inner drivers temporarily, but the long-term outlook for cryptocurrencies remains positive.

Market statistics

Let’s look at some market performance statistics. In general, they are impressive and point, without doubt, to good performance in the future.

-

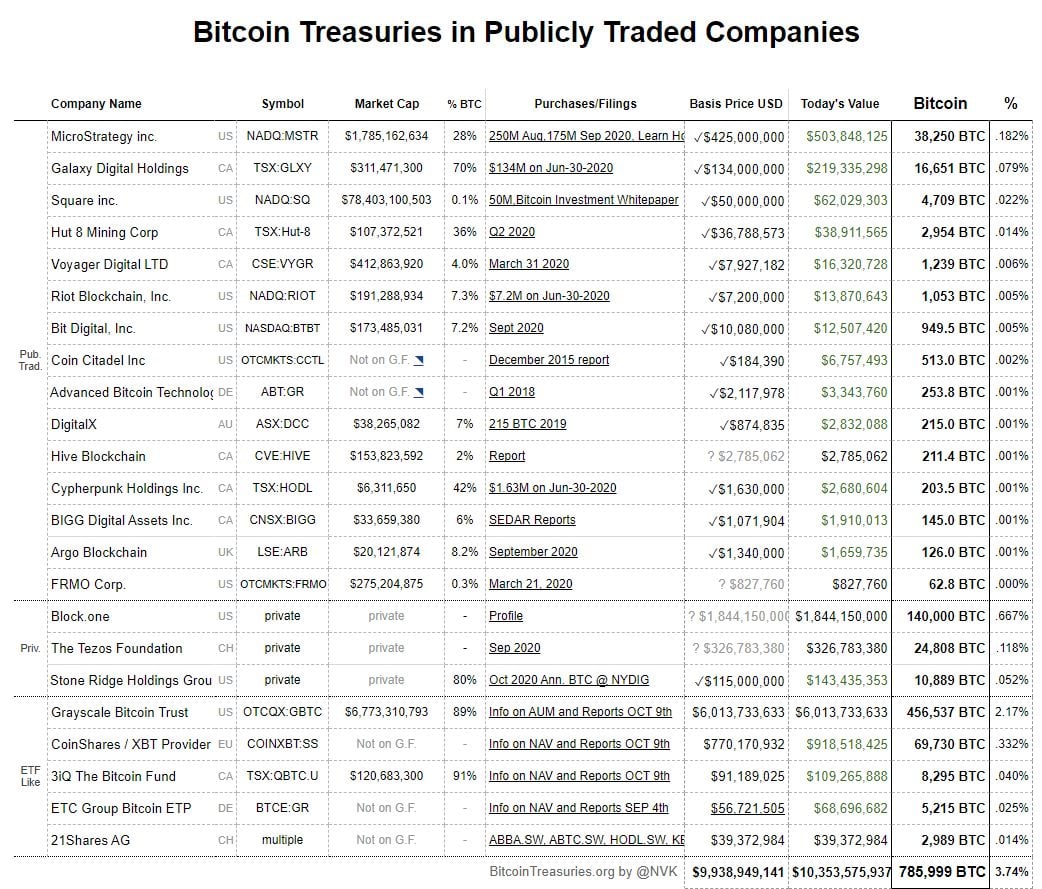

Bitcoin Treasuries reports that the total investment of public companies in Bitcoin has reached $9 billion (equal to 760,242 BTC) and keeps growing.

The following list posted on their website gives a breakdown of BTC holdings at various companies. Greyscale Fund assets have reached $6.7 billion, increasing by more than $1 billion in Q3. So strong is the demand for coins from hedge funds that it is substantially impacting the demand/supply balance and causing a price rise in the longer-term.

-

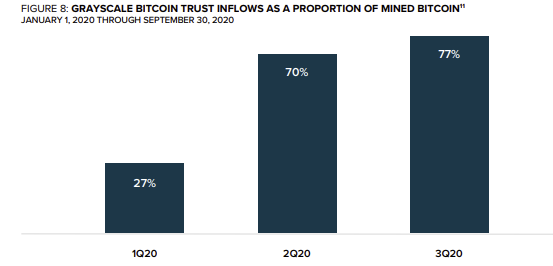

Dan Tapiero shows how much newly-mined BTC Greyscale Fund has “consumed” in 2020.

In an October 14 tweet, Dan Tapiero writes:

“SHORTAGES of Bitcoin possible. Barry’s Grayscale trust is eating up BTC like there is no tomorrow. If 77% of all newly mined turns into 110%, it’s lights out. Non-miner supply will get held off mkt in squeeze. Shorts will be dead. Price can go to any number.”

A tweet by @lightcrypto of Oct. 10 reads:

“Bitcoin is experiencing the beginnings of a sell-side liquidity crisis. It has always been like oil on crack. Production s entirely inelastic, demand meanwhile, is reflexive.”

