Bitcoin Fundamental Briefing, May 2023

DEBT CEIL TANTRUM

May is rather specific month not only for Bitcoin and whole cryptocurrency industry, but for all global markets. The asset-specific valuation now takes the back seat, clearing space for more important fundamental factors – fears and nervousness around US debt ceil saga and potential default.

This is rather big topic and what you do see in the news – is just a top of the iceberg. The problem is significantly deeper and promised to bring more serious problems, not only inside the US but for the whole market society across the Globe. Because right now, political ambitions and domestic US elites’ struggle involved in the pure financial question of debt ceiling. Despite that ceil has been risen 70+ times previously – this time everything could go different. And in our regular FX and Gold market reports we week by week consider this large topic, trying to get puzzles together.

In recent 2-3 weeks we see rising demand for US Dollar that we’ve warned our forum members about. Falling of other assets – commodities, stocks, cryptocurrencies now is not the question of correct valuation, (i.e. that these assets are overpriced) and not the question of fair price, but the question of scare. Investors accumulate cash for multiple purposes, preparing for liquidity draught whatever decision on debt ceil will be made.

It is common opinion on the markets that BTC is out of risk. It is a safe haven, right? Almost the same as gold. So, whatever happens with the US debt, it should be win-win situation anyway… But we’ve heard it vast number of times before, and right at the eve of 2021 collapse and Fed tightening cycle. Now history and statistics clearly show that BTC behaves differently. And by amount of reasons that we explain below, we dare to suggest that BTC is among assets that could take most significant hurt of the US debt ceil saga…

MARKET OVERVIEW

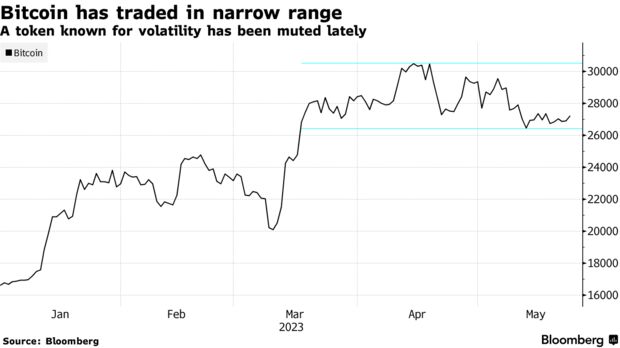

For an asset that’s known to be highly volatile, Bitcoin has been shedding that characteristic of late.

The largest digital asset is lingering around $27,000 for the third consecutive Tuesday in what’s been “lackluster price action,” according to K33’s Bendik Schei and Vetle Lunde. And “the remarkably unremarkable state of the market is now aggressively reflected in most metrics,” with seven-day average trading volumes touching two-and-a-half-year lows, and 30-day volatility at its lowest since January, they wrote in a note.

In addition, Bitcoin has been under-performing US stocks during the second quarter. “This has led to a continuation of the prevailing trend throughout 2023 – correlations between BTC and US equities are declining,” the duo said.

Despite the muted moves of late, cryptocurrencies have overall been surging this year. Bitcoin had started 2023 at around $16,600. Much of the move, fans say, may be attributed to digital tokens acting as safe havens during times of market troubles. Many analysts, however, dispute this theory.

In the US, equities investors have been focused on the debt ceiling, which likely has some — though not a ton — of impact on Bitcoin’s price as well, says Ilan Solot, co-head of digital assets at Marex.

“Part of the allure of crypto is being a store of value outside the financial system,” he said. “For some investors, it works as a hedge for anything that looks like systemic or policy risk — be it banking stress, currency debasement, or irresponsible monetary and fiscal policies.”

But not everyone agrees. Cryptocurrencies have in the past failed to act as hedges during geopolitical turbulence, for instance, or when inflation was rising.

The debt-ceiling uncertainty has led to US-dollar strength, which is “another unfortunate hit to crypto assets,” according to Noelle Acheson, author of the “Crypto Is Macro Now” newsletter.

“But wait, isn’t BTC supposed to be a ‘safe haven’ also? An alternative or ‘insurance’ asset that flourishes when the fiat system is strained?,” she wrote in a note. In theory, yes – this kind of environment should be good for crypto assets, especially those with a verifiable and immutable hard cap as well as growing global adoption. But BTC is behaving these days as a risk asset driven by monetary liquidity considerations, which shows that monetary flows still dominate its narrative.”

