Bitcoin Fundamental Briefing, July 2022

Through suffering to renown

So, another month has passed and we closely come to major events of this year. I’m writing this report before Fed July rate decision and IIQ GDP release on next day. It is a bit curious to hear but whatever data we get, it doesn’t make revolutionary effect on economy situation in the US, and, correspondingly on performance of cryptocurrencies.

Since the beginning of the year we thoroughly explain all aspects on the US economy and why it has structural problems that can’t be resolved with just interest rate change. Our constant readers know enough on the US economy problems as we regularly discuss it in our weekly fundamental reports on Gold and FX markets.

Also we have assured in useless of forecasts of big banks and companies, such as Bloomberg Intelligence and others who devotedly promised strong bitcoin resistance to all headwinds, especially inflation, and believed in good upside performance through the 2022 year. With this hindsight in mind, we think that we could start this report with our view first on ongoing process and expectations, making our own conclusion. Then we provide you opinion of other analysts on Bitcoin future.

Market Overview

Bitcoin sank to a more than one-week low, buffeted by investor skittishness ahead of a looming Federal Reserve interest-rate hike and amid harsher regulatory scrutiny of the cryptocurrency sector.

Risk appetite is generally on the back foot before an expected 75 basis-point Fed rate increase Wednesday (today), part of a tightening cycle that’s sapping liquidity.

“We’ve had some stabilization over the past few weeks and that gave some folks confidence that perhaps a bottom was being put in place,” Katie Stockton, co-founder of Fairlead Strategies, said on Bloomberg Television. “We’re not so convinced.”

Rising interest rates and high-profile meltdowns like that of crypto hedge fund Three Arrows Capital have pummeled digital tokens this year. Bitcoin is down 55% since the start of 2022.

“Macro drivers haven’t flipped for people to really go long, bear market squeezes are always very vicious,” said Patrick Chu, head of institutional coverage of APAC at OTC trading platform Paradigm.

The turmoil is leading to ever greater regulatory oversight of the industry. Coinbase Global Inc., for instance, is facing a US probe into whether it improperly let Americans trade digital assets that should have been registered as securities, according to people familiar with the matter. Coinbase shares fell as much as 20%. Rival exchange Kraken is being investigated by the Treasury Department over whether it allowed users in Iran to trade on the platform, The New York Times reported, citing people familiar with the matter.

Adding to the uncertainty about crypto assets’ direction is the backdrop of geopolitical tensions, with Russia cutting gas supplies to Europe and rising food prices sparking concerns about instability in developing markets. The US dollar is up against all major developed-market currencies this year, providing another headwind for digital tokens.

“Rising geopolitical tensions might provide some underlying support for the dollar, which could drag down risk appetite, which would weigh on cryptos,” said Edward Moya, senior markets analyst at Oanda.

