Mastering Trailing Stop Loss in the Forex Market

Introduction to Trailing Stop Loss

In trading, there is a point where traders enter and exit trades. The operation of entry and exit can be performed in different ways. Some of the widely used order types include market order, limit/pending order, buy/sell stop order, stop-loss order, and trailing stop-loss order. Stop- loss and trailing stop-loss orders are specifically used for exiting a trade, while the rest is used for both entering and exiting a trade.

Risk management is one of the most vital concepts in trading. Having a clear understanding of when to take profits or cut losses is a critical factor in risk management. Trailing stop loss is a tool that helps traders to trade with discipline by reducing risk and maximizing profit along the way.

Getting Familiar with Stop Loss and Trailing Stop Loss

Before getting into the concept of trailing stop loss, let us understand what stop loss in trading even is. Later, we shall get in detail with trailing stop-loss orders.

What Is a Stop Loss?

Stop-loss is an exit order in trading that is used to cut the losses at a specified price. So, this order is kept below the entry price for a long trade. Likewise, it is kept above the entry price for a short trade. For example, let’s say a trader takes a long trade at $150 and places the stop loss and take profit at $100 and $200 respectively. So, if the price touches or goes below the $150 mark, the stop loss order gets executed, and the trader incurs a loss on the trade.

What Is a Trailing Stop Loss?

Trailing stop loss is a type of stop-loss order which blends factors like risk management and trade management. It is a varying stop-loss order, which helps lock in profits as the trade goes in the required direction and also covering the amount that could be lost if the trade does not perform. This order can be implemented manually by the trader or can be set up to work automatically through the brokers.

Stop-loss is a good tool for reducing one’s risk. However, the problem with them is that they are static and do not move. For instance, let’s say you purchased security at $100 by keeping the ‘take profit’ at $210 and stop-loss at $90. Now, if the price goes all the way up to $209 and drops to $90, then this protection will be worthless. This hence led to the invention of trailing stop-loss.

How Does Trailing Stop Loss Work?

Trailing stop-loss is a type of stop-loss order that adds a dynamic nature to overcome the hurdle, as mentioned earlier. It is derived from the combination of two concepts – the ‘trailing’ component and a ‘stop-loss’ component. With this trailing feature, the stop-loss is no longer stationary but trails the current market price by a specified amount (percentage). Doing so, one will be able to lock in profits along the way as the trade performs.

A trailing stop-loss is initially placed just like a typical stop-loss order. So, a trailing stop-loss would initially act as a regular sell order for a long position, and as a regular buy order for a short order. Now, since it’s a ‘trailing’ stop-loss order, it will move as the price moves.

Placing Trailing Stop Loss – Long Trade Example

Assume that the current market price of the EURUSD is 1.1260. Let’s say you have bought this pair at this price and kept a trailing stop-loss of 10 pips. Meaning, for every ten pips the currency moves up, the trailing stop-loss will also move up by ten pips. But, if the price moves down, the stop-loss does not move down; instead, it remains static.

The initial trailing stop-loss is 1.1250. If the price moves up to 1.1270, then the trailing stop-loss would move to 1.1260. Similarly, at 1.1280, the trailing stop would move to 1.1270.

Now, if the price falls from 1.1280 to 1.1275, the trailing stop would be the same (at 1.1270). But, if the price continues to fall and reaches 1.1270, the trailing stop order will be executed, which would result in the exit of the trade. So, this trade would lock in a profit of 10 pips.

The tabular representation of the above example is illustrated below.

| Trailing Stop (Long trade) | |||

| Price direction | Price movement | Trailing Stop price | Profit(+)/Loss(-) |

| 1.1260 | NIL | 1.1250 | – |

| Up | 1.1270 | 1.1260 | – |

| Up | 1.1280 | 1.1270 | – |

| Down | 1.1275 | 1.1270 | – |

| Down | 1.1270 | 1.1270 | – |

| 1.1270 | Position Closed | NIL | 10 pips |

Placing Trailing Stop Loss – Short Trade Example

Let’s say the current value of a currency pair is 0.9865. Assume that you have shorted this pair at 0.9865. You set the stop-loss and take profit at 0.9885 and 0.9800. Also, you kept the stop-loss to trail 20 pips. So, as the market keeps dropping by 20 pips, your stop-loss will also move down by 20 pips. But, note that, if the price moves up, the trailing stop does not move up.

