Bitcoin Fundamental Briefing, January 2022

WALKING ON THE EDGE

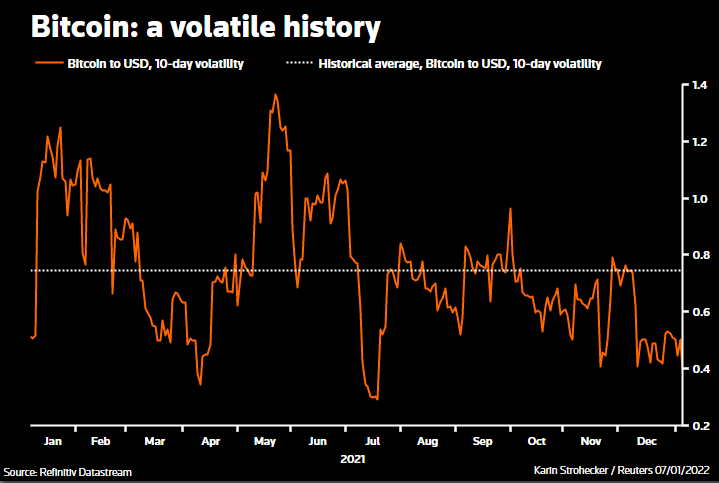

We suggest that it is no need to talk about the BTC performance that we’ve got in January. The collapse is comparable to the one that we saw in May. But still, it is a big difference between them. The first one, in May, has been triggered by external factors, when China banned domestic mining and any cryptocurrencies turnover. But now – the situation is quite different. Our constant readers probably remember that since the middle of 2021, when the smell of Fed policy change was already flying in the air we said that this is one of the major risks for Bitcoin.

People were in the euphoria of the rally, drunk with upside performance. Here and there we were hearing that BTC is an absolutely new feature, it is the gold’s rival, etc. But we knew that institutional investors do not like any “new” assets, and suggested that the BTC should be build-in with the total structure of the universe of financial assets. The question was only with the place that it should take.

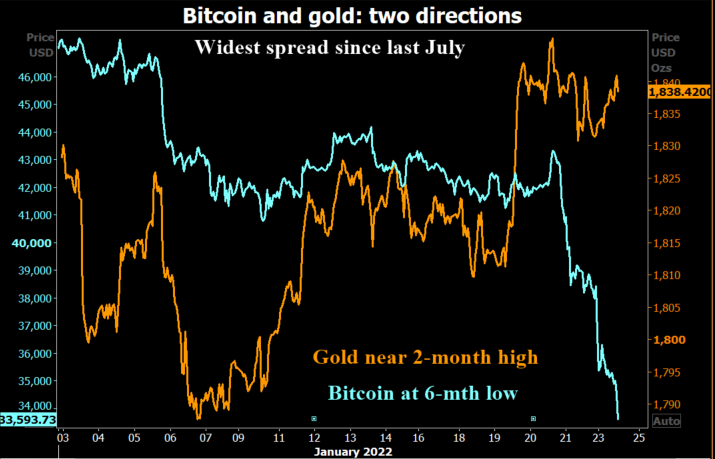

Now, when interest rates have turned to motion and geopolitical risks start to grow the role and place of Bitcoin is clear – second quality risky asset, like some average stock from Russel 2000 index. For some reason now people stop recalling that just a few months ago they wanted to replace gold with the BTC. It’s a pity, but this is the reality. Bitcoin has fallen under massive sell-off earlier and harder than blue-chip stocks. It has become the cold shower for many, and now when we understand the real place of cryptocurrency in the financial world we should try to estimate what waits for us right around the corner.

MARKET OVERVIEW

After a wild 2021, bitcoin’s new year hangover has lingered into the first week of 2022 – and might get worse.