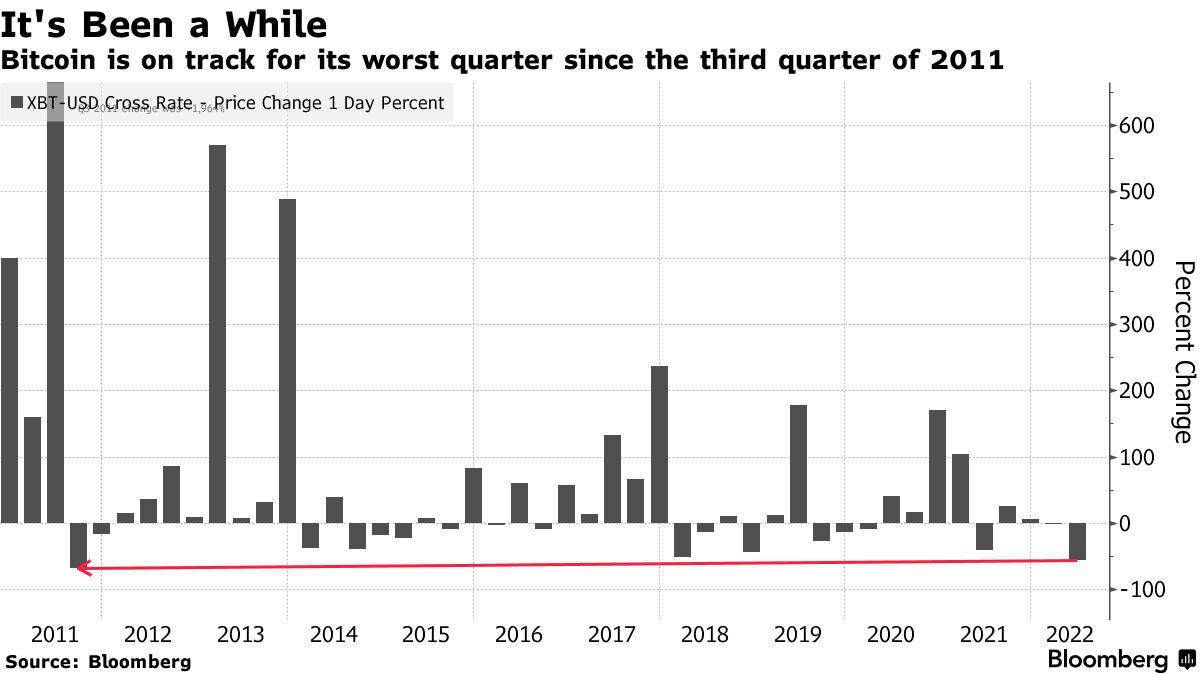

Thus, Bitcoin is on track for its worst quarter in more than a decade, as hawkish central banks and a string of high-profile crypto blowups hammer sentiment.

The 58% plunge in the biggest cryptocurrency is the largest since the third quarter of 2011, when Bitcoin was still in its infancy, data compiled by Bloomberg show. The current bear market, however, stands out for the amount of crypto leverage that’s been unwound — and for the regulatory scrutiny being heaped on an asset class many central banks now consider a threat to financial stability.

That total market figure now stands at around $900 billion, pummeled by a quarter in which the burgeoning Terra crypto ecosystem collapsed close to zero, and a mounting liquidity crunch caused several prominent companies to border on insolvency. Even some of crypto’s best funded companies announced swaths of layoffs, while Bitcoin’s current trading levels have seen it floating back and forth over the $20,000 mark for a number of weeks.

While perhaps not directly correlated to falling prices, the mood around Bitcoin was worsened by the Securities and Exchange Commission’s rejection of a bid to turn one of the world’s largest Bitcoin funds, Grayscale’s Bitcoin Trust (GBTC), into an exchange-traded product late on Wednesday. Another knock came in the form of a report that Genesis Trading, a sister company to Grayscale, may be facing a loss in the region of hundreds of millions of dollars from its exposure to struggling crypto lenders.

The recent drumbeat of bad news signals a broad rebuke to crypto’s love of unbridled speculation and free-wheeling innovation, which has now cost investors dearly. Its obsession with leverage laid at the heart of that mindset, as lenders and hedge funds alike parlayed their customers’ assets into even riskier bets that quickly buckled as prices dropped.

Yet for all the gloom, some analysts are pointing to signs that the bottom may be near. The deleveraging that accelerated the rout in past months may not have much further to run, JPMorgan Chase & Co. strategists including Nikolaos Panigirtzoglou said in a note published Wednesday. They also pointed to venture capital funding that “continued at a healthy pace in May and June.”

“Bitcoin has had good success over the last dozen years at making cyclical lows every 90 weeks,” said Fundstrat technical strategist Mark Newton. “Lows should be right around the corner according to this cycle composite, and one should be on alert in the month of July, looking to buy weakness for a healthy rebound, just as sentiment seems to be reaching a bearish tipping point.”

OUR VIEW ON BTC PERSPECTIVES

To get clear understanding what future BTC will get, we need to update Fed steps in recent month. The US economy problems are growing. As we’ve discussed last weekend – nearest business expectations and sentiment is deteriorating, based on recent PMI numbers:

Firms expect higher costs across all categories of expenses in 2022, but median expected increases were unchanged or lower than when this question was last asked in April for most categories. Responses indicate a median expected increase of 7.5 to 10 percent for energy and for raw materials and of 5 to 7.5 percent for intermediate goods, health benefits, and total compensation (wages plus benefits).

As we’ve warned you, the next step that should follow soon is rising of unemployment, and take a look – Initial claims stubbornly rising, for the 8 weeks in a row, reaching the levels of Nov 2021. Not the numbers per se are interesting but the tendency, how they are increasing.