At this point, we chime in to add that this is just the beginning. As we’ve mentioned in our previous report, Powerprofile agencyhas conducted a poll that suggests that 90% of UK and US Pension funds intend to buy more BTC in the foreseeable future. This means that hedge funds will rival for free coins not only with individuals but also pension funds.

-

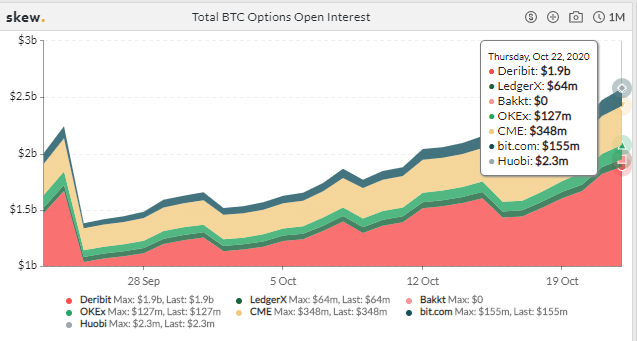

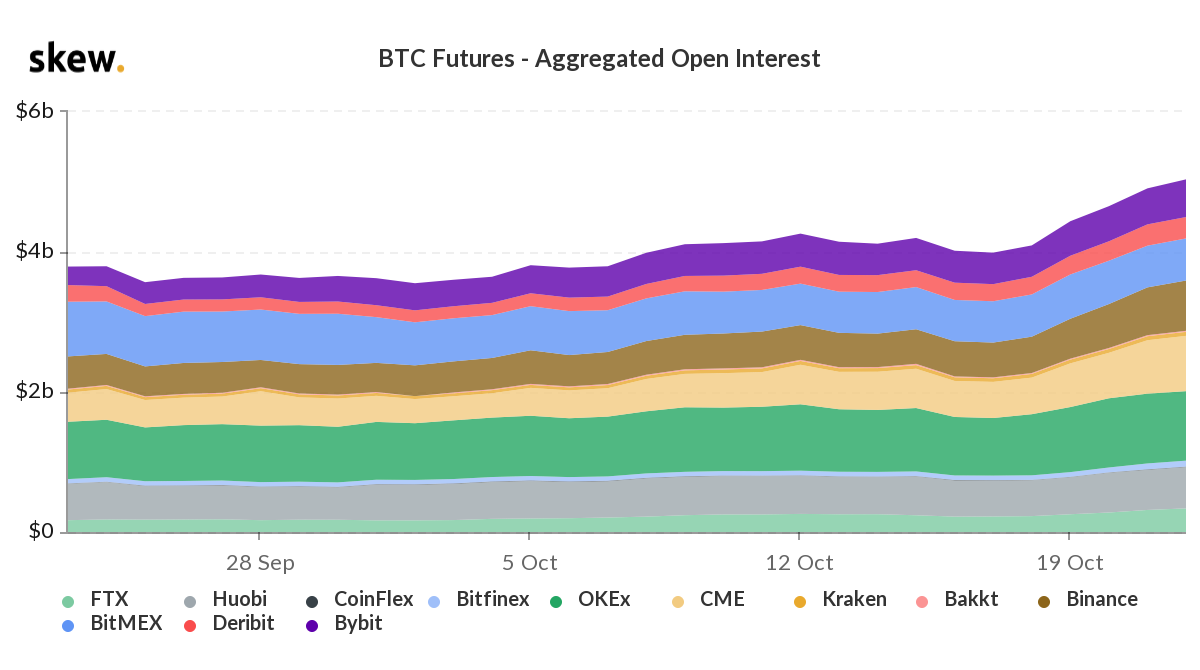

Open interest has reached all time high backing by 13K rally.

In an interesting turn of events, CME’s open interest has exceeded Binance’s level for the first time – this may be an indication of rising interest in Bitcoin from large

