Bitcoin Fundamental Briefing, February 2022

TIME FOR REVELATIONS

There were a lot of optimistic forecasts on Bitcoin perspectives in December and at the beginning of 2022 which had economical reasons to happen. Although we have some skeptics on these forecasts in the face of the coming Fed rate hike and growing inflation – some scenarios were suggesting that BTC indeed could move higher. And they do not lose their validity still.

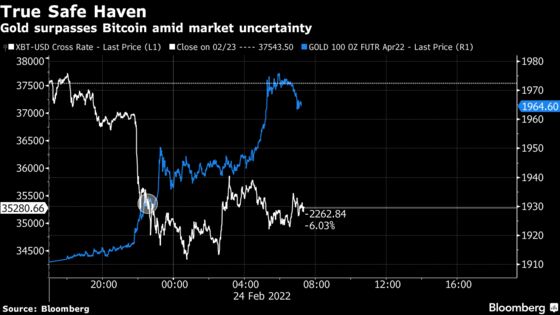

But, when geopolitics intrude – forecasting is a thankless task as you do not know what could happen even within an hour. But at the same time, we know the features of different assets and how they react to situations like we have. For example, Gold is a traditional safe-haven asset that we see right now. Stocks usually fall during any geopolitical conflict. And precisely the same reaction we see on Bitcoin – it is falling, like in the same way as stocks do. Which makes us treat it as a stock-kind asset and forecast its performance in the same way as we do for the stock market. It two words it means negative reaction as on geopolitical escalation as on hawkish Fed policy.

MARKET OVERVIEW

Investors are bracing for more gyrations in bitcoin and other cryptocurrencies, as worries over a hawkish Federal Reserve threaten to squelch risk appetite across markets.

While proponents of cryptocurrencies once touted their lack of correlation to other assets, bitcoin and its peers saw huge gains over the last two years, rallying along with stocks as the Fed and other central banks pumped unprecedented levels of stimulus into the global economy. Bitcoin is up 1,039% since March 2020 and ether has risen 2,940%, though the rallies in both cryptocurrencies have been interrupted by the numerous-stomach churning selloffs.

Their recent volatility has come amid a broader market selloff driven by investors recalibrating their portfolios to account for a more aggressive Fed, which is now expected to raise rates as many as seven times this year as it fights surging inflation.

Worries that an aggressive central bank tightening cycle going forward will hamstring risky assets have made it difficult for some traders to maintain their bullish outlook on bitcoin and other cryptos, an asset class already identified with intense volatility.

