Bitcoin Fundamental Briefing, January 2021

The trail of rally…

We probably make no mistake if we call the recent month the brightest period in the life of Bitcoin and all cryptocurrency market in general. Many investors and traders are inspired, somebody even shocked and scared, but nobody stays indifferent to recent events. This was an incredible journey, but more and more thoughts are coming on what next? Where this rally leads bitcoin?

Just within two recent weeks, we see a lot of debates and speculation on this subject. And this is the question that stands vital to the majority of traders. That’s why, in this research, we focus mostly on the perspective of Bitcoin, providing opinions and views of reputable and reliable financial institutions. Additionally, we provide our outlook and some concern on longer-term perspective and set the question that nobody thinks about yet.

As we were two steps ahead when we have forecasted explosive money flow to the Bitcoin market from institutional investors in the middle of the last year, as now – we ask you the question that should make you think on whether Bitcoin is indeed attractive in the perspective of 1-2 years…

Market performance after the rally

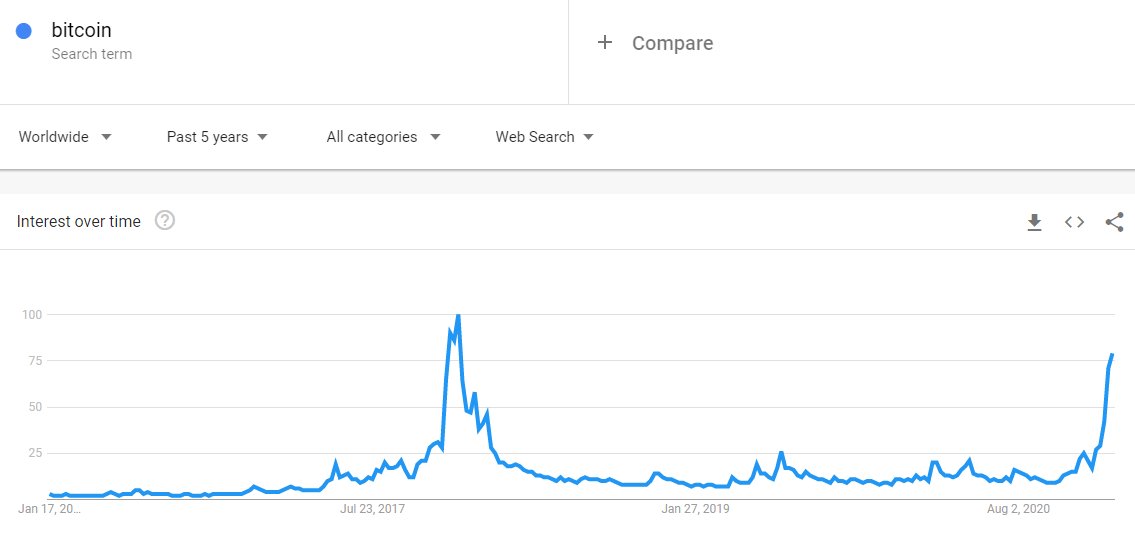

First is, let’s look at numbers that the market shows after the rally when it finally has turned to retracement. For instance, Google Trends shows that the popularity of Bitcoin almost returns to the top of 2017:

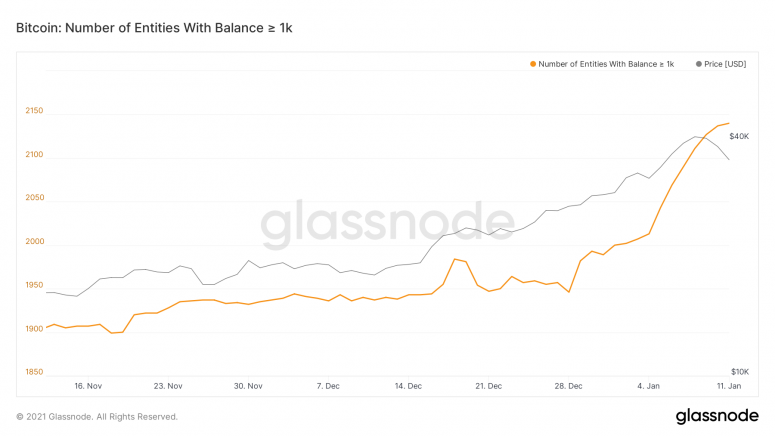

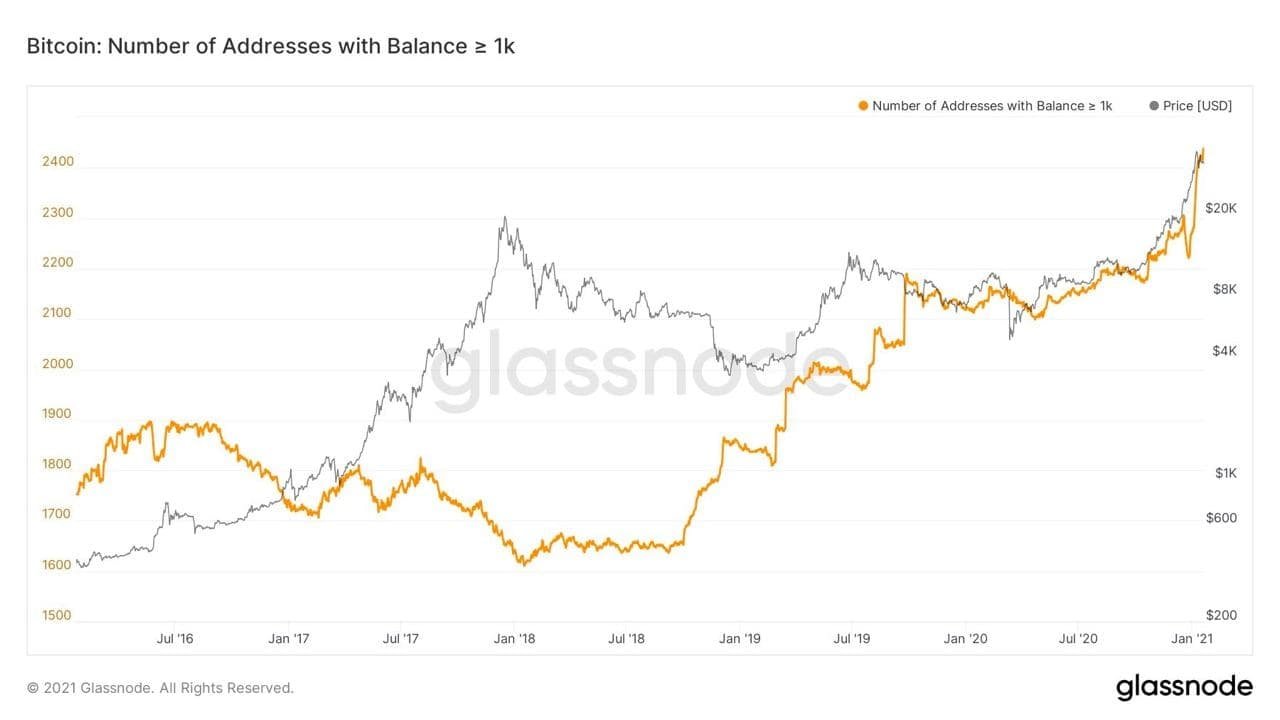

Glassnode reports that the recent pullback on the BTC market has not confused investors and big whales used it to accumulate more BTC:

The growth in the number of bitcoin whales in such circumstances indicates large investors’ confidence in the short-term nature of the correction. In previous bullish cycles, gains were often accompanied by pullbacks of 20% or more. The current growth phase is fueled by institutional investment. This sets the market apart from the 2017 situation when a retail craze gripped it.

According to the technical director of Glassnode, Rafael Schultze-Kraft, a short-term pullback in quotes should not affect confidence in the long-term growth of the first cryptocurrency. The expert believes that new highs in several fundamental indicators keep the signal to hold coins.

Previously we already mentioned his opinion on Bitcoin price potential – it could reach $200K per coin.