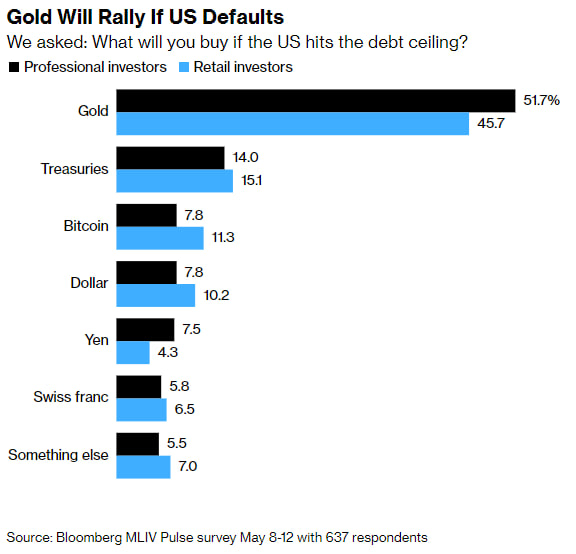

The risk of a US debt default is greater than it’s ever been, threatening to tip global markets into a brand-new world of pain. For investors, there are few places to hide other than the oldest hedge in the book: gold.

The precious metal is by far the top pick for those seeking protection in case Washington’s game of chicken over the debt ceiling ends in a crash, according to Bloomberg’s latest Markets Live Pulse survey. More than half of finance professionals said gold is what they would buy if the US government fails to honor its obligations.

The second most popular asset to buy in event of a default, according to the global survey of 637 respondents, was US Treasuries. There’s something of an irony to that given that’s the very thing America would probably be defaulting on.

But it’s worth bearing in mind that even pessimistic analysts see bill holders getting paid— just late — and that in the case of the most fraught debt crisis in previous years, Treasuries rallied even as the US had its top credit rating removed by Standard & Poor’s.

So, Bitcoin takes only 3rd place in investors’ default protection priorities, but, for the truth sake, it worth noting that it stand ahead of JPY and CHF fiat currencies.

A sovereign default by the world’s biggest economy should probably be unthinkable. But it’s definitely thinkable right now.

About 60% of MLIV Pulse respondents said the risks are bigger this time around than in 2011, the worst debt-limit crisis of the past. The cost of insuring against non-payment through one-year credit default swaps has surged well past levels seen in previous episodes, although they still suggest that the actual chance of a default is relatively slim.

“The risk is higher than before, given the polarization of the electorate and the Congress,” said Jason Bloom, head of fixed income, alternatives, and ETF strategies at Invesco. “The way both sides are so dug in, means there is the risk they don’t get their act together in time.”

The most elevated rates are those around early June, close to the point that Treasury Secretary Janet Yellen has warned the US might run out of borrowing headroom. If the department can make it past mid-June, then it’s likely to get a bit of breathing room from expected tax payments and other measures, before facing fresh challenges from late July, where market pricing also indicates a degree of strain and concern.

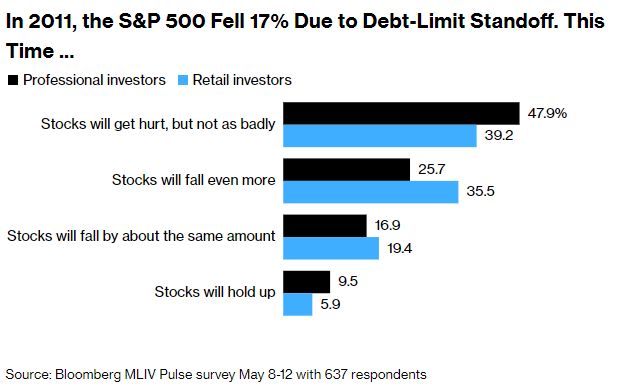

In the 2011 standoff — which led to a credit rating downgrade by S&P but not an actual default — a surge in Treasury buying took the 10-year yield to a then-record low, while gold rallied and trillions were wiped off global equity values.

Due to tight relation of BTC performance to stock market, we’re particularly interested with stock makets reaction on 2011 precedent. Investment professionals are less pessimistic on the outlook for the S&P 500 Index this time than retail traders.

