Gold vs. Silver Trading – Which is better?

Gold? Silver? Which is better for trading? That’s the question most traders ask before investing in either of these two precious metals. Traditionally, more traders prefer investing in gold than in silver. However, this can be a mistake because we’ve seen times when the price of silver moves faster than that of gold.

One reason for the preference in gold is that it is often viewed as a more valuable asset in the human imagination. For example, on 1st March 2018, one ounce of gold was trading at $1,321.50 while one ounce of silver was trading at $16.71. So, gold can be seen as a more lucrative investment than silver.

Nonetheless, the truth is that there are times when silver is a better investment than gold and vice versa.

This article will try to explain the reasons when choosing one precious metal over the other is preferable.

Choosing Between Gold and Silver

Here is a chart from www.macrotrends.net showing gold’s price (blue color) and silver’s price (orange color) from 2006 to early 2018.

As seen on the chart, gold and silver prices are strongly correlated. Few other financial assets ever exhibit this strong degree of correlation seen on the two precious metals.

Because they tend to move in the same direction, you should choose wisely the one to trade in. For example, instead of investing heavily in one precious metal, go for the one that is likely to bring more returns on your investment.

The above chart demonstrates that from June 2006 to October 2008, investing in gold was preferable to silver. During this period, a gold purchaser would have earned more than 20% in profits whereas a someone who bought silver would have experienced losses of more than 10%.

In June 2006, gold was priced at around $596.15 while silver was priced at around $10.70. In October 2008, at the height of the global financial crisis, gold was priced at $730.75 while silver was priced at $9.28.

From April 2009 to April 2011, trading in silver was a better choice than trading in gold. Silver strongly performed better than gold. In April 2009, silver was trading at $12.63 while gold was trading at $883.25. And, while the price of silver skyrocketed in April 2011 to $48.70, the highest ever, the price of gold was at $1535.50.

If you bought silver during this period, you could have gained almost 300%, which is more than the gain of about 75% in trading gold.

From May 2011 to May 2014, trading in gold was better than trading in silver. During this period, losses incurred in gold investments were significantly less than those from silver investments.

Therefore, as evidenced by the above analysis, there are times when trading in silver is better than trading in gold and vice versa.

Let’s look at the factors that will determine the choice you make.

Factors to Consider Before Making a Choice

Deciding to own either gold or silver can be a difficult task. However, with careful consideration of the differences between the precious metals and the factors influencing their movements, making an appropriate choice is possible.

Here are some factors to consider.

1. Volatility of Gold and Silver

Silver’s price shows more volatility than that of gold. Every year, about 25,000 metric tons of silver are supplied to the global market. The yearly gold supply is about 3000 metric tons.

As much as this may seem that the silver market is larger than gold, the opposite is true. Because of the enormous difference in their prices, the value of their annual supplies also differs significantly. At present prices, the value of gold’s yearly supply is about nine times larger than silver.

Therefore, silver exhibits more volatility because it requires only a comparatively small amount of money to cause price movements. It is estimated that when gold moves by 1%, either upwards or downwards, silver moves by about 3%.

Here is a table showing how the prices of the two metals performed in the past.

| Rise from 1970 low to 1980 high | Drop from 1980 high to 1985 low | Rise from 2008 low to 2011 high | Drop from 2011 high to 2016 low | |

| Gold | 2,300% | -65% | 165% | -43% |

| Silver | 3,100% | -88% | 440% | -70% |

As seen in the above table, silver gains more percentage points during bullish conditions and loses more points during bearish conditions.

As a trader, you can use silver’s high volatility, to your advantage. For example, if you place buy orders during bullish market conditions, silver will give you better profits than gold.

Similarly, when the market is bearish, silver will selloff quicker and farther than gold. Thus, when the bullish strength seems to be dwindling, selling silver could be a better option.

2. Gold-silver ratio

The gold-silver ratio is a determinant of the amount of silver needed to purchase one ounce of gold. For example, since the current price of gold is $1,321.50 and that of silver is $16.71, the ratio could be calculated as $1,321.50 / $16.71 = 79.08. This means that it requires 79.08 ounces of silver to purchase one ounce of gold.