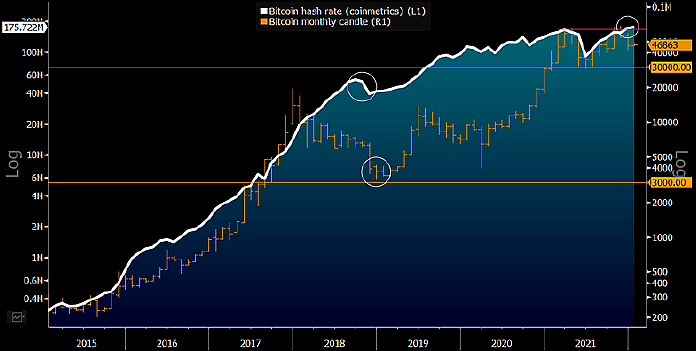

The computing power of its network dropped sharply this week as Kazakhstan’s internet was shut down during its uprising, hitting its cryptocurrency mining industry – the second biggest in the world.

The drop in bitcoin “hashrate” might, in theory, hit its price. The more miners on the network, the greater the amount of computing power needed to mine new bitcoin. If miners drop off the network, it becomes easier for the remaining miners to produce new coins – in theory boosting supply.

Bitcoin has fallen below $41,000 to its lowest since late September with hawkish signs from the Fed adding to the malaise. Some see it slipping further into the $30,000-range. Crypto investors will be searching for signs bitcoin can get off the ropes.

Declines across the cryptocurrency market follow a week of rough trading for equities, particularly momentum stocks. As the 10-year U.S. Treasury yield spiked at the start of 2022, investors have been rotating into more cyclical and value names. Recently the 10-year climb was as high as 1.8%, after ending 2021 at 1.5%.

“We’ve seen bitcoin behave like a risk asset on numerous occasions over the past few months,” said Noelle Acheson, head of market insights at Genesis.

“When the market gets jittery, bitcoin tumbles. We’ve seen various indications that market sentiment is somewhat spooked by the spike in the 10-year — that’s not good for any asset that has high volatility in cash flows. Unlike many assets that are tainted by this brush, bitcoin is liquid and therefore can take more selling pressure without a heavy hit.”

Bitcoin gained on the day on Monday (24th of January) as buyers stepped in to buy the cryptocurrency, after earlier tumbling to its lowest level in six months on fears of a Russian attack on Ukraine and before this week’s Federal Reserve meeting.

Bitcoin is now at a critical juncture where analysts say that further selling could reverse its long-term bull trend.

The currency fell earlier on Monday on rising tensions between Russia and US/NATO. NATO said it was putting forces on standby and reinforcing Eastern Europe with more ships and fighter jets, in what Russia denounced as an escalation of tensions.

Nerves over the Federal Reserve’s two-day policy meeting, starting on Tuesday, added to the mix, with the U.S. central bank expected to confirm it will soon start draining the pool of liquidity that has supercharged growth stocks. Concerns that the Fed could tighten too quickly at its meeting this week added to investors’ nerves.

“The story is really how aggressive is the tightening,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York, noting that a Fed move to reduce the size of its balance sheet will tighten conditions along with higher interest rates. Cryptocurrencies fell along with other risk assets as “people are pulling back on risk broadly,” he added. Stocks also bounced off their lows in afternoon trading.

Katie Stockton, the founder of technical analysis firm Fairlead Strategies, said that closing this week above the $37,400 level, where there is support from the Ichimoku cloud bottom, may be key to whether the selloff is a correction in an uptrend or the start of a bear trend.

If Bitcoin fails to rise back above this level, then “the long-term uptrend is essentially reversed by that breakdown,” she said.

Around $465 million in crypto assets have been liquidated in the past 24 hours, according to data from Coinglass, with Bitcoin trades accounting for $167 million of that total.

Smaller cryptocurrencies, which tend to move in tandem with bitcoin, also slumped but ended off their lows. Ether, the second-largest digital coin, was last down 3.5% at $2,451, after earlier reaching $2,160, its lowest level since July 27.

