Bitcoin Fundamental Briefing, November 2021

PENDING THE RALLY

This month the news background is humble. If we sweep aside routine things happening almost every month, we get not as many decisive events this time. In two words, we would say that market is consolidating and taking the breath. We recognize no bad things by far and suppose that upside tendency stands intact. Although few specific risks exist. That’s why this time report contains just a few news lines and mainly is dedicated to BTC price forecasts.

MARKET OVERVIEW

Cryptocurrency market indicators such as average bitcoin funding rates, inflows into crypto investment products, and the ratio of old-to-new coins being sold suggest a near-term consolidation for the sector and lower odds of a year-end rally bitcoin bulls are predicting.

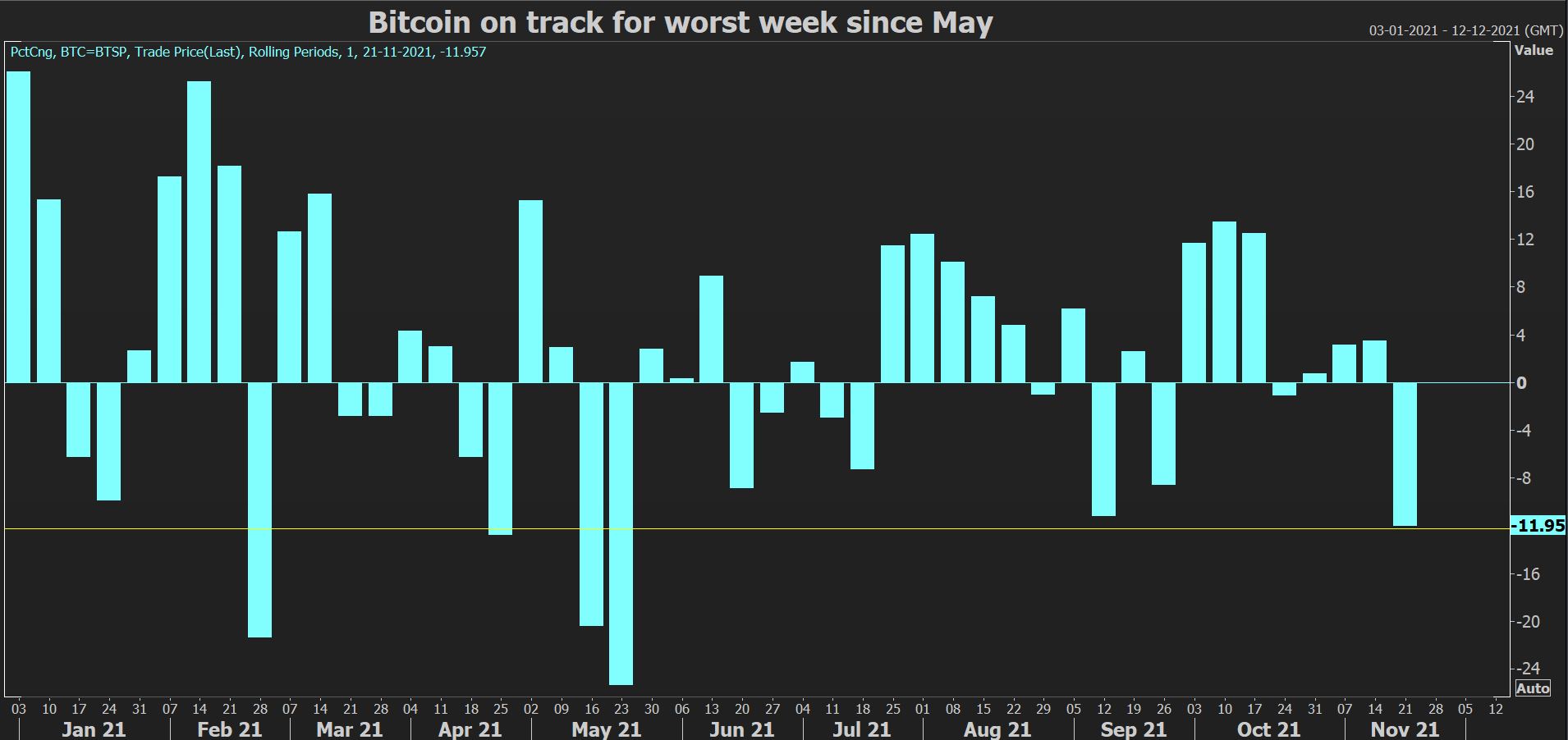

Bitcoin rose 1.6% on Friday to $57,850.56 but was on track for weekly losses of over 11%, its worst week since May. It is 16% lower than its Nov. 10 record high of $69,000. Ether, the second-biggest cryptocurrency by market value, was 14% off its peak at $4,202.45.

Concerns that creditors of Mt Gox, a crypto exchange that collapsed in 2014, could liquidate their bitcoin-denominated repayments also weighed on sentiment.

“Selling pressure has been quite constant,” said Matthew Dibb, chief operating officer at Singapore-based crypto asset manager Stack Funds, who expects it could continue until the token finds support at around $53,000.

Dibb said there was profit-taking and concern about more selling in the wake of a Tokyo court signing off on plans to repay creditors of Mt Gox, a crypto exchange that collapsed in 2014 after losing half a billion dollars in bitcoin.

