Bitcoin Fundamental Briefing, July 2021

Silence before the storm?

July this year is the most quiet month in the modern history of cryptocurrencies. I’ve tried to surf across the news, events, and analysis throughout the month but found just a few exciting materials. Overall news background stands routine – some funds, ETF’s have been initiated, new ASIC’s devices purchased by different mining companies, here and there speeches about the necessity of tighter regulation, or, vice versa – lighter constraint, Central Banks cryptocurrencies, legal claims on different crypto subjects here and there, etc. – everything the same as usual. In general, this is not bad – interest in cryptocurrencies stands stable.

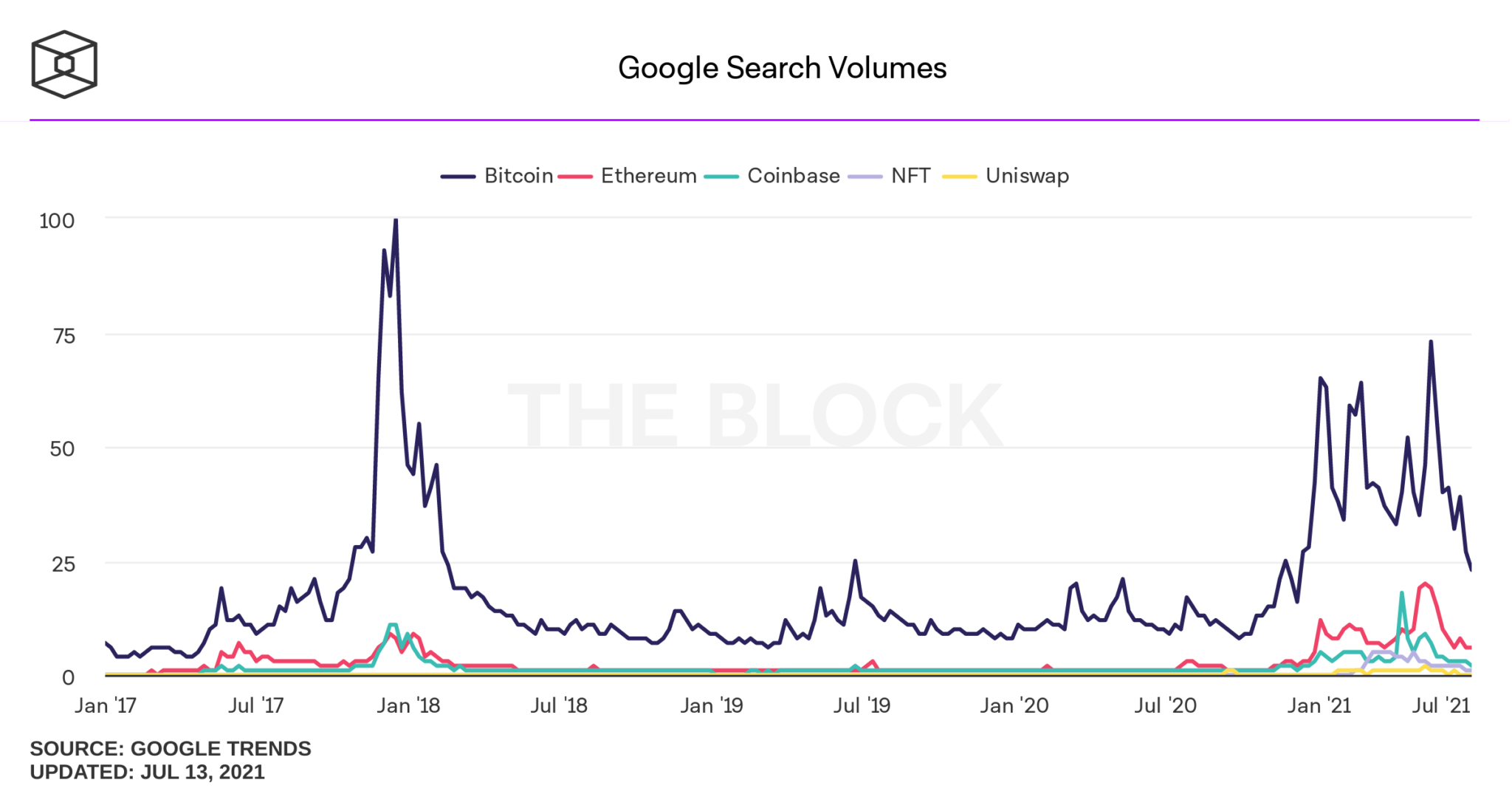

At the same time, in July, I see fewer forecasts, analyses, and investors not arguing on Bitcoin trend, ETH, or any other currency. Definitely interest in this topic has dropped. Speculators are not as interested in cryptos because of flat standing for 2-3 months, while institutional investors have lost faith because of the 50% May collapse. Indeed, Google Trends shows interest drop to this topic – now it stands on the level of November 2020. Now it stands 68.5% lower than on May’s peak – repeats the dynamic of the BTC. We see the same trends on searching ETH, Uniswap, Coinbase, and other leading objects of the crypto market.

BlackRock CEO Larry Fink told to CNBC that in last two weeks investors are not interesting in cryptocurrencies at all. Previously there was some interest.

In June we’ve found the same position from JP Morgan and its poll that shows low interest of institutional investors to Bitcoin investments, at least currently:

Only 10% of institutional investment firms surveyed by JPMorgan trade cryptocurrencies, with nearly half labelling the emerging asset class as “rat poison” or predicting it would be a temporary fad.

Of those firms who did not invest, 80% did not expect to start investing or trading in cryptocurrencies, according to the survey conducted at JPMorgan’s Macro, Quantitative and Derivatives conference, attended by some 3,000 investors from around 1,500 institutions.

New source of bullish sentiment

Experts and traders opinion now come to the consensus that the market needs a strong driver – either in the sphere of colossal coin amount purchasing by some fund, company, or bank, or regulatory sphere when some authority grants or prohibits something. Last time it was China with its mining prohibition.

Look what has happened on the fake release that Amazon intends to sell for Bitcoin – the price jumped to 40K. Investors are hungry for the driver.