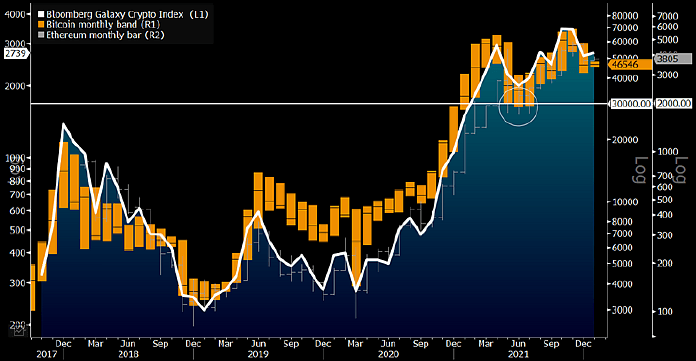

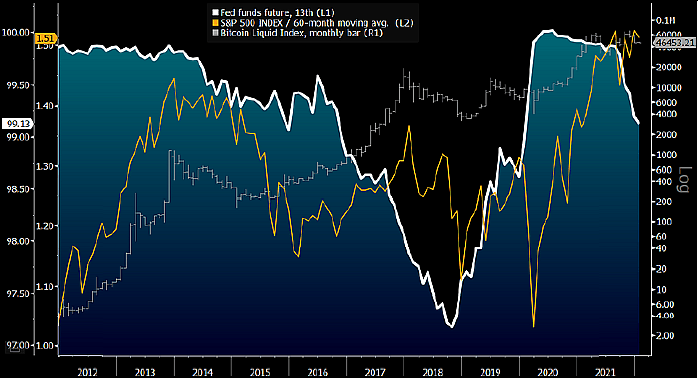

The picture above shows that Bitcoin is driven by major economic factors in a specific manner, mostly in a row with classic riskier assets. In general, the rising of the interest rates and higher Fed activity are the negative factors for the BTC. At the same time, when rates are falling due running into the safe-haven, as we see now, also plays bad tricks with it.

MARKET SENTIMENT

Bitcoin’s market capitalization has dropped to around $793 billion, crypto platform CoinGecko estimated. It has lost about $93 billion since the start of this year.

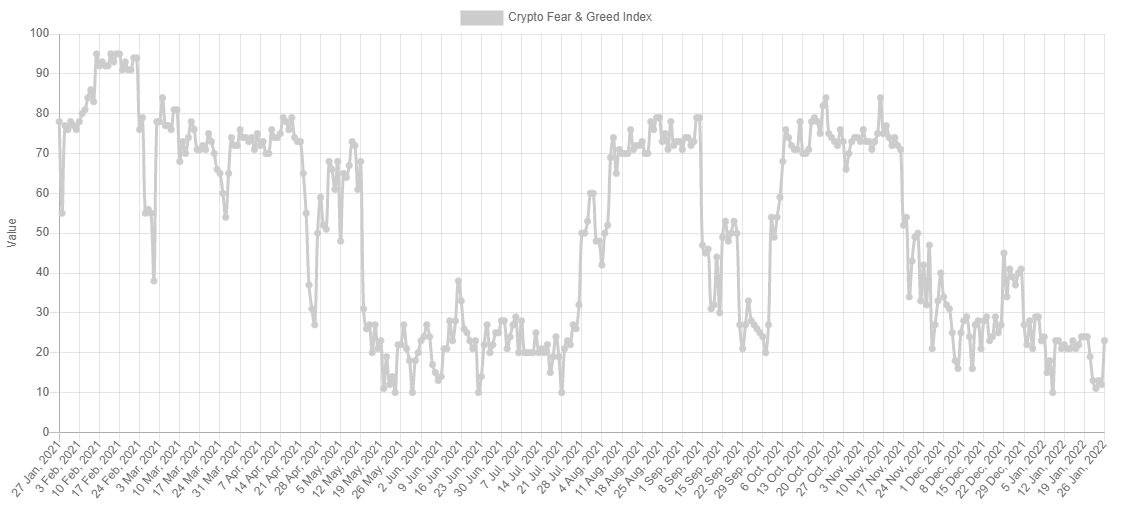

Crypto data platform Coinglass’s bitcoin Fear & Greed index last week touched its lowest level since July 2021, when bitcoin prices were trading at $30,000. Bitcoin futures on the CME saw volumes record the biggest monthly fall of 77.4% to $11 billion in December, researcher CryptoCompare said on Friday.