“Those affected will receive a large sum of bitcoin, likely happening in Q1 or Q2 of 2022. This has brought some fear into the market on a longer term horizon,” he said, on the expectation that those creditors are likely sellers.

Both ether and bitcoin also seem to have suffered as the mood in global markets has been cautious over recent days amid concerns about economic growth, interest rates, and inflation.

“Bitcoin’s long-term outlook remains bullish,” said OANDA analyst Edward Moya. But the waters over the next few months will be rough as institutional investors look to see if the Fed will be forced to raise rates sooner and trigger a broad-based selloff of risky assets that include bitcoin.”

In the past week, traders have become less willing to pay to hold long positions in bitcoin futures. Average funding rates, a barometer for sentiment in the perpetual swaps market, have fallen to around 0.008%, according to cryptocurrency analytics platform CryptoQuant, their lowest since early October.

“Do we set new highs before the end of the year? I’d say we’ve come a long way,” said Paul Eisma, head of trading at crypto firm XBTO Group in New York, adding he expected bitcoin to trade between $53,000 and $57,000 for the rest of the year.

Bitcoin’s Taproot upgrade over the weekend, its first major update since 2017 that enables its blockchain to execute more complex transactions, was well telegraphed and largely priced in as the asset rallied into the event, market experts said.

There is also increased spending of older coins — associated with long-term investors exiting their positions — though it remains small in relative magnitude, according to blockchain data provider Glassnode.

A ratio between short-term and long-term bitcoin holders signaled stable equilibrium between 1-week and 1-year old coins, meaning a balanced distribution between newer and older, “smart money” investors and indicating a likely period of consolidation. Tops in price are typically established when large volumes of coins are held by newer investors.

Crypto product inflows have also been subdued in the year’s second half, averaging $750 million daily versus $960 million in the first, data from digital asset manager CoinShares showed on Monday.

Still, crypto investment products attracted $151 million in investments last week in their 13th consecutive week of inflows, and total product inflows for the year so far have hit a record $9 billion, according to CoinShares.

“It alludes to the fact that we’re also not overheated at the 60K market. There’s still a good way to go,” Justin d’Anethan, institutional sales manager at crypto trading firm EQONEX wrote in a daily newsletter.

The total market capitalization of cryptocurrencies stood at $2.7 trillion as per CoinGecko, down from a peak of over $3 trillion.

NEWS LINE

Banking Industry Likely to Capitalize on Stablecoin Deposit Demand, Says Morgan Stanley

The banking industry will most likely try and capitalize on the demand for stablecoin deposits on the back of the market’s exponential growth, Morgan Stanley’s lead cryptocurrency strategist, Sheena Shah, said in a report.

Shah notes that “institutional investor interest in participating in the upward price momentum is building,” adding that bitcoin’s dominance is slipping as “alternative coins outperform due to their lower [U.S. dollar] prices and potential use cases.”

The stablecoin market cap has grown to $137.7 billion from $20 billion a year ago.

Vikram Pandit Says All Big Banks Will Think About Crypto Trading

In “one to three years, every large bank and, or securities firm is going to actively think about ‘shouldn’t I also be trading and selling cryptocurrency assets?’ ” Pandit said at the Singapore Fintech Festival event in a segment with Bloomberg’s Haslinda Amin. Pandit, who led the U.S. bank during the financial crisis, co-founded investment firm Orogen in 2016.

“My big hope is that central banks around the world understand the benefit of a central bank digital currency, and move on to accept, adopt them,” Pandit said. Moving money around the world while trying the modernize a paper-based banking system is “cumbersome” and creates a lot of “deadweight” cost, he said.

Commonwealth Bank (CBA) has announced that it will become Australia’s first bank to offer customers the ability to buy, sell and hold crypto assets, directly through the CommBank app.

Binance Calls for Global Regulatory Frameworks for Crypto Markets

Binance, the world’s leading blockchain ecosystem, today announced 10 Fundamental Rights for Crypto Users that can serve as a guiding hand in regulatory discussions and the development of global frameworks for crypto markets. The customer rights, as described in a series of advertisements published today globally, are meant to ensure safe access to emerging technologies, liquidity, and secure platforms among other steps to “protect users without limiting growth and innovation.”

APAC Family Offices Show Growing Interest in Cryptocurrency

While only 19 percent of family offices in APAC invest in cryptocurrency – far less so than the 28% and 31% in Europe and North America respectively – more than half (53%) of respondents in APAC see cryptocurrency as a promising investment. This is not as popular a view in Europe (33%) or North America (43%).

Furthermore, more than one-third of family offices in APAC plan to increase their investment in cryptocurrency in 2022. This is significantly higher than expected allocations to cryptocurrency in Europe (17%) and North America (30%).