This is just a beginning and we expect that unemployment rate should start creeping to 10%. Real estate sector also stands at the edge and New Home Sales (single family) , as a leading indicator, already drops with the pace of 2008 subprime crisis. Later, with the delay of 2-3 months we should see drop in Building Permits and Housing Starts.

If we take in consideration the demographic factor, then we will see that now is only 1.8 homes sold per 1000 capita. This is the lowest level ever, except 2008 year:

THe US Bond market is paralyzed now. Foreign investors contract their US Treasuries holdings, and Fed has problems with demand on new auctions for the bonds that is vitally necessary to support existent market re-finance elder issues.

With the all time high budget deficit and ultimately negative trade balance US economy has no other sources to finance them. By our view, Fed has only two scenarios.

First is – to do everything correct but painfully.

This scenario suggest that they have to keep rising interest rate, leading it significantly higher. In best case they have to be equal to inflation ratio, i.e. rates have to be around 9-10% (or to 4-5% at least). Fed has to keep promised QT programme drying out more liquidity. With this action overall artificially boosted consumer demand should blow up and drop significantly. People will loose ability to spend more than they earn. This will be big hurt to economy and recovery could take for few years, or even decade. Crisis probably will be not just economical, but political as well, accompanied with big social unrests.

But current Fed steps makes us think that they choose different way.

Second way is – to disguise problems and postpone its resolving

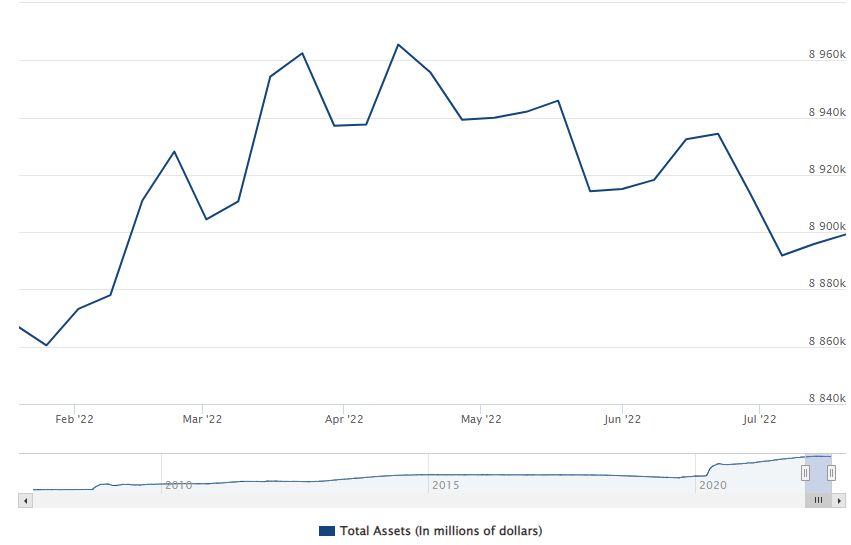

There are multiple reasons, why we think that Fed is going with this way. First is – take a look at Fed’s balance sheet. They have promised to sell 47 Bln. per month, starting June and then accelerate selling.

Since the beginning of the year Fed has contracted balance for ~ 65 Bln, but since the start of QT – just for 15 Bln that is significantly less than promised ~96 Bln for two months:

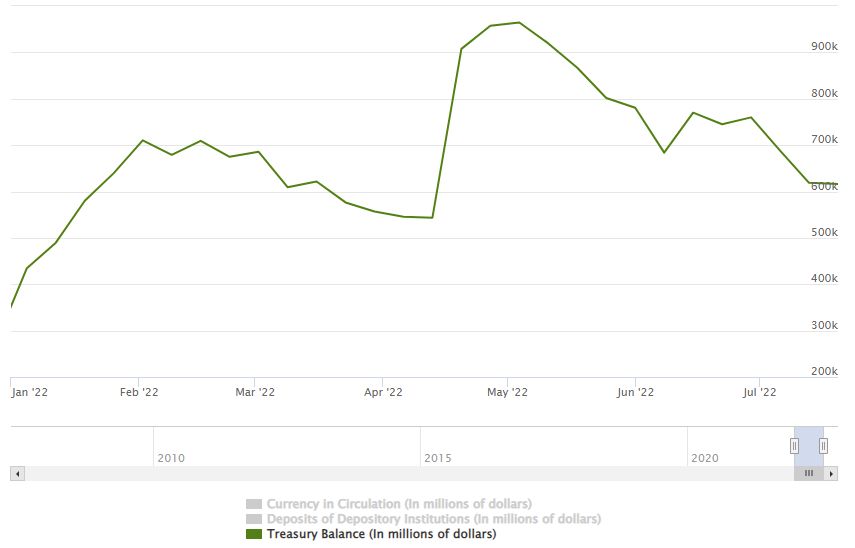

But this is not all yet. Within the same period the US Treasury deposit has dropped for ~ 300 Bln. This is the money that have been pumped back into economy:

It means that the net inflow into economy was around $230 Bln since the beginning of the year. It is more interesting that in recent two months Fed added ~ $150 Bln. This explains why as stock market as BTC market show upside bounce. Many investors are deceived with this action, suggesting that the bottom is near.

Now, using just simple maths, we could see that Fed has 600 Bln on US Treasury deposit. In three months they have spent ~ 300 Bln to support the stock market. The background of Democrats power are bankers and they are not interested with fast rate hike that could crush their business on massive bankruptcies cases, default provisions etc.

Second, it is just four months until November elections and Fed has enough cash make it all the way until them. This, in turn, should support stock market from immediate crush and take elections in relatively positive sentiment. Crush now is unavoidable, but with this scenario it comes in 2023 when Fed will start printing money again as they have no other way. All this stuff will happen on the background of deteriorating economy conditions in the US.

Finally, technically long term charts suggest reaching of our major targets around 12.2K and 8.9K. Market has no strong supports any more and stands between two targets – COP and OP. This week we could get bearish grabber, suggesting downside continuation.

Rising rate (today) even for 0.75% almost twice increase households’ debts serving burden, which will have direct negative impact on the stock market, and BTC.

The White House already starts preparing background to not call recession as “recession”. J. Yellen said that this is not a recession but necessary slowdown of economy. And they try to blur the definition of recession –

Both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data—including the labor market, consumer and business spending, industrial production, and incomes. Based on these data, it is unlikely that the decline in GDP in the first quarter of this year—even if followed by another GDP decline in the second quarter—indicates a recession.”

That’s being said – our view is whatever scenario Fed will choose, either to act strictly, forcely and directly and crush economy fast, or keep pumping liquidity, falsify statistics, postponing the blow on later time – the result will be the same. As BTC as stock market should crush. Stock market probably drops stronger as BTC is already lost ~60% of capitalization and behaves like a leading indicator here.

As technically as fundamentally we do not believe in the bottom and soon reversal of BTC market. The Fed tactic to postpone the resolving of the problems should provide liquidity and let market to stay flat or show short-term rallies, like we see here. But this will last only until the moment of the final crush. The more radical Fed steps will trigger immediate drop on the BTC. This is our view and explanation why we do not consider investing in Bitcoin any time soon.

LET’S SEE WHAT OTHER INVESTORS THINK…

Actually, we’re not alone with this judgement on the market. Steve Sosnick, chief strategist at Interactive Brokers, told Yahoo Finance Live that,

“don’t be fooled. It’s tough. Don’t be seduced by them [rallies],” as he pointed out that this week’s increase was just a part of the market where ’volatility works in both directions. Let’s be honest about it. That’s why I like to call that socially acceptable volatility. The other term, which is not as polite, it was a bear market rally.”

Sosnick explained that the 2-3% market bump is a common mathematical calculation,

“We are still in a bear market and we still are seeing the Fed as a headwind, and so to that extent, that becomes problematic and so we really have to see if this was a one or two day wonder.”

Sosnick believed that the bearish market will persist longer and decline further as long as the Federal Reserve remains in its monetary policy position,

“Right now, you really don’t get bottoms until or unless you see some sort of change in fiscal or monetary policy. However, “I don’t see that [new fiscal policy] right now,” he added.

Sosnick agreed with Sanford Bernstein’s recent release note that the market has not yet reached capitulation and that investors have not thrown in the towel. According to him, a simple way to tell when capitulation occurs is when investors have “given up all hope.”

“The real capitulation happens when people say, oh, God, i don’t even – don’t talk to me about this anymore,” Sosnick told Yahoo FInance, “None of us want that to happen. That’s not good for any of us at this table and watching. But that’s real capitulation.” and “I think we are away from that.” he said.

