Bitcoin Fundamental Briefing, June 2022

The edge

Cryptocurrencies in general and bitcoin in particular are coming to the most tough moment in the history. Many people and investors start asking on whether Bitcoin survives or fail totally and people just forget its name.

Yes, situation on bitcoin market is frustrating but let’s not dramatize it too much. at least we do not see the hazard of total annihilation. For us and for our readers collapse on the bitcoin market was mostly expected. In December of 2021 we were skeptical on crypto fans, when they were waiting starting of the new year with enthusiasm, as market was rebounding from May 2021 lows, and thought that global financial tendency, such as Fed tightening and extreme inflation will not impact the Bitcoin, or conversely, Bitcoin will become even stronger. This is big delusion.

But fundamental picture was promising nothing good. Of course, we couldn’t foresee that collapse will be so miserable, but, overall negative background already was starting to form around the market.

As people have fallen in euphoria in December – as now they fall in total pessimism. We intend to stay aside from both emotional conditions and use the common sense for analysis. At the same time, overall fundamental background stands not if favor of sharp upside reversal. Bitcoin could stop dropping, exhausting existed capitalization, but absolutely different conditions are needed to reverse it up.

Market overview

Bitcoin plunged through several closely watched price levels to the lowest since late 2020 as evidence of deepening stress within the crypto industry keeps piling up against a backdrop of monetary tightening.

The largest digital token by market value tumbled as much as 15% to $17,599 on Saturday, marking a record-breaking 12th consecutive daily decline according to Bloomberg data.

Ether fell as much as 19% to $881, the lowest since January 2021. The two bellwethers of the crypto market are both down more than 70% from all-time highs set in early November.

“What we’re seeing is more liquidations driving prices and sentiment lower, which triggers more liquidations and negative sentiment — some flushing-out needed still, but this will at some stage exhaust itself,” said Noelle Acheson, head of market insights at Genesis, one of the largest and best-known lenders in the digital-assets space.

The latest leg down pushed Bitcoin below $19,511, the high the coin hit during its last bull cycle in 2017, which it reached at the end of that year. Throughout its roughly 12-year trading history, Bitcoin has never dropped below previous cycle peaks.

Altcoins were no exception to soured investor appetite in the wake of Bitcoin’s fall, with every token on Bloomberg’s cryptocurrency monitor trading in the red. Cardano, Solana, Dogecoin and Polkadot recorded falls of between 12% and 14%, while privacy tokens such as Monero and Zcash lost as much as 16%.

A toxic mix of bad news cycles and higher interest rates has been deleterious to riskier assets like crypto. The Federal Reserve raised its main interest rate on June 15 by three-quarters of a percentage point — the biggest increase since 1994 — and central bankers signaled they will keep hiking aggressively this year in the fight to tame inflation.

“Investors are continuing to position defensively following last year’s liquidity-driven digital asset bull market,” Alkesh Shah, head of crypto and digital assets strategy at Bank of America Corp., said in a note on Friday. “Although painful, removing the sector’s froth is likely healthy as investors shift focus to projects with clear road maps to cash flow and profitability versus purely revenue growth.”

Broader signs of stress emerged with last month’s collapse of the Terra blockchain, and worsened this week following crypto lender Celsius Network Ltd.’s recent decision to halt withdrawals.

Adding to the mood, crypto hedge fund Three Arrows Capital suffered large losses and said it was considering asset sales or a bailout, while another lender, Babel Finance, followed in Celsius’s footsteps on Friday. Even long-term holders who have avoided selling until now are coming under pressure, according to researcher Glassnode.

“After Celsius, the focus last few days has been Three Arrow Capital and Babel Finance.” said Teong Hng, chief executive of Hong Kong-based crypto investment firm Satori Research. “Su Zhu, the founder of 3AC seems to be missing in action, after purportedly suffering huge losses due to massive drop in crypto this round.”

The top four stablecoins saw exchange net outflows last week that were 4.5 times larger than the prior week, Bank of America’s Shah said, having charted net outflows in eight of the 10 prior weeks. Stablecoins are often relied upon by crypto traders to move funds around the ecosystem without needing to exit into traditional currencies, so persistent outflows indicate that investors remain defensive, he added.

Even with the piercing of the key $20,000 level, historical data show that Bitcoin may find key support around that mark as previous selloffs demonstrate where the token usually finds points of resilience, according to Mike McGlone, an analyst for Bloomberg Intelligence.

Bitcoin may “build a base around $20,000 as it did at about $5,000 in 2018-19 and $300 in 2014-15,” he said in a note on Wednesday. “Declining volatility and rising prices are earmarks of the maturing digital store-of-value.”

Still, the digital currency is fast approaching its December 2020 low of $17,589. It traded as low as $13,222 the prior month that year.

The crypto market now stands at a fraction of its heights in late 2021, when Bitcoin traded near $69,000 and traders poured cash into speculative investments of all stripes. The total market cap of cryptocurrencies was around $881 billion on Sunday, down from $3 trillion in November, according to pricing data from CoinGecko.