SENTIMENT ANALYSIS

GlassNode doesn’t see the signs of panic or massive sell-off, despite 20% BTC pullback

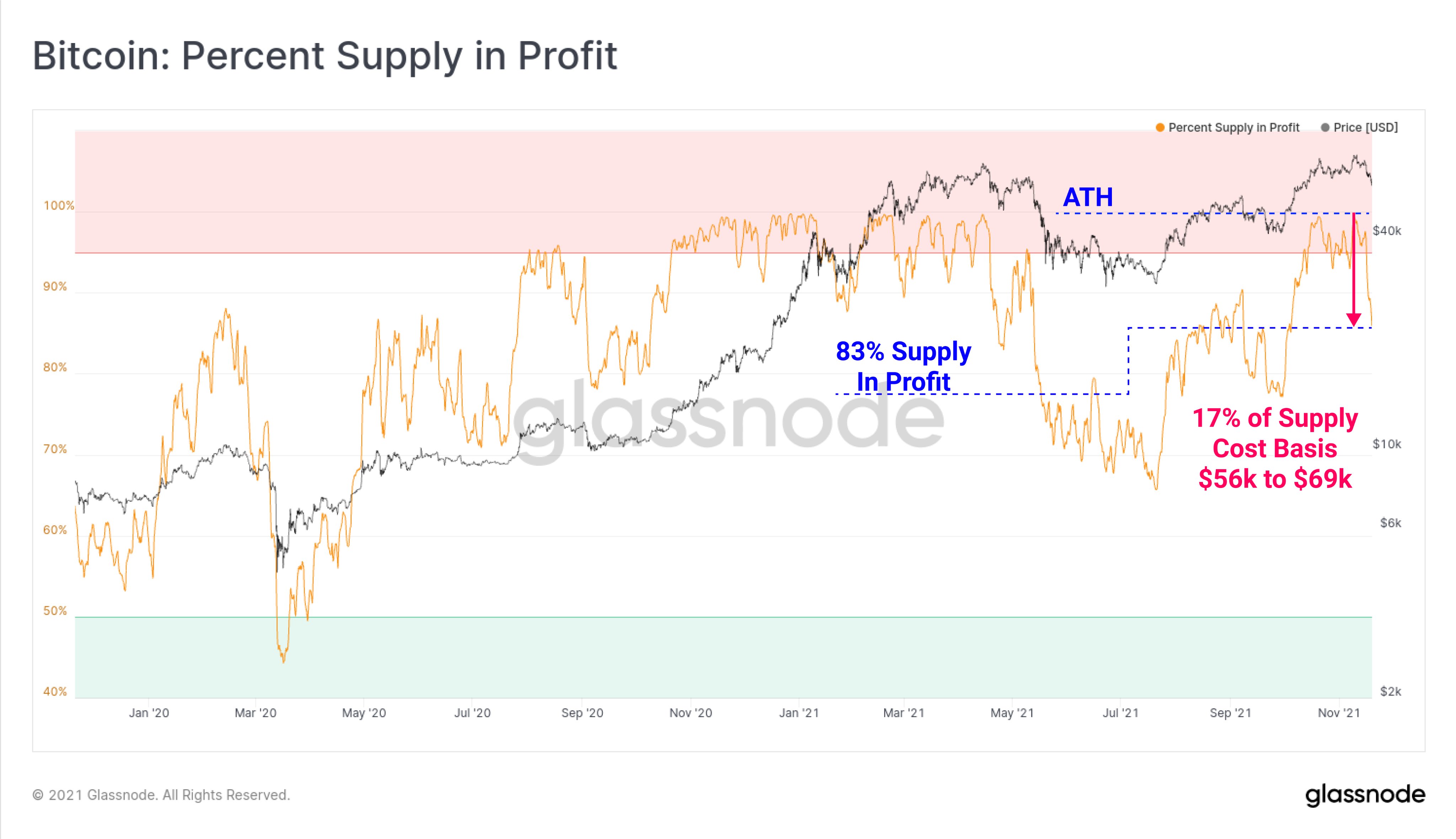

When the Bitcoin market experiences a large sell-off, the change in profitable supply indicates of how many coins have an on-chain cost basis above the current price. Since the ATH, over 17% of the $BTC supply has fallen underwater, leaving 83% of the supply in profit.

