Bitcoin Fundamental Briefing, April 2022

Cryptocurrencies show moderate activity in April. Evident statements from the Fed and J. Powell concerning interest rates tightening makes a pressure on the market. In fact Bitcoin now is a hostage of investors’ opinion. Since the moment of massive institutional investors entry, cryptocurrencies were stopped to be “family” romantic market, the island of freedom. They forcely were put in the stock investing basket, although initially it was supposed that they care more features with the gold. But – investors have decided, and now it is confirmed by strong correlation of the BTC and stock market.

That’s why cryptocurrencies right now are driven with the same factors that are vital for the stocks – changes of the interest rates and high inflation. The competition from bond market is rising, as neither stocks nor cryptocurrencies can’t provide and passive income.

Supposedly history was able to go in the different way, but, right now analysts that see big problems on the stock market try to not make any clear BTC price forecasts, at least for 6-12 months perspective, providing only some common long term view. Speaking about our personal view – we keep our bearish scenario and do not see ready-to-use background for long-term investing in Bitcoin, mostly keep watching for $26K target still.

MARKET OVERVIEW

Bitcoin extended this month’s losses in Monday trade as investors shied away from risk assets amid a more hawkish outlook for Federal Reserve policy tightening.

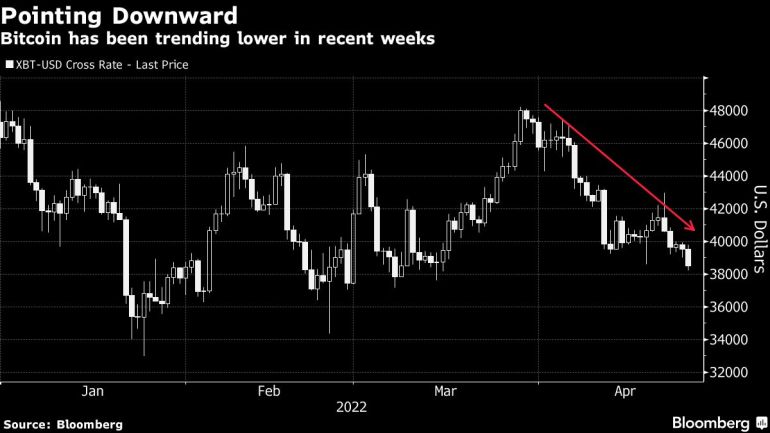

The largest cryptocurrency slid as much as 3.3% to $38,223, the lowest since March 15, and down more than 20% from last month’s high. It was little changed after paring the earlier loss. The second-biggest coin, Ether, slumped as much as 4.8% to $2,799, a level not seen since March 18.

Price charts are signaling further declines are likely, technical analysts say. Bitcoin has dropped below its Ichimoku cloud support on a weekly chart, with secondary support only coming in around $27,200, said Katie Stockton, founder and managing partner at Fairlead Strategies. She isn’t alone in seeing more downside.

“Bitcoin looks to be breaking a pivotal minor two-month trend on Friday’s pullback that likely causes weakness down to test January lows,” Mark Newton, a technical strategist at Fundstrat, wrote in a research note Friday. He expects an initial pullback to $36,300, “but breaks of that level should lead to a full retest of $32,950 without too much trouble.”