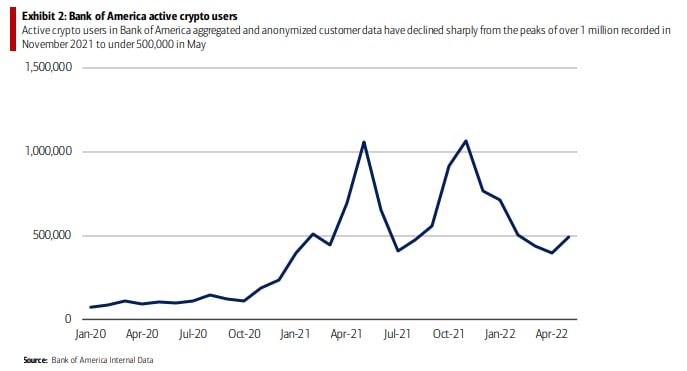

Active crypto users amount has dropped two times, since the peak, according to BofA calculation:

Deutsche Bank Sees Bitcoin Returning to $28,000 by Year-End

Given how closely it has been trading with US stocks, Bitcoin could reach as high as $28,000 by the end of the year, according to an analysis from Deutsche Bank. The analysis by Marion Laboure and Galina Pozdnyakova suggests a more-than 30% rally from the coin’s Wednesday trading level of around $20,000 — though even that price-point leaves the token trading at less than half its November peak.

The bank’s strategists predict the S&P will recover to January levels by year-end and Bitcoin may come along for the ride.

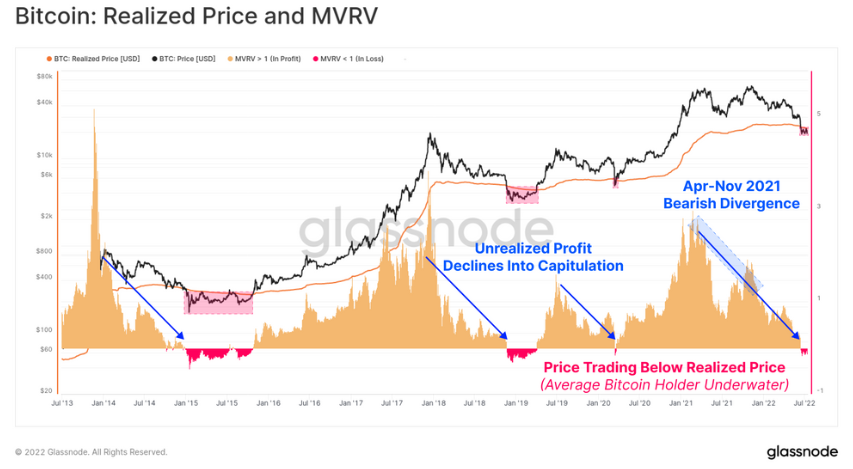

Numerous signals indicate that genuine bottom formation could be underway, – Glassnode.

A buzz is building in crypto-investor circles and on Twitter about Bitcoin’s stealth July rally, which has beleaguered investors starting to ponder whether the largest digital asset has found a bottom.

It’s difficult to call a bottom, even more so “with this one, because its rally was fueled so much by young people who had never invested in anything before,” said Matt Maley, chief market strategist at Miller Tabak + Co. “Crypto is a liquidity asset right now, so as long as the Fed is tightening, it’s going to be hard for it to see a sustained rally. Second, the asset class has lost a lot of confidence with investors, so it’s going to take time for it to regain that confidence.”

The token and its brethren have gone through “one of the heaviest, and fastest downwards repricing events in their history,”

wrote analysts at Glassnode, meaning that a ton of excess leverage has already been purged from the system. And for a floor to be established, investors need to experience “a wide-ranging capitulation event,” that causes seller exhaustion.

They’re watching a measure called realized value, which shows the difference between the value of a coin at time of disposal and the time of acquisition. It’s frequently considered to be the on-chain acquisition price of Bitcoin’s supply, they said. Right now, it’s showing an unrealized loss of minus-5%, and previous bear-markets have also all tended to bottom below the realized price.

“Numerous signals indicate that genuine bottom formation could be underway,” Glassnode analysts wrote.

