Bitcoin Fundamental Briefing, October 2022

“UPTOBER?”

So, another month has passed. Bitcoin has not shown any significant dynamic, mostly coiling between 19 and 20K levels. But although market stands the same on a first glance, recent headlines tell that investors’ sentiment is changing slowly. Despite that BTC price has not changed – big events have happened in October. Few central banks have switched the backpedal and turns to QE again, or combine QE with interest rate hike – Bank of Japan, Bank of England, ECB. Bank of Canada has changed the rate only for 0.5% instead of 0.75% expected, while the US GDP has shown 2.6% growth in IIIQ of 2022.

Finally, seasonal factor also has strong impact on the minds of investors. Besides, it is pre-election October, which is promised pre-election rally. More and more publications are released on a subject that BTC sets the bottom and pivoting.

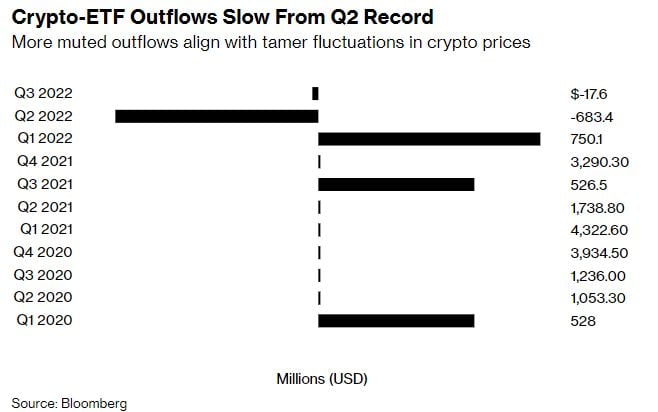

As Bloomberg reports, The money flowing out of crypto-related funds in the third quarter has slowed down, a sign that many bearish investors may have already piled out of the risky asset class.

Investors pulled out $17.6 million from crypto exchange-traded funds in the three months ending Sept. 30, according to data compiled by Bloomberg Intelligence. That figure, as of Friday morning, is far below the record $683.4 million withdrawn from such funds in the second quarter. The outflows mainly took place in the past two months.

“I wonder if the second quarter was the ‘get me out’ part of these funds,” said Todd Sohn, ETF strategist at Strategas Securities. The third quarter saw “some laggards,” and investors who are just “keeping the faith mentality,” and waiting for crypto to rebound, he added.

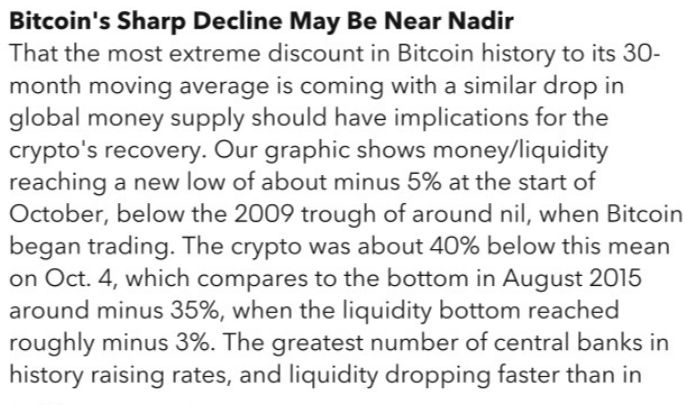

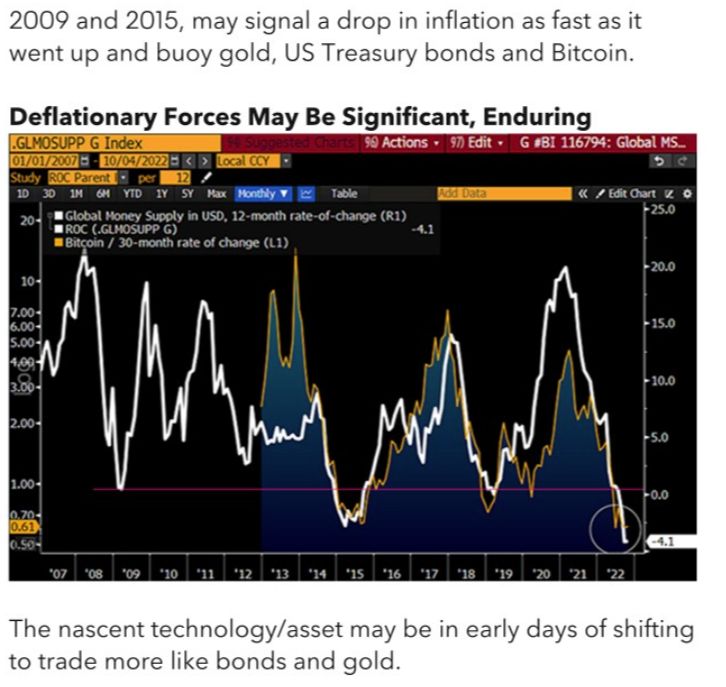

One of the most popular crypto memes during the Covid pandemic was about how the Federal Reserve was “printing” an endless amount of dollars – “money printer go brrr,” in Twitter parlance — and how that enhanced the value of Bitcoin, which has a capped amount of tokens.

