Bitcoin Fundamental Briefing, September 2021

New clouds on the horizon

September started in a positive mood, and investors were full of inspiration and expectations, hoping that cryptos finally show positive performance recovering from the May collapse. And for the most part of the month, this was true. But, last week, we’ve heard the Chinese echo of the May disaster, when China forbade all transactions in major cryptocurrencies. Although it was not absolutely new information and mostly a continuation of the beginning story, it makes investors worry and nervous, raising further doubts on cryptocurrencies’ perspectives. And it is really something to think about. We’re not tending to dramatize the overall situation but also see new risks from the regulation side.

September month is passing under the sign of the headline:

China’s top regulators ban crypto trading and mining, sending bitcoin tumbling

China’s most potent regulators on the 24th of September intensified a crackdown on cryptocurrencies with a blanket ban on all crypto transactions and mining, hitting bitcoin and other major coins and pressuring crypto and blockchain-related stocks.

Ten agencies, including the central bank, financial, securities, and foreign exchange regulators, vowed to work together to root out “illegal” cryptocurrency activity. The first time the Beijing-based regulators have joined forces to explicitly ban all cryptocurrency-related activity.

China in May banned financial institutions and payment companies from providing services related to cryptocurrency transactions and issued similar bans in 2013 and 2017.

Friday’s statement is the most detailed and expansive yet from the country’s primary regulators, underscoring Beijing’s commitment to suffocating the Chinese crypto market.

“In the history of crypto market regulation in China, this is the most direct, most comprehensive regulatory framework involving the largest number of ministries,” said Winston Ma, NYU Law School adjunct professor.

Chinese government agencies have repeatedly raised concerns that cryptocurrency speculation could disrupt the country’s economic and financial order, one of Beijing’s top priorities.

Analysts say China also sees cryptocurrencies as a threat to its sovereign digital yuan, which is at an advanced pilot stage.

“Beijing is so hostile to economic freedom they cannot even tolerate their people participating in what is arguably the most exciting innovation in finance in decades,” top U.S. Republican Senator Pat Toomey tweeted.

The People’s Bank of China (PBOC) said cryptocurrencies must not circulate and that overseas exchanges are barred from providing services to China-based investors. It also barred financial institutions, payment companies, and internet firms from facilitating cryptocurrency trading nationally.

The government will “resolutely clamp down on virtual currency speculation … to safeguard people’s properties and maintain economic, financial and social order”, the PBOC said.

“The losers in all of this are plainly the Chinese,” said Christopher Bendiksen, head of research at digital asset manager CoinShares. “They will now lose around $6 billion worth of annual mining revenue, all of which will flow to the remaining global mining regions,” he added, citing Kazakhstan, Russia and the United States.

Other issues of regulation

U.S. probes possible insider trading at Binance – Bloomberg News

U.S. officials are examining possible insider trading and market manipulation at Binance, potentially adding more heat to the cryptocurrency exchange that has become a target of regulatory scrutiny in many countries.

The company has faced warnings and business curbs from financial watchdogs from Britain and Germany to Japan, who are concerned over the use of crypto in money laundering and risks to consumers.

The exchange, whose holding company is registered in the Cayman Islands, has scaled back its product offerings and said it wants to improve relations with regulators.

Changes to Binance offerings in Australia

As Binance constantly evaluates its product and service offerings to comply with local regulations, we will cease offering the following products to existing Australian users – Futures, Options and Leveraged Tokens

Coinbase: we are not launching the USDC APY program

After months of trying to engage with the SEC on our planned Coinbase Lend product, we recently received notice that it intends to pursue legal action against us. We believe dialogue is at the heart of good regulation, even if the SEC may not.

U.S.’s Binance Probe Expands to Examine Possible Insider Trading

U.S. investigations into Binance Holdings Ltd. have expanded, with authorities now examining possible insider trading and market manipulation — the latest sign that scrutiny of the world’s largest cryptocurrency exchange is intensifying.

As part of the inquiry, U.S. officials have been looking into whether Binance or its staff profited by taking advantage of its customers, said people with knowledge of the matter who asked not to be identified because the probe is confidential. The review involves Commodity Futures Trading Commission investigators, who in recent weeks have been reaching out to potential witnesses, one of the people said.