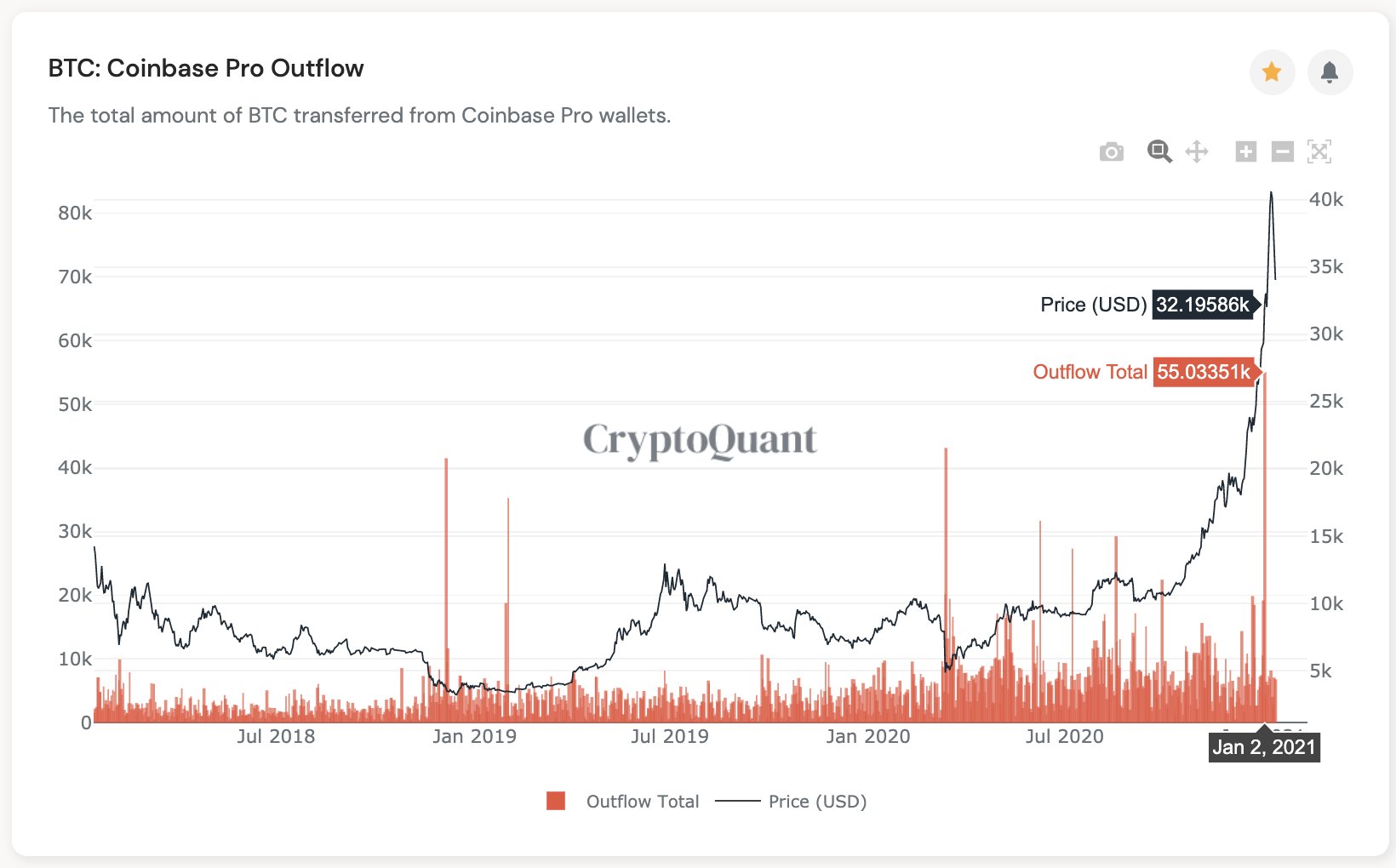

CryptoQuant director, Ki Young Ju suggests that as Institutional investors have bought BTC around 30-32K on average – they will protect this level.

There are many institutional investors who bought BTC at the 30-32k level. The Coinbase outflow on Jan 2nd was a three-year high. Speculative guess, but if these guys are behind this bull-run, they’ll protect the 30k level. Even if we have a dip, it wouldn’t go down below 28k.

Those of you who watch our regular technical updates on BTC knows that the 28K level is strong weekly support area and oversold level, as well.

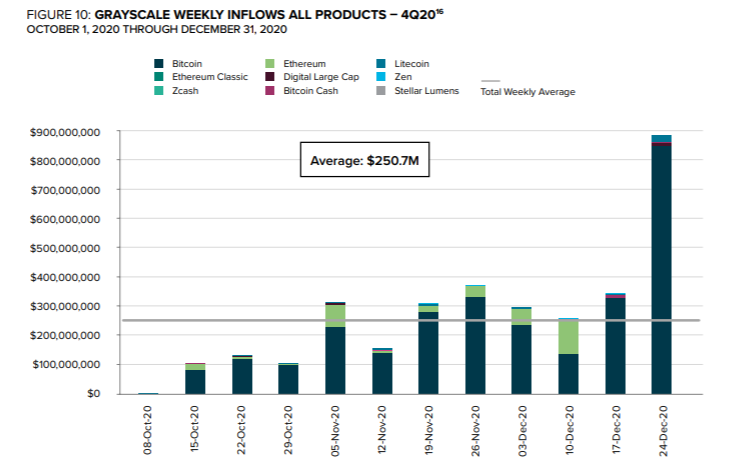

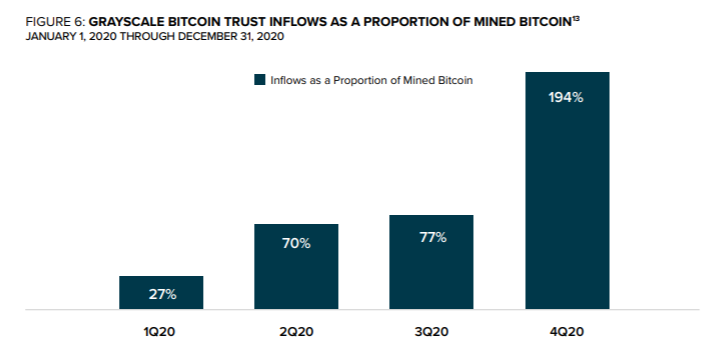

Grayscale – 4Q REPORT: Last quarter, we saw a total investment into Grayscale products of $3.26 billion – an average weekly investment of $251 million. 93% of total investments in Grayscale funds come from Institutional investors.