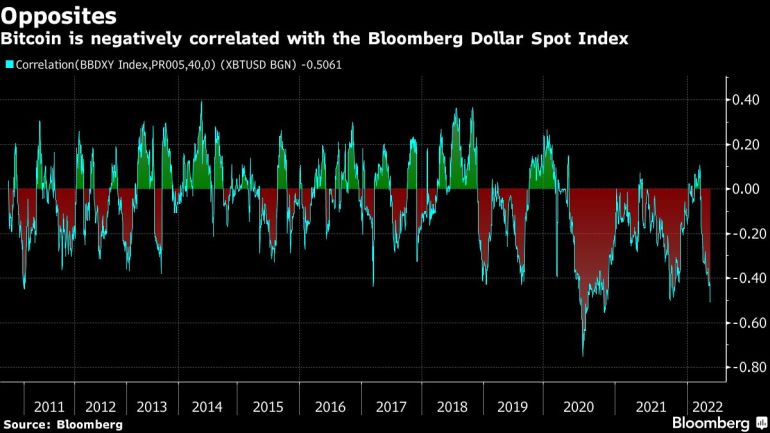

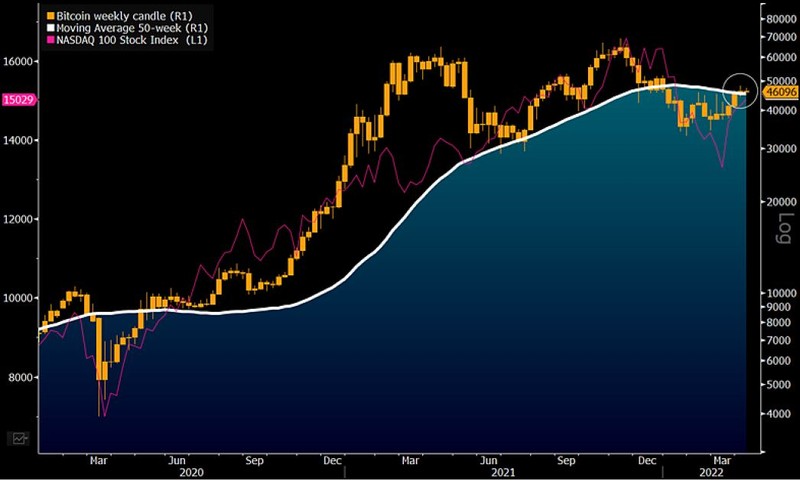

For all its recent losses, Bitcoin remains in the middle of a trading range that has held since the start of the year, between about $35,000 to $45,000. The digital currency moves strongly in line with the tech-heavy Nasdaq 100, and is negatively correlated with the dollar.

With the Fed expected to hike rates in 50 basis-point steps in coming months to combat inflation, some of the factors that fueled cryptocurrencies’ stellar gains in the past couple of years are going into reverse.

“As it becomes more valuable to hold dollars, some investors may reallocate from Bitcoin or gold to the dollar,” a team from Nydig wrote in a report Friday. “Like the negative correlation of Bitcoin to the dollar, the negative correlation of Bitcoin to real rates has only emerged in the last couple of years. Bitcoin will still be mainly driven by fundamental factors, such as user growth and network usage, but it’s important to understand the evolving macro relationships, they said.

Later in the week Bitcoin rose above a key technical level with little fanfare on Wednesday. The world’s largest digital currency rose as much as 2% to $42,204 to break its 50-day moving average, before fluctuating between gains and losses.

“Bitcoin is at very significant technical levels,” said Teong Hng, chief executive of Hong Kong-based Statori Research. The $42,000 level “is the 50-day moving average and with a close above, the technical picture could get more bullish.”

All told, Bitcoin’s tight trading range, as it fails to meaningfully rally, is leaving some market watchers bored.

“It’s so dull — it’s like watching grass grow right now. This was supposed to be the exciting asset that was volatile and has a bit of mojo. But no,” said Fiona Cincotta, senior market analyst at City Index, by phone.

Katie Stockton, founder of Fairlead Strategies, a research firm focused on technical analysis, wrote in a note that Bitcoin support holds near the $40,000 level. She’s also watching an indicator known as the daily MACD, which currently reflects “improved short-term momentum that supports a move higher toward next resistance” near the $48,100 mark.

The macro-economic picture is deteriorating fast and could push the U.S. economy into recession as the Federal Reserve tightens its monetary policy to tame surging inflation, BofA strategists warned in a weekly research note.

“‘Inflation shock’ worsening, ‘rates shock’ just beginning, ‘recession shock’ coming”, BofA chief investment strategist Michael Hartnett wrote in a note to clients, adding that in this context, cash, volatility, commodities and crypto currencies could outperform bonds and stocks.