Now the proverbial printer has been turned off, with the central bank raising rates and the price of the largest digital token crashing more than 50% this year, leaving the average investor caring little whether there is a finite amount of Bitcoin.

What’s behind the demise of the meme is a steep reduction in money supply, or M2, which is a measure of the amount of money in the US financial system.

“The logic would be that with the money supply, or M2, coming down, there’s less money floating around that could find its way into risk assets, and clearly cryptocurrencies have proven to be risk assets over the course of the last 12-18 months,” Art Hogan, chief market strategist at B. Riley, said in an interview. “You’d suspect that would be a negative for some of the riskier edges of the investment universe.”

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, points that the reversal of excess liquidity in the economy from the Fed and other central banks has contributed meaningfully, in my perspective, to the lower appetite for digital currencies.”

A dropoff in the money supply then made an asset like Bitcoin less attractive to investors –even those who viewed it as a hedge against inflation. “You don’t want to buy your insurance when the house has already burned down”

That all changed this year, as macroeconomic conditions put investors off risk assets and token prices nosedived. The implosion of the Terra blockchain, as well as the collapse of hedge fund Three Arrows Capital and crypto firms like Celsius Network caused a further sell-off and cooled venture capital funding.

Nomics compiled an analysis of coin activity for Bloomberg and discovered that more than 12,100 tokens have become “zombies” this year, defined as tokens that have not traded for a month. That’s more than twice as many as in all prior years combined, the researcher found.

“During the bull market of 2021, there was plenty of money, attention, and liquidity for new and existing projects,” Jacob Joseph, a research analyst at researcher CryptoCompare, said in an interview. “However, in the ongoing bear market, even good projects with utility will struggle to sustain their operations as they lose access to capital and funding.”

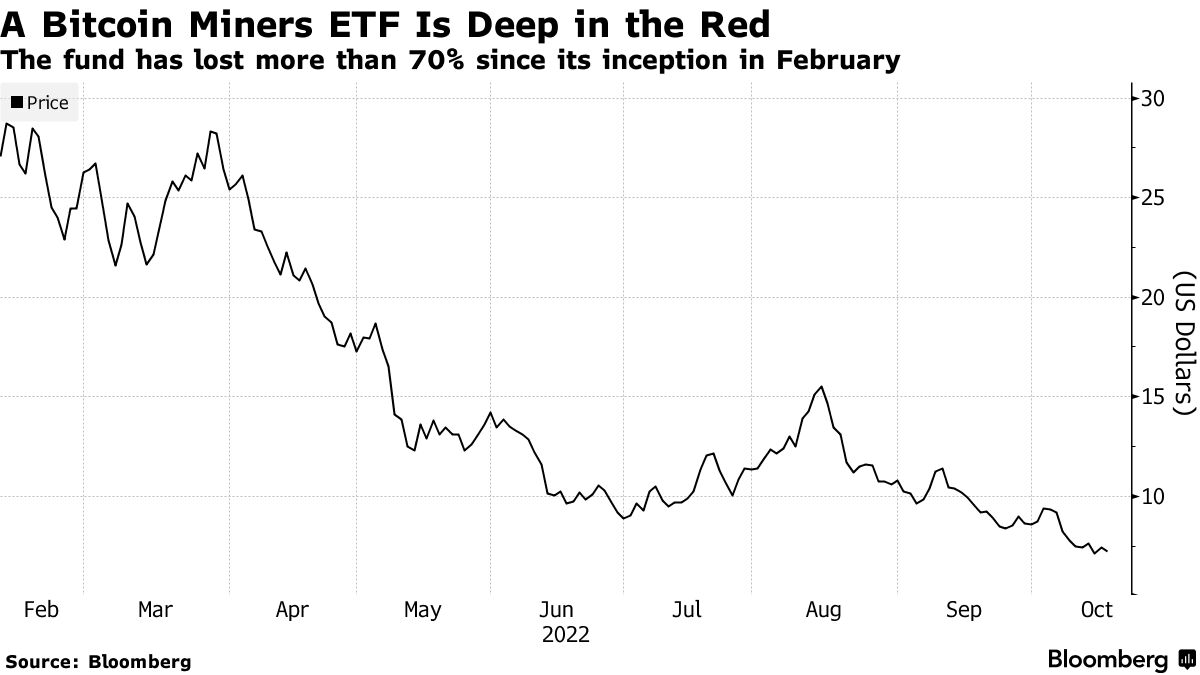

Miners now are also in a tough situation. Mining companies are increasingly opting to sell equity, resorting to one of their least attractive options to raise money as profits dry up and higher interest rates makes borrowing more expensive.

Other less favorable alternatives to raising equity include selling Bitcoin at lower prices or facing bankruptcy, says Daniel Frumkin, head of research and content at crypto-mining services firm Braiins. Core Scientific, for example, sold about 85% of its Bitcoin reserves since the end of March, its September update indicates.

A recent surge in mining difficulty, a measure of Bitcoin miners’ computing power, delivers another blow to companies looking to ride out the current slump. A higher level of computing power will lead to lower mining revenue for already-bruised Bitcoin miners. And the more mining power there is, the less each Bitcoin miner receives.