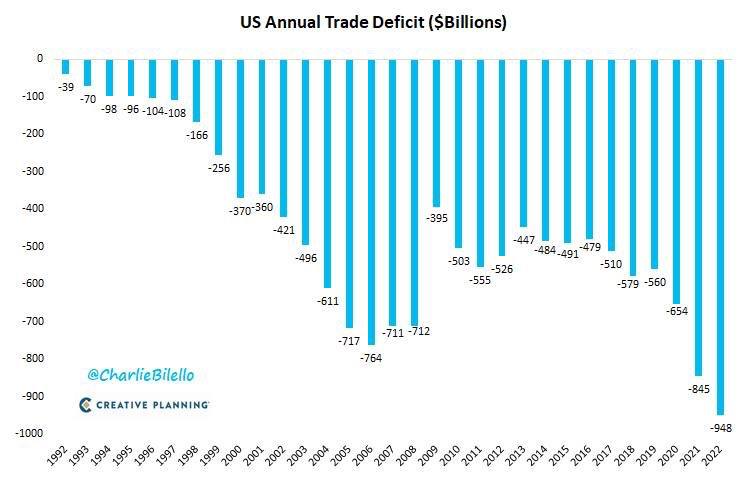

Some investors believe that the debt ceiling drama has already caused some harm to the dollar, and 41% say its standing as the primary global reserve currency is at risk if the US defaults.

Thus, even repeating of 2011 story could lead BTC back to 20K area (~17% drop). It could totally destroy bullish technical picture that we’ve discussed last time and open way to 12.5K major downside target.

Some investors believe that the debt ceiling drama has already caused some harm to the dollar, and 41% say its standing as the primary global reserve currency is at risk if the US defaults.

But we think different – many things tell that this time could be much worse and win-win situation for US Dollar…

AROUND DEBT CEIL

While I was writing first part of research, the news has come that preliminary agreement on debt ceil has been achieved. Hooray. Should we celebrate already? I guess not. We have dedicated the whole report to this subject and come to conclusion that road to final debt relief will be bumpy. Agreement has to pass the Congress and Senate, and there are lot of those who will try to get its own benefits trying to sell own voice as expensive as it could.

Republicans control the House by 222-213, while Democrats control the Senate by 51-49. These margins mean that moderates from both sides will have to support the bill, as any compromise will almost definitely lose the support of the far left and far right wings of each party. To win the speaker’s gavel, McCarthy agreed to enable any single member to call for a vote to unseat him, which could lead to his ouster if he seeks to work with Democrats.

Objections are already started. As democrats and republicans are throwing hot cinder to each other, watching in which hands it will stuck – those will be accused in default. And the booing is already started. Rep. Ralph Norman –

This “deal” is crazy. Raising the debt ceiling by $4 trillion with virtually no cuts is not what we agreed to. I will not vote for the bankruptcy of our country. The American people deserve better.

First vote on the agreement project comes on Wed, 31 of May, it seems close, but what the results will be? Meantime US Treasury assets keep melting, and by the end of the May they stand around $38 Bln. Could US Treasury last until agreement will be signed? This is big question. Indirect signs, suggesting problems comes from far left newspapers headlines. None of the old corporate left media criticizes the debt ceiling deal. Lots of cute stories about the State Debt. Zero scary headlines.

But bureaucratic delays is not the major bearish factor of course. Despite what will happen with debt ceil, by our view, it will be loose-loose combination for bitcoin in perspective of few months.

We see three major bearish factors here. First is, some investors who was buying BTC as insurance from the US Default, now could unwound their positions, at least partially.

Second is the Fed. After May meeting we warned about rate hike in June and called to not believe in probabilities which was showing just around 20% that this should happen. Now situation drastically has changed. Chances for rate hike on 13-14th June meeting stand around 65% ( 525-550 column):

And this is not some caprice. Last month we’re getting positive US Data. GDP, PCE, Job market, Consumption numbers show that US economy keeps moderate positive pace, Job market is tight, while inflation is raising. This is healthy background for another rate hike.

And recent speeches of Fed’s members give clear hint that this should happen again. I would say even more – due to the third reason, below, July rate hike also has big chances to happen. Once again – do not believe in current probabilities and market expectations. Besides, stable economy conditions stand on a background of rising 5-year inflation expectations:

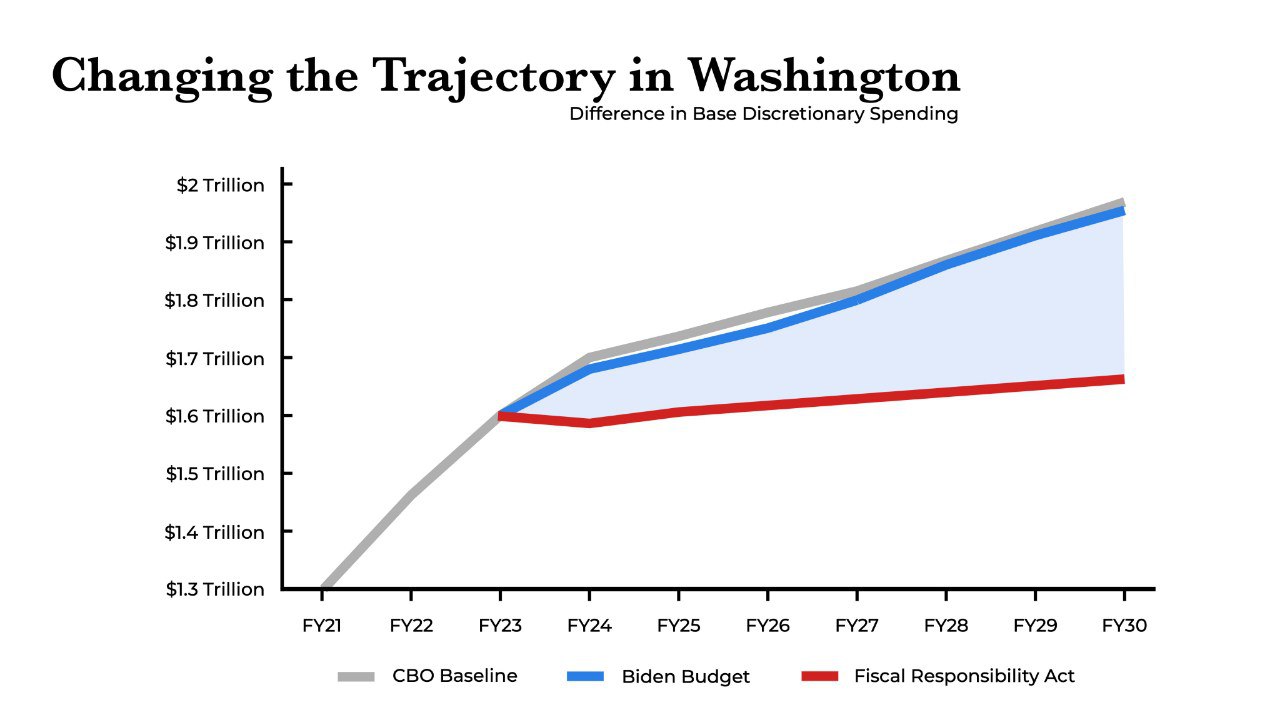

And third is – US Treasury activity. Once debt ceil will be raised officially, Ministry of Finance immediately comes on market and start grabbing all liquidity around that could reach. According to analysis by Goldman Sachs, the US Treasury may have to sell $700 billion in T-bills within six to eight weeks of a debt ceiling deal just to replenish cash reserves spent down while the government was up against the borrowing limit. On a net basis, the Treasury will likely have to sell more than $1 trillion in Treasuries this year.

Who is going to buy all of those bonds? The market may be able to absorb all of that paper, but it will almost certainly cause interest rates to rise even more as the sale drains liquidity out of the market. In effect, as the Treasury floods the market with new debt, bond prices will likely fall in order to create enough demand for all of those Treasuries.

A Bank of America note projects that the anticipated post-debt ceiling bond sale would have an impact equivalent to another 25 basis point Federal Reserve rate hike. The liquidity crunch will spill over into the private bond market. The price of non-government debt instruments will have to fall as well in order to compete with Treasury bonds. That means the cost of borrowing will go up for everybody. US government always starving. And with a such of appetite, it is big challenge to make them full.