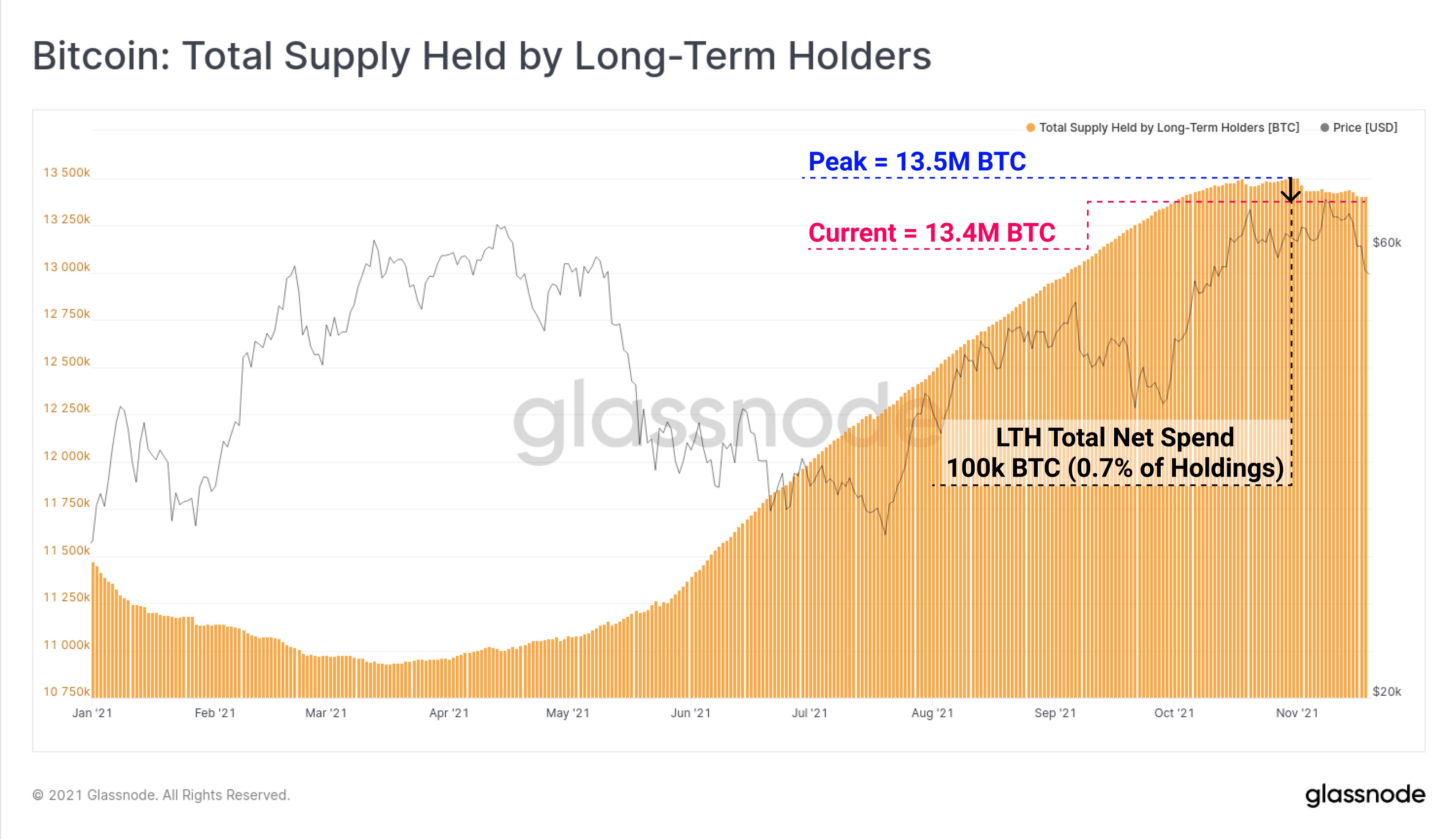

Even after a near 20% correction (-$13.5k) off the ATH, Long-Term Holders (LTH) do not appear to be spending their coins in panic. After peaking at 13.5M $BTC, LTHs have only distributed 100k $BTC over the last month, representing just 0.7% of their total holdings.