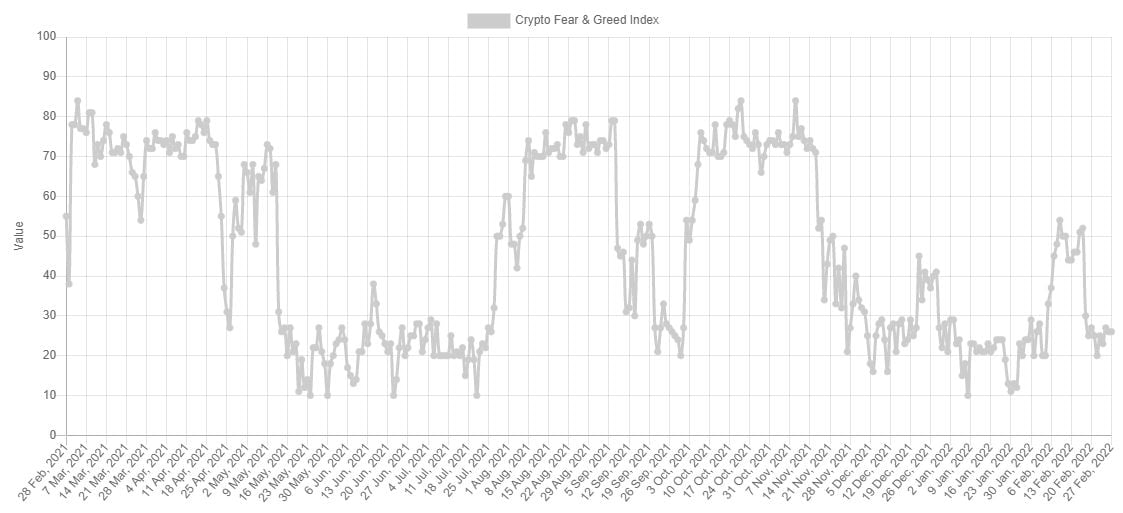

Escalating tensions in Ukraine also spark broad market moves, investors said. Fear and Greed index stands near lows, suggesting that Investors are scared and not ready for investing:

Bitcoin has “really become the ultimate momentum trade and there are so many risks that can trigger a 40% drop out of nowhere,” said Ed Moya, senior analyst at Oanda.

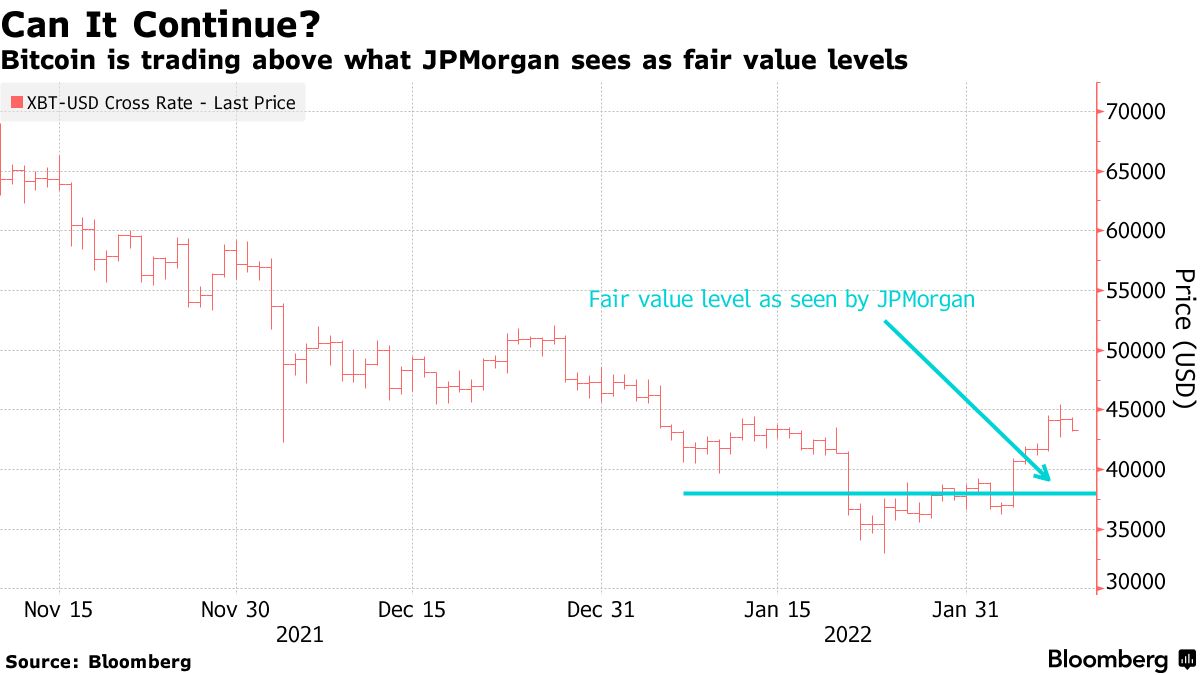

Bitcoin’s volatility hasn’t stopped some analysts from trying to gauge the currency’s fair value or point out potentially important price levels.

Analysts at JPMorgan estimate bitcoin’s current fair value at around $38,000 – some 15% below its recent price – based on its volatility in comparison with that of gold, another asset investors often use to hedge their portfolios against inflation and economic uncertainty.