A handful of Bitcoin miners have been ramping up sales of their rigs to help them ride out the storm or at least trim their debt. But firms that took massive loans backed by the value of their mining machines are feeling the squeeze as prices of some of these popular rigs have plunged more than 80% since last November.

This also poses a major risk to their financiers, who are already under pressure with Bitcoin lingering around $20,000 since June. Lenders, including Celsius Network Ltd. and Asia-based Babel Finance, are grappling with liquidity issues exacerbated by the crypto-market crash earlier this year. Another major crypto lender Genesis, who also lends money to Bitcoin miners, has said it’s eliminating 20% of its 260-person workforce, and its parent company had filed a $1.2 billion claim against bankrupt crypto hedge fund Three Arrows Capital.

“To expand during the bear market, Bitcoin miners must raise capital,” Jaran Mellerud, crypto-mining analyst at Hashrate Index, said. “Without raising equity now, these companies will be unable to fulfill their expansion plans, and some of the most indebted ones might even go bankrupt.”

MARKET OVERVIEW

Bitcoin gained for a second day, spurring optimism among the almost always bullish advocates of the bellwether cryptocurrency for an end to the months-long decline known as crypto winter. The virtual currency rose as much as 4.1% to $21,018, bringing its increase since Monday to as much as 7.8%. That’s helped to reduce this year’s decline to about 55%. Other digital tokens gained more on Wednesday, with Ether jumping 6.4% and Dogecoin increasing 13%.

Crypto traders celebrated the advances, a welcome change after months of limited price action. Bitcoin broke above $20,000 for the first time in more than two weeks on Tuesday, ending its longest run below that price level since the token first breached the threshold in late 2020.

The upward movement could point to “a building crypto sentiment shift,” according to Noelle Acheson, author of the “Crypto is Macro Now” newsletter. “It remains to be seen whether this is enough to awaken the momentum traders, but it does feel like something has changed,” she said. Acheson pointed to high open interest, “hinting at more activity ahead as traders come back into the market.”

Aggregate short liquidations on exchanges hit $700 million during Tuesday’s (27 Oct.) crypto specific surge, with the highest levels for Ether and Bitcoin since May and July 2021 respectively, according to data from Genesis.

“On the surface, this appears to be a short squeeze, given the significant amount of liquidations across a number of venues; but there are encouraging signs that we may be stabilizing or even building towards a modest rally as we head into November,” said Steven McClurg, co-founder and chief investment officer at digital-asset fund manager Valkyrie Investments.

The recent narrow trading range could be a result of seller exhaustion. According to Purves, it’s possible that the majority of people who want to sell the token have already done so. “It could be showing signs of a bottom here,” said Purves.

For the token to break out of the doldrums, Purves said the digital asset will need new money, ideally from institutional investors. Unfortunately, he doesn’t see significant action on that front. “I think the bulls need to see a lot more,” he said.

Bitcoin is back on track to respect a history of climbing in October amid speculation that the Federal Reserve is getting closer to pivoting toward less aggressive interest-rate hikes.

The Fed may be starting to show some signs of potentially pivoting, Nick Hotz, vice president of research at digital-asset manager Arca, said in an interview. “From a more macro markets standpoint there’s definitely a lot on the short side,” he said. “If people close those shorts, it could drive the price higher.”

Scaled back Fed expectations are apparent in a slide in the dollar this week. At the same time, a 60-day correlation coefficient between Bitcoin and a dollar gauge is around the most negative on record.

