Forex – where to start: a ready-made Trader’s kit (+5 useful tools to fix common mistakes)

Forex trading can be challenging. There’s a bunch of variables here:

- indicators

- candlesticks

- economic releases

It’s great, when everything in your mind is perfectly organized for maximum productivity, like in the picture above. But when you’re only getting started, trading may seem quite complicated, with lots of factors that you need to consider. In this article, we’ll take a look at the Trader’s kit – what basic tools it contains. We’ll also give you some tips that will help you avoid common beginner mistakes. Now, let’s get started!

Step 1. Trading chart

We hope, that you already opened a trading account with a reliable broker. If not, make sure to pick a broker with 13 years of experience in the industry, FSA regulation and 350 000 active clients around the world.

Then everything is simple: open a trading chart. You can view quotes provided by your broker, but to get a more complete market picture we recommend using professional TradingView charts. They are very popular among traders when it comes to price analysis.

And here comes a typical mistake # 1. When the price on the chart of your broker differs from the TradingView quotes, just analyze the price on TradingView, but trade according to your broker’s chart. If you see this discrepancy, don’t worry: TradingView and your broker just have different quote providers. A 1-2 point difference in price shouldn’t be a problem.

Step 2. Pick your time frame

A timeframe is a period of time. Simply put, it represents a time interval during which one candlestick is plotted on the chart. The main timeframes are:

- daily

- 4-hour

- hourly

- 5-minute

You can switch between them in the top menu of TradingView window:

The common mistake # 2 is that beginners usually trade 1-minute time frames. They think that with one-minute charts they have more candlestick combinations and can trade even 12 hours a day. However, such an approach suits only professional scalpers. If you’re not one of them, let’s pick the right time frame for you:

- Do you prefer taking risks? Are you prone to jaywalking? Do you like extreme sports? Do you always feel the need for some adrenaline? Then pick a 5 or 15-minute time frame.

- If you like being on the safe side, select a wider time frame – one hour, 4 hour, or daily will do.

Step 3. Select your trading instrument

Pick one or several financial instruments. In the Forex market, traders usually work with currency pairs. The most popular are 7 major currency pairs or “majors”:

- The euro and US dollar: EUR/USD.

- The US dollar and Japanese yen: USD/JPY.

- The British pound sterling and US dollar: GBP/USD.

- The US dollar and Swiss franc: USD/CHF.

- The Australian dollar and US dollar: AUD/USD.

- The US dollar and Canadian dollar: USD/CAD.

- The New Zealand dollar and US dollar: NZD/USD.

And here comes typical mistake # 3: Simultaneously trading many currency pairs, blindly, having no clue what drives them.

All cool traders focus on one or two assets. If you want to become a professional trader, pick 2-3 currency pairs at the start. For example, EUR/USD, USD/JPY and AUD/USD. Do your research. Study volatility of a particular instrument, see how it reacts to news, study its relations with other pairs. Read about interest rates, set by the Central banks of the respective currencies and learn how they affect the prices.

You can do it later. And we’re moving on to the most interesting part:

Step 4. Analyzing a trading chart

A trader should focus on 3 components of a chart:

- Trend (the direction of the price)

- Zones (trend reversal areas)

- Candlesticks (indicates the price range, market’s open, high, low, and close price for the day)

That’s the theory. Why don’t we go straight to practice?

Step 5. Your first analysis

Open the daily chart and take a good look at it. Let’s find the trend first. Where does the price move: up, down or sideways? You don’t need any complex calculations here, just your eyes: 👀