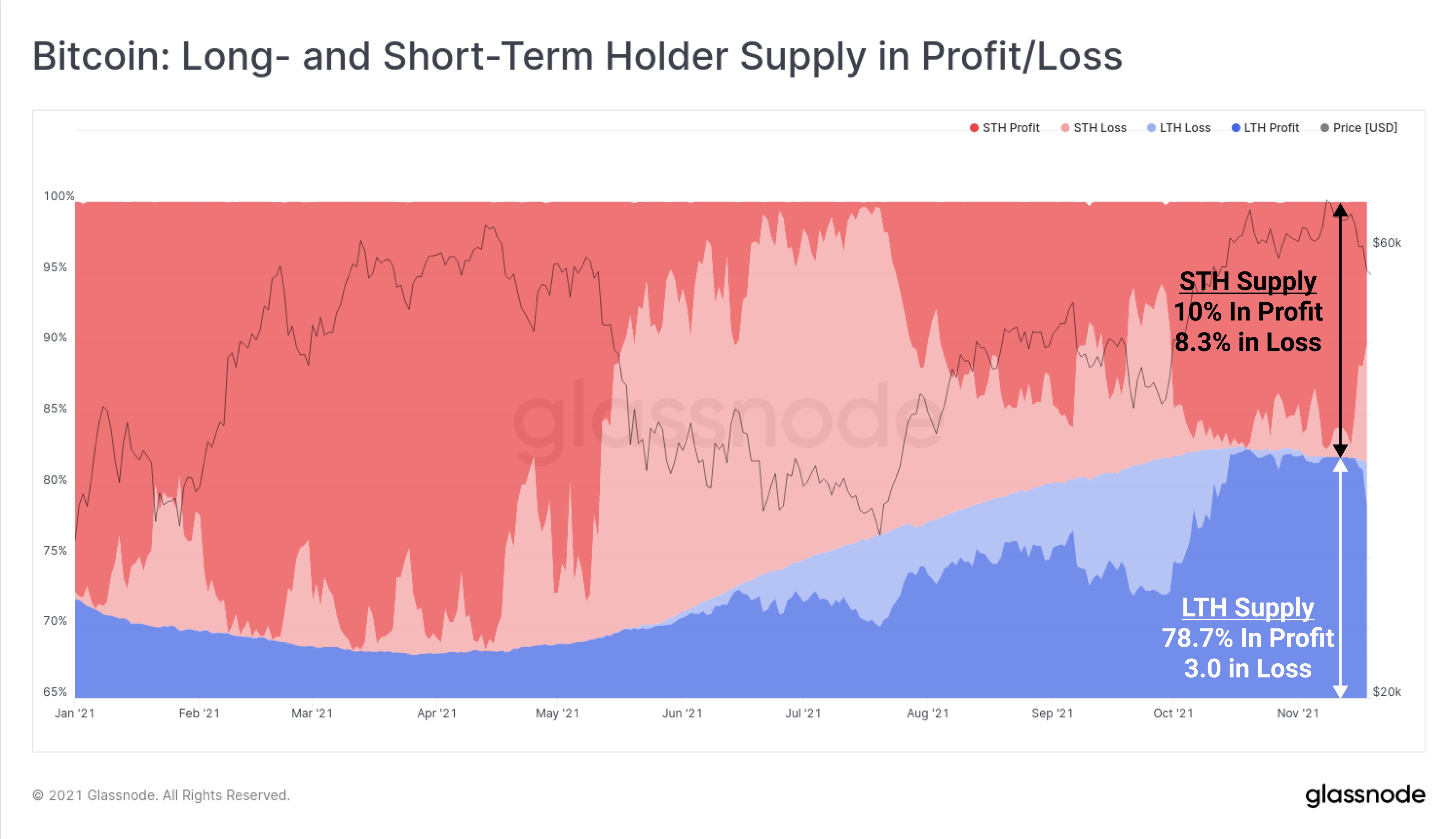

As a proportion of supply (excl. exchanges), the vast majority of LTHs remain in profit, holding 78.7% of $BTC in profit. Only 3% of the supply is held by LTHs at a loss. STHs who bought the top currently hold the majority of all $BTC at an unrealized loss.

Famed economist Mohamed El-Erian, the Allianz chief economic advisor on Bitcoin “When to buy again?”

El-Erian categorizes bitcoin investors into three buckets: “fundamentalists” who are in it for the long haul, professional investors looking to diversify their portfolios, and day trading “speculators.”

The economist said he would only feel comfortable buying again once some of the speculators in the market are “shaken out.” The first two types of investors, he says, are “really strong foundations for that market long term.”

“When I speak to people in the crypto industry, I say you have a responsibility not to repeat the mistake of Big Tech,” El-Erian said. “The big mistake of Big Tech was they didn’t realize they were becoming systemically important, so they didn’t engage in preemptive regulatory discussions.”

“Crypto needs to take seriously that there are concerns about illicit payments; there’s concerns about fraud; there’s concerns about stability of platform,” he added.