BANK OF AMERICA – THE NATURE OF BTC CORRELATION IS CHANGING

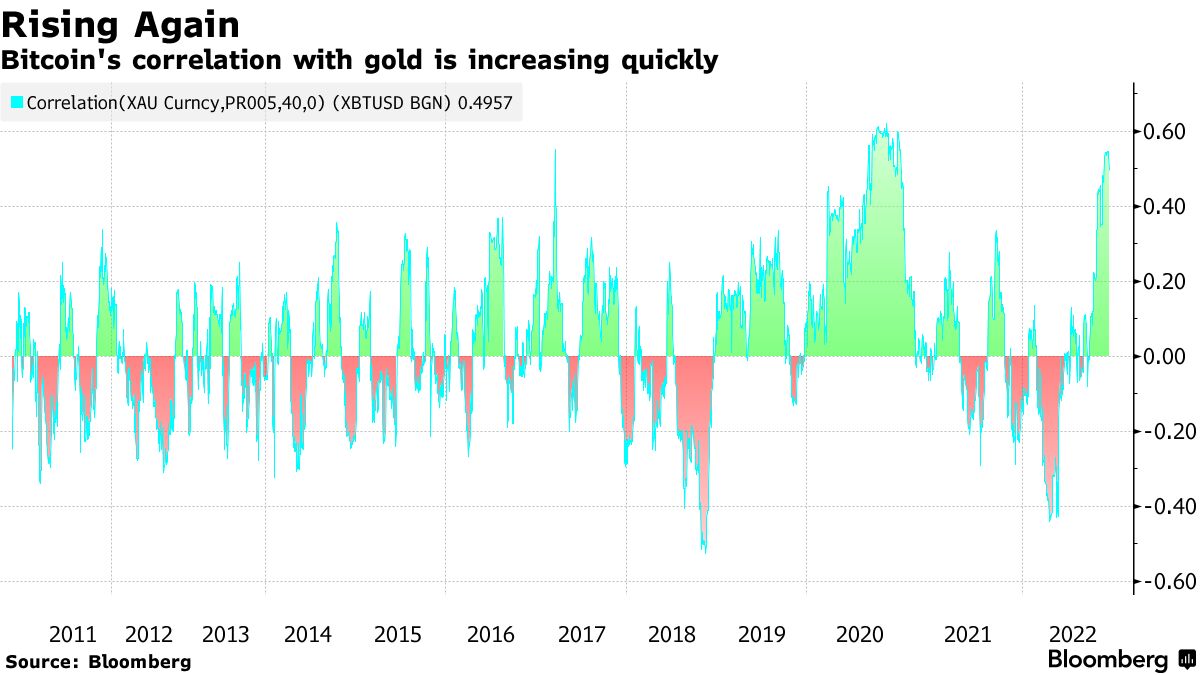

Bitcoin’s movements in relation to other assets may indicate that investors see it becoming a haven again, after a stretch where it’s traded basically as a risk asset, according to Bank of America Corp.

The largest cryptocurrency has a 40-day correlation with gold of about 0.50, up from around zero in mid-August. While the correlations are higher with the S&P 500, at 0.69, and Nasdaq 100 at 0.72, they’ve flattened out and are below record levels from a few months ago. BofA digital strategists Alkesh Shah and Andrew Moss see that as a sign that things could be changing.

“A decelerating positive correlation with SPX/QQQ and a rapidly rising correlation with XAU indicate that investors may view Bitcoin as a relative safe haven as macro uncertainty continues and a market bottom remains to be seen,” the strategists wrote.

The BofA note dovetails with recent comments from the likes of Mike Novogratz, who said on Thursday that he sees Bitcoin as “the canary in the coal mine” alongside gold and expects it to rally before other tokens, as well as Lauren Goodwin from New York Life Investments, who has said that Bitcoin and gold could both be perceived as a central-bank hedge.

WHAT OTHER ANALYSTS THINK ABOUT BTC BOTTOM?

Bitcoin’s 30-day volatility is near a six-year low, according to a note by Arcane Crypto’s Vetle Lunde and Bendik Norheim Schei, and that could mean a breakout is due. The last time it reached those levels was in the summer of 2020. Bitcoin maintained levels below its current price at the time for four days before “the price exploded up,” said the note.

But whether the token can maintain trading above $20,000 remains to be seen.

“Some people are watching $20,000 for the psychological significance of it,” said Katie Stockton, co-founder of Fairlead Strategies. She said that based on her firm’s models, she would need to see “consecutive daily closes” above roughly $19,600 to “confirm a minor breakout.”

Fresh CoinGreko report tells that total crypto market cap seems to have found its bottom when it hit a low of $875B on July 19. In Q3, it rallied up to ~$1.2T in August, before falling again to end the quarter at +6.5% or about ~$100B higher than at the end of Q2.

Despite speculations of Bitcoin and the stock market, total crypto market cap correlation with the S&P 500 was still high at 0.85 in Q3 2022, although this was a slight decrease from the previous quarter (0.92). Similarly, total crypto market cap also moved pretty much in lockstep with BTC (0.9).

While Q3 was rather choppy for Bitcoin, it managed to outperform other asset classes except for the US Dollar Index (DXY). However from a YTD perspective, Bitcoin still experienced the largest loss of -58%, as compared to all other asset classes.

Bitcoin dipped hand-in-hand with US equities, but managed to largely recover compared to the equities market, ending Q3 with only a -1% change in price.

Glassnode Insights – A Case for Bitcoin Bulls and Bears

As the volatility of Bitcoin markets compress to historical lows, we present both the bull and the bear case for Bitcoin. We cover the $1.5B overhang of a miner deleveraging, weak on-chain activity, persistent draining of exchanges, and unwavering HODLer conviction.

Periods of extremely low volatility for Bitcoin are very rare, and there are historical examples that have broken both higher, and lower, with extreme force. Thus, in this weeks edition, we will lay out both a Bull and Bear case from a primarily on-chain perspective, covering the following topics:

- On-chain activity and utilization of the network remains persistently weak, suggesting lacklustre network effect expansion.

- Miners are on the cusp of severe stress, with some 78.2k BTC held in treasuries at risk.

- Exchange BTC balances continue to drain, whilst an excess of $3B/month in stablecoin buying power is flowing in.

- The HODLer cohort have reached all-time-high coin ownership, and steadfastly refuse to release coins back into the market.