Despite that, Amazon denies this news later, the taste of this driver remains, and the price is still coiling around 35-37K area. In general, Amazon keeps vacations in cryptocurrencies and sooner or later intends to accept cryptocurrencies together with classic payment:

“Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true,” said a spokesperson from Amazon. We remain focused on exploring what this could look like for customers shopping on Amazon.”

We see that this might become the new source of a positive mood to the market and a hidden source for the new bull run. Last year our stake was on institutional investors and their money. In our long-term view, in 2020, we’ve talked about this topic many times, and this stake has worked – a lot of institutional funds have come on the market, pushing it to 60K area. Now big companies are shocked by the May collapse and need to recover. They will return someday and support the market again. Meantime – we see a new source of optimism, which is the big companies.

More and more big companies start to accept BTC as payment – Tesla, Amazon on the way, PayPal, later it could be Apple, Facebook, Google, and many others. Mastercard and Visa are working to make wires and exchange more accessible and comfortable to the clients. Rising turnover should lead to an increase in demand as well. And we see it as a supportive factor to the crypto market – if not due to institutional investors, but because of global turnover, demand for cryptocurrencies should start recovering slowly.

“We’ve witnessed promising growth in crypto, evidenced by Fidelity’s recent survey indicating that more than half of institutions across Asia, Europe, and the U.S. currently invest in digital assets,” said Scott Army, CIO of Galaxy Vision Hill, referring toFidelity’s report that 71% of institutional investors plan to gain crypto exposure. “

Most institutional investors expect to hold or invest in digital assets in the future, according to research from Fidelity Digital Assets’ 2021 Institutional Investor Digital Assets Study.

Seven in 10 institutional investors see themselves gaining crypto exposure going forward, and more than 90% of those interested in digital assets expect to have portfolio allocation within five years, the report indicated.

Institutional investors that are skeptical of the asset class primarily cite volatility and security as top concerns, the report said. But concerns are less prevalent today than they have been in recent years, according to Tom Jessop, president of Fidelity Digital Assets.