PRICE FORECASTS

Goldman Sachs Sees Ethereum Soaring To $8,000 By Year End

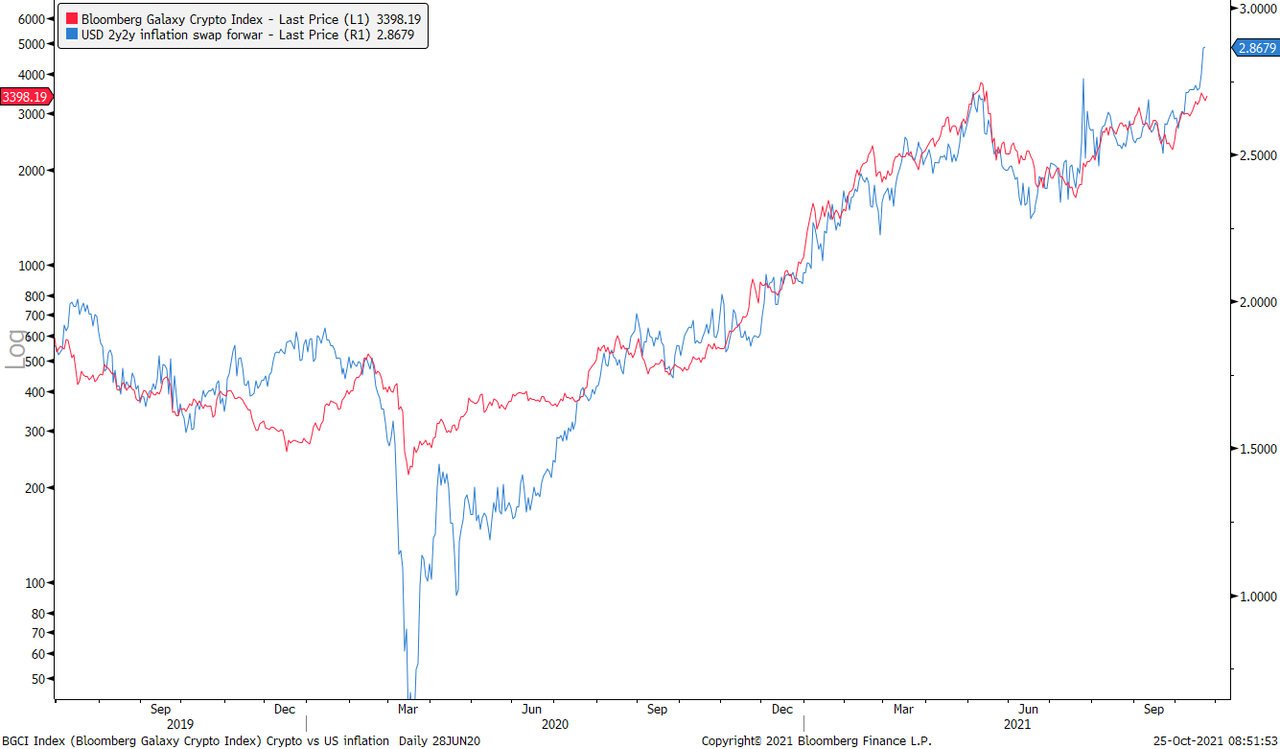

In a note from the bank’s Global Markets managing director Bernhard Rzymelka, the bank shows that crypto assets have traded in line with inflation breakevens since 2019. Specifically, he charts the Bloomberg Galaxy Crypto Index (red) on a log axis, versus the USD 2y forward 2y inflation swap (blue). While correlation may not be causation, the chart below is clear enough to indicate that inflation certainly is a driving force behind the relentless crypto melt-up to all-time highs.

What does this mean practically?

Well, if market-based views of inflationary pressures persist, we may soon see a melt-up across the crypto universe and especially one token.

As the Goldman strategist writes –

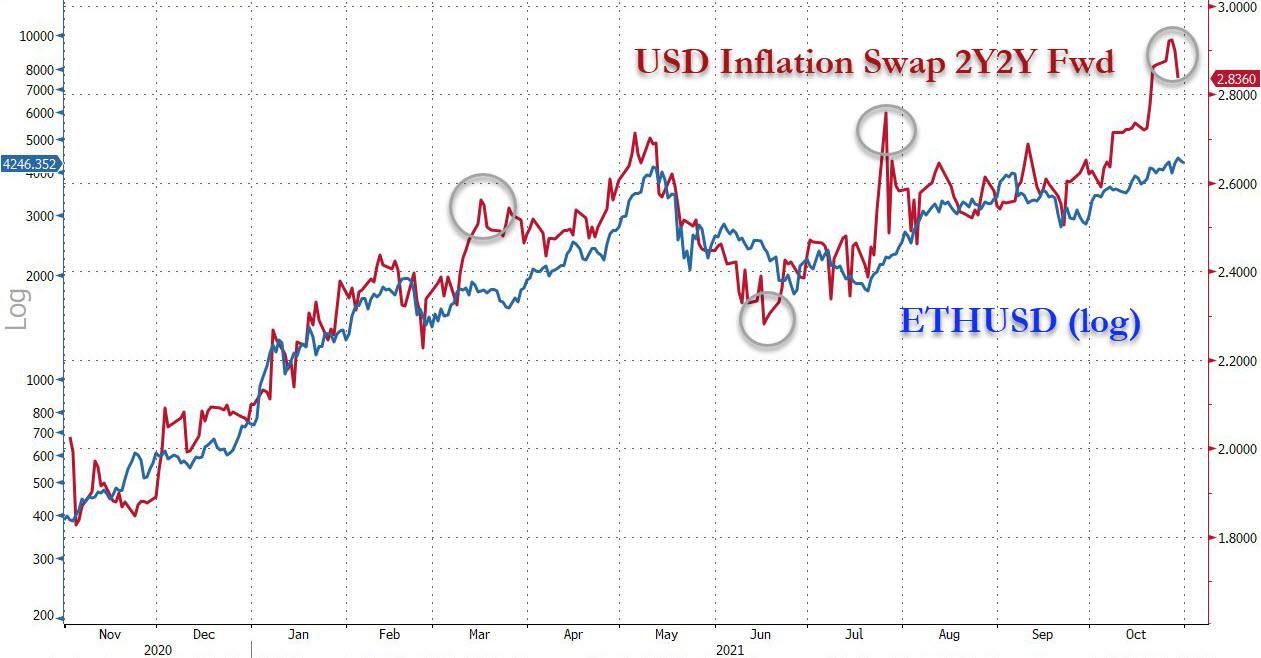

the local backdrop looks supportive for Ethereum as “it has tracked inflation markets particularly closely, likely reflecting the pro-cyclical nature as “network based” asset.”

And, as Rzymelka notes,

“the latest spike in inflation breakevens suggests upside risk if the leading relationship of recent episodes was to hold (grey circles below).”