Now market sentiment stands near record fear, according to Greed/Fear Index:

Cryptocurrency investment products and funds had net outflows totaling a record $207 million, on the 1st week of 2022, a report from digital asset manager CoinShares showed, as prices continued their tumble in the first trading week of the year.

The sector has experienced four consecutive weeks of outflows since mid-December, reaching a total of $465 million, or 0.8% of total assets under management.

CoinShares investment strategist James Butterfill said the outflows were a “direct response to the FOMC (Federal Open Market Committee) minutes which revealed the U.S. Federal Reserve’s concerns for rising inflation and the fear amongst investors of an interest rate hike.”

A policy tightening by the Fed is a negative factor for risk assets such as cryptocurrencies because of tighter liquidity conditions and increased market volatility.

“A phase of heavy loss realization by top buyers has followed the Dec. 4 flush-out (in bitcoin),” said blockchain data provider Glassnode, in its latest research report.

Far from being the hedge against inflation or the uncorrelated alternative asset it was sometimes plugged as, bitcoin has suffered disproportionately, losing 40% from its peak in November, as the Federal Reserve and other major central banks spelt out plans to raise rates and remove monetary stimulus.

Justin D’Anethan, a Hong Kong-based cryptocurrency analyst, points to how the leverage ratio — which tracks the open interest across cryptocurrency trading venues relative to bitcoin currency reserves — has been growing despite the liquidation of bitcoin holdings, which could be a sign of more short positions being accumulated in the currency.

Investors had turned to favoring “puts” even in options, he noted.

Analysts Dalvir Mandara and Bilal Hafeez at research firm Macro Hive pointed to outflows from cryptocurrency exchange-traded funds and the reduced profitability of incoming bitcoin as reasons to be bearish.

Yet, among a mixed bag of indicators, they pointed to the slowing growth in bitcoin open interest as suggesting hesitation among investors and a positive funding rate for perpetual futures as a sign traders are still willing to pay, albeit low amounts, to keep their bitcoin longs.

GLASSNODE VIEW

The Bitcoin market has had yet another challenging week, with prices declining from the weekly open of $43,413, down to a new local low of $34,407. This puts the total drawdown relative to the November ATH at 49.9%.

Alongside declining prices, investors have capitulated over $2.5 Billion in net realized value on-chain this week. The lion’s share of these losses is attributed to Short-Term Holders who appear to be taking any opportunity to get their money back.

With the bulls now firmly on the back-foot, such a heavy drawdown is likely to change investor perceptions and sentiment at a macro scale. Drawdowns of this magnitude are markedly higher than the -20% to -40% range seen in the 2017 and 2020-21 bull cycle corrections.

The Net Unrealised Profit/Loss (NUPL) metric presents the overall market profitability as a proportion of the market cap. NUPL is currently trading at 0.325 which indicates that an equivalent to 32.5% of the Bitcoin market cap is held as an unrealized profit.

This comes in stark contrast to the much higher profitability values of ~0.75 set in March, and ~0.68 set in October last year.

Unlike 2013 and 2017 bull markets, aggregate network profitability actually declined between the ATHs set through Mar-Apr and Oct-Nov tops. This is a result of coins being distributed at the highs, lifting the overall market cost basis, and thus creating a bearish divergence in this indicator.

The market is now trading below the Realised-to-Liveliness Ratio (RTLR) price of $39.2k, but above the Realised price of $24.2k. Again, this is often observed during early to mid stage bear markets, adding confluence to the observations above.