-

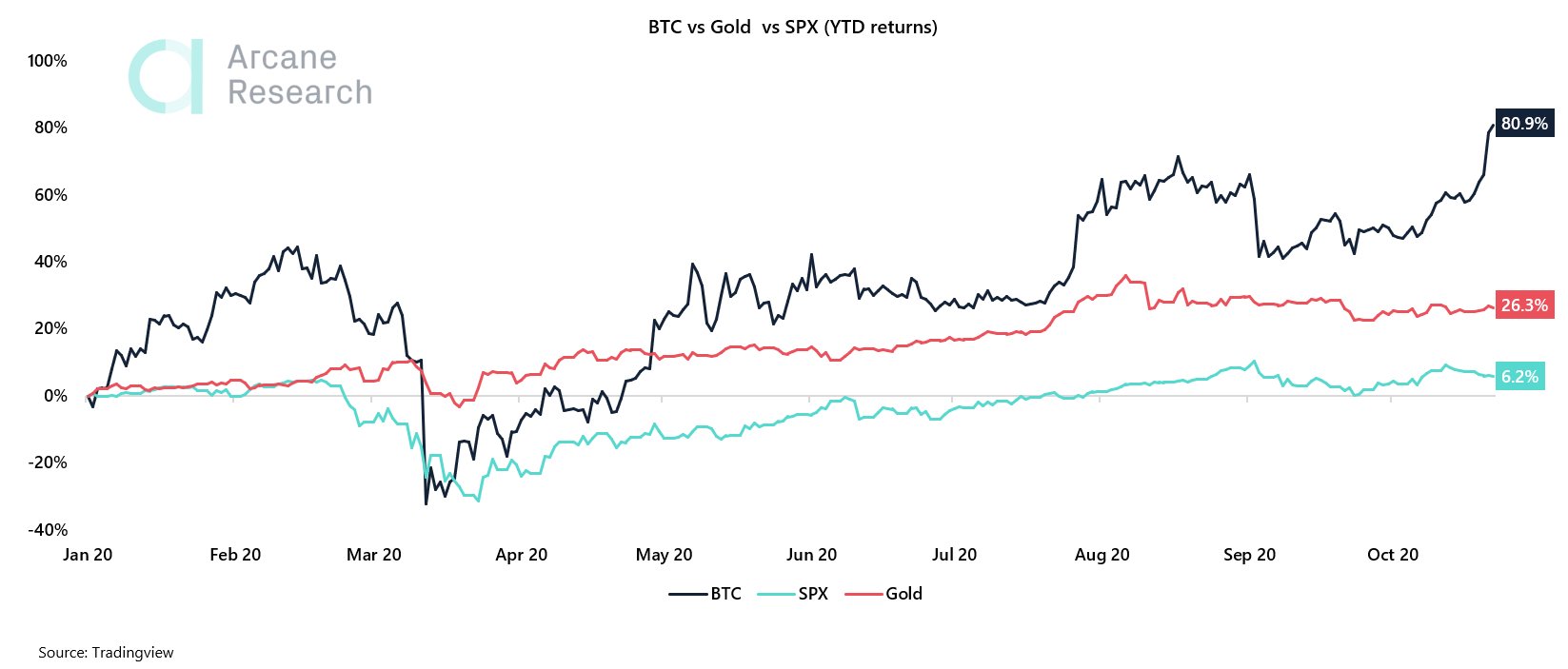

Arcane Research shows that the BTC market has risen 80% this year, compared to gold’s 26.3%, and S&P 500’s mere 6.2%.

A tweet by Vetle Lunde on October 22 comments, “2020, a decent year for Bitcoin,” and presents the following chart:

-

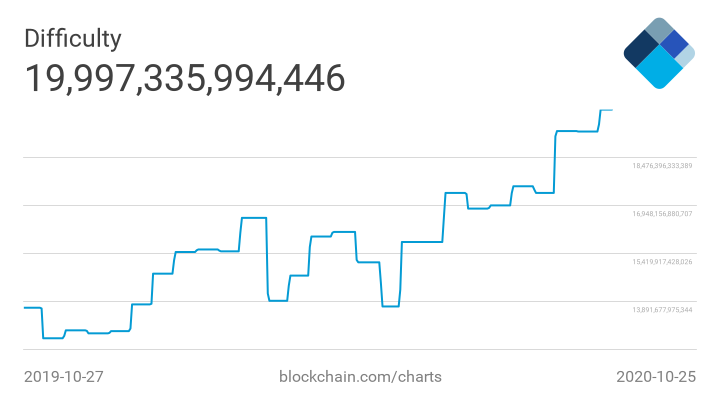

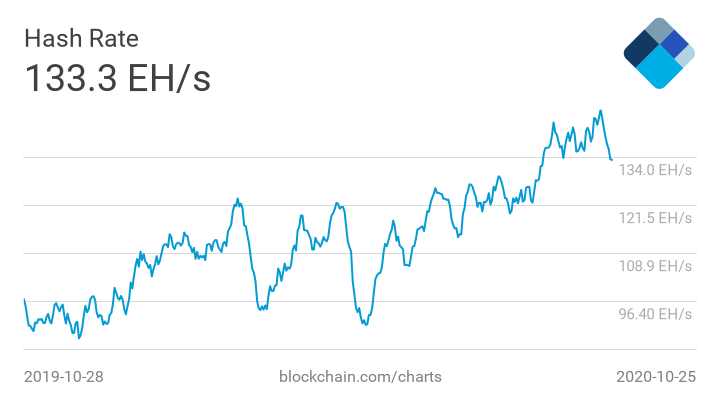

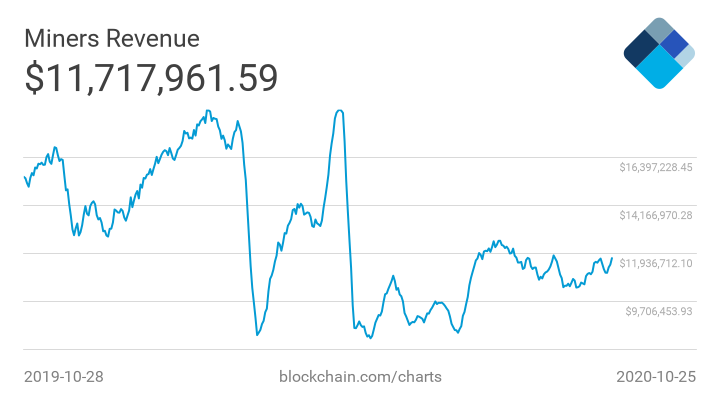

Inner Bitcoin statistics also look positive.

As the following charts show, rate, difficulty, and miners’ income have been growing since the halving in the summer:

Next we have few interesting headlines that seem important for longer-term Bitcoin perspectives

Hot headlines

Next, we have a few headlines that seem important for the longer-term Bitcoin perspective.

As announced on October 21:

“The migration toward digital payments and digital representations of value continues to accelerate, driven by the COVID-19 pandemic and the increased interest in digital currencies from central banks and consumers. PayPal Holdings Inc. announced the launch of a new service enabling its customers to buy, hold, and sell cryptocurrency directly from their PayPal account, and signaled its plans to significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide.”

The news pushed Paypal capitalization to all time highs and shares jumped 5+%, suggesting that investors are reacting positively. Indirectly, this also indicates a positive attitude from traditional investors toward crypto, treating this new Paypal feature as a positive development.

Wirex, in a post published on October 21, states:

“We have now launched the waitlist for our highly-anticipated Wirex multicurrency card, taking us one step closer to becoming the ultimate cryptocurrency platform. The move comes following the announcement of a product overhaul, with the launch of a Mastercard-enabled card heralding a number of game-changing product updates that will change the alternative payments space forever.”

Due to launch in November, the new card is linked to 19 secure currency accounts in the Wirex app, allowing Wirex cardholders to spend multiple fiat and crypto seamlessly anywhere that accepts Mastercard, without exchanging or offboarding.

Surprisingly, the first government to adopt a national cryptocurrency is the Bahamas. “Sand Dollar,” as it called, is in direct relation to the Bahamas dollar, which in turn is directly linked to the US Dollar.

It looks as though China wants to be second country after the Bahamas to issue a national cryptocurrency, and the first among developed nations. As Changchun Mu, the director of the Chinese Institute of CBDC, announced:

“The ‘dual offline’ wallet has been fully developed and having a friendly user experience. The wallet is expected to be applied in the follow-up pilot.”

Changchun Mu added that the public’s enthusiasm exceeded his expectations. As reported on 8btc.com:

“China’s ‘red packets’ lottery giveaway of digital yuan to 50,000 residents of Shenzhen resulted in 62,788 transactions with a total value of 8.764m yuan (US$1.32m) during the week-long central bank digital currency (CBDC) test in the city. Users added a total of 901,000 yuan (US$134,945) to their digital wallets during the trial.”

In April 2020, the Bank of Korea launched the CBDC pilot program, which is expected to run until December 2021. The central bank maintains that it will not necessary issue a CBDC in the near future.

Mode, a London Stock Exchange-listed company, which brands itself as a “Bitcoin banking app,” has revealed it now holds around £750,000 ($980,000) worth of BTC after announcing plans to put 10% of its cash reserves into the cryptocurrency. Mode is one of the first publicly-traded British companies to put Bitcoin on its books.

The Block reports that a fintech fund managed by Lombard Odier Investment Managers, the asset management arm of the Swiss private bank, is investing in digital asset companies. The public markets investor is looking for “picks and shovels” investment opportunities in the market.

On October 6, Riot Blockchain stated that it continues its operational expansion by purchasing an additional 2,500 next-generation S19 Pro Antminer (110 TH/s) miners for $6.1 million from BitmainTech, scheduled for receipt and deployment delivery in December 2020. With this purchase, they expect to reach 842 PH/s in operational hash rate with 9,540 miners deployed by late December 2020. This represents an increase of approximately 50% over the previous estimate of Riot’s deployed hash rate as of the end of 2020.

In a press release of October 23, the US Federal Reserve states:

“Under the current recordkeeping and travel rule regulations, financial institutions must collect, retain, and transmit certain information related to funds transfers and transmittals of funds over $3,000. The proposed rule lowers the applicable threshold from $3,000 to $250 for international transactions. The threshold for domestic transactions remains unchanged at $3,000.”