Let’s say the market dropped from 0.9865 to 0.9845. Now, since trailing stop-loss is dynamic in nature, it moves down by 20 pips (to 0.9865). So, it is as good as saying that the stop-loss is at breakeven. Later, the market drops even lower to 0.9825. The trailing stop would now be set at 0.9845. From 0.9825, the market jumps to 0.9840. But, the trailing stop stays static at 0.9845. Finally, the market moves up by five pips, which results in the trailing stop to be triggered. Hence, though the price didn’t hit the take profit, you are still in a profit.

The summary of this trade is tabulated as follows.

| Trailing Stop (Short trade) | |||

| Price direction | Price movement | Trailing Stop price | Profit(+)/Loss(-) |

| 0.9865 | NIL | 0.9885 | – |

| Down | 0.9845 | 0.9865 | – |

| Down | 0.9825 | 0.9845 | – |

| Up | 0.9840 | 0.9845 | – |

| Up | 0.9845 | 0.9845 | – |

| 0.9845 | Position Closed | NIL | +20 pips |

Trailing Stop Loss Strategies

Keeping a random trailing stop on any trade will no doubt reduce the risk and lock in profit along the way, but will lack logic in exiting a trade. By using the below strategies, the Trailing Stop Loss order can be placed accurately.

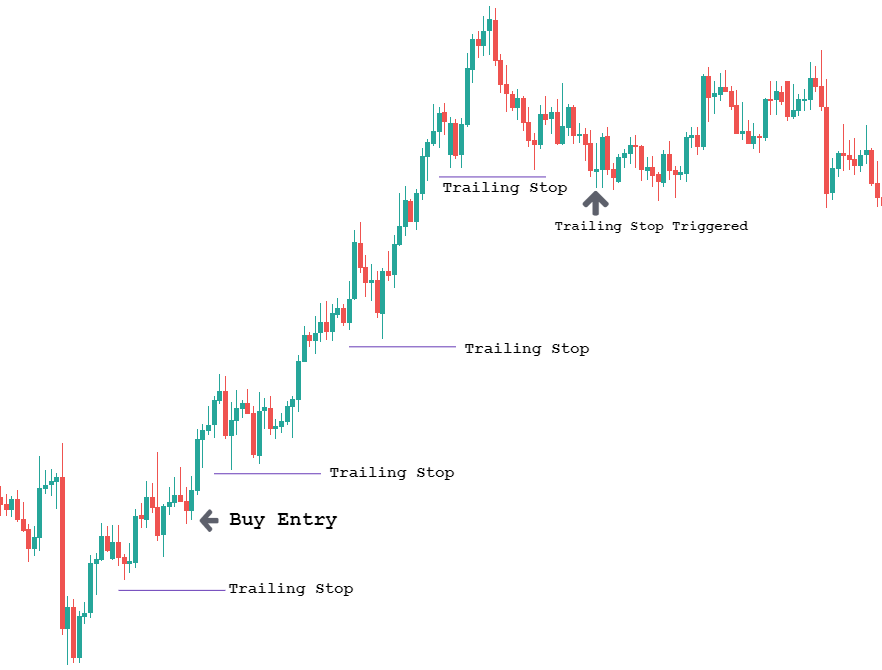

Support and Resistance Trailing Stop Strategy

Support and Resistance areas are the ideal locations to place a trailing stop-loss. According to this strategy, for a long trade, as the price breaks above a resistance level, the stop-loss must be moved to the most recent Support level. This is because a break below the Support level signifies a probable reversal in the market.