But, it is more interesting that Grayscale has bought two times greater amount of Bitcoins that were mined in the same period:

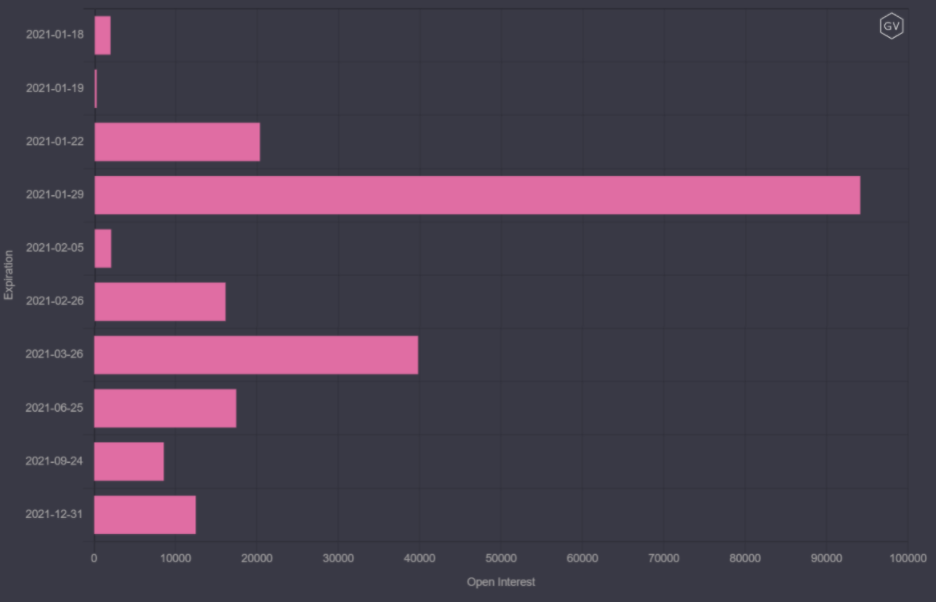

Open Interest on Bitcoin options hits $8.8 Bln:

Bitcoin addresses holding over 1000 BTC hit a new all-time-high. This year alone 164 addresses got added, currently worth $6 billion.

Santiment reports that Hodling of Bitcoin is becoming the trending strategy once again, after All Time High’s were made repeatedly the past couple months. Dormant coins that were being moved during the sharp rise above $40k are now… back to being dormant.

It means that drawdown of liquidity on the market works as additional supportive factor to the price of BTC.

To not overload report with numbers, we keep aside other trading volume statistics, hash rate, mining results, etc. All these numbers suggest that the current pullback doesn’t care yet the features of reversal. This type of behavior is mostly typical for retracements. But let’s take a look at what big banks and funds think about the current situation.

Big Whales Forecasts

Guggenheim Fund

It happens so that last time we’ve mentioned a big BTC purchase by this fund and their forecast of BTC price of $400K. So it makes sense to take a look at what they now think about the BTC perspective.

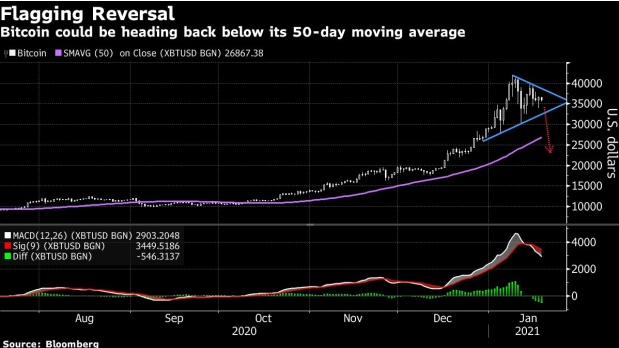

In short-term Scott Minerd suggests that profit taking is a good decision. As a target they point on 20K level, which is also our monthly retracement target:

Bitcoin’s parabolic rise is unsustainable in the near term. Vulnerable to a setback. The target technical upside of $35,000 has been exceeded. Time to take some money off the table.

“I think for the time being, we probably put in the top for bitcoin for the next year or so,” And we’re likely to see a full retracement back toward the 20,000 level.”

While in the longer term they confirm 400K expectation

JP MORGAN

JP Morgan strategists – 40’000 is key test for bitcoin boom

The cryptocurrency could be hurt by an exodus of trend-following investors unless it can “break out” above US$40,000 soon, a team including Nikolaos Panigirtzoglou said. The pattern of demand for Bitcoin futures and the US$22.9 billion Grayscale Bitcoin Trust will help determine the outlook, they added.

“The flow into the Grayscale Bitcoin Trust would likely need to sustain its US$100 million per day pace over the coming days and weeks for such a breakout to occur,”

The JPMorgan strategists said Bitcoin was in a similar position in late November, except with US$20,000 as the test. Flows of institutional investment into the Grayscale trust helped the world’s largest cryptocurrency extend its rally, they wrote. In general, JP Morgan treats investments pace into Grayscale as one of the major driving factors for BTC.

Trend-following traders “could propagate the past week’s correction” and “momentum signals will naturally decay from here up till the end of March” if Bitcoin’s price fails to break above US$40,000, they said.