We have now established that numerous signals point to a macro scale bear trend in play.

Interestingly, STH supply remains near multi-year lows, which is indicative of their counterpart, the Long-Term Holders (LTHs), who appear impressively unfazed by such a severe drawdown.

The proportion of LTH supply has actually returned to a modest uptrend, which indicates a general unwillingness for this cohort to liquidate. Faced with what looks like a bear market, LTH coins are firmly in cold storage, which remains a constructive undertone.

Bear markets are hard to define in Bitcoin, as the traditional 20% drawdown metric would trigger a bear almost every second Tuesday given the volatility. Thus we look to investor psychology and profitability as a gauge of likely, and actualized sell-side activity.

What we identified this week are significant realized losses, a steep drawdown, a return to HODLer led accumulation, and top buyers taking any opportunity to get their money back. If it looks like a bear and walks like a bear, it could very well be a bear. But as with many things over the last two years…could this time be different?

BITCOIN PRICE FORECASTS

Bitcoin could rise to $75,000 this year to a top record high, SEBA bank CEO predicts

Bitcoin’s price could nearly double to $75,000 this year as more institutional investors start to embrace the world’s most popular cryptocurrency, according to the CEO of Swiss bank Seba.

“We believe the price is going up,” Guido Buehler told CNBC’s Arjun Kharpal at the Crypto Finance Conference in St. Moritz, Switzerland, on Wednesday.

“Our internal valuation models indicate a price right now between $50,000 and $75,000,” said the boss of the regulated Swiss bank which has a focus on cryptocurrencies. “I’m quite confident we are going to see that level. The question is always timing.”

Asked if bitcoin will test the record levels seen last year, Buehler said he “thinks so” but he stressed that volatility will remain high. Buehler said he thinks institutional investors will help to boost the price of bitcoin in 2022.

“Institutional money will probably drive the price up,” he said. “We are working as a fully regulated bank. We have asset pools that are looking for the right times to invest.”

A majority of JPMorgan’s clients see bitcoin at around $60,000

Around 41% of JPMorgan clients see bitcoin ending the year at around $60,000. Meanwhile, only 5% expect bitcoin to hit $100,000.

Bullish exuberance around bitcoin hitting the elusive $100,000 milestone last year was fever-pitch. But the coin ended the year at less than half that, shifting the sentiment as illustrated by a poll released by JPMorgan on Monday.

The investment bank surveyed 47 of its clients between December 13 to January 7 as part of its broader macroeconomic outlook for the year.

The result: Around 41% of the clients see the world’s most valuable cryptocurrency ending the year around $60,000, an upside of around 46% from Monday’s price. Meanwhile, only 5% expect bitcoin to hit $100,000 by year-end.

JPMorgan in November 2021 said bitcoin could surge to $146,000 in the long run if its volatility subsides and institutions start preferring it to gold in their portfolios. That’s roughly 256% above the coin’s current level. A price of $73,000, the bank said, looks reasonable for 2022.

Bitcoin’s volatility is currently around four to five times higher than gold, the bank said. That would have to fall dramatically before institutional investors plow in.

GOLDMAN SACHS: Bitcoin could reach $100K if…

Despite this, there is a new member joining the $100,000 bandwagon this year. Goldman Sachs said bitcoin could rocket to that level but only if it continues to take market share from gold.

Citing bitcoin’s $700 billion market capitalization, compared to the around $2.6 trillion worth of gold owned as an investment, Goldman Sachs said that the cryptocurrency currently has a 20% share of the “store of value” market.

Bitcoin will “most likely” become a bigger proportion over time, Goldman Sachs said, in a list of 2022 predictions. In a hypothetical scenario in which bitcoin grabs a 50% share of this market, its price would reach just over $100,000, the note said.

The “Bond King”, DoubleLine Capital CEO, Jeffrey Gundlach – $25K level looks good

The head of DoubleLine Capital, Jeffrey Gundlach, called bitcoin too expensive in light of the upcoming tightening of the Fed’s monetary policy and suggested waiting for the price to drop to $25,000 to buy it.