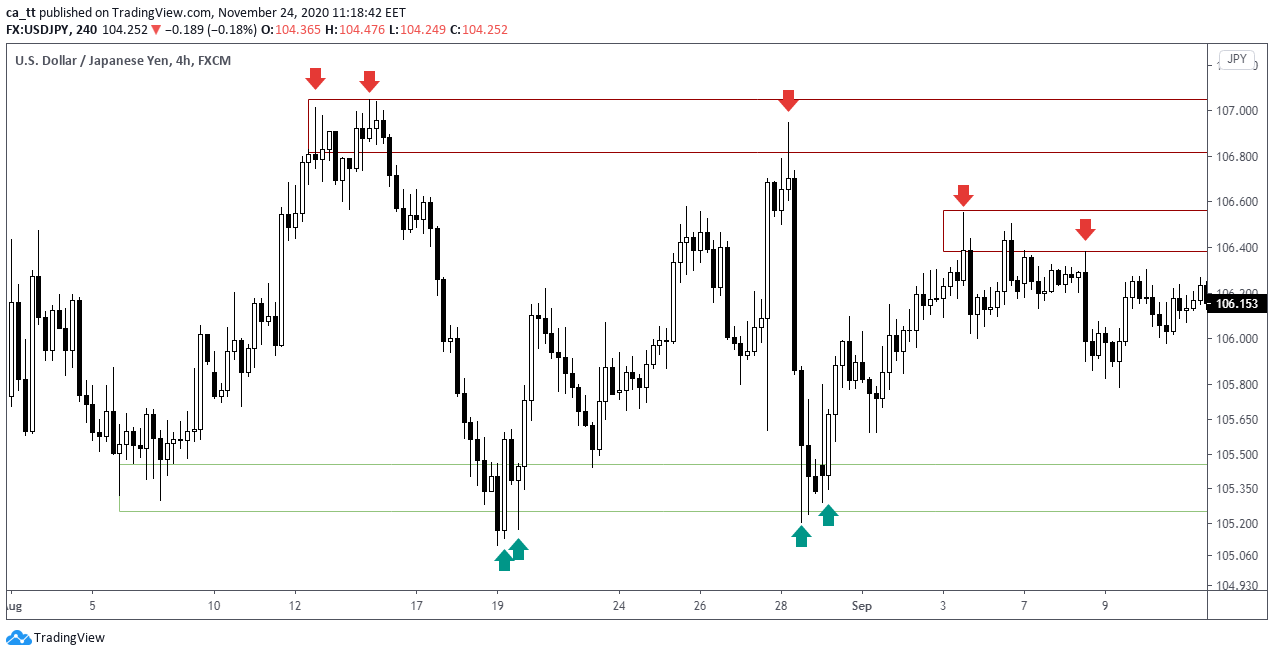

On our USD/JPY chart, we can see the price slowly going down. So, it’s a clear downtrend i.e:

- each subsequent bottom is lower than the previous one

- each subsequent top is lower than the previous one

Let’s plot the zones

Traders are always looking for supply and demand first – areas where prices trends to start rising or falling. No calculations again, only your eyes:

As we can see, the price goes to the demand zone (below) and starts to grow; when it approaches the supply zone – it often bounces down.

Supply/demand zones are the best areas to trade.

Candles

The final component of a trading chart are candlesticks.

Each candle is unique. There are no two identical candles on the chart. Let’s find the most powerful candles on the chart. Let’s go back to our zones. Pay attention to the candles formed near the supply / demand zones:

When a candle is formed within the demand/supply zone it’s usually a large candle that engulfs several previous ones and has long shadows. Such candlesticks signal an upcoming reversal. To earn decent money from Forex, you should know 2-3 patterns. In other words, it makes no sense to know 100 candlestick combinations. Learn to trade using 2-3 chart patterns – and your deposit will grow 2-3-4 times.

Summing up

In this article, we’ve considered everything you need to know for a quick start in trading. As you can see, it’s not that complicated: you don’t need to perform any complex calculations to earn money. You need to have entirely different qualities:

- willingness to learn new things

- patience

- consistency

Your trading journey is just beginning. Now, it all depends on the trading strategy you choose.

Author Profile

AMarkets CFD & Forex Online Broker

To open real account with AMarkets, Click Here.

To learn more about AMarkets, Click Here.

To contact AMarkets, Click Here.

Info

377 Views 1 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023