And that recession will cause the S&P 500 to fall below the key 4,000 level by the end of 2022, BofA said, which represents potential downside of 11% from current levels.

A rising hashrate makes it becomes harder for miners to earn coin and cover their costs of hardware, electricity and staff – so many are more likely to sell, rather than hold, their newly minted cryptocurrency, exerting a bearish force on the market.

The total value of coins held in miners’ wallets has fallen to around $75 billion from $114 billion at the start of November, as their profitability has been squeezed by the rising hashrate as well as falling prices, according to Oslo-based crypto research firm Arcane Research.

Miners have been transferring more coins to exchanges than adding to reserves, according to crypto industry analytics firms, a sign of selling or intent to sell.

The seven-day average of total mining cost per transaction validated has fallen to $176.8 from a record $235.57 hit in May last year, data from blockchain.com shows.

Shares of U.S.-listed crypto miners Marathon Digital Holdings and Riot Blockchain have plunged 66% and 52% respectively since early November. The Valkyrie Bitcoin Miners ETF is meanwhile trading at a roughly 5% discount to its net asset value since the fund’s launch in early February, and the Viridi Clean Energy Crypto-Mining & Semiconductor ETF has lost 23% since the beginning of the year.

Bloomberg: ETF regulation might become a major driver

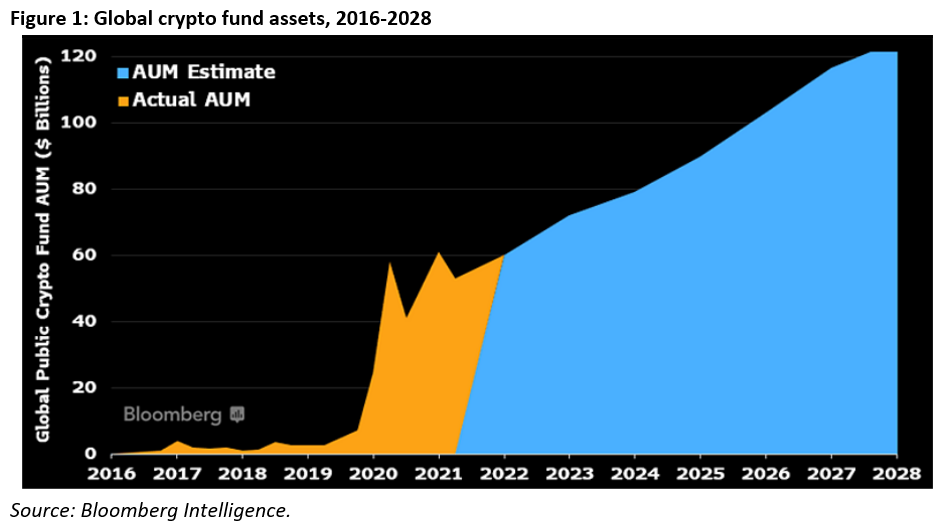

According to Bloomberg Intelligence report – regulatory approval is a key catalyst for a spot Bitcoin ETF by the end of 2023. If this happens, there is likely to be tens of billions in assets added to crypto funds given such a move would signal regulatory clarity and approval of the digital assets space. Currently U.S. advisors control about $26 trillion, with only a small minority of those advisors having exposure to crypto and the majority who do, allocate only 1% or less of their clients’ portfolios.

According to BI’s report, institutions taking crypto positions rose to 52% last year, up from 33% in 2019, bringing further liquidity to the sector. Furthermore, growth in the number of broker-dealers in the U.S. offering crypto products continues to support retail investor involvement in the sector, with convenience and simplicity creating a compelling incentive for entry-level investors.

ARCANE RESEARCH: Are we nearing a correlation 1 moment?

BTC’s correlation to tech is climbing, while gold and the DXY are increasingly negatively correlated as fear and hawkish policies are on everyone’s lips.

The broad financial markets are in an odd state at the moment. Bitcoin’s 30-day correlation to tech stocks has climbed to highs not seen since July 2020, while bitcoin’s correlation to gold has plunged to all-time lows.