Bloomberg Crypto: JPMorgan sees Bitcoin at $146,000 as long-term price target

Bitcoin’s market capitalization of around $575 billion would have to rise by 4.6 times — for a theoretical price of $146,000 — to match the total private sector investment in gold via exchange-traded funds or bars and coins, strategists led by Nikolaos Panigirtzoglou wrote in a note. But that outlook depends on the volatility of Bitcoin converging with that of gold to encourage more institutional investment, a process that will take some time, they said.

A crowding out of gold as an ‘alternative’ currency implies big upside for Bitcoin over the long term,” the strategists wrote Monday. However, “a convergence in volatilities between Bitcoin and gold is unlikely to happen quickly and is in our mind a multiyear process. This implies that the above-$146,000 theoretical Bitcoin price target should be considered as a long-term target, and thus an unsustainable price target for this year.”

At the same time JP Morgan analysts suggest that BTC can’t replace Gold in portfolios and can’t protect investors from markets collapses.

The upshot? Crypto investing might be best seen as way to protect against the loss of faith in a country’s currency or payment system — rather than a competitor to the likes of gold. Bitcoin is the “least reliable hedge during periods of acute market stress,” wrote strategists John Normand and Federico Manicardi in a report.

While they acknowledged the appeal of Bitcoin as an answer for investors who are worried about policy shocks, the team cautioned that it won’t behave like a traditional defensive asset anytime soon.

“The mainstreaming of crypto ownership is raising correlations with cyclical assets, potentially converting them from insurance to leverage,” they added.

Normand and Manicardi analyzed Bitcoin’s relationship with other assets to try to answer the question: Can investors use it to diversify a portfolio?

In the past five years, Bitcoin had a low correlation with hedges, such as gold and Treasuries and the yen, making it potentially useful for investors managing a broad portfolio. But in the recent run-up, the dynamics have changed and Bitcoin is moving more in lockstep with traditional cyclical markets.

“If sustained, this development could erode diversification value over time,” they said.

“Whether cryptocurrencies are judged eventually as a financial innovation or a speculative bubble, Bitcoin has already achieved the fastest-ever price appreciation of any must-have asset,” Normand and Manicardi wrote.

For now, JPMorgan sees headwinds for the largest cryptocurrency, with indicators like a buildup of speculative long positions and an increase in investment wallets holding small amounts of Bitcoin showing potential froth.

“The valuation and position backdrop has become a lot more challenging for Bitcoin at the beginning of the New Year,” the strategists wrote. “While we cannot exclude the possibility that the current speculative mania will propagate further pushing the Bitcoin price up toward the consensus region of between $50,000-$100,000, we believe that such price levels would prove unsustainable.”

JPMorgan Strategists Say U.S. ETF Could Sap Bitcoin Price

That’s because competition from such a vehicle could spark outflows from the Grayscale Bitcoin Trust, the world’s largest traded cryptocurrency fund. The ETF would erode the Grayscale trust’s effective monopoly, sparking outflows and a slide in its premium to net asset value — which in turn could hurt Bitcoin’s price, strategists led by Nikolaos Panigirtzoglou wrote in a note.

A cascade of GBTC outflows and a collapse of its premium would likely have negative near-term implications for Bitcoin given the flow and signaling importance of GBTC .

Skybridge COO: Big Investors Could Push Bitcoin Above $500,000

Skybridge Capital is an investment advisory firm with over $7 billion in assets under management and is run by former White House communications director Anthony Scaramucci. It launched its Bitcoin fund on January 4, with minimum investments of $50,000.

Institutional investment into Bitcoin could push the cryptocurrency’s price up to $500,000, according to Skybridge Capital COO Brett Messing—unless the coin remains a very niche asset.

“Bitcoin is either a super niche asset that trades between $500 and $50,000, or it’s worth well over $500,000,” Messing told Decrypt, adding, “It’s hard for me to see how $150,000 makes sense for it.”

In fact, Messing is so confident in Bitcoin’s future that he believes it will reach highs of $100,000 in just over a year.

“I will be surprised if we don’t get above $100,000 in the next 15, 16 months,” he added.

But a price of half a million dollars depends on whether or not institutional investors keep buying Bitcoin. If institutions continue to purchase Bitcoin, Messing said the price will surge past the $150,000 bracket, and do so easily.

“It’s just hard for me to see how you can justify Bitcoin being worth $150,000, because it doesn’t get there without institutions, so they stop buying? Morgan Stanley is going to buy for their clients but Goldman Sachs isn’t? It doesn’t seem possible to me,” he said.

UBS, Barclays

Cryptos Won’t Work as Actual Currencies, UBS Economist Says

The “fundamental flaw” inherent in cryptocurrencies is that supply can’t be reduced when demand is slumping in most cases, Paul Donovan, chief economist at UBS GWM, said in a video this week. That means they can’t be considered currencies, he said.