MINING BUSINESS MEETS PROBLEMS

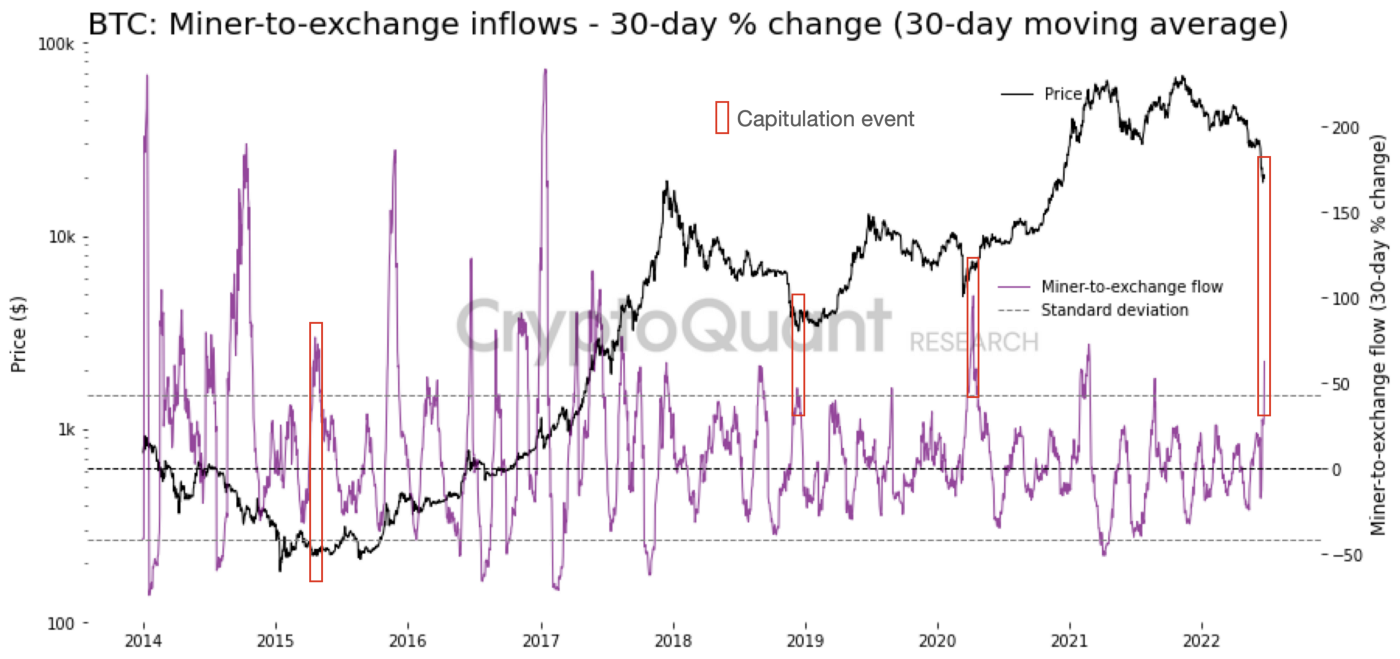

A major “capitulation event” in which Bitcoin miners funnel thousands of tokens to exchanges could signal an approaching bottom for the world’s largest cryptocurrency, if history is any guide.

In an effort to salvage plunging profits, Bitcoin miners are turning sellers after seeing the price of the bellwether token more than halve in 2022. This past month, miners moved 23,000 Bitcoin to exchanges, representing the highest monthly flow since May 2021, when China initiated a crackdown on its domestic crypto industry, data from tracker CryptoQuant shows.

Market watchers have said that the slew of selloffs is only likely to continue, driving coin prices down further. But some, like CryptoQuant senior analyst Julio Moreno, say they’re a sign of an approaching market bottom.

CryptoQuant has dubbed the phenomenon a “capitulation event” or the start of a “capitulation period” for miners. Moreno says this typically comes right before a bottom, in line with past market cycle patterns.