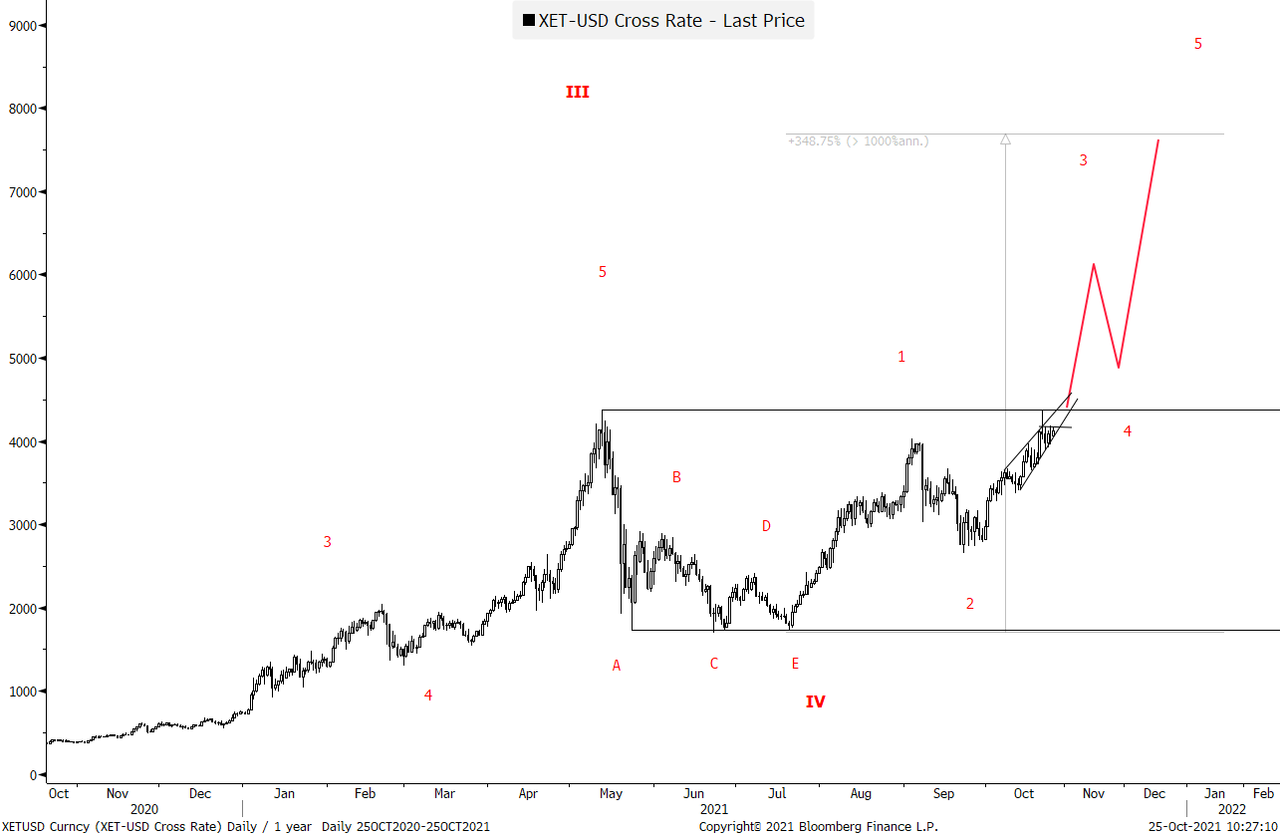

This, according to Goldman, lines up well with the Ethereum chart. In the past few days, the price of the crypto broke out to new all-time highs, rising just shy of $4,500 with a narrowing wedge, which to Goldman is “either a sign of exhaustion and peaking… or a starting point of an accelerating rally upon a break higher.”

To Goldman, the answer to this rhetorical question is easy, and the bank hints that ethereum could surge as high as $8000 in the next two months if the historical correlation with inflation FWDs persists.

And while some could argue that ETH is due for a pullback, Goldman counters that while the recent surge may appear stretched, “the RSI has yet to hit the overbought levels seen at past market highs.”

One final word of caution. As the Goldman traders notes, US inflation swaps imply core PCE inflation at or above 2.50% for the next 5 years. That’s a lot of overheating, and current market levels hence price a rather aggressive interpretation of the Fed’s AIT framework of “moderately above 2% for some time” already.

On one hand, the upside to inflation markets – and possibly crypto assets – hence looks limited unless the market starts doubting the FOMC’s inflation credibility (much) more fundamentally. In other words, as we have been saying since 2014, cryptos have emerged as the asset class that will benefit the most if we have another major inflationary/stagflationary scare.

As Goldman concludes,

“this lines up rather well with the Ethereum chart, suggesting a late-stage rally with longer-term market top ahead.”

JPMorgan suggests Bitcoin is overvalued now

Digital assets are forecast to climb 15% next year, doubling the expected return from hedge funds and outpacing the 12.5% gain from real estate, cryptocurrencies’ wild swings diminish their appeal, JPMorgan’s outlook says.

Take bitcoin, an asset the JPMorgan team views as a competing investment for gold. With the coin’s volatility roughly four times that of the precious metal, the firm’s model puts its fair value at around $35,000. Should the relative volatility get halved into next year, then a price target of $73,000 “seems reasonable,” the strategists said.

“This challenges the idea that a price target of $100k or above, which appears to be the current consensus for 2022, is a sustainable bitcoin target in the absence of a significant decline in bitcoin volatility,” the strategists wrote. “Digital assets are on a multiyear structural ascent, but the current entry point looks unattractive.”

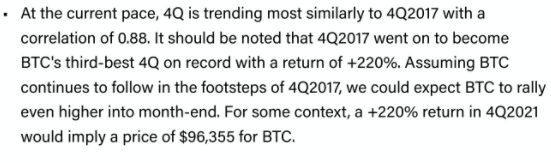

Kraken expects Bitcoin to reach $ 96’355 area

Bloomberg Intelligence, Mike McGlone –

A Bitcoin floor appears to be inching up toward $60,000 from $50,000, with fuel for a year-end sprint toward $100,000. Ethereum appears on track for $5,000, with support of around $4,000.