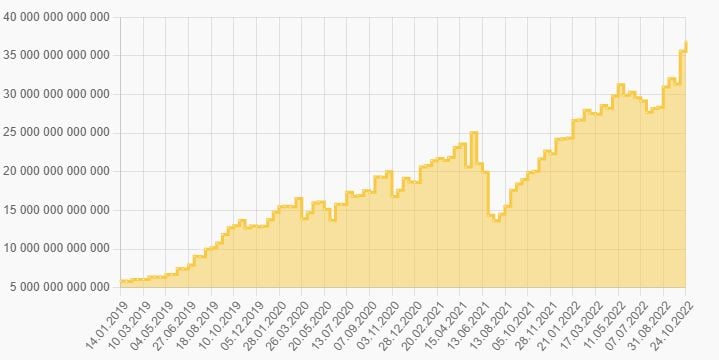

The mining industry has been in the spotlight of late, with hashrate and difficulty pushing to new all-time-highs (covered in WoC 40). This acts to increase the cost of BTC production, despite miner revenues per hash falling to all-time lows.

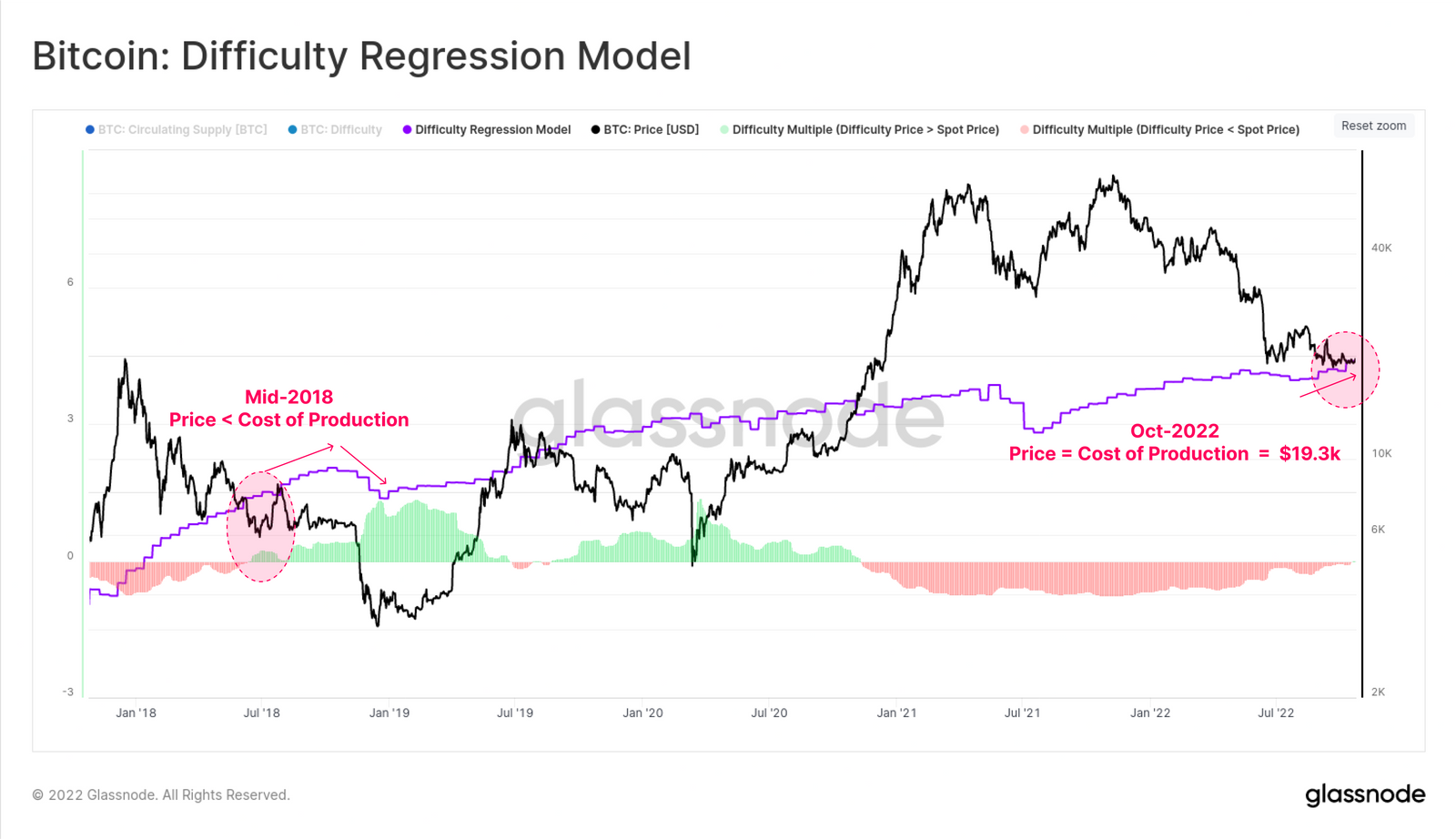

The Difficulty Regression Model is an estimated all-in-average cost of production, and is coincident with the spot price of $19.3k at the time of writing. A bearish cross-over was last seen in mid-2018, with a major mining industry capitulation following soon after, and persisting for several months.

Indeed, the mining Hash Price has reached all-time-lows this week, with miners earning just $66.5k/day per Exahash applied. With Hash Price now falling below the post 2020 halving lows, despite coin prices being ~2x, this demonstrates just how extreme the recent increase in hashrate competition has become.

