Bitcoin Fundamental Briefing, May 2022

The Crush of the legend…

Since the winter 2021, when we were looking forward, in perspective of 2022, we were sceptic concerning bullish scenario for Bitcoin because of rising hawkish rhetoric from the Fed and increasing correlation with the stock market. It is not needed to be a prophet to predict how interest rates hike impacts on the stocks. When Fed policy turns from gentle to aggressive – effect now is obvious. The question is only where this nightmare could stop.

Result of recent 5-6 months tells that all inspiring forecasts from Bloomberg Intelligence and Mike McGlone, other respectable analysts who were speaking that “cryptocurrencies are special” and they will react specially, they could resist to coming interest rates tightening have been crushed by reality.

Our hypothesis suggesting that Bitcoin gradually is turning to stock-kind asset is totally confirmed. BTC correlation to NASDAQ stands around 95%, and market already has lost 60% of its capitalization:

As Bloomberg tells – Bitcoin’s Plunge Exposes Idea of Uncorrelated Asset as ‘Big Lie’.

“I think it will continue to trade with the equity market and risk assets,” said David Donabedian, chief investment officer of CIBC Private Wealth Management. “That’s the big lie that’s been exposed, the idea that it’s some new asset class that’s going to help diversify your portfolio has been blown to smithereens.”

Some traders believe that since Bitcoin market right now involves more institutional investors, this should be the subject for the hope that they support market.

…the amount of institutions now involved in the market, which may be a source of support, said Paul Veradittakit, an partner at digital asset manager Pantera Capital. “Compared to 2018, there are more institutional investors with exposure to crypto and most see this as a buying opportunity,” said Veradittakit.

We disagree. Many times before we said that the whole investment world follows the patterns in management. By our opinion – involving big amount of institutional investors makes market less diversified, as all of them act similar in similar situations. And this just increases the scale of collapse. It is even more important that all of them treat Bitcoin not as some “Special safe haven asset” as many thoughts but as simple second-quality stock, and recent action just supports our view.

Those of you who watch our regular BTC videos know that price hits very important support level around 26K which could stabilize price for awhile, but for how long?

And there are real problems with this question guys…

Market overview

(Bloomberg, May 23, 2022) Bitcoin drifted around the $30,000 level it’s been hovering around since the collapse of the TerraUSD algorithmic stablecoin triggered a selloff in cryptocurrencies. That mirrored the length of the declines in the S&P 500, underscoring how stocks and crypto remain closely linked.

“If the S&P falls some more, that should create one final flush and a great buying opportunity for Bitcoin,” Fundstrat Global technical strategist Mark Newton said. “There’s a lot of bearishness, and we should be approaching a time when you really want to buy into that in the next couple of months.”

Bitcoin has struggled in recent weeks as inflation remains elevated even with central banks in rate-hiking mode, boosting prospects for more monetary tightening. Also weighing on the outlook for crypto markets, regulators across the world have stepped up calls for stricter oversight since the TerraUSD stablecoin tumbled from its intended dollar peg earlier this month.

The tendency to trade in line with stocks means crypto traders are now closely watching economic indicators for signs of where monetary policy — and, by extension, digital-asset prices — is heading.

“Bitcoin is likely to hover around $29,000 to $31,000 for the next couple of weeks,” said Noelle Acheson and Konrad Laesser of Genesis Global Trading in a note Friday. They added that some economic-data releases, like US gross domestic product or inflation measures, “could change the narrative.”

Rick Bensignor, president of Bensignor Investment Strategies and a former Morgan Stanley strategists, uses DeMark technical indicators — which compare the most recent maximum and minimum prices to the previous period’s equivalent price to measure demand — to argue Bitcoin likely won’t break higher anytime soon.

“I’d still expect another four weeks of heaviness,” he said in a note Monday. The May 12 low around $25,425 and the bounce from that keeps support intact at $28,900, he said.

Short-term picture by analysts’ opinion doesn’t look fascinating.