A “proper currency,” as Donovan termed it, can be a stable store of value, providing certainty that it will be able to buy the same basket of goods tomorrow as it buys today. That confidence is derived from central banks’ ability to reduce supply when demand is falling. There is no such mechanism for switching off supply on most cryptocurrencies, and therefore their value can slide — leading to a collapse in spending power.

“People are unlikely to want to use something as a currency if they’ve got absolutely no certainty about what they can buy with that tomorrow,” Donovan said in the video.

UBS Wealth Warns Clients Crypto Prices Can Actually Go to Zero

As Wall Street jumps on the Bitcoin rally like never before, the Swiss firm says prices may rise in the near term, but the industry faces existential risks over the long haul.

“There is little in our view to stop a cryptocurrency’s price from going to zero when a better designed version is launched or if regulatory changes stifle sentiment,” authors including Michael Bolliger, the chief investment officer for global emerging markets, said in a report Thursday. “Netscape and Myspace are examples of network applications that enjoyed widespread popularity but eventually disappeared,” the strategists wrote in response to rising client interest.

Like most firms, UBS Wealth is skeptical on the real-world utility of virtual tokens, but stop short of calling crypto prices a bubble, given the difficulty of determining a fair value for an asset without cash flows.

“Investors in cryptocurrencies must therefore limit the size of their investments to an amount they can afford to lose,” UBS Wealth said.

Barclays private bank slams bitcoin as ‘almost uninvestable’

Barclays Private Bank chief market strategist Gerald Moser doesn’t seem impressed by recent rally on the market.

“While it is nigh on impossible to forecast an expected return for bitcoin, its volatility makes the asset almost ‘uninvestable’ from a portfolio perspective,” Moser told Financial News.

Moser adds that the volatility seen in bitcoin mimics the behavior of other risk assets like oil.

“Many would probably throw the cryptocurrency out of any portfolio in a typical mean-variance optimization.”

“The performance of the cryptocurrency has been mostly driven by retail investors joining a seemingly unsustainable rally rather than institutional money investing on a long-term basis,” Moser said.