Bitcoin Making Inroads With Younger U.S. Investors

- 6% of U.S. investors now own bitcoin, up from 2% in 2018;

- 13% of investors younger than 50 own it, versus 3% of older investors;

- Concern that bitcoin is “very risky” has declined.

Jack Dorsey says bitcoin will be a big part of Twitter’s future

Twitter CEO Jack Dorsey confirmed to investors that bitcoin will be a “big part” of the company’s future, as he sees opportunities to integrate the cryptocurrency into existing Twitter products and services, including commerce, subscriptions and other new additions like the Twitter Tip Jar and Super Follows.

“If the internet has a native currency, a global currency, we are able to able to move so much faster with products such as Super Follows, Commerce, Subscriptions, Tip Jar, and we can reach every single person on the planet because of that instead of going down a market-by-market-by-market approach,” Dorsey explained.

“I think this is a big part of our future. I think there is a lot of innovation above just currency to be had, especially as we think about decentralizing social media more and providing more economic incentive. So I think it’s hugely important to Twitter and to Twitter shareholders that we continue to look at the space and invest aggressively in it,” he added.

Facebook hopes the cryptocurrency it backs will launch in 2021

David Marcus, the head of Facebook Financial, also known as F2, said he hopes both the cryptocurrency called Diem and the social networking firm’s wallet Novi, will launch in 2021. Diem used to be called Libra before a recent rebrand. It is run by a consortium called the Diem Association. The Facebook-backed cryptocurrency effort has faced huge criticism from global regulators. Marcus said he hoped regulators would give the project the “benefit of the doubt.”