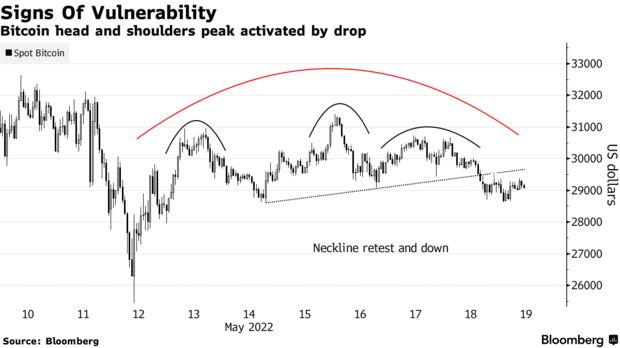

Bitcoin, which which has rebounded about 15% from its crash lows of last week, is looking increasingly vulnerable to another drawdown. The bounce has traced a so-called “saucer top” formation on the hourly chart, within which a bearish “head and shoulders” top has been activated due to the price falling back below the neckline. The pattern suggests Bitcoin would have to advance past $30,800 to shrug off the technical downside risk.

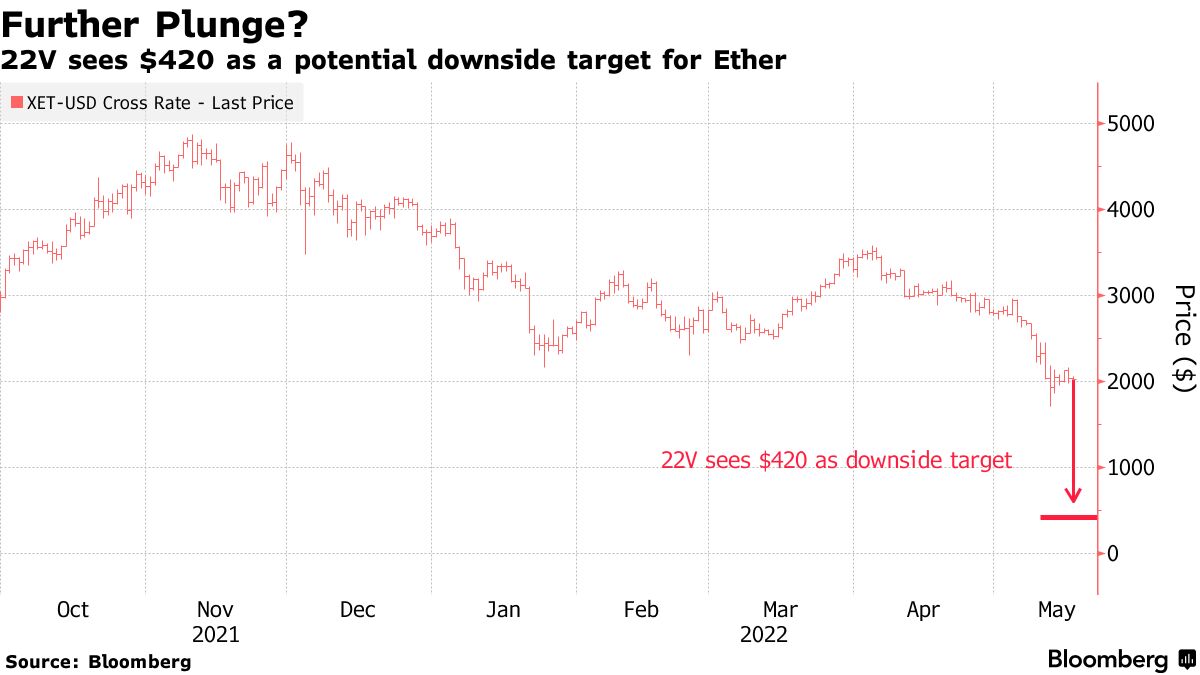

The forecast for ETH also doesn’t look inspiring:

Ether, the second-biggest cryptocurrency by market cap, has fallen about 60% from its November record. It could be due to drop another 80% or so, according to technical analyst John Roque of 22V Research. His downside target is around $420, compared with its current level about $2,000, Ether is “oversold daily and oversold weekly and cannot rally,” Roque said in a note Monday.