On October 1, the CFTC filed a civil enforcement action charging five entities and three individuals with operating the unregistered trading platform BitMEX and violating multiple CFTC regulations, including failing to implement required anti-money laundering procedures. Among those charged were owners Arthur Hayes, Ben Delo, and Samuel Reed, who operate the platform through a maze of corporate entities. These entities, also named as defendants, are HDR Global Trading Limited, 100x Holding Limited, ABS Global Trading Limited, Shine Effort Inc. Limited, and HDR Global Services (Bermuda) Limited (BitMEX).

SEC Commissioner Hester Peirce said that the BitMEX case is the “signal” that US regulators have sent a clear warning.

“Crypto firms are often a rich source of low-cost deposits for the few banks that openly serve the sector. As such, analysts have paid close attention to deposit growth at Signature, Silvergate Bank, and Metropolitan Commercial Bank. The $1 billion in deposit growth from digital asset banking at crypto-friendly Signature Bank was driven in part by the bank holding the dollars backing stablecoins,” said CEO Joseph DePaolo.

-

Switzerland adopts the Federal Act on the Adaptation of Federal Law to Developments in Distributed Ledger Technology (DLT)

On October 19, the Federal Department of Finance (FDF) initiated the consultation on the blanket ordinance in the area of blockchain. Amending specific provisions in ten existing federal acts, this has further improved the framework conditions for Switzerland to become a leading, innovative, and sustainable location for blockchain and DLT companies.

-

Fidelity, Vanguard, Schwab loading up on crypto mining

According to financial filings with the US Securities and Exchange Commission, three of the largest asset managers are diversifying to hold blockchain stocks. Charles Schwab has begun purchasing shares of Riot Blockchain, joining Fidelity and Vanguard – already investors in Riot, HIVE Blockchain Technologies, Hut 8, and BC Group – in allocating mutual fund holdings to a cryptocurrency company.

US Federal Reserve Chair Jerome Powel stated the following in a discussion hosted by the International Monetary Fund:

“We do think it’s more important to get it right than to be first, and getting it right means that we not only look at the potential benefits of a CBDC, but also the potential risks, and also recognize the important trade-offs that have to be thought through carefully.”

Powell said it is vital the Fed assess what impact a CBDC might have on a range of critical issues.

Bitcoin price forecasts

-

JPMorgan says Bitcoin has “considerable” upside as it better competes with gold as alternative currency.

According to a Market Insider article, JPMorgan believes that Bitcoin’s 2020 surge could continue although it’s still a relatively small asset class, mostly favored by millennial investors who are not as influential as older generations that predominantly favor physical gold. The physical gold market is worth $2.6 trillion, including assets held within gold ETFs. For Bitcoin to catch up, it would have to surge 10x from the current levels.

“Even a modest crowding out of gold as an ‘alternative’ currency over the longer term would imply doubling or tripling of the Bitcoin price,” and, over time, crypto could be held for other reasons than being a store of wealth as gold is. “Cryptocurrencies derive value not only because they serve as stores of wealth but also due to their utility as means of payment. The more economic agents accept cryptocurrencies as a means of payment in the future, the higher their utility and value,” JPMorgan explained.

Simply put, they concluded that risk is to the upside for Bitcoin: “The potential long-term upside for Bitcoin is considerable as it competes more intensely with gold as an ‘alternative’ currency we believe, given that millenials would become over time a more important component of investors’ universe.”

Research Director Ria Bhutoria noted that the flow of institutional investors can strengthen the relationship of crypto with traditional markets, although they are initially uncorrelated in nature.

Analysts believe that fundamentally digital assets are less vulnerable to economic hardship. In a world where interest rates are close to zero, Bitcoin is a “potentially useful” asset. More importantly, Fidelity notes:

“The risks of refusing to include Bitcoin in a portfolio today are higher than the risk of missing out on this opportunity.”

According to Bhutoria, the flow of only 1% of the $ 50 trillion bond market into the crypto market can push the capitalization of Bitcoin to $500 billion (at the time of writing, capitalization is $211 billion). He also considers a scenario in which the capitalization of the first crypto rises to $ 1.3 trillion.