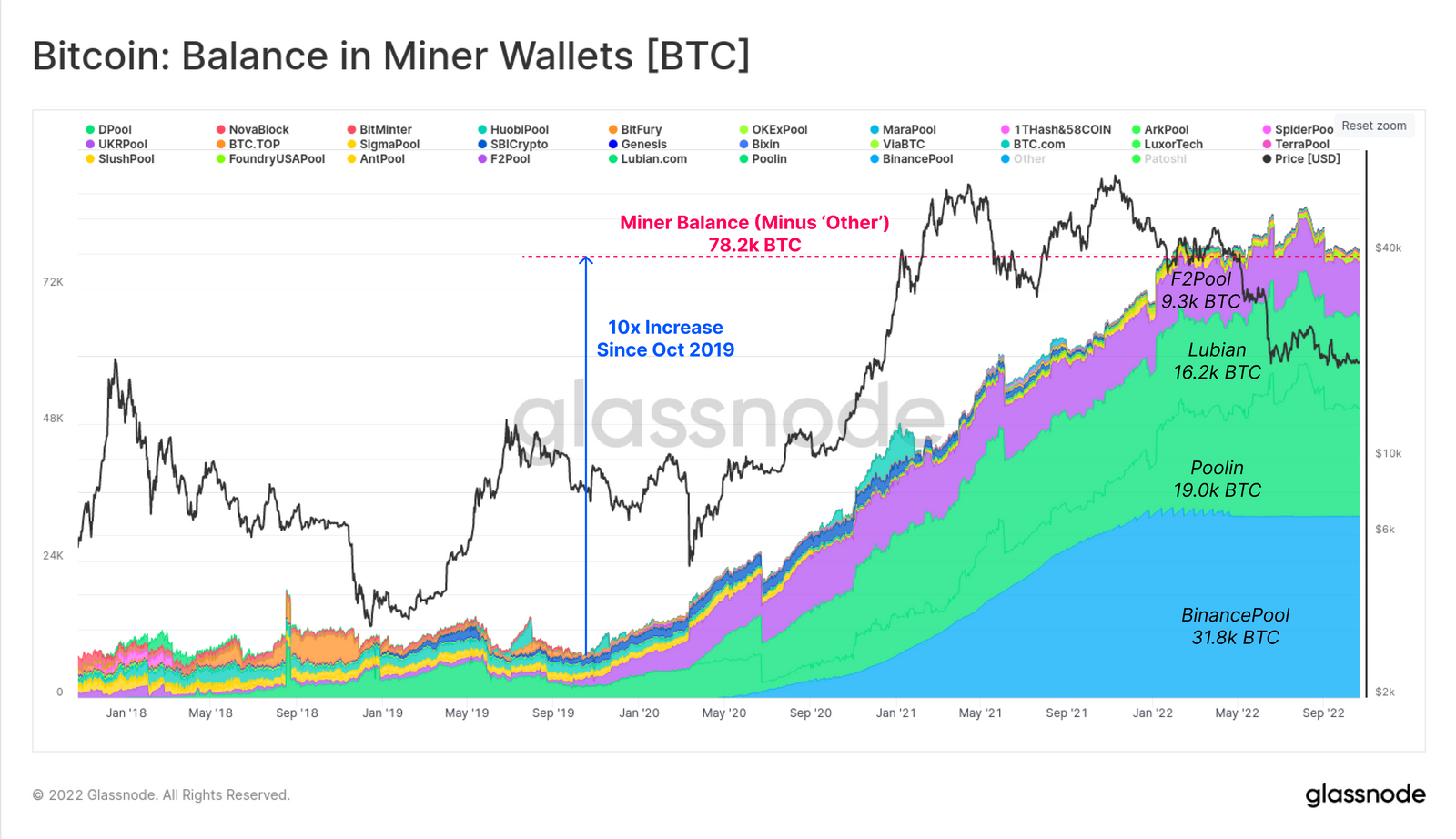

The chart below shows that miner balances have increased by 10x since 2019, with a total of 78.2k BTC held today. This is worth $1.509B at a price of $19.3k, which is a non-trivial overhang for an increasingly distressed industry.

Of this, the vast majority is held by miners associated with BinancePool, Poolin, Lubian, and F2Pool. All have seen a stagnation of their balance in 2022, suggesting that prices below $40k have imposed income stress, and motivated a behavioural shift.

Overall, the Bitcoin demand side, as measured by on-chain activity and network participation, is lacklustre to say the least. There are some green shoots of hope in the mempool, however there remains a $1.5B overhang of coins held by the mining cohort, whom are in extremely distressed territory.

The bullish case for Bitcoin at present is one of unwavering conviction, and persistent balance growth by the HODLer cohort. Liquid coins continue to flow out of exchanges, relative stablecoin buying power is increasing, and extreme volatility and severe downside has thus far failed to shake out Bitcoins most die-hard believers. Due to the HODLers of last resort, whereby the supply flows out of exchanges, and into HODLer wallets is at an all-time-high. Despite being small in relative number, the conviction of Bitcoins die-hard believers is unshaken, and their balance continues to grow, through thick and thin.