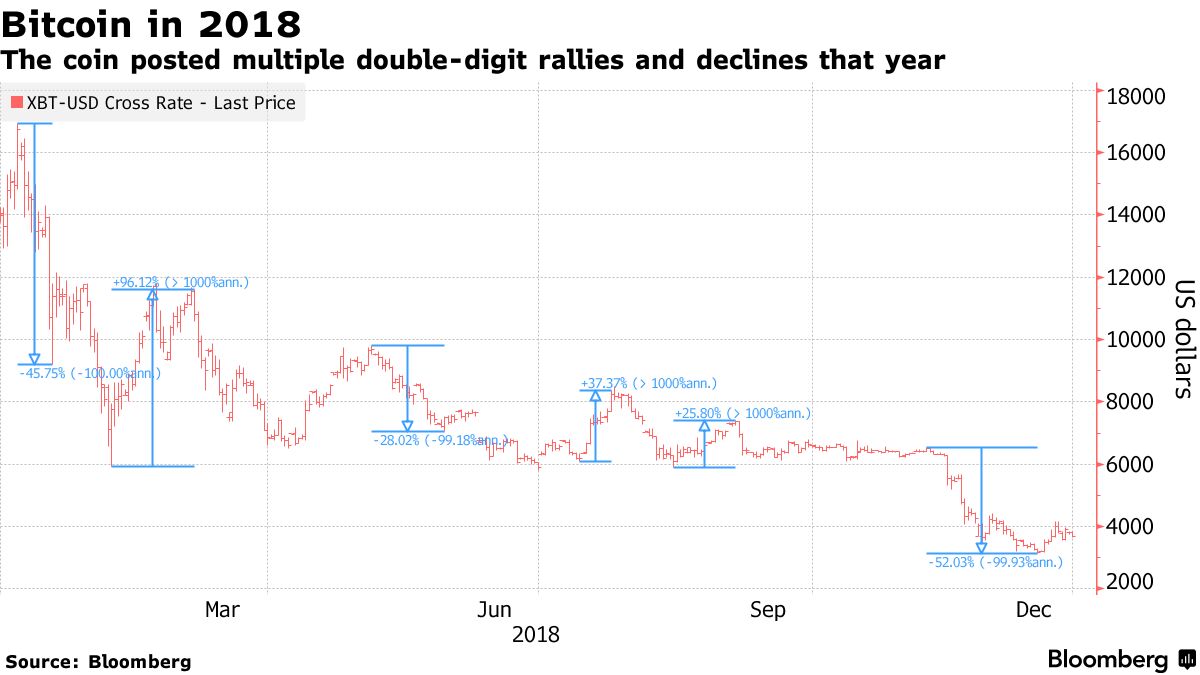

Mike Novogratz, the founder of Galaxy Digital Holdings Ltd. , noted that some smaller tokens are down 80% from their highs. And should their losses accelerate to the same degree they did in 2018, those coins could lose an additional 70%.

“My point is picking bottoms is dangerous,” he tweeted. “And if you do scale in slowly.”

Cryptocurrencies have suffered this year, undergoing a dark stretch that’s affected just about every corner of the market. Bitcoin and Ether are down 50% each since November, when many coins peaked, while XRP, Dogecoin and Solana have all lost roughly 70%. Shiba Inu is down 80%. And investors are also souring on NFTs and other crypto-centric offshoots.

Bitcoin, the largest digital-asset by market value, dropped as much as 5% to $28,706 on Friday. The S&P 500 dipped 20% below its January peak on an intra-day basis.

| Decline since Nov. | Decline YTD | |

|---|---|---|

| Bitcoin | -52% | -37% |

| Ether | -55% | -47% |

| XRP | -62% | -51% |

| Bitcoin Cash | -68% | -56% |

| Dogecoin | -69% | -51% |

| Solana | -75% | -71% |

Source: Bloomberg

That hasn’t kept some from saying that now is a good time to buy digital assets at a discount — Twitter is rife with such posts. Nor have predictions ceased, after more than $1 trillion has been erased in crypto-markets value since the fall, that the bottom is in.