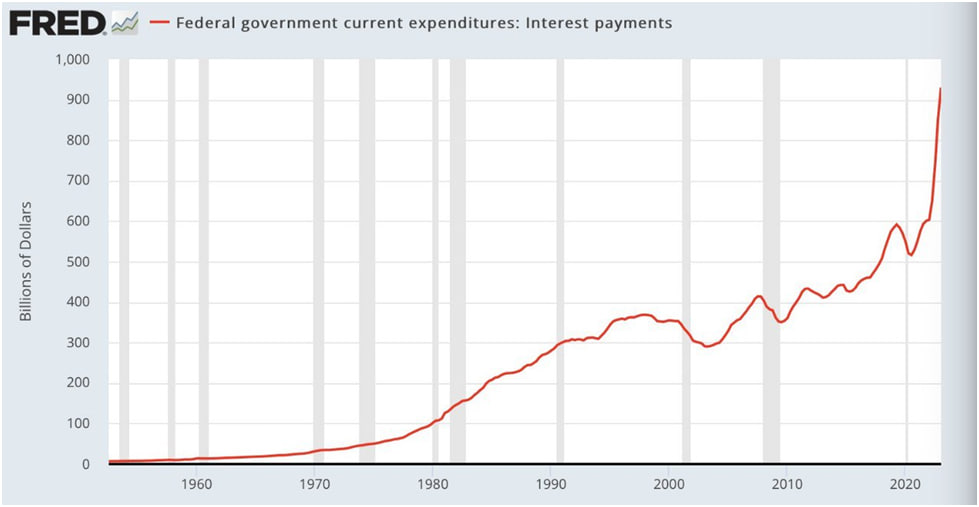

Another problem is rising interest expenses. When rate is coming to 6% they becoming valuable part of total expenses:

And how they intend to go with this is absolutely unclear

With the Fed rate near 6% non interest bearing BTC, as well as stock market has poor chances to show the rally. Besides due to clowning around the debt ceil, investors probably start loosing interest to hold US debt, or at least demand higher yield

And on a background of all this mess, BTC has low chances to succeed until the end of the year. Despite that we could get some moments of bullish reaction.

OTHER (Secondary) ISSUES

Here is few other issues that have secondary importance but still worth to be mentioned as they show overall sentiment on the market.

Although we do not mention new regulatory issues – but trend goes, and goes on a way of more tightening. Here are few headlines:

Crypto should be regulated as gambling, UK lawmakers say

EU states approve world’s first comprehensive crypto rules

Binance pulls out of Canada amid new crypto regulations

Binance Faces US Probe of Possible Russian Sanctions Violations

Crypto giant Binance commingled customer funds and company revenue, former insiders say

The frog is cooked slowly. Exactly as with the anti-Russian sanctions. In addition, large players should come out of the BTC, therefore it is necessary to create demand from small players, and it is difficult to think of lowering the status of other coins to securities in this regard. As soon as the big guys comes out of the BTC, he is also recognized as wrong and subject to regulation.

It is difficult to say, whether this process is started already, but few indirect signs exists. According to CoinShares’ latest Digital Asset Fund Flows report, the volume of cryptocurrency investment product transactions amounted to $900 million over the past week, a significant 40% decline from the year’s average. Similarly, trading volumes across trusted exchanges in the broader market plunged to a new low since late 2020, standing at a mere $20 billion for the week. Outflow stands for the five consecutive weeks.

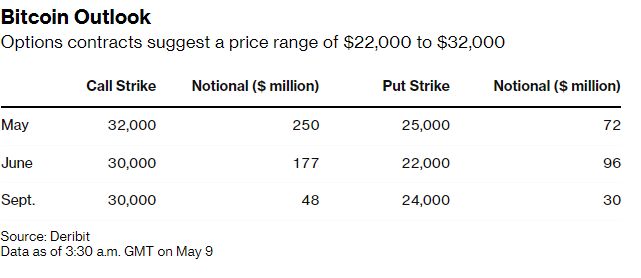

Bitcoin’s fading bounce is sowing caution about its outlook. The highest notional values for Bitcoin options contracts expiring in May through September now point to a $22,000 to $32,000 price range, whereas the ceiling was around $38,000 to $40,000 a week ago, Deribit data show.

Still, Anthony Scaramucci, Skybridge founder tells that BTC could reach 40K level.

I’m sticking with it. You know, it’s interesting. I haven’t changed the portfolio at all. I think we’ve been rewarded by that because a lot of things happened last year…you got fraud, you got over leverage, you’ve got excess confidence. And it caused a really big depression in the markets and the markets probably overshot to the downside. And so we think intrinsically Bitcoin’s worth about forty thousand dollars. It’s trending right now twenty five to twenty seven. But what we do see is better minor activity. We see more wallet expansion.

You have 4 percent global absorption for bitcoin, about three hundred and forty million wallets. That’s roughly where the Internet was in 1998. We just have to get from four to eight percent and you’ll see explosive returns in bitcoin. So I want people to be patient, but I get it. It’s a great meet, new story, great media story that it’s not doing well right now. But I think this is where the rubber meets the road.

Signs of reaching the end of the Fed’s key rate hike cycle may be a catalyst for a strong bitcoin rally. According to Matrixport analysts, the first cryptocurrency will rise in price by 20%, to $35,000-36,000.