Regulators Investigate Crypto-Exchange Developer Uniswap Labs

The Securities and Exchange Commission is investigating the startup behind one of the biggest cryptocurrency exchanges, as regulators probe further into parts of the digital-asset market that have resisted oversight, according to people familiar with the matter.

SEC’s probe into Uniswap Labs comes amid heightened regulatory interest into cryptocurrencies and the digital asset market, with Chair Gary Gensler calling on Congress last month to give the agency more authority to better police crypto trading and lending.

Gensler in August had called on lawmakers to give the SEC more power to oversee DeFi platforms, which are not regulated in the United States.

Treasury pushes global crypto data-sharing rules in budget bill

Proposal would require cryptocurrency exchanges to report foreign owners of U.S. accounts. The administration is hoping to add to the filibuster-proof package requirements that cryptocurrency businesses report information on foreign account holders so that the U.S. can share information with global trading partners, according to an administration official who wasn’t authorized to speak for the record.

I don’t even know if this is legal. Why don’t the foreign agencies just ask us for the info directly, as they have been for the last decade. Presumably, US companies are not directly serving non-US clients, except through subsidiaries in foreign countries, which engage locally, said Jesse Powell, Kraken exchange

Ray Dalio: if bitcoin is really successful, regulators will ‘kill it’

Ray Dalio, founder of the world’s largest hedge fund, Bridgewater Associates, believes regulators would ultimately take control of bitcoin if the cryptocurrency gains mainstream success.

“I think at the end of the day if it’s really successful, they will kill it and they will try to kill it. And I think they will kill it because they have ways of killing it,” Dalio told Andrew Ross Sorkin Wednesday on CNBC’s “Squawk Box” at the SALT conference in New York.

GARY GENSLER testimony in front of Senate Banking and tone is negative–more so than his previous remarks. Something else interesting–instead of stablecoins he’s calling them “stable value coins.” Stable value funds are SEC-regulated so..

Gensler’s statement to the Senate : 1. Crypto exchanges are selling what we believe are securities; 2. “Make no mistake,” we are coming after crypto exchanges; 3. There will be no warning shots or “clarification” first. The glove was thrown, and now… the Gauntlet.

Stablecoins should be backed by cash and may need to be issued by banks, according to U.S. Senator Cynthia Lummis, who has become one of Capitol Hill’s most ardent supporters of cryptocurrencies.

“It may be the case that stablecoins should only be issued by depository institutions or through money-market funds or similar vehicles,” said Lummis, a Republican from Wyoming, in a speech Wednesday on the Senate floor. “Stablecoins must be 100% backed by cash and cash equivalents, and this should be audited regularly.”

Price Forecasts

A new cryptocurrency research team at Standard Chartered has predicted bitcoin will double in value and hit $100,000 by early next year and that it could be worth as much as $175,000 longer-term.

The bank also said it “structurally” valued Ethereum, the second-most traded crypto asset, at $26,000-$35,000 although to reach that level bitcoin would have to be near $175,000.

“As a medium of exchange, bitcoin may become the dominant peer-to-peer payment method for the global unbanked in a future cashless world,” Standard Chartered’s new crypto research unit headed by Geoffrey Kendrick who is also the global head of its emerging market currency research said in a note sent to clients. Cyclically, we expect a peak around $100,000 in late 2021 or early 2022″

Ether should be 55% lower, JPMorgan strategist says

Ether’s fair value is around $1,500 based on measures of network activity, a JPMorgan global market strategist has said. That’s roughly 55% lower than Friday’s price of around $3,470 for ethereum’s token.

Nikolaos Panigirtzoglou told Insider that the ethereum network is less attractive than the current price of ether suggests, as it’s facing growing competition from blockchains such as solana and cardano.

“We look at the hashrate and the number of unique addresses to try to understand the value for ethereum. We’re struggling to go above $1,500,” he said. There is a question mark here. The current price is expressing an exponential increase in usage and traffic that might not materialise.”