“Now bitcoin is suitable for speculators. It will remain volatile as it is reset by market participants. I wouldn’t be in a hurry to buy it. The score is high. I like to buy cheap things. Perhaps $25,000 would be a good level to go long,” the billionaire said.

Gundlach’s skepticism about the outlook for the markets stems from hawkish signals from the Fed. He allowed a high probability of a recession in the US economy in the second half of 2022 after four increases in the key rate.

The CEO of DoubleLine Capital drew attention to the relationship between the dynamics of the US stock market and the Fed’s balance sheet. In his opinion, against the backdrop of extreme valuations of securities, this “should be a concern for investors”

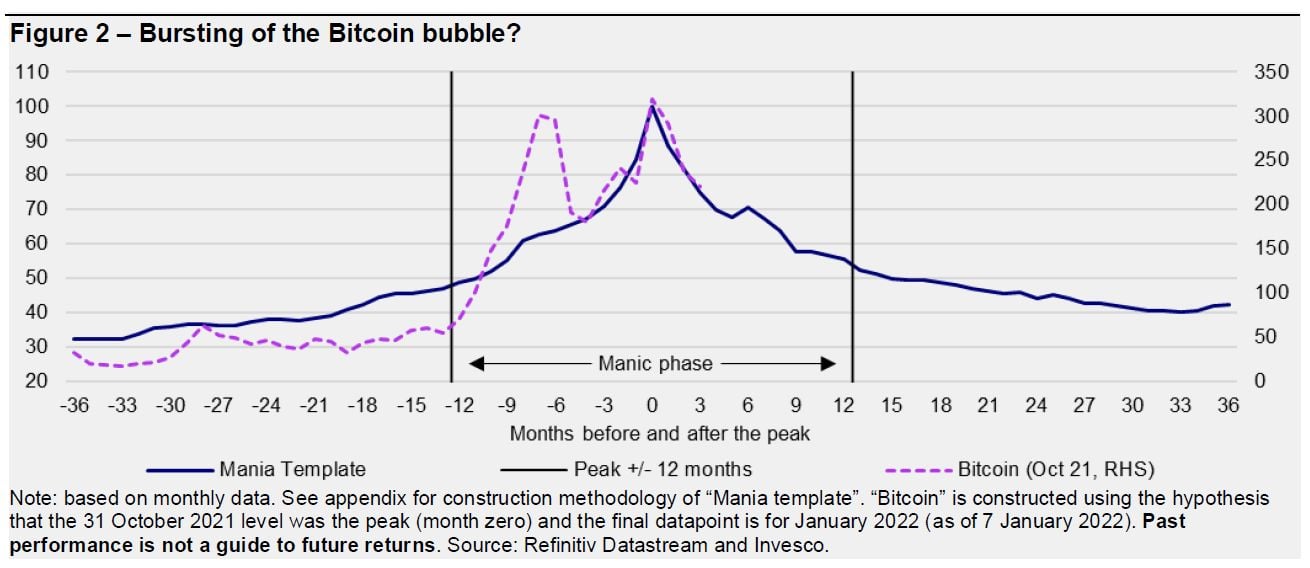

INVESCO – Bitcoin falls below $30 K during 2022

Last year we spoke of Bitcoin falling below $10,000 but instead, it reached a peak of around $68,000. The mass marketing of Bitcoin reminds us of the activity of stockbrokers in the run-up to the 1929 crash (as brilliantly described in John Kenneth Galbraith’s The Great Crash, 1929). We know how that ended and Bitcoin has already fallen to around $42,000 (as of 7 January 2022), following closely the downward path of our mania template (see Figure 2). That template suggests a loss of 45% is experienced in the 12 months after the peak of a typical financial mania. If that pattern is followed (assuming we have seen the peak), the price of Bitcoin would fall to $34,000-$37,000 by the end of October, depending upon whether we use daily or monthly data to define the peak (the latter is used in Figure 2). The template also suggests that bubbles typically deflate for a further two years. Hence, we think it is not too much of a stretch to imagine Bitcoin falling below $30,000 this year (with the health warning that we have got this wrong before and that it seems to be going through a series of bubbles).