A melt-up in Bitcoin and Ethereum into year-end is likelier than retracement, we believe, after 2021 corrections cleansed speculative positions, and with increasing demand and adoption, and declining supply, sustaining a bull market. The startup of U.S. ETFs and the fact that cryptos counter China bans limit downside risks.

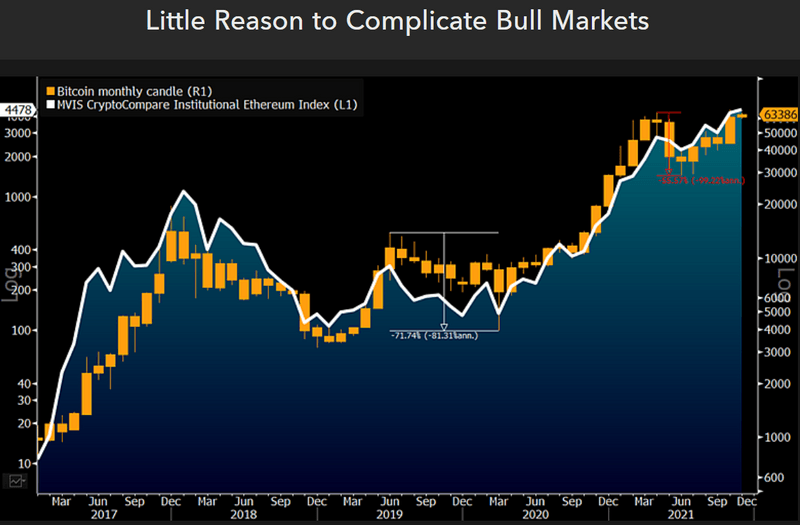

Our graphic points to further appreciation in the top two cryptos. If the first-born catches up to the performance of the No. 2 asset by market capitalization (Ethereum) in 2021, Bitcoin’s target resistance value would be about $100,000 relative to what’s looking like a firmer $60,000 floor.

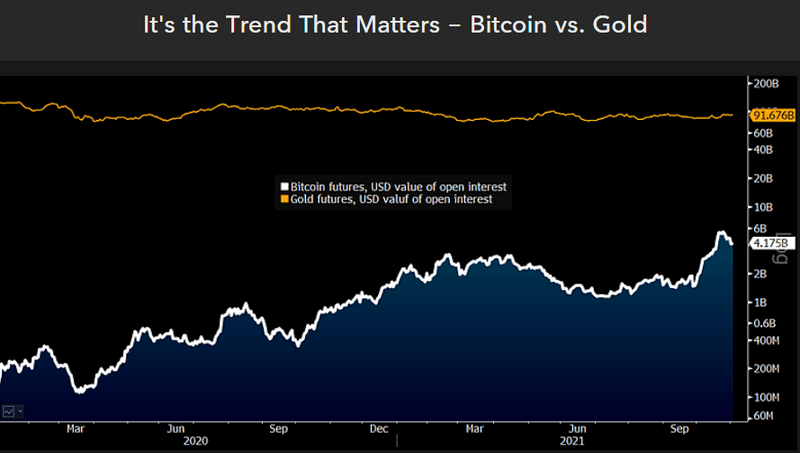

Our graphic points to a young bull market in CME Bitcoin futures open interest vs. the opposite in gold. Bitcoin open interest of about $4 billion pales in comparison with gold (around $90 billion), but at the start of 2020, the crypto-futures market was only $200 million vs. $125 billion for gold.

Trends matter. We see greater potential of accelerating upside for Bitcoin-futures participation on the lucrative nature of “cash and carry” strategies. Going long the crypto, hedged 1-to-1 with futures, has returned more than 20% in the past year.

Ethereum has been a top-performing major crypto asset in 2021, and we expect that to continue after a drawdown of about 60% in 1H.

THE BOTTOM LINE

We probably should separate the performance of Bitcoin in the short term and long term. The nearest perspective looks more or less optimistic by far. The technical bounce we got last week doesn’t break the major tendency. Price shows just a 30% pullback, which is an absolutely normal and reasonable reaction on the achieved monthly extension target.

Based on overall sentiment and professional analysts’ view, the central consensus accepts the idea of reaching 75-100K area by Bitcoin in the near term. Approving new stimulus packs for ~ $2.5Trln brings a lot of liquidity and suggests further growth as the NFT market as cryptocurrencies directly. Although some investors suggest temporal consolidation around 51-53K area.

For the truth’s sake, we should say that this is our view as well. The point is 51-53K area is a solid technical support area, and a real bullish market should stay above it. So, for Bitcoin, it will also be a kind of test of how it responds on this level.

Talking in the longer term, the perspective looks not as clear. Cryptocurrencies step into the new environment of tightening cycle for the developed central banks, particularly the Fed Reserve. The recent spike in inflation data and clouds of faster Fed tapering has also pushed down BTC prices. Investors treat Bitcoin as other financial assets with specific features, such as significant volatility and high return. It means that Bitcoin could get the same impact from interest rate tightening as other financial non-interest-bearing assets.

The role of Bitcoin as protection against inflation is still arguable enough, as it was not tested previously in a natural environment. This is still a theory that it should provide reasonable protection against inflation, but nobody knows this definitely. And the risk is that once inflation keeps going higher, investors could lose patience and turn to classic assets, such as gold and inflation-protected securities.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

433 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023