Bloomberg Intelligence: Bitcoin at $100,000, $5,000 Ethereum is path of least resistance

Crypto-assets appear in a revived and refreshed bull market with the 2H benefit of a steep discount from previous highs at the start. Bitcoin has been a laggard amid the DeFi revolution led by Ethereum. The digital reserve asset in a world going that way and the building block of fintech is how we respectively view the No. 1 and No. 2 cryptos. Success breeds competition, as evidenced by Cardano advancing to No. 3, but so-called Ethereum-killers have a history of speculative excesses. We see Ethereum on course toward $5,000 and $100,000 for Bitcoin.

Recent push into altcoins has crypto markets looking frothy, JPMorgan says

The bank estimates that retail investor net flow into US stocks hit a record high of almost $16 billion in July, and stood at about $13 billion in August. The previous record was $10 billion last June, JPMorgan highlighted.

“Cryptocurrency markets [are] looking frothy again,” JPMorgan said. The bank noted that altcoins now represent about 33% of the cryptocurrency market, a big surge from its 22% reading in early August. The share of altcoins looks rather elevated by historical standards and in our opinion it is more likely to be a reflection of froth and retail investor ‘mania’ rather than a reflection of a structural uptrend,” JPMorgan concluded.

Market Sentiment analysis

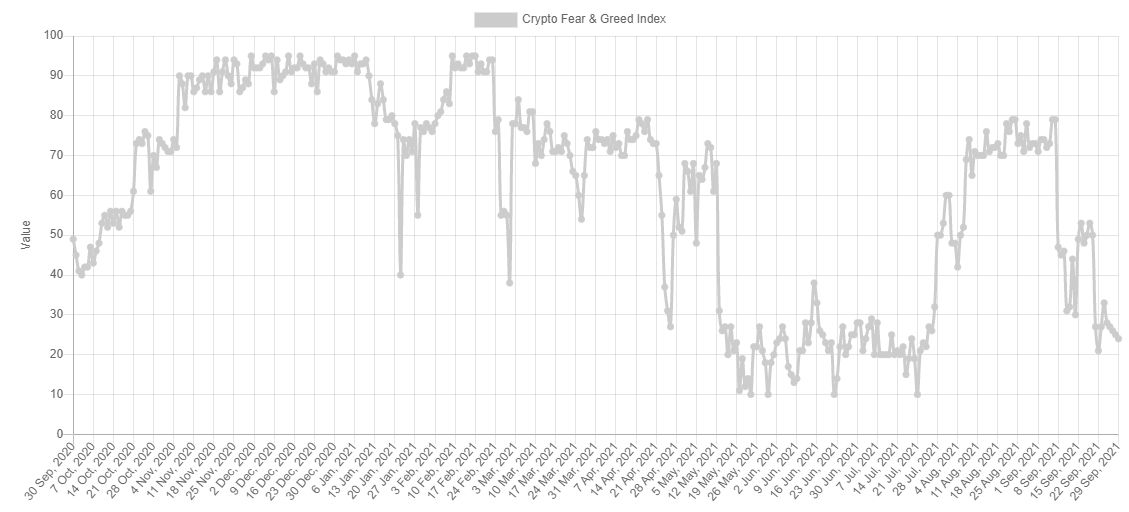

BTC now stands under Fear impact, showing strong drop as Fear&Greed Index stands around 25%. At the same time, based on index value – the drop should slowly come to an end as index flirts around lowest levels of 10-15 % that is downside limit:

Despite the drop and Fear dominance on the markets – sentiment is not hurt too much as Glassnode suggests that long-term holders remain unshaken

The Bitcoin market experienced volatile downside price action this week, opening at $47,328 on Monday and sliding to a low of $39,876. The sell-off comes alongside continued pressure on the industry from regulators, a sell-off in equities markets, challenging conditions in Chinese debt markets, and yet another Bitcoin ban in China.

We can see , that a very similar pattern is in play which speaks to the more bearish case of reduced participation being a dominant driver. This adds weight to the argument that the market may be dominated by HODLers and traders, with less participation by newer entrants and retail speculators.

The assessment we can take away from this, is that the highest likelihood is that the majority of today’s market participants, are longer-term HODLers and accumulators.