To Alex Tapscott, managing director of Ninepoint Partners’ Digital Asset Group, the bottom is in, though he doesn’t rule out a potential re-test of $19,000. Still, “the risk-reward for Bitcoin is skewed heavily to the upside,” he said. “For the long-term investor, this is a rare and tantalizing entry point.”

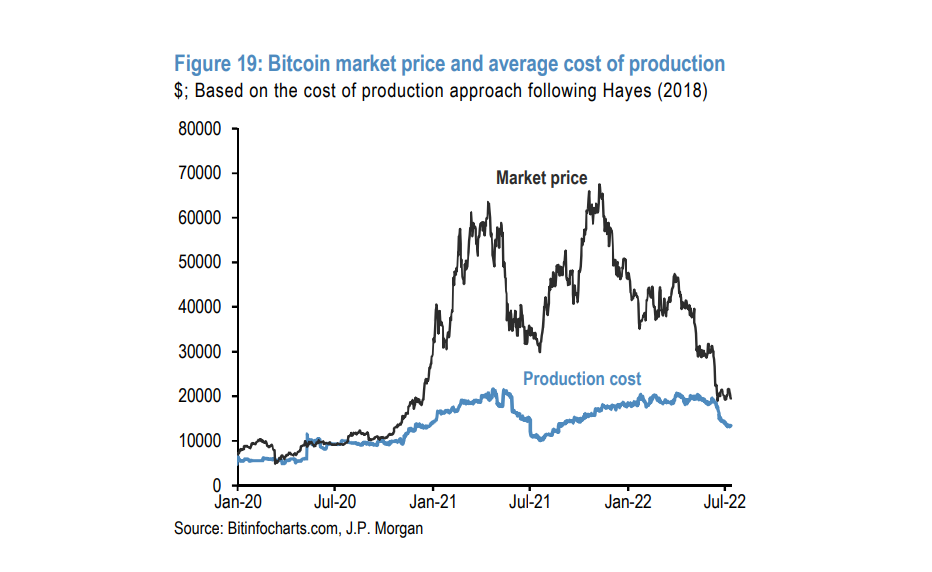

JPMorgan Says Bitcoin Cost of Production May Be Down to $13,000

Bitcoin’s cost of production has dropped from about $24,000 at the start of June to around $13,000 now, which may be seen as a negative for pricing, according to JPMorgan Chase & Co.

“While clearly helping miners’ profitability and potentially reducing pressures on miners to sell Bitcoin holdings to raise liquidity or for deleveraging, the decline in the production cost might be perceived as negative for the Bitcoin price outlook going forward,” the strategists wrote. “The production cost is perceived by some market participants as the lower bound of the Bitcoin’s price range in a bear market.”

Last month, JPMorgan strategists led by Panigirtzoglou said that sales of Bitcoin by miners could pressure the price into the third quarter as the operations boost liquidity, meet costs and possibly deleverage.

A good portion of the troubles may be behind crypto now, according to JPMorgan. Indicators like the firm’s net leverage metric

“suggest that deleveraging is already well advanced,” the strategists said. The current deleveraging cycle may not be very protracted,” the strategists said, given “the fact that crypto entities with the stronger balance sheets are currently stepping in to help contain contagion” and that venture-capital funding, “an important source of capital for the crypto ecosystem, continued at a healthy pace in May and June.”

The current phase of deleveraging in cryptocurrencies is at an advanced state and may not last much longer, according to JPMorgan Chase & Co.

Crypto Mining Giant Dumped Most of Its Bitcoin Holdings in June

Core Scientific Inc., a top crypto miner, sold the bulk of its Bitcoin holdings in June as a steep drop in digital assets squeezes finances for even the leaders of the industry.

Core Scientific sold 7,202 mined coins for $167 million last month, leading to a 79% drop in Bitcoin holdings on its balance sheet, according to the company’s monthly update. The Austin, Texas-based company now holds 1,959 coins.

Publicly traded miners have struggled along with digital assets themselves. Marathon Digital Holdings Inc. is down 76% year-to-date, Riot Blockchain Inc. has dropped 78% and Core Scientific has tumbled 86%.

Tesla Sold About 75% of Its Bitcoins

Tesla Inc. said a Bitcoin impairment affected its second-quarter earnings and that it has converted about 75% of its Bitcoin purchases into fiat currency.