The plunge in prices on May 12, amid TerraUSD’s breakdown, “signaled clear tendencies of extreme and irrational fears,” according to a research note by BlockFi and Arcane Research. Funding rates reached lows not seen since July as liquidations spiked, all while spot volumes remained elevated.

“All these events suggest that the current selloff could be nearing a point of saturation,” the report said, though it added that assessing the crypto market without consideration for what’s going on with broader risk assets is “likely unwise.”

Recession or not, crypto prices could have further to fall, according to Mike Belshe, founder and CEO of BitGo.

“Even if the economy avoids a downturn, I’m confident that prices will collapse and the exuberance will subside,” he said in an interview. “This would be more pronounced if we enter into a recession.”

“We haven’t had them go through a real recession and the question I ask myself is, if you take Bitcoin now, what is the greater probability? That it will double in value or that Bitcoin will halve in value?,” Jonathan Macey, professor at Yale Law School who studies corporate finance, said by phone. “And I think the odds are that it’s going to halve in value.”

“I wouldn’t look for a sustainable rally there until the Fed’s getting ready to lower rates again,” David Donabedian, chief investment officer of CIBC Private Wealth Management, said by phone. “And that’s quite a ways away.”

Crypto fans desperate for a floor in Bitcoin’s selloff may have to be patient. Every significant slump in the largest cryptocurrency since 2014 has reached the 200-week moving average. That lies close to $20,000 — or about 35% below Bitcoin’s current price, which is already down by a similar percentage in 2022.

Thus, this is the sentiment on the market. As you could see, the major opinion that drawdown is temporal, soon it should normalize, a big hopes stand around 20K area. Nobody considers current drop as a by-product of structural crisis in the US economy that could last for few years.

FOR HOW LONG THIS NIGHTMARE COULD LAST?

To understand the scale of the problem, lets take a look first at the dry numbers. Greed, recklessness, incompetence, speculative excitement, a strong belief in own exclusivity and the absolute stability of the system created a sequence of decisions that provoked a chain reaction in the system.

To understand the scale of the shock, the world’s central banks, which are part of the “circle of trusted” structures of the Fed (ECB, Bank of England, Bank of Japan, SNB, Central Bank of Australia, Central Bank of Canada, Central Bank of Sweden, Denmark and New Zealand) created almost $ 12 trillion of new liquidity in two years.

For comparison, from August 2008 to December 2019, the total volume of emissions for all these endless iterations of QE amounted to 12.2 trillion from the above-mentioned Central Banks, i.e. in 2 years as much was created as in 11.5 years of “new normality”.

And to stop collapse on the markets – they need reverse it back. Now we have huge structural disbalance in economy when everybody wants to consume but nobody wants to work.