Prices have returned to the cost basis of short-term holders. Given we estimated ~58% of them are already underwater, the key question is whether these buyers from August and September will sell their coins at a loss and drive prices lower. The other question is whether the HODLers who remain can provide enough buy side support if they do?

CDD-90 is currently trading at very low levels of around 150k CDD. This level is coincident with periods of large scale accumulation, including both early bull markets, and later stage bear markets.

We can also see that the relative supply held by Short-term Holders has reached an all-time low of 20% of circulating supply. This is a rare occurrence that has historically described the late stage accumulation periods of bear markets by the smarter money.

We can confirm this downtrend is influenced by the withdrawal of coins from exchanges, which continues at a significant rate. The exchange net position change metric demonstrates an evident change in character and market preference following March 2020. The market shifted from a regime of dominant inflows to one of the outflows. July to September has been a historically significant period of net outflows, ranging between 80k and 100k BTC/month.

Long-term holders now hold an all-time high of over 80% of circulating BTC. Of note in the 2021 cycle is the relatively small distribution of coins that occurred in the Q1-2021 bull compared to previous cycles. LTH supply drew down to only 67.7% of supply, where previous cycles were between 54% and 58%.

We can also note the recovery speed, which indicates that 12.3% of the circulating supply was accumulated in the 2020-21 bull market and remains unspent today.

Despite relatively low on-chain activity and many market fractals resembling bearish conditions, there remains an undertone of extreme HOLDing and accumulation behavior. This is somewhat unique to this market cycle and is a dynamic worth keeping an eye on.