Vanda Research, meanwhile, said in a recent note that most of the bearish bets on a weaker bitcoin price were entered at around $47,000, and “there could be a large short-squeeze if the aforementioned threshold is crossed, and retail investors return to crypto-trading.”

Meanwhile, correlations between bitcoin and the S&P 500 reached an all-time high on Jan 31, according to data from BofA Global Research, undercutting the case for those hoping to use the cryptocurrency as a hedge against market turbulence.

Some investors are steeling themselves to ride out the volatility in bitcoin, betting that the long-term value proposition of blockchain technology, the built-in supply limit, and the network effect it produces, will endure despite frequent price swings.

Jurrien Timmer, director of the global macro at Fidelity, likened the current speculation in cryptocurrencies to the turbulence tech stocks experienced during the dot-com era more than two decades ago, a boom-and-bust period that saw a comparatively small group of companies left standing.

“Amazon is still around and Apple is still around and they’re bigger than ever and the thinking is that for bitcoin that will be the same,” he said. “But it’s not immune to those waves of speculation and sentiment.”

Bitcoin could reach $100,000 as soon as 2023, Timmer has said, based on his supply/demand models.

Others believe mature cryptocurrencies like bitcoin and ether are unlikely to deliver the kind of eye-watering gains they have notched since their founding.

Understanding the risks linked to them and decentralized finance is going to be one of the main challenges for investors in 2022, said Lily Francus, director of quantitative research strategy at Moody’s Analytics.

Cryptocurrencies “are going to remain very volatile going forward, but there are significant players on both the institutional side and the retail side that are still growing, so the interest is still growing,” said Oanda’s Moya.