Crypto markets could be set for another “winter” of price crashes and could fail to recover for years, analysts at investment bank UBS have warned, as clouds gather to take the shine off digital assets.

The last crypto winter occurred at the end of 2017 and early 2018, when bitcoin tumbled from around $20,000 to stand below $4,000 more than a year later, causing many investors to lose interest in digital assets.

Interest rate hikes from the Federal Reserve in 2022 are set to dent the appeal of cryptocurrencies such as bitcoin in the eyes of many investors, the analysts, led by James Malcolm, said in a note to clients on Friday. That’s because rising interest rates are putting paid to arguments that bitcoin is a good alternative currency or store of value, they said.

The UBS analysts believe there are reasons to think things are about to get worse, leading to a “crypto winter” where assets slide and then fail to come back for a long time.

If central banks are moving to get a handle on inflation, then that damages the argument that investors should hold bitcoin as protection against price rises, Malcolm and his colleagues said.

It’s also simply bad for the price, as central bank stimulus was a key factor lifting crypto tokens in 2020 and 2021. The analysts also said there’s also a dawning realization among crypto investors that bitcoin is not “better money”, because it’s very volatile and its limited supply makes it inflexible.

Another problem that could lead to a sharp fall in prices is the shortcomings of crypto technology.

For example, blockchain technology is hard to scale up because of its decentralized design, which requires all members of the network to be able to oversee and verify transactions, the UBS analysts said.

Regulation is a third major problem, they wrote. Rampant speculation on crypto networks “inevitably invites closer oversight to guard consumers [and] protect financial stability,” UBS said.

“High-flying stablecoins and [decentralized finance] projects seem almost sure to face bigger setbacks from authorities in the coming months.”

Fidelity: what more would a skeptic need to see to believe digital assets are not going away?

Fidelity provides an extended overview of 2021 year and makes comments on every big achievement of cryptocurrency markets. They do not provide any definite price forecast but the overall conclusion sounds optimistic for the long term perspective:

Overall, we would say 2021 was a year that further confirmed digital assets have arrived and are here to stay. We continued to see more high-profile individuals and institutional investors make allocations, more corporations add it to their balance sheet, and even the first sovereign nation to declare it as legal tender. The bitcoin network demonstrated its resiliency despite the second-largest economy in the world effectively banning it. We have seen the rapid rise and demand for stablecoins, a parallel money market-like product that has drawn the attention of regulators. Furthermore, digital assets have officially entered the legislative and political arena and will likely receive more attention come midterm elections. Finally, digital assets are spreading to the world of art, culture, music, and gaming. All of this leads us to ask, what more would a skeptic need to see to believe digital assets are not going away?

Bloomberg Intelligence: Bitcoin $30,000 and Ethereum $2,000 set underpinnings for 2022

As the situation on the BTC market has changed drastically right in January, for the dessert we share with you Bloomberg Intelligence analysts, Mike McGlone view:

Rising risk assets in 2022 may embolden a Federal Reserve facing the greatest inflation in four decades, and in the process favor Bitcoin. Crypto assets are tops among the speculative and risky, but the firstborn is rapidly transitioning toward becoming the world’s digital reserve asset. We expect the enduring trio — Bitcoin, Ethereum, and crypto dollars — to maintain dominance. The top 2021 upcomers — Binance Coin and Solana — may end the pattern of temporary visitors among the top five.