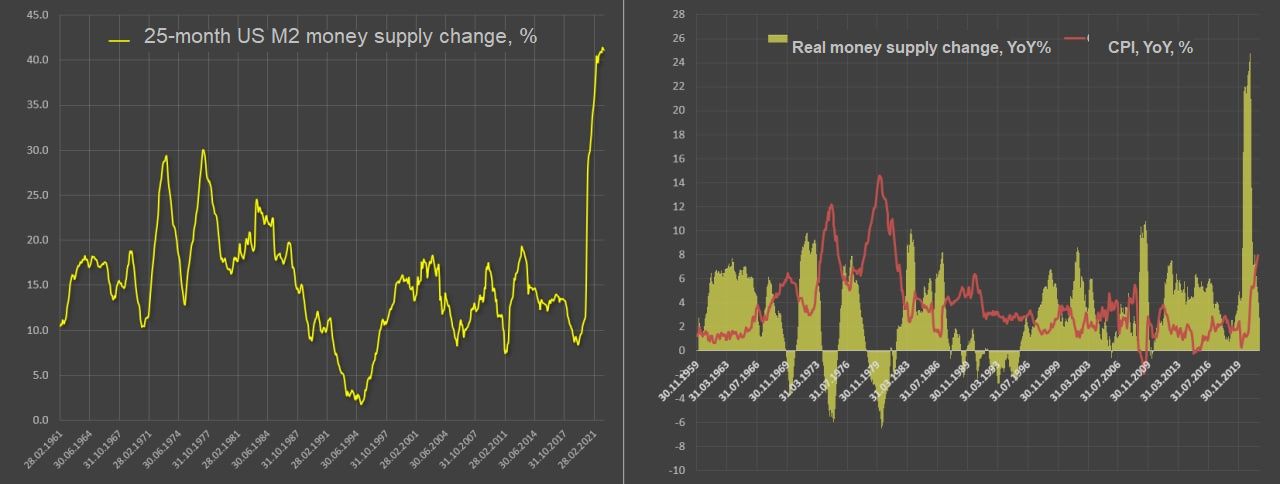

From February 2020 to March 2022, were printed 41% of all dollars that have been created ever, since the founding of the United States. There was no such thing in the history of the United States.

Prior to that, the 28-30% growth rate of the money supply over the same period (25 months) was in January 1973 (29% growth) and March 1977 (30%).

Is it any wonder why inflation in the US is now storming double-digit levels? A year ago, the real money supply in the United States grew by 25% — this is 2.5 times higher than the previous peaks – in December 1971, June 1983 and June 2009 on the wave of aggressive fiscal incentives. After such monetary emissions with a lag of 2 years, the peak of inflation is formed, and the real money supply goes into a deep negative territory. The growth of inflation in the United States will not stop until inflation “eats up” all excess emissions.

In fact, you could get more details about current economy conditions of the US in our regular weekly reports on FX and Gold market, where we week-by-week making an updates on major statics and fundamental factors.

Here we just tell that the problem is people would like to consume two times more goods that economy could provide. Until this disbalance will be fixed – US remains in recession. Currently we see this process through inflation, which is 7-10% per year by far. The US economy should drop for 50% to fix this disbalance. Until this happens, inflation remains.

How Fed could do this? It has to crush the consumption, and the most simple way is to increase the cost of money by rising interest rates. It increases the debt burden of the households. Additionally Fed is drying liquidity out of the markets. The promise of the Fed sounds scaring:

What we need to see is inflation coming down in a clear and convincing way and we’re going to keep pushing until we see that,” Powell said at a Wall Street Journal event. “If we don’t see that, we will have to consider moving more aggressively” to tighten financial conditions.

Despite that QT (Quantitative tightening) should start only in June, Fed already is started this process since December. And take a look – once it has started, the stock market feels the headache:

The problem is that 52.6% of the US population have assets in the stock market directly or indirectly according to the Fed. Now the market may go into reverse (a slight increase of 4-5% from Friday’s lows) after 8 weeks of decline. But the market probably is doomed.

The record growth of the market created a fictitious and imaginary wealth effect, at the same time hipsters and the younger generation entered the market as never before. The households’ activity on the market was a record for the entire trading period from January 2021 to July 2021 and gradually decreased from September.

Now they will have to return the system to its original position, at least by zeroing out all fake growth on doping 2020-2022. But it won’t end so easily, there are too many imbalances in the system. You can’t inflate a 60 trillion bubble in stocks and a 3 trillion bubble in the crypto without consequences.

Fed vitally needs the liquidity to support the bond market. It already has difficulties with selling of the new issues of Debt, because nobody wants to buy it with the real rate around “-8%”. Thus, in March there was a net debt repayment for ~100 Bln. In fact, they have to rise rate somewhere to 8-10% to keep the interest on the bonds, but it will crush the economy into hard recession. That’s why they now try to get assets wherever they can to support the bond market. EU and Japan, China can’t help them anymore as they already have negative trade balance and current accounts and have no “free money” to invest in the US bonds.