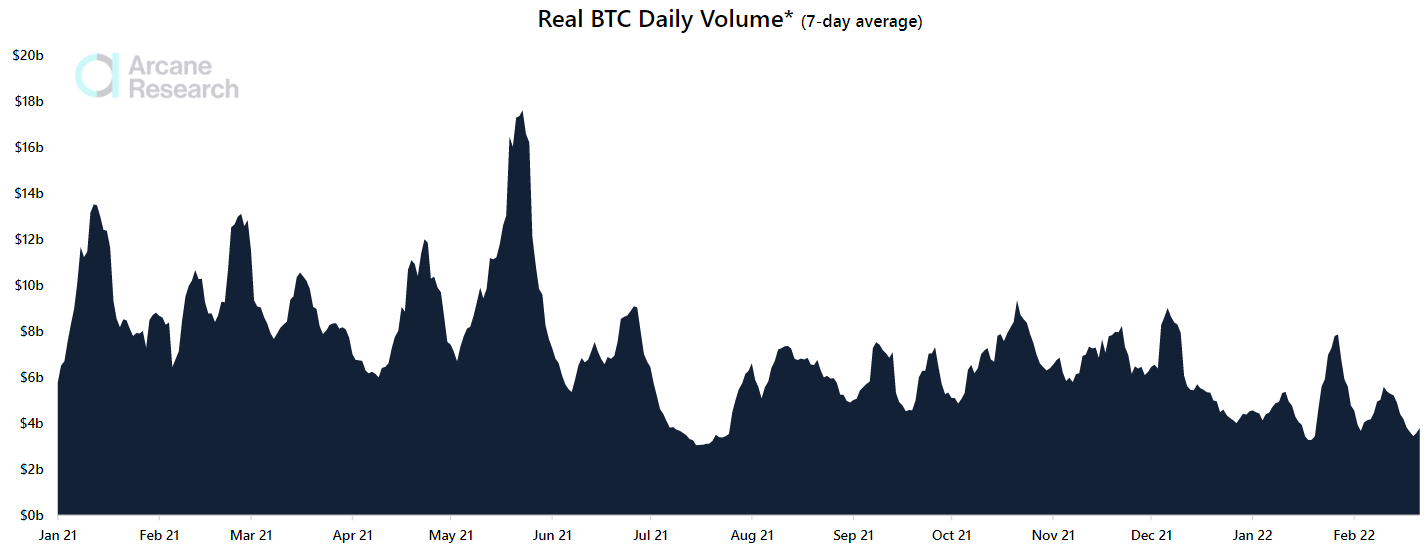

Arcane Research reports the same things concerning rising Bitcoin correlation with S&P 500 index. The Russia-Ukraine conflict has accelerated, leading fear to grow in both the stock and crypto markets, with bitcoin’s 90-day correlation to the S&P 500 climbing to the highest level seen since October 2020. And the spot daily trading volume has dropped significantly:

So it turns out BTC is not a hedge against inflation, not a hedge ag. oil squeezes, not a hedge ag. stocks. And, of course, Bitcoin is not a hedge against geopolitical events –actually the exact opposite. A perfect sucker game during low interest rates.

(Bloomberg) — Bitcoin is falling while gold is rising as investors seek traditional refuges amid the turmoil in Ukraine, undercutting the often-touted argument from advocates that the cryptocurrency is now a digital version of the long-time haven asset.

“Bitcoin is much more of a momentum and risk-driven asset than it is the independent store of value that people want it to become, it’s not there yet,” said Tom Essaye, a former Merrill Lynch trader who founded “The Sevens Report” newsletter.

“Gold is doing exactly what it should be doing right now, but it’s a much more mature asset and it’s got a proven history in these types of conflicts of how it trades,” Essaye said.

“This is the first time Bitcoin has ever encountered a potentially major global conflict, and I would expect that the declines will continue as long as stocks are under pressure.”

MARKET SENTiMENT ANALYSIS

Glassnode reports that Bitcoin bulls face a number of headwinds, ranging from dwindling demand on-chain, to over 4.7M BTC held at an unrealized loss.

Weakness in both Bitcoin, and traditional markets, reflects the persistent risk and uncertainty associated with Fed rate hikes expected in March, fears of conflict in Ukraine, as well as growing civil unrest in Canada and elsewhere.

As the prevailing downtrend deepens, the probability of a more sustained bear market can also be expected to increase, as recency bias and the magnitude of investor losses weighs on sentiment. The longer that investors are underwater on their position, and the further they fall into an unrealized loss, the more likely those held coins will be spent and sold.

One of the distinct signals of bearish Bitcoin markets is a lack of on-chain activity. This can be identified using tools such as Active Addresses/Entities as a proxy for users, or via blockspace demand metrics such as Transaction Counts, and On-chain Fees spent as users bid for inclusion in the next block.

Bear markets are characterised as periods of relatively low network activity, and diminished interest from retail, marked out in the red channel below. The lower-bound of this channel has historically increased in near-linear fashion, suggesting that the pool dependable Bitcoin users (the HODLers) is still growing over the long-term.

A probable cause for this spending behaviour is associated with the financial cost, and psychological pain of holding an underwater investment. We can see in the chart below that the proportion of on-chain entities in profit is oscillating between 65.78% and 76.7% of the network.

The flip side of this observation is that more than a quarter of all network entities are now underwater on their position. Furthermore, approximately 10.9% of the network has a cost basis between $33.5k and $44.6k, with many of them purchasing in recent weeks. If the market fails to establish a sustainable uptrend, these users are statistically the most likely to become yet another a source of sell-side pressure, especially if price trades below their cost basis.

Short-Term Holders currently own 54.5% of all coins held at an unrealized loss (2.56M $BTC), creating sell-side headwinds for price.

As a gauge of just how underwater Short-Term Holders are, we can calculate the STH Realized Price (aggregate cost basis) by dividing price by the STH-MVRV Ratio (result in blue). This indicates that STHs have an average on-chain cost basis of $47.2k, which at the time of writing (BTC price $38.1k) is an average unrealized loss of -19.3%.