Price supports exiting 2021 of about $30,000 for Bitcoin and $2,000 for Ethereum appear solid. At about 80% of the Bloomberg Galaxy Crypto Index, we expect the top two cryptos to remain dominant and continue advancing in 2022. A risk-off swoon like that of 2020 may put those key supports in play but is unlikely. What’s more probable, we think, is Bitcoin heading toward $100,000 and Ethereum breaching $5,000 resistance. A key issue we see is the Federal Reserve, as it faces the greatest inflation in four decades, is more inclined to raise interest rates if risk assets continue climbing.

Cryptos are tops among the risky and speculative. If risk assets decline, it helps the Fed’s inflation fight. Becoming a global reserve asset, Bitcoin may be a primary beneficiary in that scenario.

Peaking commodities and cryptos, alongside declining Treasury yields in 4Q, may indicate a normalization of stock market returns in 2022. If the S&P 500 retreats and stays down awhile, we expect Bitcoin to come out ahead, following rising bond prices and gold. Yet among the three, the digital asset has the highest volatility. Our graphic depicts the Bloomberg Galaxy Crypto Index peak in November, as federal-funds futures prices accelerated rate-hike expectations for 2022-23. Long-risk assets at the start of 2022 may be fighting the Fed.

Top force to stop Fed tightening – wobbly equities:

Crypto tops the speculative excesses and may be an early indicator that the broader market tide is due to receding.

$30,000 2021 Dip May Be New $3,000 From 2018:

“Bitcoin is in what I see as a unique stage of transition from a risky to a riskless store of value. It replaces gold, becoming the global collateral. Therefore, I believe that this [reaching the $100,000 mark] will happen in 2022,” he said.

OUR OWN VIEW AND CONCLUSION

To join the community of price forecasting analysts we provide our view on long-term Bitcoin performance. Currently, we gravitate to conclusions of UBS, Invesco, and J. Gundlach, suggesting that the market stands in a bear trend. To not be as pessimistic as mentioned persons we would say that BTC needs to eliminate a few bearish signs to assure us that trend has changed. These signs are marked with the numbers on the chart:

Our major concern is #1 – bearish volatility breakout. Once we’ve traded upside breakout it has shown great spot-on performance. Now we’re waiting for something similar but in the opposite direction. Pattern progress should take three stages:

In the 1st stage, BTC should complete downside extension naturally. Usually, it happens around some strong support area and the last one that we have of this kind is 26K area that includes Yearly Pivot Support 1 and last all-time 5/8 Fbi support;

In the 2nd stage extended upward bounce should happen. It should be not less than 42K area and not greater than 52K, which is 5/8 pullback from 26K potential lows;

The final stage suggests downside action, at least of 0.618 scale as it was to 67K with upside breakout pattern. It should lead the price back to 20K area.

Now about two other concerns. #2 is the downside breakout of the all-time monthly K-support area, which is a very strong bearish sign per se. Price absolutely disrespects the K-area, which looks even more bearish.

Finally, #3 is erasing of bullish grabber that was the key to potential 3-Drive “Sell” pattern on the monthly chart and could lead price to 76K area. Now, this scenario is totally erased.

Taking it all together, from the technical view we just do not have any reasons and do not see any signs for optimism. The picture could start changing for the better if basic inputs of a current fundamental situation in the US start to change.

By taking a look at the fundamental background, keeping technical factors aside, Mike McGlone’s arguments that Fed rate change should crush the stock market and support cryptomarket looks doubtful and blur, especially in the light of recent BTC reaction on fundamental factors, compares to the stock market.

BTC performance now confirms our view that we’ve said in the middle of 2021 – it behaves like 2nd quality risky asset or stock, falling under massive sell-off even earlier than any blue-chip stock. As it pays no interest as higher Fed will hike the rate as more pressure will be on the bitcoin – as from bonds as from dividend stocks.

We suggest that the situation could change only if the US economy turns to relation again and Fed stops raising rates before they reach the 2.0-2.5% level. The market now is ready for four rate hikes this year, but some uncertainty stands around the quantitative tightening (QT) Fed programme. Faster tightening and/or yield changing for 0.5% at once could push BTC to the new lows.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

564 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023