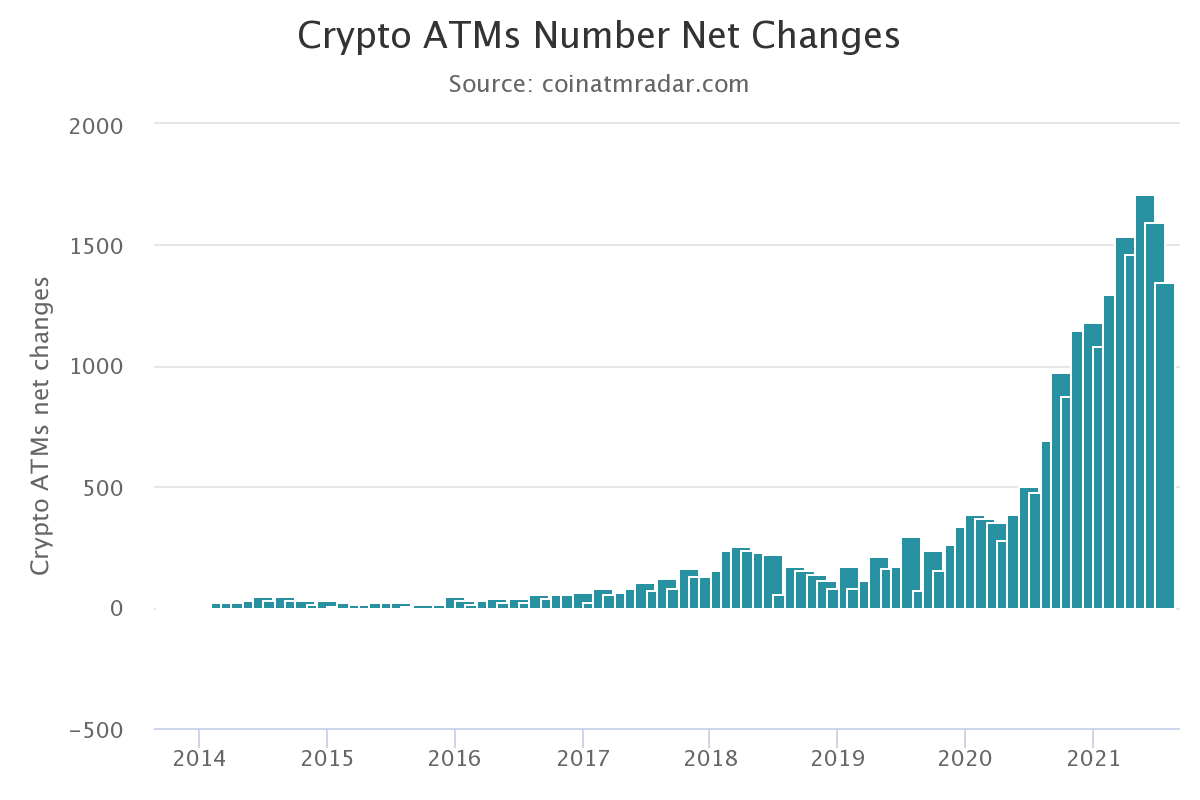

Crypto ATM increases 70% this year:

Silvergate Capital Corporation IIQ report shows growing interest to cryptocurrencies:

- Digital currency customer related fee income for the quarter was $11.3 million, compared to $7.1 million for the first quarter of 2021, and $2.4 million for the second quarter of 2020;

- Digital currency customers grew to 1,224 at June 30, 2021, compared to 1,104 at March 31, 2021, and 881 at June 30, 2020;

- Digital currency customer deposits grew by $4.3 billion to $11.1 billion as of June 30, 2021, compared to $6.8 billion as of March 31, 2021

JPMorgan to give all wealth clients access to crypto funds

The bank told its financial advisers in a memo earlier this week to take buy and sell orders from its wealth management clients for five cryptocurrency products effective July 19, the report said. Four of such products are from Grayscale Investments and one from Osprey Funds, according to the report.

Market sentiment

Although the long-term picture looks inspiring, in the shorter term, there are few reasons for happiness. Sentiment stands weak. The recent rally, as it becomes clear now – has fake reasons. In general, experts treat the current situation as not very optimistic.

On-chain Activity Remains Quiet

In direct contrast to the volatility in spot and derivatives markets, the transaction volume and on-chain activity remains extremely quiet. On a 14-day Median basis, the entity-adjusted transaction volume for Bitcoin remains depressed at around $5B per day. This remains a significant decline from the $16B/day prior to the May Sell-off.

However, volume has not yet collapsed to the same extent as the 2017 blow-off top, where network volume saw a full retrace, a subsequent bear market and eventually, a lengthy capitulation. It remains to be seen whether on-chain volumes start to pick up in response to recent volatile price-action.

we review whether there are any signs of older profitable coins being spent on-chain to take advantage of market strength for exit liquidity. What would be relatively bearish is to see a significant increase in older coins (>1yr) spending during this relief rally as was seen in 2018 after the blow-off top.

So far, we have not seen such behavior. If general dormancy of older coins persists, it would suggest conviction to HODL remains relatively strong and favor a more constructive view on market structure moving forwards.

Bloomberg Mike McGlone strategists – Bitcoin more likely to hit $60k than $20k

Mark Mobius on China Crackdown, Bitcoin and Gold

ETHERIUM

JPMorgan Says Ethereum Upgrades Could Jumpstart $40 Billion Staking Industry

In order to create a more scalable and energy-efficient system, blockchain development teams, including the progenitor of the decentralized finance movement, ethereum, are switching from proof-of-work to proof-of-stake, where investors lock-up their funds on the blockchain in exchange for rewards.

According to the report, staking today generates an estimated $9 billion worth of revenue annually for the crypto industry. Authors predict that ethereum’s shift to proof-of-stake after the launch of long-anticipated ethereum 2.0 next year will spur adoption of the alternative consensus mechanism and could cause staking pay-outs to balloon to $20 billion in the quarters following the launch of Ethereum 2.0 and $40 billion by 2025.

“Not only does staking lower the opportunity cost of holding cryptocurrencies versus other asset classes, but in many cases cryptocurrencies pay a significant nominal and real yield,” the report reads.

Currently staking cryptocurrencies like SOL or BNB can earn yields ranging from 4% to as high as 10% annually, according to data from stakingrewards.com. The Winklevoss crypto exchange Gemini for example, currently advertises to investors the chance to earn annual yields up to 7.4% on their crypto balances. The report also says that as the volatility of cryptocurrencies declines, the ability to earn a positive real return will be an important factor in helping the market become more mainstream.