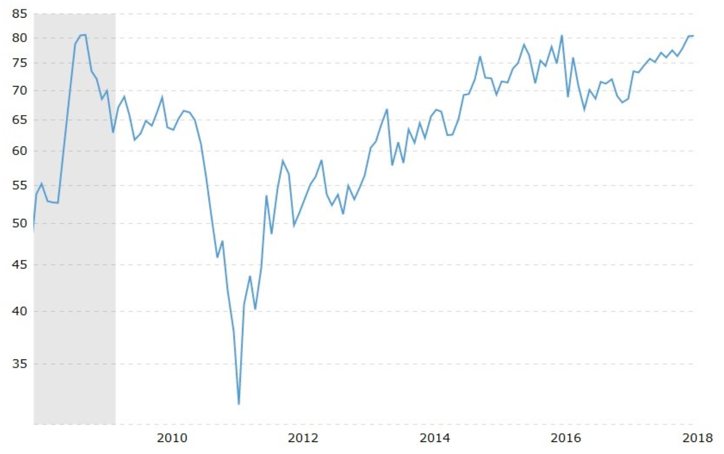

Here is a chart showing the historical gold-silver ratio for the past ten years.

You can use the gold-silver ratio to determine whether to trade in gold or silver. If the ratio swings to extreme levels, it could point to trading opportunities in both silver and gold.

For example, the above chart shows peaks and bottoms that could give trading signals for the precious metals. The peaks could indicate bullish signals while the bottoms could point to bearish signals.

When the gold-silver ratio peaked in November 2008, it indicated that it was the best time to trade in both gold and silver. Also, the bottom of April 2011 showed a ripe selling opportunity, right?

Usually, if the ratio is low, like below 40, traders interpret that silver is overvalued (it’s the same as gold being undervalued). As such, if gold is undervalued, it could be better to sell silver and purchase gold.

Likewise, if the ratio is high, like above 80, it could indicate that silver is undervalued. Consequently, buying silver and selling gold could be a better option.

Another strategy is to look at the gold-silver extremes as reversal indicators for the prices of the precious metals. If an extreme is significantly large, it could indicate an intensive imminent price reversal. Therefore, you should position yourself well to benefit from the reversals.

3. Industrial demand

It is estimated that around 12% of gold supply is utilized for industrial purposes. However, because of silver’s beneficial features, an enormous 56% of its supply is utilized in the industry.

From electrical appliances to medical equipment to household items, silver is everywhere, and you can’t avoid using it. In fact, it’s said that silver largely drives the modern life.

Therefore, the state of the global economy usually has a considerable influence on the price of silver. During periods of economic growth when demand for silver is high, the price of the metal often increases, making it a better investment than gold.

Furthermore, unlike gold, most of the silver used in industries is not recycled. It is estimated that recycled gold accounts for about 40% of the yearly supply of the precious metal.

Since silver is more abundant than gold, it is easy to increase production to keep up with the demand, instead of recycling.

So, buying or selling either silver or gold just because of the thought that silver’s industrial demand has outstripped supply does not seem to be a good idea.

4. Financial stress and central banks

In times of economic stress, buying gold is more desirable. The precious metal is often viewed as a hedge against economic uncertainties and inflation. If there are problems in the economy, such as political instabilities, natural catastrophes, or unfair monetary policies, investors usually rush to gold to protect their investments from losses.

For example, during the 2008-2009 global financial crisis, demand for gold soared, and its price rose by more than 50%. After the crisis had set the stage for gold’s price, it continued to rise until it reached an all-time high of $1,996.55 in August 2011.

Therefore, in times of economic weaknesses, owning gold is usually a better option than owning silver. Although silver’s price also rises during times of financial stress, the extent of movement is far much lower than that of gold.

Furthermore, central banks also play a role in determining the value of gold. Most central banks around the world hoard gold in their reserves—in fact, they own about 20% of the world’s gold.

Since they have massive leverage in the physical gold market, they can do whatever they like to meet their objectives, such as selling, purchasing, or leasing. For example, in January and February 2013, central banks purchased about $3 billion worth of the precious metal.