An increase in the cost of borrowing leads to a downward revision of the growth trajectory of shares of high-tech companies. The growth of the price relationship between bitcoin and the Nasdaq Composite index reflects the belonging of digital gold to the category of risky assets in the eyes of institutional investors, experts stressed.

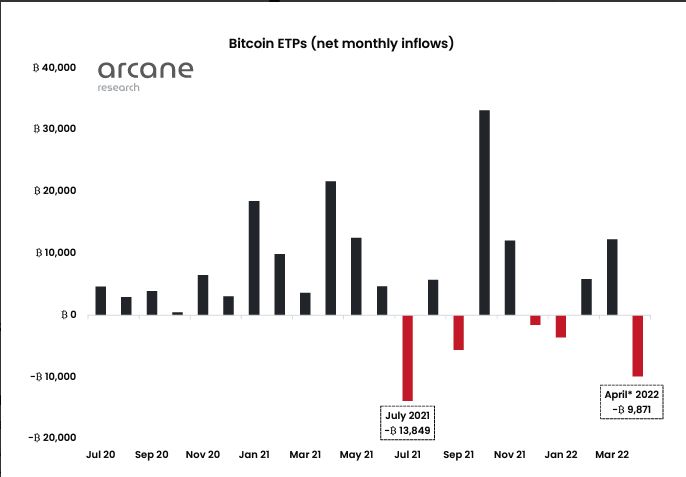

Gold currently serves as a hedge against inflation, while bitcoin ETPs record the outflow of funds. In the first two weeks of April, their AUM decreased by 9871 BTC. While maintaining the current pace, the historical anti-record of July 2021 will be updated by the end of the month, when investors withdrew 13,849 BTC.

The current dynamics may also indicate the upcoming formation of the bottom in the medium term. Experts recalled that the negative dynamics of flows to funds last summer coincided with the completion of the correction in digital gold.

MARKET SENTIMENT

The Fear&Greed index stands near long-term lows, indicating solid fear sentiment on the market:

Yields, implied volatility and trading volume in Bitcoin derivatives markets continue to compress, leading to an aggregate decline in capital inflows. On-chain volumes also remain muted, however, more constructive medium to long term fundamental trends are starting to develop.

The market has now traded within an increasingly tight price range for almost three months, leading to historically low yields available in futures markets cash-and-carry trades, alongside a persistent decline in trade volumes. Implied volatility priced into options markets has also broken below 60% this week, which is significantly lower than the 80%+ volatility that characterised much of 2021.

Compressing trade volumes, low implied options volatility, and rolling basis yields persistently below 3% in futures markets. All are leading to a leaking of capital out of Bitcoin markets as investors seek higher returns elsewhere.

The aggregate futures trade volume has been in a macro decline since Jan 2021. During the first half of 2021, trade volumes between $70B and $80B per day were typical. In the current market however, futures trade volumes are down over 59%, currently around $30.7B/day. There was barely an uptick in Oct-Nov 2021, even as prices pushed to new all-time-highs.

Open interest in futures markets is also notably lower than it was during peak bullish periods, currently hovering around $15 Billion, with a 2:1 split between perpetual futures, and calendar expiring futures.

A declining leverage ratio across all futures markets, despite increasing leverage in perpetual swaps, suggests that a reasonable volume of capital is actually leaving the Bitcoin market.

If we annualize the perpetual funding rate, and compare it to the 3-month rolling basis available in calendar futures, we can see a likely reason behind why capital is rotating out of Bitcoin markets.

Yields available in futures markets have compressed to levels barely above 3.0%, which is hardly superior to the yield available from a 10y US treasury bond (2.9%), and significantly lower than the recent US CPI inflation print of 8.5%. It is likely that declining trade volumes and lower aggregate open interest is a symptom of capital flowing out of Bitcoin derivatives, and towards higher yield, and potentially lower perceived risk opportunities.