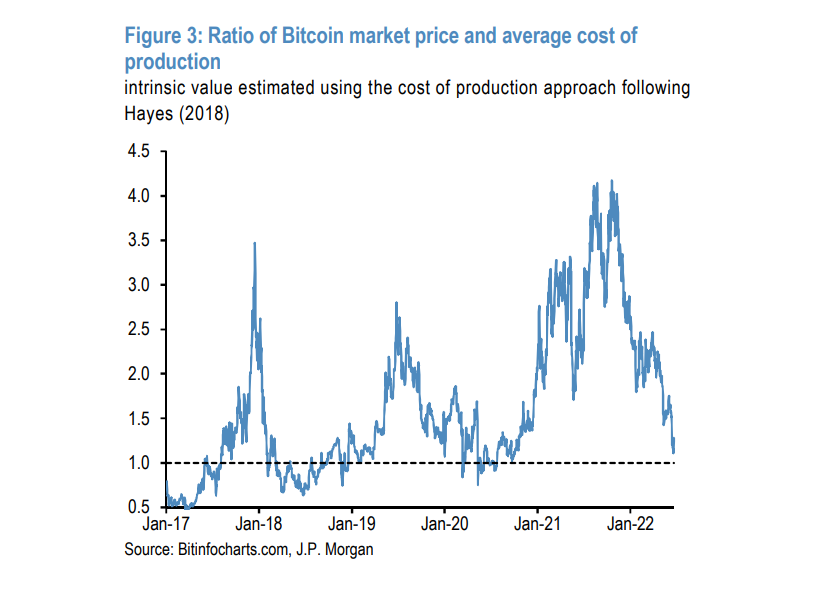

“With miners’ revenue dropping and mining difficulty still at high levels, miners are now in the “extremely underpaid” territory,” he wrote in a note dated June 23. “Some miners’ revenue can’t meet the break-even point, so they have to cash out to cover expenses/loans,” he wrote.

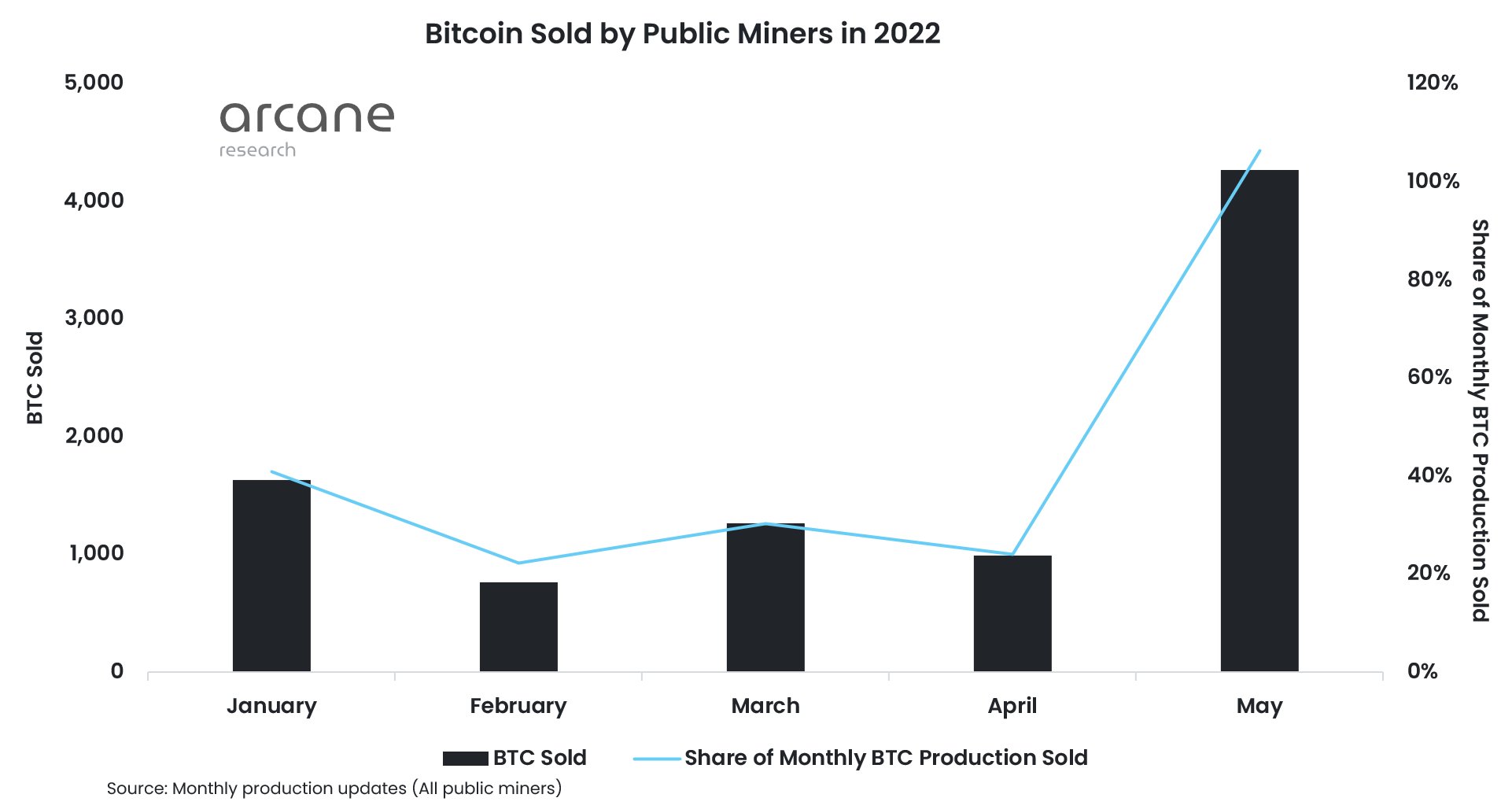

Bitcoin miners needing to sell could weigh on the token’s price for some time, according to JPMorgan Chase & Co. Privately-held miners may have sold a larger share of their block rewards from mining activity to meet ongoing costs and could be less levered given their more limited access to capital markets, they said.

