5 of the Best Forex Trading Tools and Where to Get Them

We list the best forex trading tools that every trader should know about. Learn how to use them and most importantly where to get them

Did you know that there are a plethora of forex trading tools that anyone can easily access and use to improve their results?

If you know where to look, finding quality trading tools doesn’t even have to cost you an arm and a leg.

5 of the best forex trading tools:

- Position Size Calculator

- Economic Calendar

- Session Map

- Trade Journal

- Twitter Account

As you can see, the list features a diverse range of forex trading tools to both directly and indirectly help you improve as a trader.

In the end, remember that a tool is only as effective as the tradesman who’s hand it is in!

Let’s get into the list, shall we.

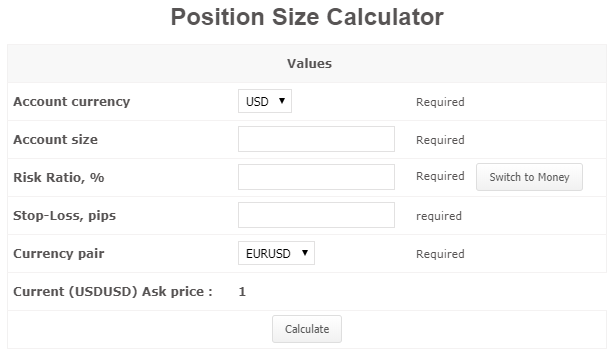

1. Position Size Calculator

Top of our list of forex trading tools that every trader should know about, is a position size calculator.

If you’ve moved onto a live account, you should already know that the most important aspect of trading should be risk management.

You must first and foremost ensure that you can continue trading, even after a number of losses in a row.

The general consensus is that forex traders should risk no more than 2% of their account per trade.

This is where the use of a forex position size calculator comes in.

How to Use a Position Size Calculator

Before you use a position size calculator, you must first have planned your trade from top to bottom.

Know your trade entry, stop loss and take profit target levels. No 2 trades are the same and these levels are going to reflect that.

Now, unlike your stop loss and take profit targets, your percentage of the account risked per trade, shouldn’t change.

Keep your level of risk constant and your profits will grow alongside your account size.

Calculator inputs:

Account Balance – First input your total account balance. You can choose balance or equity, but the key is that you stay consistent with whichever you use. The calculator tool is going to use this number to base all calculations around.

Risk Percentage – The second input is the percentage of your account that you’ve decided to risk per trade. As we said above, 2% is the generally accepted level. Think about it this way: A 19 trade losing streak at 2% risked per trade would see you at –30%. At 10% risked per trade, that would be –85%!

Stop Loss (pips) – Thirdly, enter your stop loss in pips. You should have already planned your trade from start to finish and know at which level the market will tell you that your analysis was wrong.

Currency Pair – Lastly, find the currency pair that you’re trading. This is only important if you’re trading on an account in a currency that isn’t within the pair that you’ve selected.

Where to get a Position Size calculator

You can find a position size calculator inside our forex calculator set page.

While the position size calculator tool is the most widely used, we actually have a whole range of forex calculators for you to browse.

Find out your exact account risk, profit, swap and even margin with just a few inputs and the click of a button.

If you don’t trust an indicator’s math, you can even find a pivot point calculator to manually use on any forex currency pair.

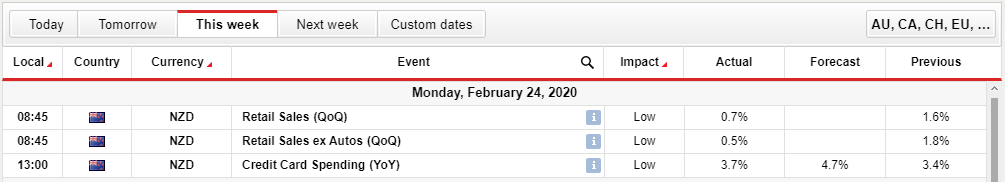

2. Economic Calendar

Second on our list of forex trading tools that every trader should know about, is an economic calendar.

An economic calendar typically lists all major economic data and news releases for the day.

Whether it’s an economic data release, a central bank interest rate decision, or even a political or monetary policy speech, an economic calendar will list them all.

Even if you’re primarily a technical focused forex trader, an economic calendar should be an integral part of your day or week’s planning.

How to Read an Economic Calendar

Economic calendars are primarily a fundamental analysis trading tool, but can help keep you out of a low liquidity market in the seconds after a crucial news release.

We know that forex markets are a forward-looking beast.

So, if the actual number released deviates from the market’s expectations that they’ve already priced in, then we’ll more than likely see a volatile move.

Calendar columns:

Impact – The economic calendar will indicate whether a release is expected to have a low, medium or high impact on the market. While there are a lot of releases every single day, many traders apply a filter to display only the high impact releases most likely to move the market.

News release – The name of the news release. You need to know what is being released or actually happening in order for you to figure out whether it’s significant to your particular trade.

Expected number – Bloomberg conducts a survey of 20 top economists for their thoughts on where the number will likely fall. An average is taken from these survey results and an expected number is given.

Actual number – This is the final number released at the time given. If the actual number is close to the expected number, then the market may have already priced in the release. If however, there is a large deviation from the expectation, things could soon get crazy!

Previous number – The previous number is given for regular data releases and can be used to track trends on economic performance.

Where to Find the Best Economic Calendar

You can find a full featured economic calendar within our economic news calendar page.

Forex news calendars automatically update in real time, as soon as the data or news is released. On good economic calendars, you won’t even have to refresh the page.