We can also see a general shift in sentiment and risk management in the Put-to-Call ratios associated with both options trade volume (blue) and open interest (pink). Demand for call options dominated much of 2021, through til September, where bullish sentiment appears to wind down. As 2022 commenced, a distinct market preference emerged for put options, as more bearish sentiment took hold, and the demand for hedging downside risk increased.

MARKET PERFORMANCE EXPECTATIONS

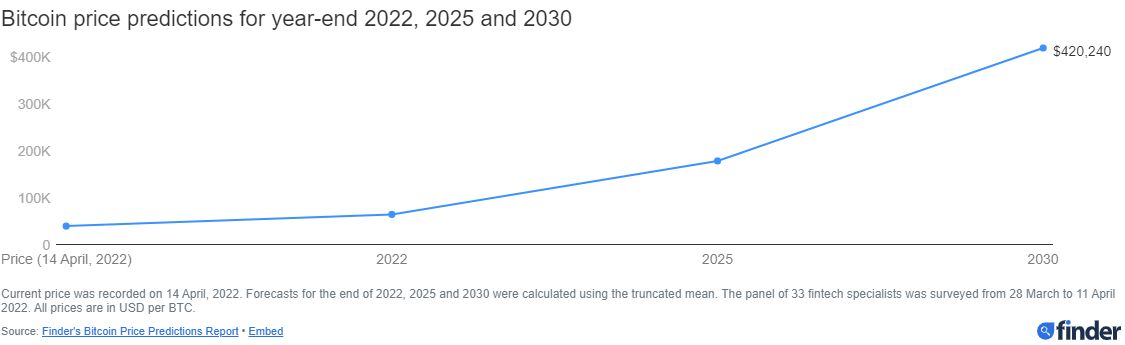

Finder releases the new report with projections of BTC price for different term. The price of Bitcoin (BTC) is expected to jump to US$65,185 by the end of 2022, according to Finder’s panel of fintech specialists.

Kate Baucherel, an emerging technology consultant and blockchain specialist at Galia Digital, gave one of the lower predictions for the end of the year, expecting BTC to close 2022 worth roughly what its value is at the time of writing: $40,000. Why? For Baucherel, BTC’s reliance on fossil fuels will hold it back.

Dimitrios Salampasis, FinTech lecturer at Swinburne University of Technology, also gave a below-average prediction for BTC’s price at the end of 2022 at $50,000. Salampasis, like Baucherel, also spoke on BTC’s use of fossil fuels.

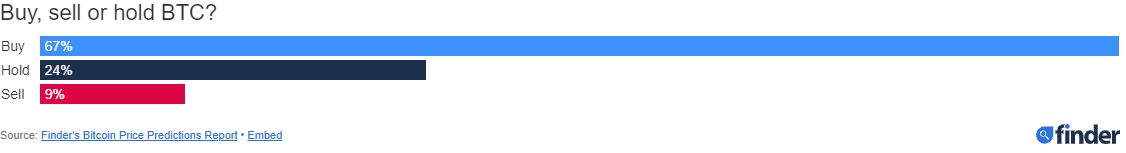

A little over two-thirds (67%) of the panel think now is the time to buy Bitcoin, with a further 24% of investors saying it’s time to hold. Just 9% say it’s a good time to get out of BTC.

Mohamed Ali El-Erian, chief economic adviser to wealth manager Allianz, suggested what changes in Fed policy will lead to an increase in the price of bitcoin. The expert predicts that the Fed may change the annual inflation target from 2% to 3%.

He considers it unlikely that the initial figure will be reached, and failure to do so will undermine the credibility of monetary policy.

In the event of such a decision by the regulator, the prices for gold and cryptocurrency will rise, the economist believes.