“Offloading of Bitcoins by miners, in order to meet ongoing costs or to delever, could continue into Q3 if their profitability fails to improve,” the strategists wrote. That offloading “has likely already weighed on prices in May and June, though there is a risk that this pressure could continue.”

Estimates of the cost to mine Bitcoin can vary. The cost of production for a large mining company is around $8,000 per token, assuming average electricity prices and fairly new mining machines, according to Arcane Crypto. However, Securitize Capital says that factoring in overhead costs for infrastructure and interest rates, the total costs for some miners may already be above $20,000.

The prolonged slump in Bitcoin is making it more difficult for some miners to repay the up to $4 billion in loans they have backed by their equipment, posing a potential risk to major crypto lenders.

A growing number of loans are now underwater, according to analysts, as many of the mining rigs lenders accepted as collateral have now halved in value along with the price of the world’s largest digital token.

If the market doesn’t improve, analysts warn it could be an ugly scenario. Selling Bitcoin reserves puts further pressure on prices and the cost of equipment could fall even lower if lenders — looking to recoup their losses on defaults — start liquidating machines they repossess. The value of Bitmain’s popular S19 mining rig is down about 47% from a high of roughly $10,000 in November, according to data from Luxor Technologies Corp.

“Bitcoin miners, broadly speaking, are feeling pain,” said Luka Jankovic, head of lending at Galaxy Digital. “A lot of operations have become net IRR negative at these levels. Machine values have plummeted and are still in price discovery mode, which is compounded by volatile energy prices and limited supply for rack space.”

Many Bitcoin miners still enjoy decent profit margins. The cost of production for a large mining company is around $8,000 per token, assuming average electricity prices and fairly new mining machines, according to Jaran Mellerud, a mining analyst at Arcane Crypto.

“But the reduced income still impacts their business as some of them have loans to repay and collateral to post for their machine purchases,” Mellerud said. “These payments might be hard for them to make without selling a significant portion of their Bitcoin holdings.”