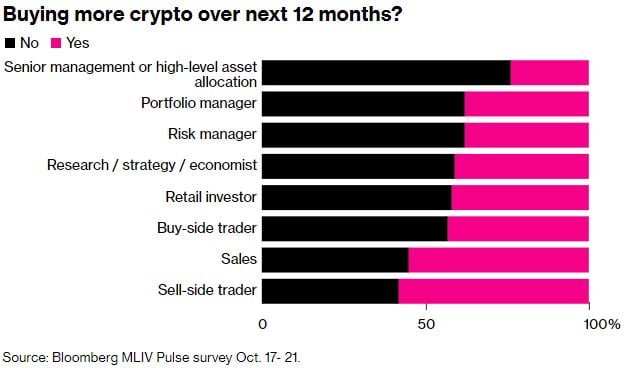

The sentiment extends to Bitcoin. Most investors were slightly more optimistic about the crypto than they were when asked in July. Almost half of respondents expect the world’s largest cryptocurrency by market value to continue trading between $17,600 and $25,000 until the end of this year — a departure from this summer’s sour outlook, when most said it was more likely to first drop to $10,000 than to climb to $30,000.

M. Novogratz suggests that the bearish cycle could last for 6 months more, pointing that the key of reversal stands in Fed pivot and ending of rate hike cycle:

"When Powell started beating inflation over the head with a sledgehammer, of course #Bitcoin came back down as did lots of assets," says @novogratz. "If he gives up this fight, you're going to see Bitcoin and other assets take right back off." pic.twitter.com/pXTVowzl3t

— Squawk Box (@SquawkCNBC) October 4, 2022

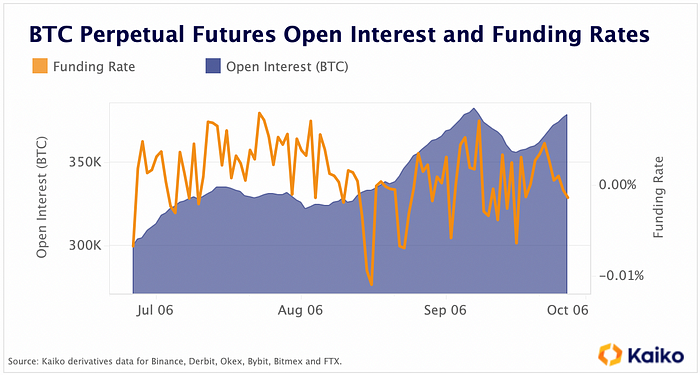

Bitcoin open interest increased 26% in Q3.

Despite displaying strong volatility, BTC’s open interest expressed in native units (eliminating price effects) has risen by 6% in September and by over 26% in Q3 to around 380K BTC. Fresh capital has re-entered the largest cryptocurrency in the second half of September, despite declining spot prices. After declining in early September, funding rates, which give an idea of the direction of investors’ positions, have improved. However, they remain neutral to slightly negative suggesting market uncertainty remains high.

Bloomberg Intelligence, Mike Mc Glone: “Digital Gold” should outperform rivals by the end of 2022

LookIntoBitcoin, Philip Swift: Forming the bottom for Bitcoin

“Look Into Bitcoin” provides great new report and analysis of different metrics, Including S2F model, which let them to conclude that Bitcoin either has set the bottom or stand somewhere near it.

The market will soon switch from selling traditional ‘risk’ assets such as Bitcoin in a risk-off environment to instead realizing that much of the risk in fact lies with governments and their currencies. That will be bullish for Bitcoin. We are seeing glimpses of this already with market concerns over the UK government. During such turbulence Bitcoin continues to hold the zone A level of support:

This is despite the market being extremely fearful right now, which has been the case for the past month:

It is worth noting that major cycle lows are often formed when the market is certain that lower prices must be reached. When the majority of the market believes that price must go lower, price then reverses to the upside away from the bear market lows.

That is why indicators on LookIntoBitcoin are so valuable, as they allow the strategic investor to step away from the panicking market herd, and see the bigger picture.

S2F

The model variance tool at the bottom of the chart highlights that price has only ever been this far below the stock to flow line once before. That occurred in the first-ever bear market for Bitcoin back in November 2011:

So, despite straying far away from the intended path of the stock to flow line, there is actually historical precedence of such price action with this indicator.

But all this stress and questioning makes the more casual market participants believe that “this time is different” and that Bitcoin will in fact fail. That tends to be the overriding sentiment we look for to identify when we are at or around the major cycle lows before Bitcoin then trends back up again.

We continue to see confluence with many indicators, all highlighting that Bitcoin is close to bottoming – if it has not already bottomed.

An update on two models specifically designed to highlight cycle lows for Bitcoin:

- CVDD (cumulative value days destroyed): $16,775

- Balanced Price: $15,940

For now, the price of Bitcoin remains extremely close to both CVDD and Balanced Price.

Working through the cycle

Finally, the amount of TIME that Bitcoin has spent through its natural cycle is also an important component to consider.