Furthermore, the STH realised price is currently trading above the Liveliness Price ($38.6k) which reflects an estimate of ‘HODLer Fair Value’. In both the 2013-14, and 2018 bear markets, when STHs hold coins well above this fair value estimate, it has signalled that the bearish trend has some time left in it to reestablish a price floor.

STHs have held coins at a loss for over 2 months now, which could be argued to be a sign of resilience, but should equally be considered a probable source of overhead resistance.

The total magnitude of coin supply held in an unrealized loss is now higher than it was during the May-July 2021 period, but is only half as severe as the worst phase of the 2018 bear market, and March 2020 flush-out.

Nevertheless, with 28.7% of Sovereign Supply currently underwater (4.70M BTC), which again poses headwinds for to bulls to establish a compelling market recovery.

Overall, the Bitcoin market has numerous bearish headwinds in play, ranging from very weak on-chain activity (a proxy for demand), to large volumes of supply held at a loss (potential sell-side). With a total of 4.70M BTC currently underwater, and 54.5% of it held by STHs whom are statistically more likely to spend it, the bulls certainly have their work cut out for them.

However, Bitcoin investors appear far more likely to hold on for dear life (HODL), and use derivatives to hedge risk, rather than selling spot to reduce exposure. It looks like a bear market. But do keep in mind, that longer term, the bear authors the bull that follows.

BTC PRICE FORECASTS

Next bitcoin bull run won’t happen until end of 2024, says top crypto exchange co-founder

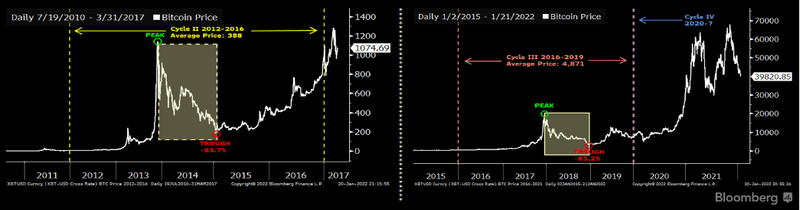

Bitcoin may not see a bull market until late 2024 or the beginning of 2025, if past price cycles are any indication, according to the co-founder of Huobi, one of the world’s largest cryptocurrency exchanges.

Du Jun told CNBC that bitcoin bull markets are closely tied to a process called halving, which occurs every few years.

The last halving took place in May 2020, and in 2021, bitcoin topped an all-time high above $68,000. A similar occurrence happened when halving took place in 2016. The following year, bitcoin hit what was at the time a record high.

Following both those peaks, bitcoin tumbled. Currently, bitcoin is sat nearly 40% off its record high from November, though it’s still off some of the lows seen in January. The next halving event is scheduled to take place in 2024.

“If this circle continues, we are now at the early stage of a bear market,” Du said, according to a CNBC translation of his comments in Mandarin.

“It is really hard to predict exactly because there are so many other factors which can affect the market as well — such as geopolitical issues including war, or recent Covid, also affect the market,” he said. Following this cycle, it won’t be until end of 2024 to beginning of 2025 that we can welcome next bull market on bitcoin.”

Cryptocurrencies are likely to plunge even further as the Federal Reserve raises interest rates and brings an era of “crazy” speculation to an end, according to a senior JPMorgan strategist.

“At some stage, I expect to see massive losses in crypto, because there is nothing there,” David Kelly, chief global strategist at JPMorgan Asset Management, told Insider.

But Kelly said the rout isn’t done yet, and he argues that digital assets are in particular danger because they serve no purpose. “It’s still all fairy dust and very vulnerable to higher interest rates,” he said.

The Fed’s pandemic-era stimulus forced bond yields down to ultra-low levels, which prompted investors to turn to highly speculative investments such as cryptocurrencies and unprofitable tech stocks, according to the veteran strategist.

“If you push real interest rates up to a positive level, you will starve the crazy ideas of cash and funnel money towards projects that actually have a positive, real economic return,” he said.