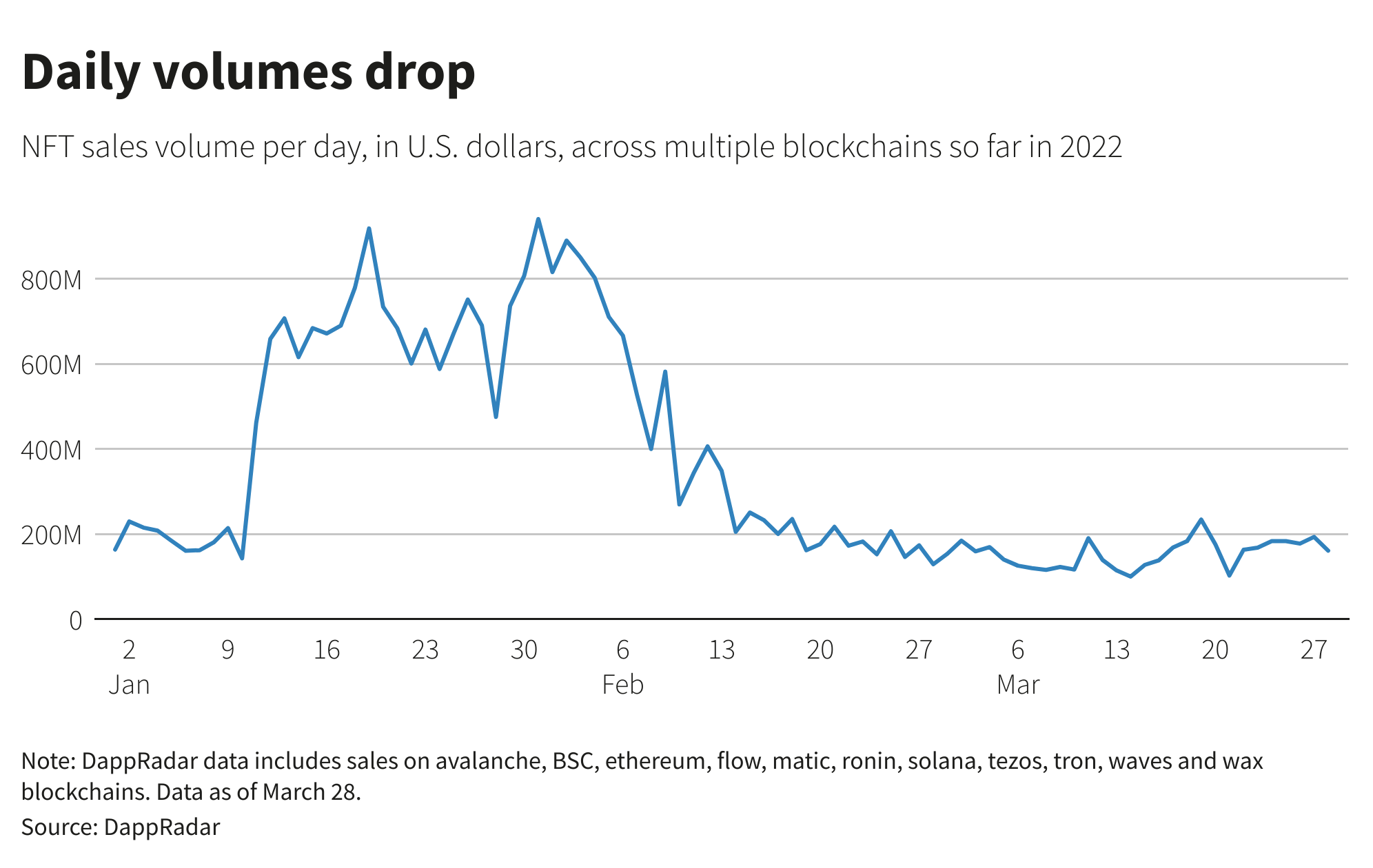

Nassim Taleb: The NFT thingy is starting to burst.

All you need is higher interest rates for things that make no sense to start making no sense. “Jack Dorsey Tweet NFT Once Sold for $2.9 Mil, Now Might Fetch Under $14K”.

Indeed, the NFT bubble isn’t popping, but it may have sprung a leak. A year on from when a single non-fungible token sold for $69.3 million in crypto at Christie’s auction house, with the buyer paying to be recorded on blockchain as the owner of a digital file that anyone can see online for free, this weird and wild market is showing some signs of slowing down.