-

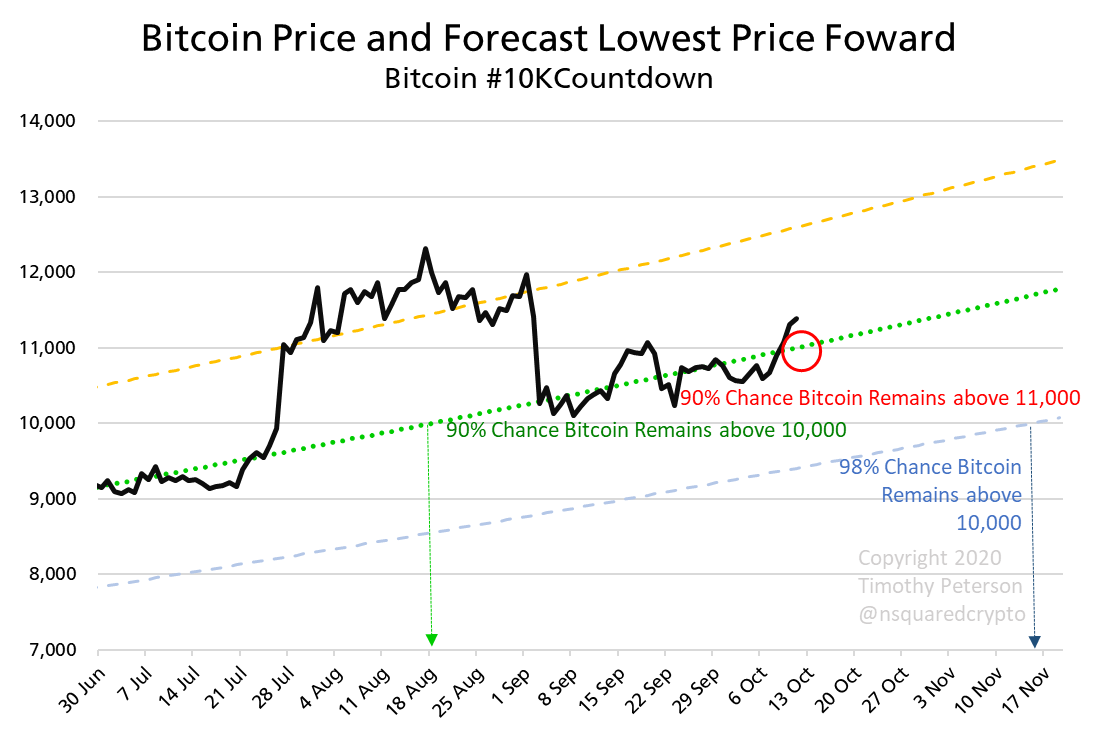

Timothy Peterson (CFA)suggests that BTC price will never drop below the 11K level again.

Peterson is basing his assessment on an in-depth analysis of long-term Bitcoin prices and major fundamental factors.

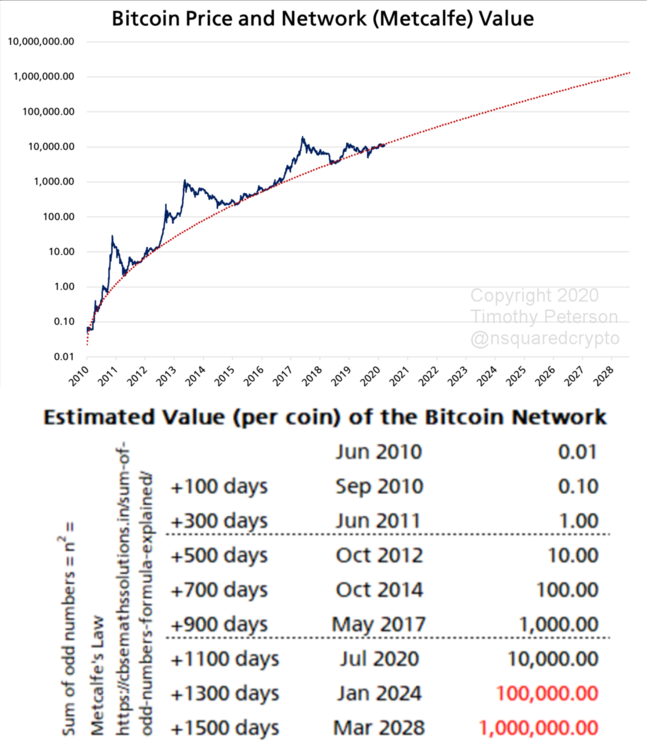

In 2018, he applied Metcalfe’s law to Bitcoin and showed that it determined over 70% of its value. In a yet unpublished work, Peterson provided a mathematical derivation that linked traditional time-value-of-money concepts to Metcalfe value, and used Bitcoin and Facebook as numerical examples of the proof.

Peterson is a follower of Metcalfe law, which is related to the fact that the number of unique possible connections in a network of n nodes can be expressed mathematically as the triangular number n(n-1)/2, which is asymptotically proportional to n^2.

According to Peterson, it is the same as E=mc2, and this math law works perfectly on the Bitcoin market.