However, most central banks do not have silver in their vaults. As such, they cannot dump silver in the market to suppress its price or carry out other intervention measures.

Thus, when central banks cause a disturbance in the gold market, it could be best to look for a more predictable investment opportunity in silver.

Gold, Silver, and the Forex Market

Gold and silver often fluctuate in larger increments than most currency pairs in the forex market, something which makes the precious metals more attractive to many traders. Besides moving slower than the precious metals, most currency pairs tend to retrace to their mean values.

For example, it is estimated that the major currency pairs in the forex market fluctuate by about 1% each day. However, gold and silver move by about 1.40% and 2.78% each day respectively.

Regarding long-term movements, the precious metals are the clear victors. Whereas 30% movements in a year frequently take place in the forex market, and rarely more than that, precious metals are accustomed to much huge yearly movements.

In recent years, gold’s price experienced an annual increase of 70% while silver’s price nearly tripled, increasing around 200%. Thus, long-term trading the precious metals can lead to more profits than trading the currency pairs.

Furthermore, comparing the price movements of the precious metals to those of the currency pairs reveals some interesting patterns. Foremost, the U.S. dollar usually moves oppositely to the precious metals.

If the U.S. dollar moves upwards, the precious metals often move downwards and vice versa. During periods of economic uncertainties when the U.S. dollar is weak, investors usually dump the currency in favor of the precious metals, making their value to rise.

Additionally, it’s interesting to note that the precious metals usually exhibit a positive correlation with the price of AUD/USD. Whenever the price of gold increases, the AUD/USD also usually moves upwards and vice versa. Historically, the currency pair shows a strong correlation of about 80% with the price of the precious metal.

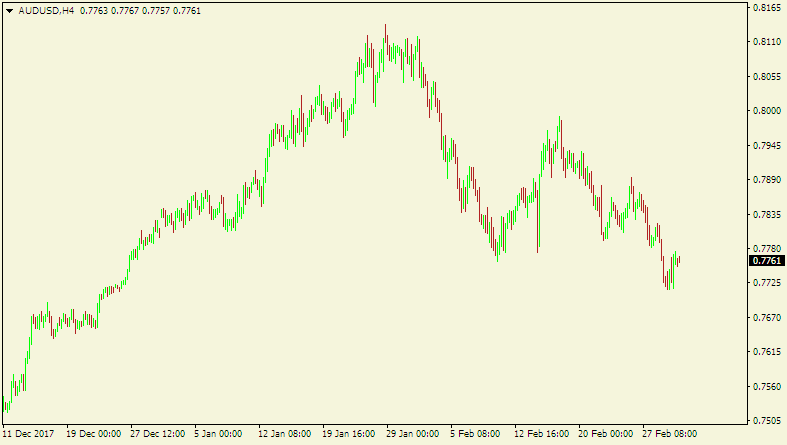

Here is a 4-hour chart of AUD/USD.

Here is a 4-hour chart of gold during roughly the same period.

As seen on the above charts, gold and AUD/USD show a positive relationship. It’s because Australia is the third-largest exporter of the precious metal in the world. The country exports about $5 billion worth of gold each year. Thus, the price of the precious metal directly affects Australia’s revenues.

Moreover, Switzerland’s currency, the Swiss franc, shows a strong relationship with the price of gold. The currency moves along with the precious metal because the country has over 25% of its money in gold reserves.

So, if using the U.S. dollar as the base currency, gold exhibits a negative correlation with the USD/CHF. If the price of gold moves upwards, the currency pair moves downwards and vice versa.

You can use the relationships that exist between the precious metals and the currency pairs to help you make sound and profitable trade decisions in the forex market.

Conclusion

Gold and silver are suitable for long-term investments. Both have provem to be reliable and valuable over the previous 5,000 years. No other financial asset holds the same track record.

While it’s not easy to choose between owning gold or silver, I hope that this article has shed more light on the subject and you’ll be able to make the best decision that best reflects your interests and goals.

Happy trading!

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

2267 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023