To get the necessary cash – Fed starts the crush of the stock market. As cryptocurrencies as less important for investors – it has become the first one that has been slaughtered.

By most optimistic view, S&P index should reach 2500 points within 1-2 years, with potential further drop to 1700 points, i.e. two times lower from all time highs. Now it has dropped just for 20%, so we could treat it only as a first stormbinder of coming collapse.

The main intrigue now is at what level, and under what economic and financial conditions the Fed puts on the brakes? It is highly likely that they won’t finish the job, i.e. they won’t be able to beat inflation. But without defeating inflation, in the near future, there will be a powerful blow on the debt markets, which will be much stronger than any blow to the stock markets. Political populists and demagogues hold the reins of power, and this public is weak-willed and irresponsible, not ready for drastic and radical steps.

Fed stands in the dead way. If they rise rate enough to struggle inflation – this increases debt burden of households in five times, which put the majority of population into poverty, crushing banking system due massive defaults. But if they do not increase rate – this could bring much harder problems, default of the national debt. With 8% inflation demand for the Treasuries decreases and at some point Fed will have no money to refinance it. So, whatever side you look – problems everywhere.

This makes us to be skeptic on perspectives of cryptocurrencies. All these talks about “exceptional role” and very “special safe haven” features become a bravada.

THE SEQUENCE OF EVENTS

Until the end of the summer we do not expect big shakes. Fed has enough liquidity on accounts, and despite additional supply of 190 Bln in bonds for open market in QT since June 1st.

In May-August 2022 period the budget deficit is expected around 650 Bln, plus 190 Bln mentioned above. Additionally to covering of the deficit, US Treasury has to manage existence debt (issue and repayment). Now the US Treasury has around 900 Bln on Fed accounts. Thus, it could lead just decreasing of the US Treasury cash on the account, but it has enough liquidity to manage this process. So, here we do not expect any problems.

At the first stage of the crisis we expect deteriorating of statistics across the board. Inflation remains high, despite any Fed efforts, but employment, retail sales, consumption, sentiment etc. should keep dropping. The wealth of households turns eroding.

After temporal pullback on the stock market that we see now – it should keep dropping as because of drying off the liquidity as because of competition from nominal interest rates to dividend yields. Higher rates should trigger massive defaults in junk bonds sector, triggering chain reaction of rising credit default spreads (CDS) and pushing stock market even lower.

On next stage, rising interest rates, massive defaults of “distressed companies” and falling profit margin of the business leads to obvious signs of the recession in statistics with rising unemployment, high inflation and negative GDP. This will be the edge for the US national debt. By seeing this, investors start to demand more reward for possible default in the US debt. This probably becomes too heavy burden for the Fed.

Through all these process, cryptocurrencies will be treated as the source of the liquidity. That’s why we do not consider them for long term investment as economy conditions already tough.

NFT follows the same trend. Blue-chip NFT collections like Bored Ape Yacht Club, which for a while outperformed the rest of the crypto market, are being hit harder than cryptocurrencies by a deep rout that is souring sentiment across the sector.

BAYC’s average sales price plummeted 29% over the last seven days in US dollar terms, while transactions have tanked by 21% and user numbers are down 27%, according to NFT watchers Price Floor and DappRadar.

“They are just fairly illiquid markets generally,” said Bucella, a partner at BlockTower Capital Advisors. “If the market is selling off en masse, they are going to sell whatever they have.”

NFT-backed loans, which allow borrowers to put up their digital artwork as collateral in order to obtain funds, may also be contributing to the recent nosedive in NFT sales.

“This could be just collateral selldowns to satisfy loan obligations,” said Bucella. “If you had folks taking some pretty significant hits on their assets, there’s a potential loan unwind.”

And we should not be surprised with that. As cryptocurrencies and NFT were invented as a big wallet to keep extraordinary liquidity – now they are primary source to draw it back.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

529 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023