We are now more than halfway through Bitcoin’s current halving schedule. Overlaying Bitcoin’s cycles on top of each other provides valuable context when exploring this bear market:

Regardless of overall gains though, the amount of time spent carving out a bear market is so far quite comparable. In the 2013 cycle, the bear market low came 779 days after its halving. In the 2017 cycle, it was 891 days.

We are currently 886 days through the current halving cycle.

So whether we have already bottomed or not this cycle, we are now likely a good way through the bear market from a time perspective.

Food for thought as many participants quit and will likely return when the price of Bitcoin is much higher! Accumulation now and over the coming months has the potential to produce outsized returns in the future for those who stay the course in this market.

WHY WE ARE CAREFUL WITH ANTICIPATION OF BTC REVERSAL

So, from the information above we see that many people are focused on BTC’s bottom and suggest that it is stand at the verge of upside reversal. All major BTC analysis agencies, such as Glassnode, Bloomberg Intelligence, Arcane research, LookIntoBitcoin, a lot of private analysts start talking about the Pivot. Media gives more headlines on this subject as well.

As it was correctly been said above – When the majority of the market believes that price must go lower, price then reverses to the upside away from the bear market lows.

But why you’ve decided that most people wait for downside continuation? Based on information above it is vice versa – the majority expects the pivoting.

We suggest that rising correlation between the gold and BTC is not because BTC starts getting “Safe haven” golden features, but with their tight relation to USD. The strong rally of USD last month increases correlation of all other assets.

Meantime, the correlation of BTC to NASDAQ still stands high, around 80%. Recent earnings reports from FANG group (Facebook, Amazon, Netflix, Google) were poor, pushing share prices of FANG down for 4-8%.

As we’ve mentioned it often in our FX and Gold weekly reports, Fed will try to relocate as much liquidity as it could out from stock market into bonds. The surviving of national bond market is a question of national security and economy. While Fed is nowhere near the pivot , promising +0.75% within a week and at least 0.5% in December – perspectives of stock market now looks blur, as well as perspectives of BTC reversal, at least until the end of 2022. So, we disagree with Mike McGlone that BTC will outperform other assets in IVQ of 2022.

We agree that Fed is coming to an edge, as J. Yellen already has mentioned problems with liquidity on US Treasuries market, while Fed itself reports record operational loss due 2+Trln of reverse Repo Agreements with commercial banks.

Indeed, It was solid liquidity problems existed that push USD demand to the moon. But this game as a reverse side. SNB, PBOC and BOJ have started interventions to support national currencies, selling USD. BOJ as 1.3 Trln in foreign reserves, China has even more, so this game could last relatively long time, especially because Japan has not stopped QE. It means that liquidity pressure should become weaker, US Treasuries yield will be pushed higher due to Japan and China sell-off, which increase pressure on non-interest bearing assets, including Bitcoin.

But at the same time, it lets Fed to stay on course of rate hike, as well as relative stability of job market in the US. Besides, recent US GDP data for IIIQ has shown 2.6% growth. And call of IMF Chief K. Georgieva to Central Banks to lead rates to “neutral’ level (when rate equals to core inflation level) could become a reality.

Finally, technical bearish factors are not eliminated. As we’ve mentioned previously – we still have bearish dynamic pressure on weekly chart of BTC. Bitcoin shows weakest upside reaction this month, compares to FX and stock market performance. We’ve mentioned existing of DRPO “Buy” here recently , but it is unclear how it will perform. Currently fundamental background stands negative, showing that the US is entering in deflationary structural crisis. Political uncertainty and risks of social escalation after November 8th brings even more risks. Besides, don’t forget about classical “pre-elections” rally. Now Democrats do their best to make image of prosperity and problems resolving to get more votes. But sometimes they achieve it by dangerous tools. We suspect that many people were deceived by recent liquidity relief and retracement on US Dollar, stocks and other markets, suggesting that “Crypto winter” is coming to an end.

The US still has solid financial strength margin, Fed has solid reserves to stay on a way of the rate tightening. We agree that Bitcoin should turn up, but in longer-term, as we suggest that Fed should choose the scenario with dollar devaluation but not national debt default, as P. Schiff tells:

But who said that investors will run in BTC first? Low volatility and rising interest it is not only about possible upside breakout. So, maybe we also should consider this scenario?

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

566 Views 2 CommentsComments

After re-reading this Fundamental report on Bitcoin and also reading your Forex Pro Weekly report for November 07 - 11, 2022 I am comforted that it is not just me puzzled by this rather strong rally in all markets, crypto included, after the Fed rate decision / speech, when it should've been the opposite reaction.

Personally I find it hard to believe the bottom is in in BTC / crypto (particularly coupled with these macro conditions). It is technically very thin ice (weekly bearish dynamic pressure, etc.).

And I also don't think it is reasonable to assume market participants are so quickly moving to consider BTC/crypto a haven against inflation, as an explanation for the rally and bullish sentiment.

Well, I guess I'd just like to hear/read your thoughts on how do you see this BTC/crypto rally holding after the Fed rate decision / speech and if you are standing by your downside targets (which I expect you do) and what would you expect to see on the weekly chart to invalidate that scenario.

Thanks again!

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023