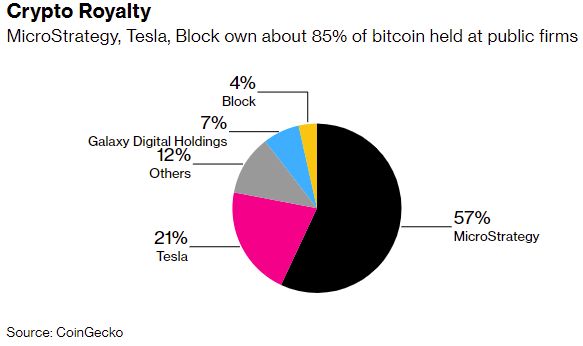

As if the environment weren’t tough enough for one-time stock market high-flyers Tesla Inc., MicroStrategy Inc. and Block Inc., the three companies took an estimated combined hit of $5 billion on their holdings of Bitcoin in the second quarter.

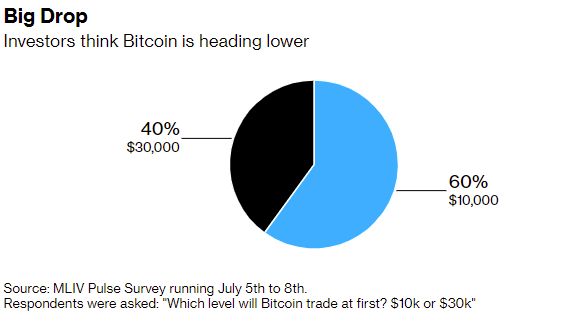

Bitcoin Is More Likely to Hit $10,000 Than $30,000, Survey Finds

The token is more likely to tumble to $10,000, cutting its value roughly in half, than it is to rally back to $30,000, according to 60% of the 950 investors who responded to the latest MLIV Pulse survey. Forty percent saw it going the other way. Bitcoin fell 2.4% to $20,474 on Monday morning in New York.

Mike McGlone, Bloomberg Intelligence –

With the Bloomberg Galaxy Crypto Index nearing a similar drawdown as the 2018 bottom and Bitcoin’s discount to its 50- and 100-week moving averages similar to past foundations, risk vs. reward is tilting toward responsive investors in 2H.

“Bitcoin is on the threshold of one of the greatest bull markets, which will begin in the second half of the year. Otherwise everybody will admit that digital assets have become a failed experiment. We believe that the popularization of cryptocurrencies will continue,” McGlone said.

Michael Burry –

Adjusted for inflation, 2022 first half S&P 500 down 25-26%, and Nasdaq down 34-35%, Bitcoin down 64-65%. That was multiple compression. Next up, earnings compression. So, maybe halfway there. — Cassandra B.C. (@michaeljburry) June 30, 2022

CONCLUSION

So, few seconds ago we’ve got IIQ GDP, and as we’ve suggested it is negative – “-0.9%“, compares to expected 0.4%. In general we could say the only thing – another swing down has to be formed approximately to 9-12K level.

The difference only in the way and time when it will happen. Based on what we see from the Fed – we suggest that they likely keep burning existent cash reserves, which are enough to support markets and keep flat interest rates until the end of the year. Supposedly the rate could change for another 0.75% until the year end. Due to this period as stock market as BTC market could feel relatively well. At least, Fed liquidity should help it to stay on surface without big drawdowns.

But, this strategy doesn’t help to struggle inflation which keep going higher and destructive processes in economy will accelerate, spreading over real estate market, personal consumption, wealth, savings, unemployment etc. As long as Fed postones radical steps to fight inflation as more devastating collapse later will be. If not now (thanks to the Fed) but in 1st half of 2023 BTC market will drop anyway – Tesla and E. Musk not occasionally sold most all BTC off the balance.

That’s why, analysts of Deutsche Bank for example, and other analysts who suggest upside action to 28-30K in near-term also could be correct. This action could happen on the background of Fed soft policy and inaction, but relief will be temporal, for the few months at best.

Finally, we could suggest fantastic scenario that the inflation will be so high, that Bitcoin start rising because of dollar devaluation. Who knows… now nothing seems as impossible.

We absolutely do not argue against taking bullish short-term positions if our suggestion on Fed strategy appears to be correct. But we stay aside by far from long-term investing.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

623 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023