The report’s authors predicted that staking will become a growing source of income for cryptocurrency intermediaries like Coinbase, especially after Ethereum 2.0 which is scheduled to be complete in 2022. The report estimates that staking presents a $200 million revenue opportunity for Coinbase in 2022, up from $10.4 million in 2020.

The same thing tells Goldman Sachs.

Major Ethereum EIP 1559 upgrade set to alter supply, fix transaction fees

Ethereum, the second-largest blockchain network, is about to undergo a technical adjustment that will significantly alter the way transactions are processed, as well as reduce the supply of the ether token and sharply boost its price.

The scheduled coding revamp will go live on Aug. 4.

The upgrade known as Ethereum Improvement Proposal (EIP) 1559 is similar, analysts said, to a bitcoin “halving” event.

Andrew Keys, managing partner at DARMA Capital, said ether’s current price has yet to factor in the looming software upgrade.

He estimates that the expected software adjustment next week, coupled with another upgrade in the first quarter of 2022, should “easily quintuple the price of ether” by next year.

EIP-1559 is a software upgrade that fundamentally changes the way transactions are processed on Ethereum by providing clear pricing on transaction fees in ether paid to miners to validate transactions and “burning” a small amount of those tokens. The burned tokens will be permanently taken out of circulation.

In token burning, miners would typically send the tokens to specialized addresses that have unobtainable private keys. Without access to a private key, no one can use the tokens, putting them outside the circulating supply. By reducing the number of tokens, the currencies that remain in circulation become rarer and more valuable.

Currently, a person or entity trying to send a transaction on the Ethereum network must pay a so-called “gas fee” in ether to miners to process their transactions.

This creates two issues, said Matt Hougan, chief investment officer at Bitwise Asset Management.

“First, it introduces a major uncertainty around whether you’ll get your transaction processed in a timely fashion,” he said. “Second, people overpay because they don’t know the clearing price and they bid too much to make sure the transaction is processed.”

EIP-1559 changes this mechanism by setting a “base fee” paid to miners for each transaction, part of which will be burned. Participants can also include an optional “tip” with their base fee to speed up the process, if desired.

Another adjustment, market players said, is doubling the amount of space available in each block. Blockchains like Ethereum settle transactions in batches or blocks. Each block can contain only a certain number of transactions.

Blocks are propagated on Ethereum every 17 seconds and EIP 1599 is going to be deployed on Block 12,965,000, which is estimated to happen on Aug. 4, said DARMA’S Keys.

There was a bug bounty, which paid people if they found bugs. That has process has been completed.

Bitwise’s Hougan cited estimates that EIP-1599 will reduce ether’s overall inflation rate from roughly 4% a year to 3%. That is about half as large a reduction proportionately seen in bitcoin “halving” events, he said.

CONCLUSION

Although we’re limited with new information this month, we still could calm down a bit and become not as nervous and don’t worry too much about the future of Bitcoin. Despite that market can’t get started the recovery and stands in a narrow trading range – it seems that fears concerning new collapse are overestimating. Glassnode research shows that market has too low an investors’ activity to start the active stage of the rally. Still, indicators show a relatively stable situation and even some early signs that it could soon change.

Based on global news sentiment in this area, we could say that everything stands positive as activity is rising gradually and interest among big investors stand relatively stable. With the “Big investors,” we understand not only mutual and hedge funds, big banks, etc., but leading global companies, private sector, banks services, etc., that also gradually increase activity and its participation rate in crypto business.

Finally, our technical view suggests that we stand somewhere on the edge of significant changes on the market, as a monthly bullish grabber has been formed on Bitcoin. Theoretically, with proper performance, it suggests at least return back to the ATH top of 60K:

For the long-term investment, we need to pay special attention to ETH and be prepared for its Proof-of-Stake shift, as it could overrun BTC in the long term. The second resource is a passive income from HODL currencies that provides a healthy 7% average, compared to 1% or even less government interest rates.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

544 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023