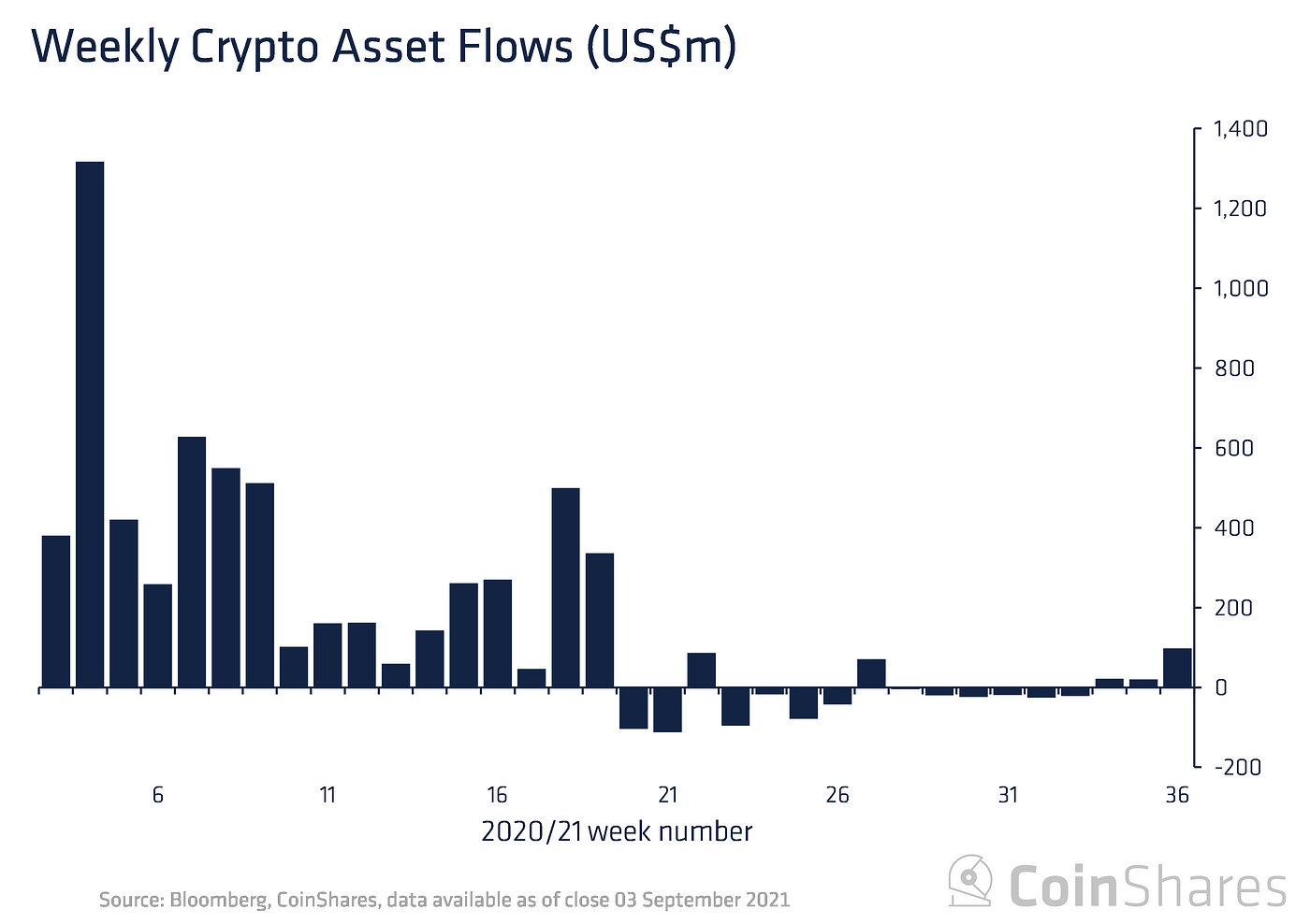

For the third consecutive week, we have seen inflows totaling US$140m, suggesting improving investor sentiment. Inflows were seen across all digital assets, although altcoins remain the favorite amongst investors on assets under management (AuM) weighted basis. Altcoin’s market share is now a record 35% of investment products.

Shop.com has started to accept cryptos for payments.

Coinbase Prime is launching with updated capabilities – we’re officially launching Coinbase Prime to all institutions.

Rick Rieder, Blackrock – Part of why I own a small piece of bitcoin is I do think there are more people who are going to enter that fray over time … I like assets that are volatile that have upside convexity. I could see bitcoin go up significantly but I think it’s volatile”

MicroStrategy Acquires Additional 5,050 Bitcoins for ~$242.9 million in cash at an average price of ~$48,099 per bitcoin. As of 9/12/21, we hold ~114,042 bitcoins acquired for ~$3.16 billion at an average price of ~$27,713 per bitcoin.

The Bottom line

This time we do not need the long-term explanation of ongoing events. Using just common sense opens the problem that could appear on the horizon in a medium-term perspective. China is a communists country. They do not need to follow democratic principles and get people’s approval of non-popular government decisions. They have decided to destroy the crypto market in the country, and they did it. The reason is apparent – they clear the road for Chinese CBDC. Anything that could provide competition must be eliminated. They have political and regulation tools, and they did it frankly and rudely.

Whether the US could do the same? Hardly. The public opinion and resonance, democratic principles mean a lot, and the government can’t make the same decision as China. But, as the US has a wide chain of provision and regulation authorities – they could do the same differently. Things that they can’t eliminate frankly – they could put under control indirectly. The recent legal acts show what they are doing. They put big infrastructure units of the crypto market under supervision and set the laws that oblige crypto companies to cooperate with government forces. Other laws transfer ETF business under big banks that are easy to control and punish if needed. It means that the market formally keeps its existence but in absolutely different legal conditions. At any moment, it could be suffocated. The plan is simple – tight the crypto market in very narrow borders and surround it with different limitations to adopt US CBDC with no competition.

We are afraid that this could significantly limit the upside potential of the market in the long term. The “free” cryptocurrencies – BTC, ETH, and others could exist, the market will have some average turnover level, but it becomes static under the impact of legal measures. This is the risk that we see already. And Ray Dalio is right – “if bitcoin is really successful, regulators will ‘kill it, or better to say, replace with national CBDC.

Outside of regulatory risks, overall sentiment looks positive. Yes, 2nd China shock has hit the markets, but it was not absolutely new and mostly should be treated as an echo of the May 2021 collapse. Thus, partially this was priced in already. Third side analysts and market sentiment shows that positive mood dominates by far in investors’ minds.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

396 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023