This economic calendar can be a little overwhelming when you first open it, so make sure you apply the filters that only show the currencies and release types that are most relevant to the markets you’re trading.

3. Session Maps

Third on our list of forex trading tools recommended for every trader, is a session map featuring clocks in different time zones.

While forex is a 24 hour a day, 5 days a week market, trading hours are still split into sessions depending on which part of the world is active at that time.

Nobody is actually locked out of the market, but the sessions are the best guide to trading during times of high liquidity and avoiding unpredictable end of day flows.

How to Read a Session Map

The forex trading day follows the international dateline from the first Monday in Asia, to Friday night’s close in North America.

While each currency pair is more likely to be active during their own trading session, you are able to use a forex session map to work out the times of day that you could focus on trading each pair.

Each day is broken into 4 forex trading sessions, named after the largest capital cities in that particular time zone, with some overlap.

Forex market sessions:

Sydney – Opens at 10 pm GMT and closes at 7 am GMT.

Tokyo – Opens at 12 am GMT and closes at 9 pm GMT.

London – Opens at 8 am GMT and closes at 5 pm GMT.

New York – Opens at 1 pm GMT and closes at 10 pm GMT.

Where to Find a Session Map

The best place to find a session map tool is the widget on the Forex Factory homepage.

The widget sits at the bottom of their calendar and updates live in a Gantt chart format as time passes between overlapping sessions.

Another popular option is to find a custom indicator for MT4 and attach a session map directly to your charts.

4. Trade Journal

Fourth on our list is trading tools for forex traders, is the humble trade journal.

By keeping a journal of your trading, you will gain valuable insights into what you did well and more importantly what you need to improve on in order to make more money.

In each journal entry you’ll generally include entry, exit, why you took the trade and how you feel after making it.

Whichever way you choose to journal your trades, just be consistent.

How to Write a Trade Journal

Trade journals can come in any number of forms, with the only thing that matters here, being that you are consistent with your daily entries.

If you’re not going to be able to keep up writing a full page of thoughts and feelings, then simply write entry and exit numbers with a one word emotion beside it.

The whole idea of keeping a trade journal is to make you more accountable for your trades and to help you take better trades going forward.

Types of trade journals:

Spreadsheet – A simple Excel spreadsheet is really all you need to start a trade journal. You have each column set up for entries, exits and check boxes for whether you followed your system and made money on the trade. Keep is simple and you’re more likely to keep journaling.

Notebook – If you’re an old-school pen and paper type of person, then a humble notebook trade journal might be best suited to you. This journal setup will allow you to further explore your emotions around each trade, an excellent tool to look back on from a trading psychology point of view.

Online journal service – There are a number of dedicated online trade journal services, with one of the biggest being a company called Edgewonk. These services allow you to break down your trading statistics into immense detail and are well worth it if you have the time.

Where to Get a Trade Journal That You’ll Actually Use

The best type of trading journal is the one that you actually use.

So, if you’re not journaling your trades, stop reading about where to find the perfect tool and just start writing down every trade you take, onto a blank piece of paper.

Find out how you absorb information in the most effective way, and use that in your trade journaling.

Whatever you do, just start writing!

5. Twitter Account**

Fifth and last on our list of forex trading tools that every trader should know about, is a humble Twitter account.

It might seem a little strange that we’ve included a Twitter account into a list of trading tools, but hear us out here.

Twitter has become the go-to place for up to the second news.

So why would you invest in a Bloomberg terminal or a news squawk service, when you can simply find all this information almost instantly on Twitter – for FREE.

How to Get the Most Out of Twitter as a Trader

There are such a wide number of variables that move forex markets, that it’s literally impossible to stay on top of them all.

Having a Twitter account allows you to get your news from a diverse range of sources, in many cases directly from the journalist themselves.

Imagine being able to say that, even just 5 years ago. The information at your fingertips right now thanks to Twitter, is mind-boggling!

Who to follow on Twitter:

Journalists – Twitter allows you to follow a wide range of journalists, working for any number of publications. By following them instead of their employers, you often get the news first and get it in their own words as if you were there.

Market analysts – With a lot of the market moving news coming in the form of economic data releases, following market analysts gives you professional insight around the numbers. These guys are often employed by brokers and essentially work to keep traders informed. They’re an excellent resource.

Other traders – While you need to be careful that it’s not the blind leading the blind here, you can learn so much from other traders on Twitter. Often traders will be happy to share their charts and trading ideas with anyone who wants to chat. Trading can be a lonely game after all.

News wire service – If not the news wire services themselves, there’s always a news junkie on Twitter who’s happy to share the Bloomberg terminal stream or any number of squawk services that are used by proprietary trading firms. Seek and you shall find.

Opening a Twitter Account

Opening a Twitter account is simple and free.

Steps to open a Twitter account:

- Go to twitter.com

- Click sign up

- Enter your details

- Confirm your account

It really is that easy.

If you don’t want to be yourself, then use an anonymous persona and hide behind a profile photo of your favourite mythological creature or something fun.

You don’t even have to post at all if you don’t want to. Just use your account to create a list of traders, analysts and news sources that you want to get your trading news from.

Final Thoughts on Using the Best Forex Trading Tools

Using any particular forex trading tool, won’t instantly turn you into a consistently profitable forex trader.

But if you use these tools alongside your trading strategy and good risk management principles, then they will make your life a lot easier.

Use them and you may just find an edge that you never knew you had.

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

651 Views 1 CommentsComments

Thanks for sharing, Fat Finger.

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023