Consider the below chart of EURNZD. Assume that a long trade was taken at the point, as shown by the arrow. The trailing stop-loss was kept below the entry price, as illustrated in the chart. Now, as the trade performed in the required direction and broke above the resistance level, the trailing stop was moved higher, at the Support Level. Similarly, it was moved two more times. Finally, the stop loss was triggered when the price went below the most recent Support level. All in all, the trade was closed with a profit.

Trailing Stop Using Moving Average

Moving Average is a technical indicator that averages out the past prices for a given period and represents it in the form of a line. Blending this indicator with a trailing stop is a great technique to exit a trade.

The strategy for this is simple. Firstly, make sure that the market is trading above the Moving Average line. Keep a trailing stop of your choice. Let the stop-loss trail as the price goes in the desired direction. And when the market drops the Moving Average, exit the trade.

A self-explanatory example is illustrated below.

Trailing Stop Using the ATR Indicator

There are indicators that are being used by traders for placing the trailing stop-loss order accurately. Average True Range is one such indicator that adds great logic to the trailing stop-loss. This indicator basically measures the pip movement in a currency pair in a given timeframe. With this, one can determine the highest, lowest, and the live pip movement in a currency pair. For example, if the current value of ATR on the 1H timeframe is 25 pips, then we can expect the price to move 25 pips in the next hour and so on.

To use this indicator with trailing stop-loss, we set the trailing stop at a multiple of the ATR value. So from the above example, we set it at 25 pips or 50 pips or 75 pips.

Let’s assume you bought a currency pair at 1.050 by analyzing the chart on the 15mins timeframe. The ATR value on this timeframe is ten pips. So, you place a stop-loss order at 1.040. Later, as the price goes in your favor, trail your stop-loss such that the difference between the highest price the market witnessed since your entry and the stop-loss is ten pips. That is, if the price moves up to 1.070, then you move your stops to 1.060 so that the difference remains ten pips. Continue to do this until the price hits your take profit or triggers your stop-loss order.

Note: Indicators work exceptionally well sometimes, and tend to fail sometimes. There is no perfect method for it. So, one must try these out on a demo account first and then apply it on a real account.

The Pros and Cons of Trailing Stop Orders

Advantages

- These orders are executed automatically when the price hits the trailing stop level, keeping the panic emotions away and giving peace of mind when a trader is away from their trading platform during a significant dip in the market.

- There is no static point for a profit with this order. As the trade keeps performing in your direction, the profits will rise too.

- Trailing Stop orders are flexible in nature. That is, you may key in any percentage of trailing stop and customize it any time during the trade, according to your risk management plan.

- The cost for a trailing stop-loss order is nil.

- This order helps traders take emotions out of their minds and focus only on their predetermined goals.

Disadvantages

- There is no surety that your trailing stop order would be filled when the market reaches that price. If the currency falls suddenly, you may not get the price you intended for a trailing stop order to be executed. Thus, you would have to close the position at a lower price than the predetermined price. This scenario usually happens in illiquid currencies or fast-moving currencies.

- Trailing Stop order may not be available for some securities.

- Trailing Stop orders are not ideal for extremely volatile markets. Keeping in mind the volatility, if you set an order too low, your risk: reward will slip out of imbalance. And if you set it high, the high volatility might stop you out and then eventually move in your desired direction.

- You may lose the ability to square off the positions in a thoughtful and analytical way before the market drops to your trailing stop order.

- Market makers are keenly aware of the trail stops that you place with your broker. In this case, your trail stop order could be triggered by a temporary pullback or whipsaw, and then continue with the actual move.

Conclusion

Some traders use trailing stop orders to lock in some profits, while some use it to exit a trade. Traders, who do not have a fixed take profit point in their minds, use a trailing stop order as their exit strategy. Also, trailing stop orders can be set to execute automatically, or can be adjusted manually depending on the price movement in the market. Hence, a trailing stop order must be used with a primary purpose to capture profits as the market moves in the trader’s direction.

We hope you find this article informative. If you have any questions, please let us know in the comments below, and we will be more than happy to help. Happy Trading!

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

517 Views 0 CommentsTags

forex strategyComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023