I believe Bitcoin and Ether will have tested these levels:

Bitcoin: $30,000

Ether: $2,500

There isn’t much science to these numbers other than a gut feeling. As such, I am buying crash June 2022 puts on both Bitcoin and Ether. I will be wrong if the correlation between Bitcoin / Ether and NDX starts dropping before a crash in risk asset markets.

There are many crypto market pundits who believe the worst is over. I believe they ignore the inconvenient truth that the crypto capital markets are currently just a 24/7 Spooo’s and Qqq’s indicator and do not trade on the fundamentals of being peer-to-peer, decentralised, censorship-resistant digital networks designed for the transfer of money.

Bloomberg Intelligence: Bitcoin, cryptos extending upper hand

The demise of fossil fuels vs. the rise of digital assets may be unstoppable trends. Risk assets were ground down some in 1Q, and cryptos are among the most exposed. The war and disruptions in markets like nickel are adding to the narrative that Bitcoin is the most fluid, 24/7 global trading vehicle in history and well on its way to becoming digital collateral.

Discounted cash flow (DCF) analysis shows Ethereum may be undervalued as it approaches an upgrade. Trend signals are positive for layer 1 chains Solana, Terra and Avalanche, but are subject to a receding tide.

Bitcoin has shown divergent strength in 2022 and may be on its way to breaching key resistance around its 50-week moving average. Sustaining above $46,300 for the year, but with the Nasdaq 100 Stock Index still down about 8%, may mark an inflection for the benchmark crypto. Our chart of Bitcoin shows a market seemingly pulled lower by equities in 2022 but coming out ahead toward the end of 1Q. Forces toward reversion lower may be more prevalent in equities.

Bitcoin appears poised to outperform the Nasdaq 100 in most scenarios. The 2022 dip may be done, if the history of the stock market since the inception of Bitcoin in 2009 is any indication. As the world acclimates to Covid-19, the Fed tightens and war in Ukraine extends, our take is that it’s unlikely to be that easy. he graphic shows the Nasdaq 100 Stock Index bouncing from revisiting its 100-week moving average for the first time since the 2020 swoon. A shakeout more akin to the financial crisis may be overdue.

CONCLUSION

To be honest, guys there are a lot of things that are needed to be said here, especially on fundamental background in the US. Hopefully you read our weekly reports on Gold and FX market where we regularly provide in-depth analysis on this subject.

Currently, as you could see from information above, market stands in depressed condition, which actually reflects in all spheres – price shape, activity, sentiment etc. Arcane Research confirms our view that BTC now sits in the basket with 2nd quality stocks and fall under sell-off once any signs of risk appears on the horizon. This is one of the most fundamental things, because whatever happens in the economy – this moment remains unchanged.

Consequently, BTC price action totally depends on the destiny of equity market. BofA suggests recession, which is we do either, as market capitalization to GDP stands 17% higher than in 2000’s dotcom bubble crush. Rate hike brings huge problems in corporate sector and we expect that recession starts with massive junk bonds defaults. High commodities cost narrows (and puts in negative territory) EU trading balance that actually is 2/3 of net assets inflows in the US financial markets (stocks and bonds).

Glassnodes shows no positive signs in market sentiment, as we see outflows few months in a row, low volatility, narrowing open interest, rising PUT/CALL ratio. Technical picture, as we show regularly in our videos also bring no bullish signs by far.

Finally, third parties give very gentle forecasts, which are mostly neutral-to-bearish. Only pure optimists, such as M. Novogratz and others suggest, as usual, 2-3 times price growth within a year, but unfortunately they do not explain why this should happen. And the only Bloomberg view that regulation should open door a bit wider for institutional investors to increase the share of investment into cryptocurrencies looks more or less reasonable. But, this should happen, by their opinion, not earlier than in 2023.

Since our opinion suggests that crisis events in the US economy become evident in summer and exacerbate closer to November elections, currently we do not see any reason to invest in cryptocurrencies, as suggest still that our $26K BTC target keeps chances to be reached in mid term perspective.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

389 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023