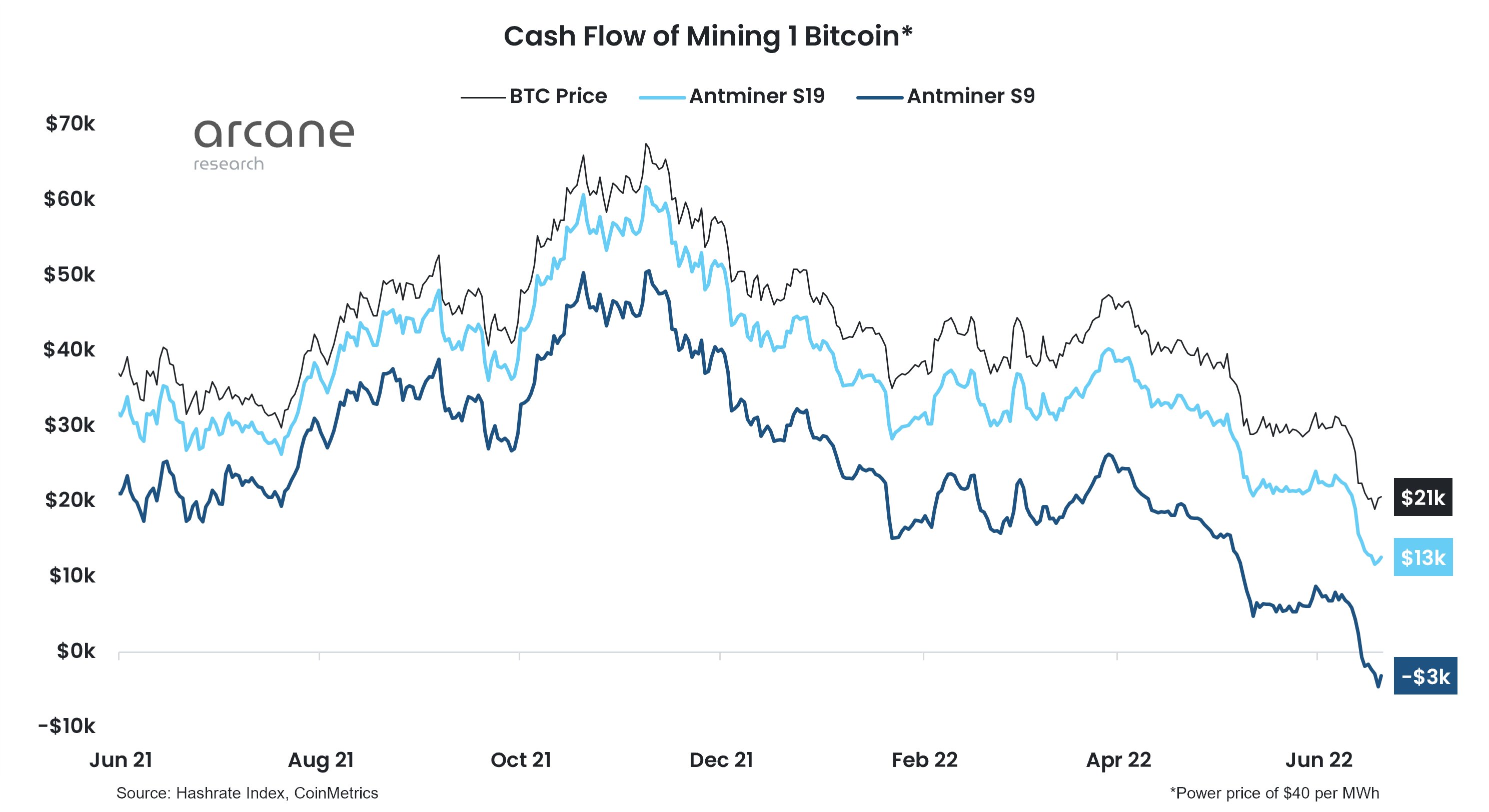

Why are the bitcoin miners forced to sell their precious bitcoin? Their cash flows are plummeting. The Antminer S19 only makes $13k per BTC – an 80% decline from the November peak (power price of $40 per MWh).

Miners have started to dump their bitcoin holdings. Public miners sold more than 100% of their production in May, a massive increase from the usual 25-40%.

Bitcoin Hashrate has dropped for 10% on a background of price collapse. The most probable reason is switch-off unprofitable mining devices, such as S9:

HOW DEEP BITCOIN COULD FALL

Investors now consider different technical indicators, gambling on possible bottom. We’re mostly focused on fundamental background.

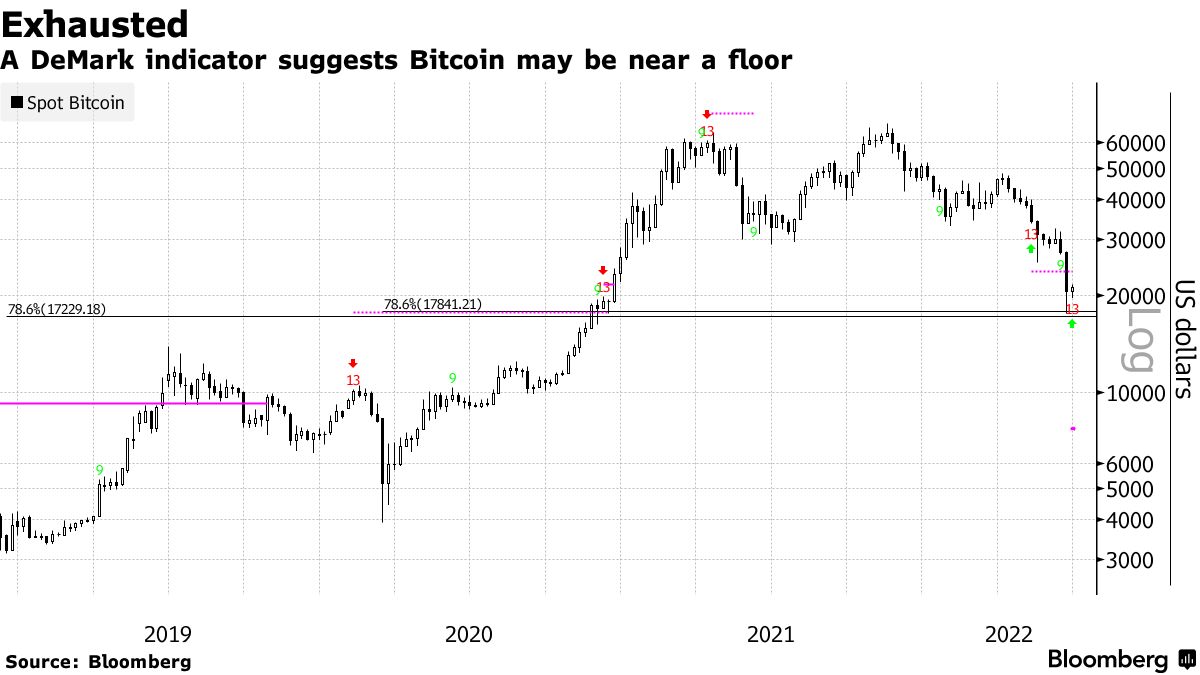

As Bloomberg reports, some technical indicators suggest that BTC might be near the bottom. A widely followed DeMark technical indicator known as TD Sequential suggests much of the Bitcoin selloff is behind us. The study uses a method of counting applied to chart patterns to try to anticipate when a market trend has run its course. Bitcoin has printed the maximum 13 downside count, which proponents of the study would argue presages a reversal. DeMark studies in the past have identified shifts in Bitcoin’s prevailing trend.