The theoretical shape of the Metcalfe model looks as follows:

And here are Peterson’s shorter-term forecasts of Bitcoin prices:

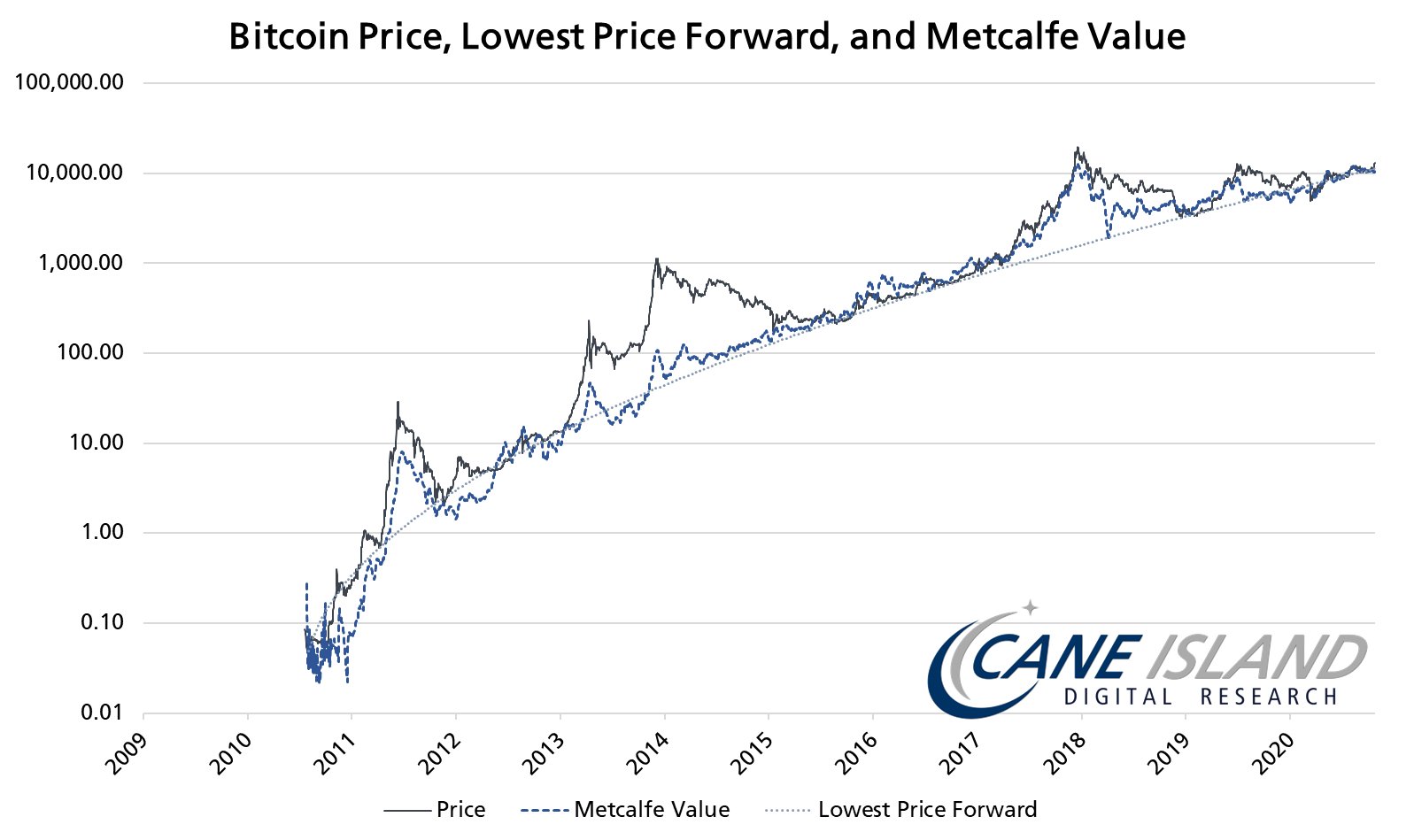

Metcalfe value is an index measuring value based on adoption. Lowest Price Forward is an index measuring downside risk based on Metcalfe value. LPF is useful for long term, and Metcalfe is useful for long and intermediate term.

Neither is a good short-term measure.