Kelly’s skepticism about digital assets is not universally shared within JPMorgan, which gives customers access to crypto investment products.

The lender has a dedicated blockchain unit, called Onyx, that on Tuesday revealed it had bought a space within a crypto-powered metaverse called Decentraland.

Kelly’s thinking is more in tune with that of JPMorgan CEO Jamie Dimon, who in October called bitcoin “worthless.” Yet Dimon has said the bank’s customers are adults, and the bank will give them access to digital assets if they want it.

The Fed could rock markets if it moves faster than investors currently expect, Kelly said — perhaps by hiking interest rates by 50 basis points in March, in response to January’s red-hot inflation numbers.

“Anything carrying very high valuations would be vulnerable, if you expect the Fed to be more aggressive early,” he said.

Crypto bull Tom Lee lays out risks to $200,000 bitcoin price target: CNBC Crypto World

Tom Lee of Fundstrat explains the upside and downside risks to bitcoin throughout 2022 and the firm’s $200,000 price target.

JPMorgan Estimates Bitcoin’s ‘Fair Value’ at $38,000, 12% Below Current Price

Bitcoin’s “fair value” is around 12% below the current price, based on its volatility in comparison with gold, according to JPMorgan Chase & Co. strategists led by Nikolaos Panigirtzoglou.

The strategists calculated the fair-value level at around $38,000 based on Bitcoin being roughly four times as volatile as gold, they wrote in a note published Tuesday. In a scenario where the volatility differential narrows to three times, the fair value rises to $50,000, they estimated.

Panigirtzoglou’s long-term theoretical target for Bitcoin — a level that would put its total market value on par with that of all gold held privately for investment purposes — sits at $150,000, up from $146,000 a year ago.

The strategists also said January’s price correction looks less like a capitulation than the one last May, which saw Bitcoin tumble as much as 50%. Still, metrics like futures open interest and reserves on exchanges are now pointing to a “more long-standing and thus more worrisome position reduction trend” that started in November, they noted.

“Our previous projection that the bitcoin to gold volatility ratio will fall to around 2x later this year seems unrealistic. Our fair value for bitcoin based on a volatility ratio of bitcoin to gold of around 4x would be 1/4th of $150,000, or $38,000,” JPMorgan said.

JPMorgan’s prior $150,000 target assumed a convergence of bitcoin volatility to that of gold, and an equalization of bitcoin allocations to that of gold in investor portfolios. Now, that is unlikely in the foreseeable future, JPMorgan said.

Institutions have been slowly warming up to bitcoin because of its uncorrelated returns to equities and other asset classes. But that notion has been challenged in recent sell-offs that occurred in tandem with equity market declines.

“The biggest challenge for bitcoin going forward is its volatility and the boom and bust cycles that hinder further institutional adoption,” JPMorgan said.

JPMorgan also said it has not yet observed signs of capitulation in the ongoing sell-off, suggesting more downside ahead for bitcoin.

“The open interest across futures contracts and the amount of bitcoin or ether held on exchanges, are pointing to less panicky or abrupt unwinding of positions than last May in particular with respect to larger crypto investors. In turn this implies that this month’s corrections looks less like capitulation relative to last May,” JPMorgan said.

Bitcoin Analysis Shows Prices May Bottom Soon, Fundstrat Says

Bitcoin stands a good chance of bottoming by the next few months, according to a technical analyst at Fundstrat.

The largest cryptocurrency has stabilized recently after falling about 50% from a record in November. According to a pricing model tracked by Fundstrat’s Mark Newton, there’s a “good likelihood” that the low for Bitcoin is coming by the spring months.

Still, he cautioned against getting bullish now.

“This minor two-week bounce might still be premature in expecting a new intermediate-term rally has begun,” Newton said.

Among key technical levels to watch, prices moving above $40,000 would be important for bulls, he added. Even if Newton expects a bottom sometime soon, he’s still thinking cautiously.