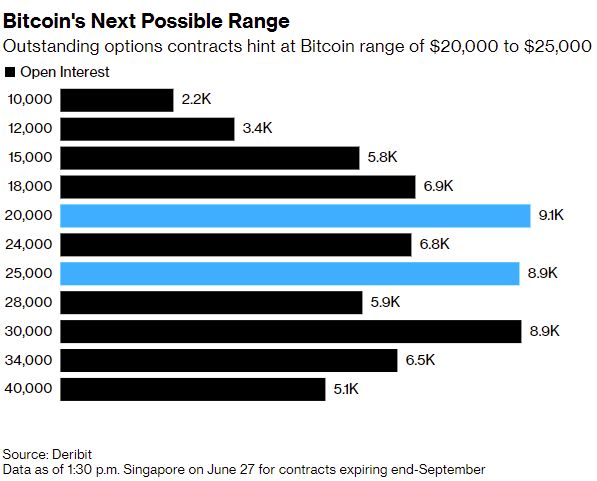

Option positions suggest the most probable range of 20-25K. Options contracts provide hints about Bitcoin’s next trading range. Significant numbers of outstanding contracts expiring end-September are at strikes of $25,000 and $20,000, data from crypto derivatives platform Deribit show. There are roughly 9,000 outstanding contracts at each of those levels. On one view, this relatively elevated so-called open interest at $25,000 and $20,000 suggests traders see the former as a Bitcoin ceiling and the latter as a floor.

“There may be some bear rallies, but I don’t see a catalyst to reverse the cycle anytime soon,” Griffin said. “When the Nasdaq bubble burst, our research found that the smart investors got out first and sold as prices went down, whereas individuals bought all the way down and continually lost money. I hope history doesn’t repeat itself, but it often does.”

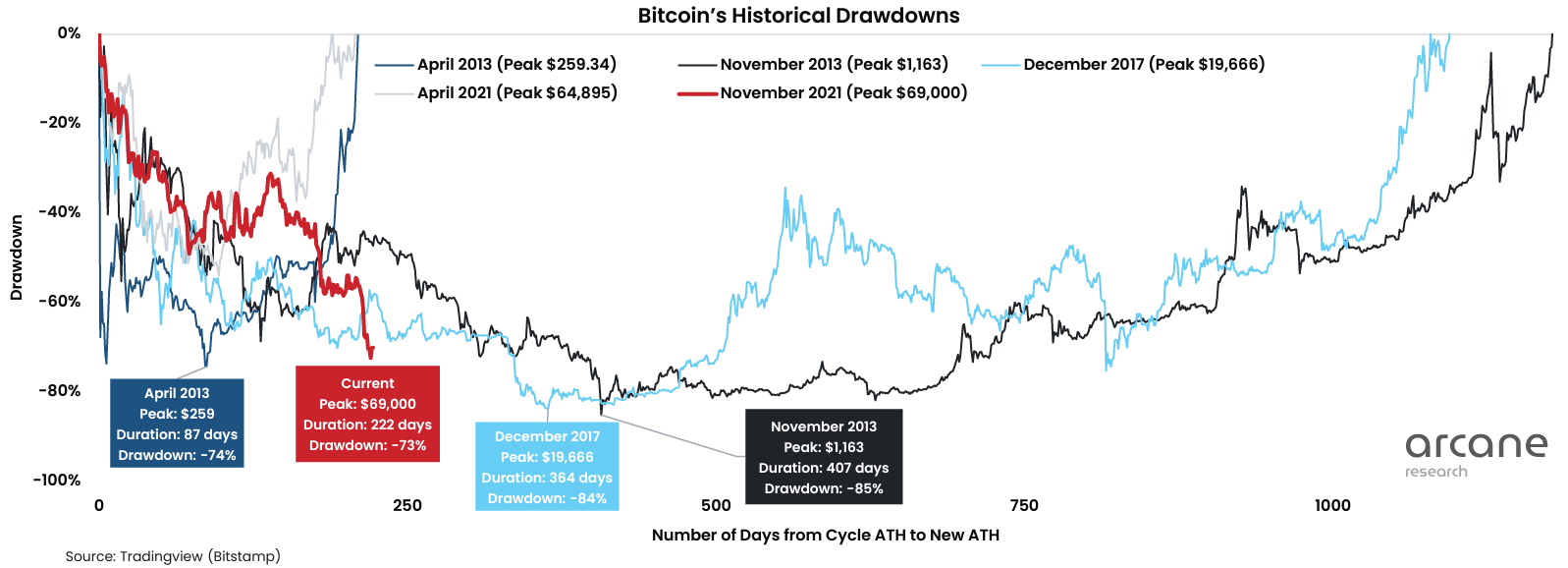

Arcane Research provides more pessimistic outlook, arguing that Hodlers were tested harder in 2013 and 2017 years, when drawdown has reached “-85%” within 400+days, while now drop stands around “-73%” within ~220 days. If Bitcoin follows this cycle then it could test $10 350 price level:

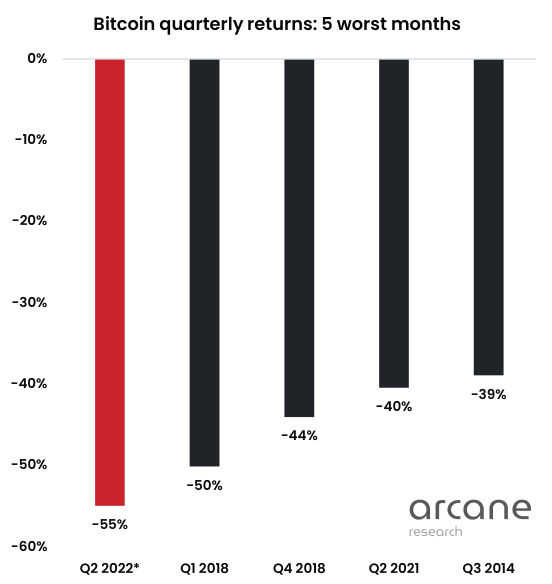

But, at the same time current quarter has become the worst within the whole history:

Some well-known economists also talk about ~10K level. Pieter Schiff tells:

– Don’t get excited about Bitcoin being back above $20K. 20 is the new 30. This is just another bull trap. Nothing drops in a straight line. In fact, this slow motion crash has been extremely orderly. No sign yet of any capitulation that typically forms a bear market bottom.

The head of DoubleLine Capital, Jeffrey Gundlach, said that he would not be surprised by the fall of bitcoin to the level of $10,000. According to him, the rapid decline in the price of digital gold to levels near $20,000 was obvious after the bulls did not keep quotes above $30,000.

“The trend is clearly not positive,” Gundlach said.

He called it inappropriate to buy bitcoin at the current price.

Glassnode reports that This weekend, The Bitcoin market has reeled from a massive deleveraging event this week, falling below the 2017 $20k ATH. Both on-chain DeFi markets, and off-chain entities deleveraged, as exchanges, lenders, and hedge funds were rendered insolvent, illiquid, or liquidated.

Realized losses reached a new all-time-high, punctuated by three consecutive days with market-wide realized losses above $2.4B/day, totalling $7.325B. The profitability stress noted above appears to be playing out in investors actualizing the losses.

The firm added that data from on-chain analytics firm Glassnode shows that as of June 20, 56.2% of addresses were still worth more in dollar terms than when their coins entered them, which Informa said raises questions about the severity of the current bear market. That’s compared with recent Glassnode data showing the average purchase price of all Bitcoins in circulation was around $23,430 — so, above current levels.

Glassnode’s “UTXOs in Profit” metrics enables to gauge the market profitability based on all unspent outputs. This metric shows that 26.7% of all unspent transaction outputs (UTXO) are in loss. Historically at the bottom of the bear markets, 50.2% – 81.1% of all UTXOs were in loss.

Revived supply 1yr+ confirms that spending by older coins it taking place, accelerating to rates of 20k to 36k BTC per day. This reflects an influx of fear and panic within even Bitcoins’ stronger hand cohort.

Glassnode concludes that the Bitcoin market has now experienced two distinct capitulation phases since the ATH in November 2021. The first phase was triggered by the Luna Foundation Guard force selling its 80k+ BTC, and the second this week via a massive industry-wide deleveraging, both on and off-chain.

Miners are now under significant financial stress, with BTC trading near the estimated cost of production, incomes well below their yearly average, and hash-rate noticeably coming off ATHs. The aggregate market has realized over $7 Billion in losses this week, with Long-term Holders contributing some 178k BTC in additional sell-side.

Bitcoin market participants across the board are at or very near historically high financial pain thresholds. With forced sellers appearing to drive much of the recent sell-side, the market might begin to eye whether signals of seller exhaustion are emerging over the coming weeks and months.

CONCLUSION

Here is our two cents on ongoing process in crypto industry. In fact we see the progress of the crisis that we’ve started to discuss in December and do it in all our fundamental reports on FX and Gold market as well. The performance of the Bitcoin absolutely doesn’t surprise. The reasons for the drop we’ve considered last time, and in our weekly reports

Now the Bitcoin still has 0.8-1 Trln in capitalization at the price level around 20K area. Whether this enough to keep pushing it lower or it is already exhaused its downside potential? Indicators and threshold levels of average bitcoin price and mining activity shows that it could go down more. But we rely totally on fundamental background.

As we’ve mentioned previously unlike crypto’s early believers, mass adoption means most investors now view crypto as just another asset class and treat it in much the same way as the rest of their portfolio. That makes crypto prices more correlated to everything else, like technology stocks.