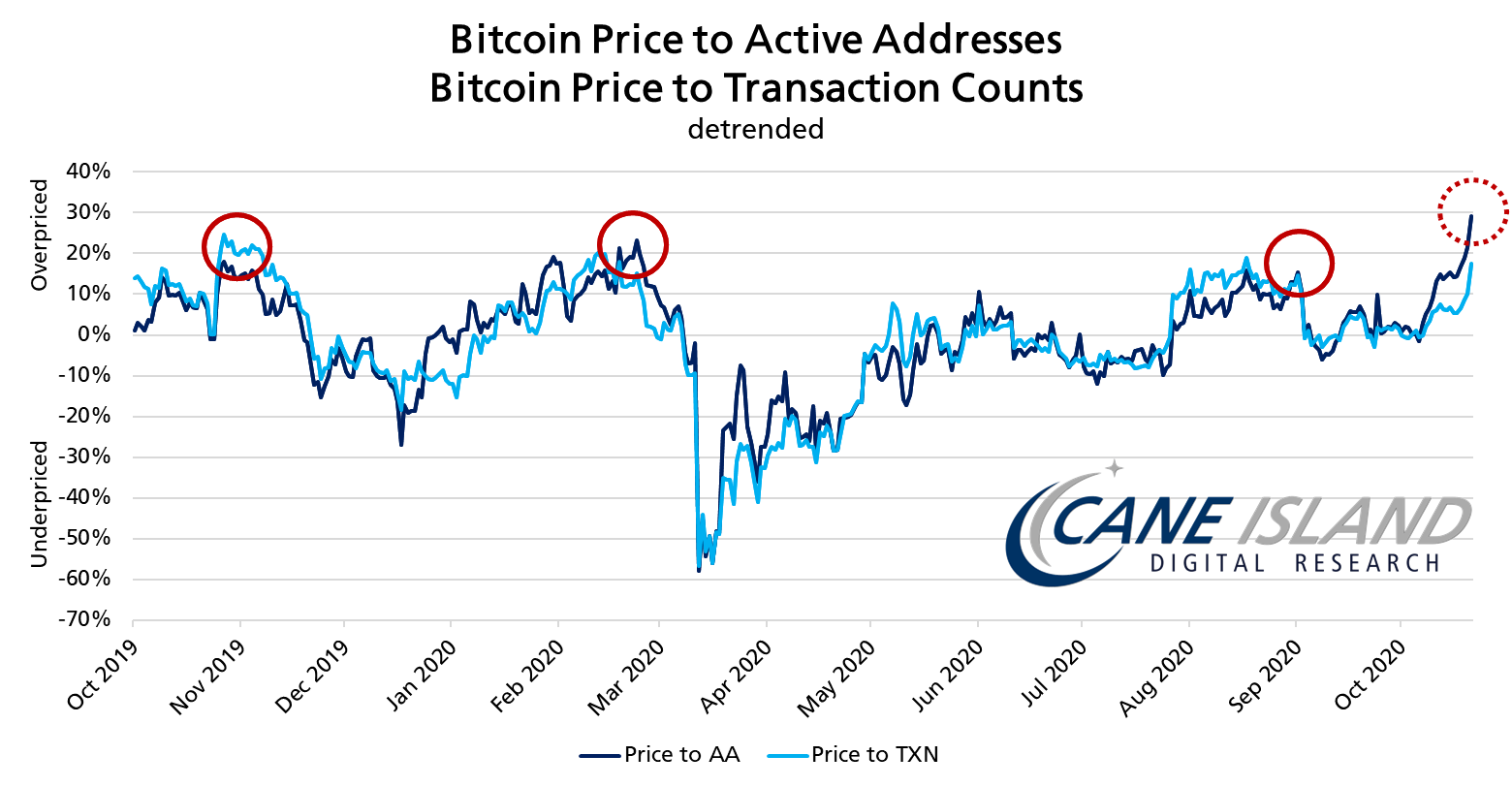

Peterson also sets two indicators that show an overbought situation on Bitcoin. They are Price-to-Active addresses and Price-to-Transactions counts – he writes:

“The three times in the past year when Bitcoin was overpriced relative to fundamentals, a correction occurred. I expect the same this time. In this case the decline could be 10-15%+. Notice the price stays elevated for a while. A drop could be 30-60 days away, if at all.”

Conclusion

The perspective on Bitcoin looks optimistic, indicating that the price has a good chance of significant growth within a few years, even by a few times.

As we have seen in this report, the statistics look great. All data points to rising interest in cryptocurrencies in general, and Bitcoin in particular. Hash rate, difficulty, mining rewards, trading volume, open interest, and massive inflows in crypto hedge funds – all this supports the positive view and market sentiment.

In our opinion, events indicate three essential things:

First, if regulation becomes too strict in the US, large companies and funds may move, possibly to Switzerland, which is closer to adopting a legal framework for cryptocurrencies than any other EU country. As reports indicated in September and October, they are working seriously on this. Of course, the Asia-Pacific region also is attractive, but Chinese legislation is weak, and US investors could prefer something more traditional.

Second, “The risks of refusing to include Bitcoin in a portfolio today are higher than the risk of missing out on this opportunity.” Fidelity’s statement encapsulates the headlines. For huge traditional funds, 1% of investment is only a drop in the ocean that could power up the relatively small Bitcoin market nonetheless. Fidelity’s position indicates that big investors must be considering investing or are starting to invest – this sentiment is also indicated by other headlines.

Third, technical and fundamental analysis of BTC’s price brings much optimism to the 1-2 year perspective. Timothy Peterson’s approach looks exciting and indicates good hindsight results.

In closing, we say that, together, all developments confirm our long-term bullish view on Bitcoin.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

883 Views 1 CommentsComments

Thanks for this report!

Can you please re-upload the metcalfe model graphs ?

They were in the video but not visible here anymore

Thanks

Leo

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023