“Until $40,000 is exceeded on a daily close, it remains in a downward sloping pattern, and it’s tough to rule out further weakness technically speaking,” he wrote.

Wells Fargo: Cryptocurrencies appear to be close to a “hyper-adopting” phase

Cryptocurrencies appear to be close to a “hyper-adopting” phase similar to the internet in the second half of the 1990s. This opinion was expressed in the report by analysts of one of the largest US banks Wells Fargo.

Comparing the development of cryptocurrencies with other innovative technologies, the specialists of financial holding noted that digital assets have not yet passed the so-called “inflection point”. After it, explosive mass adoption of innovations began.

According to analysts, the adoption of cryptocurrencies is most reminiscent of the spread of the Internet. The World Wide Web was invented in 1983, and by 1995 only 14% of Americans were using it (less than 1% of the world’s population).

These numbers are reminiscent of those that are currently observed in the field of cryptocurrencies. For example, according to a survey, 13% of Americans have bought digital assets in the last 12 months, while 3% of people in the world use them.

In 1996, the number of Internet users reached 77 million, and by 2000 – already 412 million. After 10 years, the figure approached 2 billion, and now stands at 4.9 billion users, analysts said.

According to them, cryptocurrencies at an early stage of adoption are able to outpace the Internet in terms of adoption rates.

This is what happened with smartphones and WiFi, the innovations of the digital age, whose success was based on the spread of the Internet. Cryptocurrencies belong to the same area, Wells Fargo experts noted.

“We believe that cryptocurrencies are a viable investment today, although they remain in the early stages of their investment evolution,” they said.

Analysts did not support the opinion that it is “too late” to invest in digital assets. Their explosive growth in recent years is largely due to a low base, often from scratch, they stressed, and most of the opportunities lie ahead. The entire cryptocurrency market in terms of capitalization is still inferior to one Apple technology company, analysts recalled.

Bloomberg Intelligence: Shelter from crypto winter lies in the maturing digital-asset market

The odds of another crypto-currency winter — marked by multiyear price cycles spanning 80% drops from peak to trough — should be lower, we believe, since the market matured from the last extended downturn that ended in 2019. Greater participation by institutional and retail investors, more services and applications, and added investment vehicles all stand to limit the extent and duration of the downside.

Major Bitcoin price swings of 80% may not repeat. We believe institutional investors were the early buyers coming out of the downturn. For instance, in the four quarters coming off the 2019 trough, Coinbase’s institutional volume rose 61% from pre-trough levels, while its retail trading volume dropped 53%. Retail investors eventually returned, and penetration for both groups has grown steadily to about one-third of qualified participants.

THE BOTTOM LINE

So, as we could see from the comments above, the majority of investors, even Glassnode (that usually neutral-to-optimistic forecaster) tell about the bearish sentiment on the market. In December and January reports we’ve expressed real doubts on some widely supposed Bitcoin features like “safe-haven”. After two months of performance, our doubts are enforced.

Those of you who constantly read our Forex and Gold market analysis perfectly know our view on the financial and political situation. In the geopolitical arena, we do not expect fast and peaceful resolving of the conflict in Eastern Europe and do not exclude escalation that could induct eastern Nabours – Poland and Baltic countries. We hope to be wrong actually. Nevertheless, the lasting conflict keeps holding investors in tension, and aside from investing in risky assets that Bitcoin is.

On the financial stage interest rate increase is another headwind for the cryptocurrencies, despite that fed could hold the “Tightening horses” a bit due to geopolitical escalation. With rising gold and interest rates bitcoin has low chances to become the true rival, generating no dividends or interest.

These moments make us keep our medium-term target around the $26K area and do not consider yet the long-term investing in Bitcoin. In fact, we do not have yet even clear technical background to be bullish. At the same time, periods of easing of geopolitical tensions and more dovish Fed policy potentially could provide the background for moderate upside pullbacks from time to time.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

366 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023