Though most of the financial world is taking a beating in 2022, the recent crypto market crash was amplified by its experimental and speculative nature, wiping out small-town traders who stuck their life savings in untested projects like Terra with little recourse. And the sector’s hype machine is blaring louder than ever, utilizing tools like Twitter and Reddit that have been strengthened by new generations of crypto acolytes. Exchanges have also done their part, with FTX, Binance and Crypto.com all spending on marketing and high-profile sponsorships.

Rising interest rates open more demand for the cash, as 70+% of total USD- nominated debt has floating rate. Investors sell the most risky and toxic assets, keeping the others. Fed has raised rate just for 1.25% and take a look – it hasn’t started the Quantitative tightening yet:

It means that the major liquidity drought is still ahead. The main news of the week was that the head of the Fed, J. Powell, speaking at the Congress, disavowed the relationship between special operations in Ukraine and inflation in the US. This is not about the US and Russia, but about the fact that the head of the Central Bank goes against the logic of the head of the state, says that the US monetary authorities cannot find a single explanation for the causes of the inflation disaster. At the same time, the feeling of catastrophe is growing, especially if we take into account the relationship between the money supply and the stock indices:

In other words, if the tightening continues (this is for the Fed, the ECB is milder for now), markets will collapse — actually, there is already a decline — but that is just the beginning. At the same time, aggregate demand and household savings are already going down, while their loans are growing.

Real estate market passes through the difficult times and households already pays 2500$ monthly, on average to serve the mortgage loan. T he United States Michigan Consumer Sentiment Indicator is the worst in 70 (!) years of observation:

As economists suggest, we have a canonical shift in the position of monetary (and political) authorities towards the admission of a deep and protracted crisis. As this process unfolds, both internal political disputes and serious economic conclusions will begin.

The latter will inevitably include both hysterical political moves (for example, it is possible that someone from the Central Bank will simultaneously raise the rate and increase the issue) and perfectly reasonable actions related to debt relief.

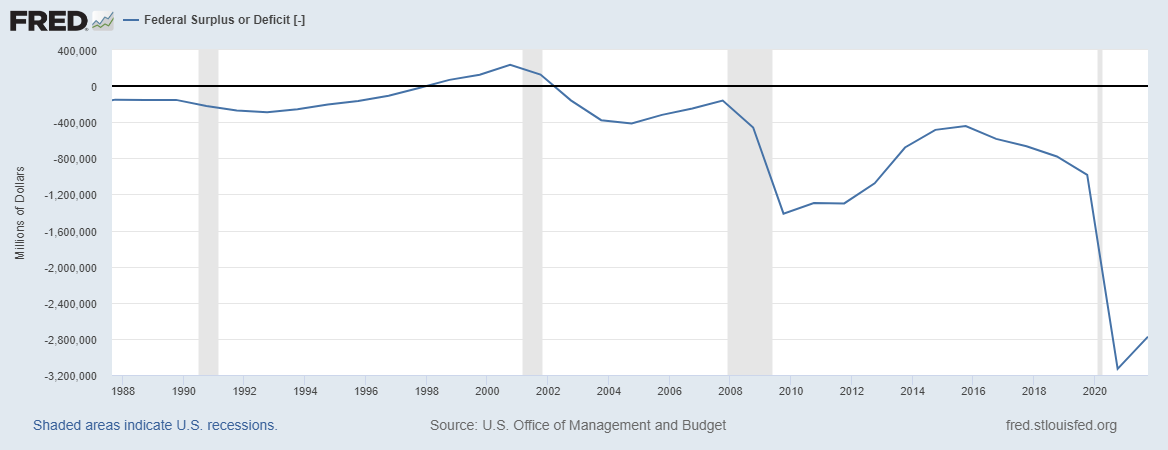

With the huge budget deficit –

and record negative trading balance, US has no resources to finance them, as debt market stagnating and Fed can’t find buyers for its toxic debt with “-6-8%” real interest rate. As Fed intends to dry more liquidity out of the market and keep rate rising – no doubts, downside action continues.

US Trading Balance

As we expect S&P below 2500 level within a year and below 2000 within 2-3 years, our BTC targets stand at ~12K and 8K correspondingly.

We suggest that Bitcoin and stock market could show the rally only If Fed pushes the backpedal and start printing money again. Although it could trigger solid rally in short-term – potentially this is the swan song that turns later to even worse collapse.

Finally by our view it is big difference between the “Stop falling” and “Start rising”. While Bitcoin could reach bottom around 10K on average just because of exhausting of downside potential and investors’ coins resources – it doesn’t mean that it turns up immediately. It still could spend few years in some range (most probably 5-20K) until fundamental background changes.

From the technical side, the 20K level is important, because in a case of downside breakout, market could turn to long term fluctuation in a new “old” range:

“Macroeconomic conditions need to improve and the Fed’s aggressive approach to monetary policy has to subside before crypto markets see a bottom”

Thus, currently we do not see good background for investing in cryptocurrencies, and should wait at least, until our former condition will be achieved – “downside potential will exhaust. “

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

438 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023