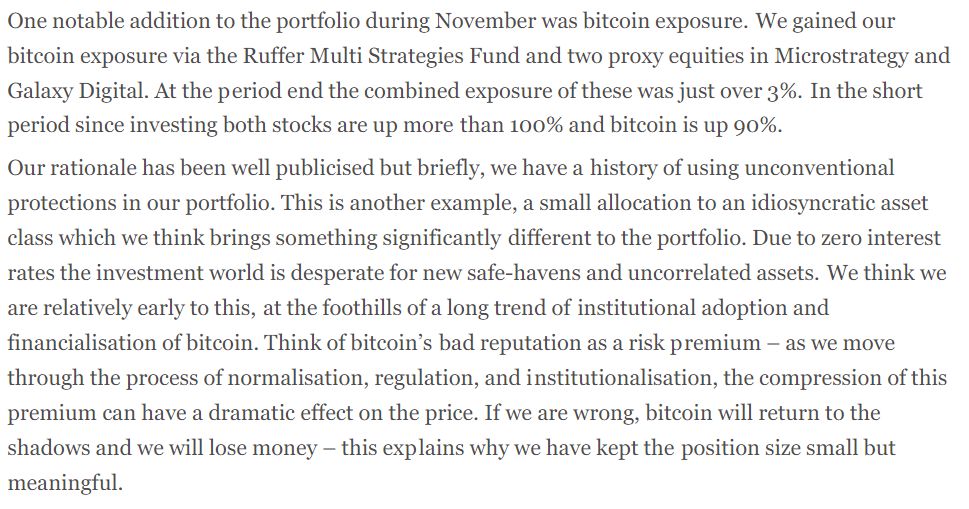

Ruffer Investments

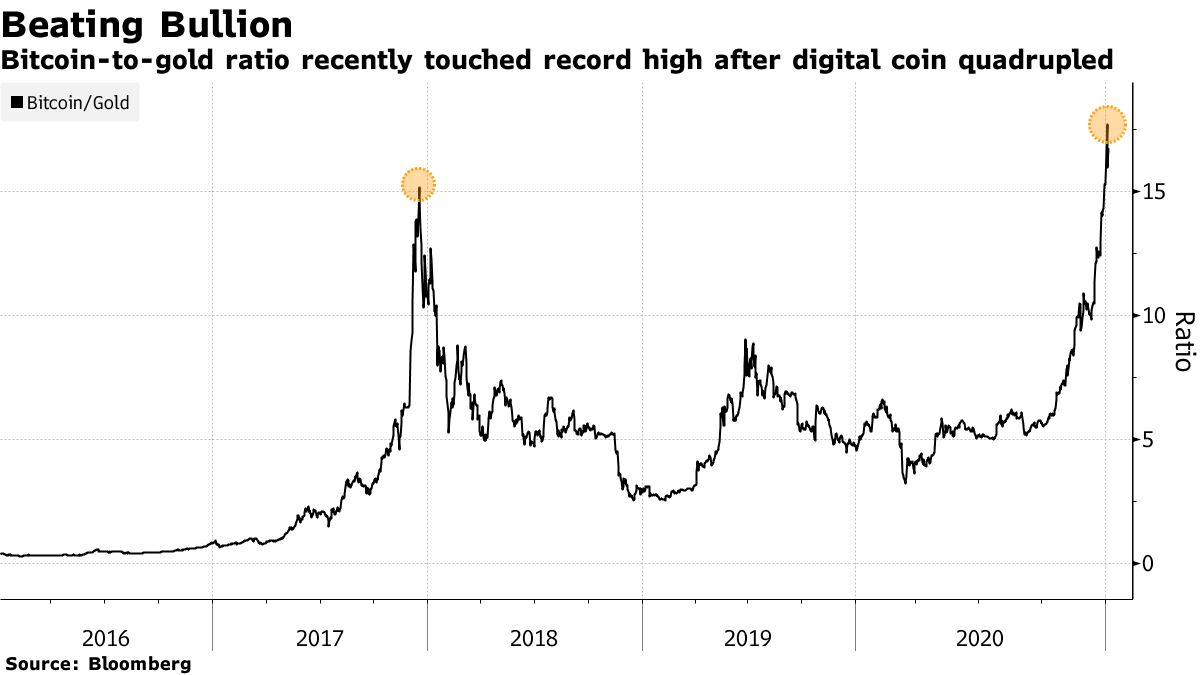

They put relatively small amount in the BTC, at least in percentage of the total portfolio but nominal value is around $744 Mln. They suggest that market stands in the beginning of adoption stage by Institutional Investors:

Bloomberg: Bitcoin volatility has scared off big companies

Many financial executives from Wall Street have changed their minds to invest in bitcoin after its rate fell by more than 25% last week, according to Bloomberg.

“Such a gap in the corporate reserve fund would put a cross on the future of any company in the S&P 500 index,” – said the experts of the publication.

Columbia School of Business professor Robert Willens said bitcoin reserves carry risks for financial executives they are unlikely to take after the first cryptocurrency fell last week.

“If corporations started buying financial assets for speculation unrelated to their core business, it would be an alarming signal to investors,” added JonesTrading chief market strategist Michael O’Rourke.

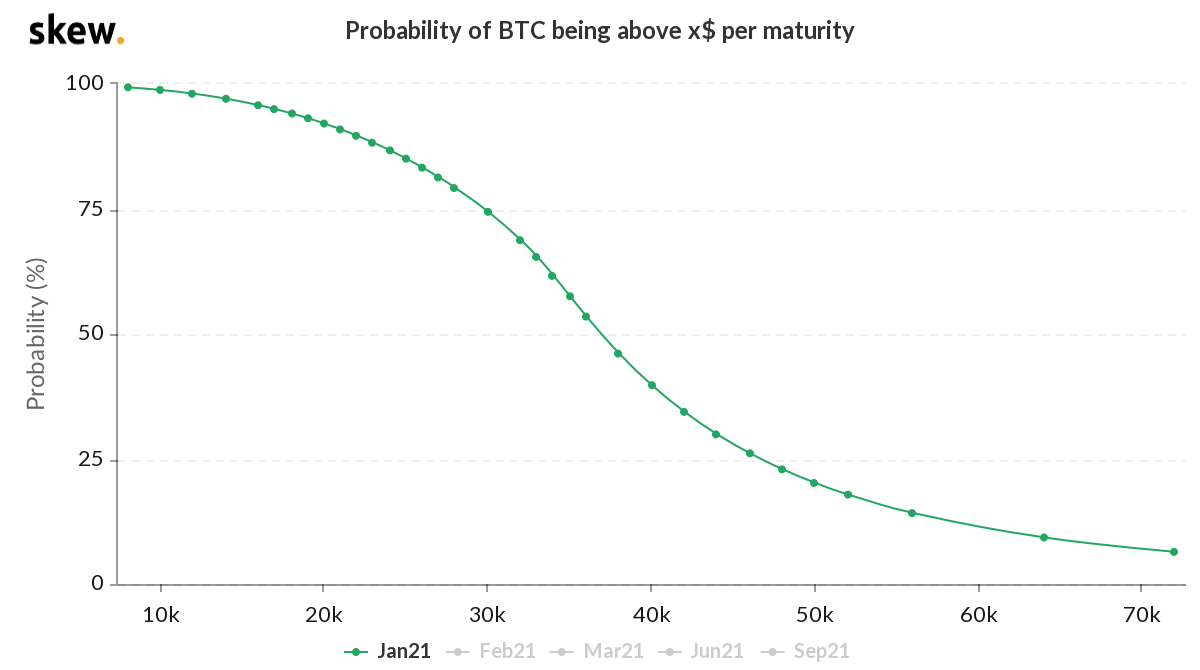

Options market shows BTC chances to rise above 30 000 around 75% and 50K around 20%

Bloomberg: Ethereum May Surge Sevenfold to $10,500, Fundstrat Global Says

Ether, the second-largest cryptocurrency, could climb more than sevenfold to $10,500 after reaching a record this week, according to Fundstrat Global Advisors LLC. Strategist David Grider’s prediction is based in part on the popularity of the related Ethereum blockchain for so-called decentralized finance applications. Ethereum has also made progress toward a network upgrade would allow it to process a similar number of transactions as Mastercard Inc. and Visa Inc.