Analysts also noted activity in my-tokens DinoLFG, Pepe, Wojak, Chacon and IgnoreFud as a sign of improving sentiment in the cryptocurrency market.

“The projected figures for May may lead to a significant increase in commissions as a percentage of the total income of miners to the levels that we observed in May 2021,” they concluded.

Despite the continued growth in the volume of transactions on the Bitcoin network, the number of active addresses has fallen to its lowest level since July 2021 – 764,000.

Glassnode in its recent two reports also shows that the bullish tendency is not obvious yet.

As momentum slows down in the Bitcoin market, the Monthly Realized Volatility has dropped to 34.1%, which is below the 1-standard deviation Bollinger Band. Historically, such low-volatility regimes only account for 19.3% of market history, and therefore expectations of elevated volatility on the near-term horizon is a logical conclusion.

The Active Investor Cost Basis is currently trading at $33.5k, which accounts only for investors actively participating in the market, and provides a near-term upper bound price model. With the Active Investor MVRV at 0.83, it suggests that many 2021-22 cycle buyers are still underwater, and may be waiting for break-even prices to liquidate their holdings.

Having recovered from the depths of the 2022 bear market, Bitcoin investors find themselves in a form of equilibrium, with little gravity in either direction.

Given the extremely low volatility, and narrow trading ranges of late, it seems this equilibrium is soon to be disturbed.

CONCLUSION

Now, there are many talks that as soon as Fed pivot appears on horizon, institutional investors will buy all BTC that they could, providing strong background for the rally. But here we have nuance, which is, once again, relates to regulation sphere. Second issue is a Fed pivot level that we already have discussed above – we expect rate hike in June and in July as well.

So, concerning regulation. Recently Grayscale and Bitwise Step Back from Ether Futures ETF Proposals . In fact, the battle to register an ETF for BTC has been going on for at least 4 years. But the SEC does not give up. And the reason for that is BTC has to be bought from exchange to put it into ETF. What’s the problem?

The SEC thus declares literally the following. We do not see the risk for the investor in the form of manipulating the price of the settled futures contract for the BTC (BTC futures are exist already). Even though the settlement price is the price of bitcoin on some exchanges . But God forbid you buy an ETF, which will contain the BTC itself! You are not completely protected from price manipulation! Fully! Sounds nonsense. How inserting a legal pad in the form of a settled futures contract helps remove the risk is unknown.

But the real reasons are following. Not because Glassnode are too small. Fidelity with 10+Trln in assets also would like to register the BTC ETF. But time is not come yet.

Because as soon as they register such a fund and drive at least 0.5% of client money there, the price will fly into space, because with this money (50 billion dollars) they can vacuum the entire spot market 2 times. Now the reserves of () bitcoins on spot exchanges are only 744 thousand pieces. At a price of 27 thousand dollars, this is only 20 billion dollars. That is, the supply of pipets is so limited.

It might be the cunning plan that the first Bitcoin ETF will be allowed to be registered only after two events – mega-QE and the appearance of normal regulation of cryptoassets. That’s when the native will begin, because the big banks and the largest investment and pension funds will be able to invest their money in a super-hyper-mega promising asset for their clients. But, of course, they will make a disclaimer that this is not for sure (LOL).

Here, raids on exchanges, by the way, help a lot – look at the chart:

(only over the past year, reserves of bitcoins on spot exchanges have almost halved. But we remember – less supply, higher price, right?

Thus, the lifehack for everybody – watch for ETF approvement by SEC, and no matter who will do it first. As soon as the first ETF will be adopted – BTC rally is right around the corner. If it will be adopted at all, of course… but this is different story.

Speaking about all other stuff that we’ve mentioned, the bottom line is – overall background is not friendly for BTC rally at least until 2023. Mostly due to high interest rate, which Fed still could raise more and coming US Treasury activity on liquidity hunting. These factors are technical and are not related to BTC valuation, but still, we suggest that this is strong headwind.

On a technical side, we keep an eye on BTC performance on weekly chart. Now everything is OK and it has chances to proceed to next 35K target. But if it steps down under 23-24K area bullish tendency will be broken and 12-13K area once again will appear on horizon. The logic is simple – market now goes from one reverse H&S target to another. If, after first target (around 27K) it stops and drops back under the neckline – H&S is over. Consequently, price should drop below the head, which is our long-term OP downside target @ 12.23K

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

651 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023