Ether is “the best risk/reward investment play in crypto,” Grider wrote in a note Tuesday, adding that “blockchain computing may be the future of the cloud.” Risks include setbacks for the network upgrade or a crypto bear market, he said. Decentralized finance, or DeFi, allows people to do things like lend or borrow funds without the need for traditional intermediaries such as banks. Many DeFi applications are run on the Ethereum blockchain.

Some other Important news

Morgan Stanley has bought 11% shares of MicroStrategy company.

MicroStrategy stands among the companies that have made big investments in BTC last month. Their total investments stand around $1.125 Bln.

BlackRock just filed documents with the SEC that contain extensive discussion of Bitcoin. Excerpt: “Certain Funds may engage in futures contracts based on bitcoin.” This appears to be the first time BlackRock has made such mentions.

… and the cherry on the pie

In the last report, we’ve expressed an opinion that now it makes sense to think about investing in altcoins. We suggest that the cryptocurrency market repeats the classic stock market pattern – when blue chips are expensive, people start to buy the other companies. Something of this kind should happen in the cryptocurrency market as well.

Recently we’ve talked about this on the forum, and the primary question is what altcoins to choose. It is evident about ETH, but what about Ripple, Tezos, or maybe something else?

Here is the answer as about Ripple as about other altcoins that might become attractive soon:

Is Grayscale about to unveil a LINK trust?

Grayscale Investments could be set to launch a raft of new products including a Chainlink trust, if freshly unearthed filings are to be believed. On the same day, a Basic Attention Token (BAT) trust, Decentraland (MANA) trust, Livepeer (LPT) trust and a Tezos (XTZ) trust were also initiated.

We hope that this could help you to choose objects for future investments. 😉

Traditional Conclusion

So, when the market stands at the peak, everybody is extremely fascinating, setting new, higher, and higher targets, predicting an exciting future.

400K/coin, 500K/coin – sounds like music. But, where is the common sense? For example, our technical analysis based on DiNapoli Volatility Breakout pattern suggests the ultimate target around 60-100K per coin in a long-term perspective. The definite value we could estimate when we get a precise number for the “C” point. Supposedly “C” point retracement should be 50-62%, although it is not the fact yet that the current pullback is the BC leg already.

Anyway, speaking about technical targets, the position of JP Morgan analysts looks logical and weighted. Besides, it sounds reasonable – 40-50K in the short-term by momentum and ~150K long-term. It is relatively conservative compared to other opinions, and we think it is something that we could use as a target.

But our conclusion mostly relates not to upside targets but more fundamental things. We suggest that market society misses a lot of important moments that have been expressed above. Here they are:

- UBS: There is no such mechanism for switching off supply on most cryptocurrencies, and therefore their value can slide — leading to a collapse in spending power.

- JP Morgan: in the recent run-up, the dynamics have changed and Bitcoin is moving more in lockstep with traditional cyclical markets. “If sustained, this development could erode diversification value over time,” they said.

It means that the wide coming of Institutional investors to crypto market brings not only their money but also their investment methods. This, in turn, means that their money works only in well-known cyclical patterns and now involves Bitcoin as they easily overcome individuals by investing volumes. And this leads us to the revolutionary conclusion, which keeps us again two steps ahead.Think about what happens to Bitcoin when Fed starts to raise interest rates. Bitcoin is a non-interest bearing asset and loose attractiveness compares to traditional assets, bonds in particular when rates are rising. So, with a high probability, Bitcoin shares the fate of gold as soon as rates start rising again. We think that the Fed could start preparing to adjust their policy as early as in Autumn of 2021. The market could start preparation even earlier. As you could see – interest rates already begin to rise. Now – add here the UBS statement that it is impossible to contract the supply of cryptocurrencies, even if demand is dropping. What could we get in the result? Right – a miserable collapse that the world has not seen before.

Besides, every time we talk about too close attention from Central Bank to the regulation of Bitcoin. This is another reason (by Barclays’ opinion as well) why investors’ interest in cryptocurrencies could decrease:

Reuters: ECB President Christine Lagarde called for global regulation of Bitcoin, saying the digital currency had been used for money laundering activities in some instances and that any loopholes needed to be closed.

Jerome Powell: Regulation of stable coins is priority task for Fed

Thus, we call – ride the tide but do this wisely, keeping in mind things that we’ve just discussed. Let’s greed fever will never touch you, and you take chips off the table in time.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

758 Views 1 CommentsComments

Good Information.

Thanks

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023