Regulators: National Futures Association NFA Self-Regulatory Organization

Prerequisite: Before you complain to regulators

| Country: | United States of America |

| Country Common Nicknames: | United States, USA, US |

| Big Bad Regulator, Long Name: | National Futures Association |

| BBR, Short name: | NFA |

| Type: | Self-Regulatory Organization [Government Authorized] |

| Main website homepage: | |

| Regulatory licenses issued: | [Yes, required membership of most professional market participants, separate from CFTC] |

| Complaints: | yes, main complain form |

| Do they do alerts? | Yes, usually 1-2 times a month |

| Do they ever eject a registered company? | Yes |

| Do they ever fine a registered company? | Yes. News releases show regular 6+ figure fines |

| Do they ever directly or indirectly file criminal charges? | No. Referred to CFTC or other regulatory agency. |

| Do they ever mandate repayments to clients? | No. Fines and membership bans only, unless arbitration is done….which has fees attached. |

| Contact info | see below [keep reading until end] |

NFA is actually a self-regulatory organization (SRO) or more specifically a Registered Futures Association that is delegated by the CFTC to develop best practices and perform certain supervisory roles on CFTC’s behalf. Certain firms are required by CFTC rules to register with NFA, which includes Futures commission merchants (FCMs), Introducing Brokers (IBs) and Retail Foreign Exchange Dealer (RFED) (Forex Brokers). And the process is quite intense and expensive. More details will be in the CFTC regulator article.

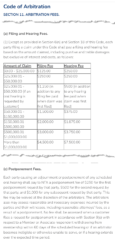

What is interesting about the NFA is that a customer could theoretically complain at both CFTC and NFA separately for any misbehavior at a NFA member forex firm. Regular NFA complaints will not result in restitution, but you may file an arbitration claim if you have good evidence. But there are filing/hearing fees, which can get quite pricey depending on the claim amount. Screenshot from Section 11 of the Code of Arbitration

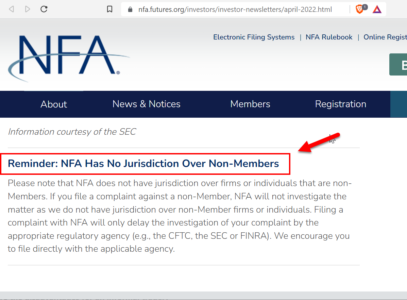

Also note that NFA cannot accept complaints about non-member firms. So you are reminded to forward non-member complaints to other regulatory agencies such as CFTC,

Of significant importance to FPA readers will be the Investor Education section, where they actually attempt to explain in laymen’s terms how the markets work. Quick links to how investors should approach opening a trading account, NFA quarterly newsletter, finding information on their broker using BASIC database or file a complaint are right there. It’s not a full course on market microstructure, but I can appreciate that these important tools are not obscure. But are there and easily accessible.

There is actually tons more information on the NFA website and I could easily make 5+ articles on regulations alone. I cut through a lot of the portions that most retail traders would not be too interested in so that you may get educated quickly and skip directly to the parts that affect users the most:

-

- researching company regulatory status

- rules related to how forex transactions are governed

- how to complain

- educational resources

It’s all here. I am particularly fascinated by the regulatory monitoring requirement where a daily summary of trade history must be uploaded to a specific database just to ensure trade finality; called Forex Transaction Reporting Execution Surveillance System (ForTRESS). There are also additional rules that state that brokers have up to 15 minutes to make a correction to a price. Afterwards, it is pretty much final. In this regard, NFA went out of their way to all but eliminate any chance of “bucketshopping”. The more I read the laws and rules, the more I actually respect the spirit of what NFA tried to do to protect retail traders.

#RegulatedFool

_______________________________________________

Remember to study the Before you complain to regulators guide before reaching out.

| Contact emails | information@nfa.futures.org |

| Contact list | https://www.nfa.futures.org/contact-nfa/index.html |

| Additional contacts | Read below |

|

Chicago |

300 S. Riverside Plaza, #1800 |

| New York | One New York Plaza, #4300 New York, NY 10004 212-608-8660 212-964-3913 (fax) |

| NFA Rules and best practices for members | NFA Rulebook |

| Member lookup | Background Affiliation Status Information Center (BASIC) |

| Complaint against member (broker) | Complaints homepage |

Author Profile

4EverMaAT

MaAT is an ancient Kemetic phrase that translates to "Truth, reciprocity, balance". Obviously when a company or trader tries to scam their client/business partner out of money, this upsets the natural balance that exists when contracts are formed and traded. But the best way forward is not to be a helpless victim, but to ensure that you are informed with whom you are trading with. And more importantly, whom you are trusting your hard earned dollars with.

4EverMaAT couldn't help but notice that the scams that most people fall for are very similar day by day, month over month, and year after year. MaAT believes that less people would fall for scams if only they took some more responsibility for their own trading choices. This ultimately means resisting one's own gambling impulse and gathering hard evidence (video, screenshot, trading history, etc) of all relevant trading activity. And consolidating this evidence so that it creates a clear, concise timeline of events. More details are related at upcoming blog RegulatedFool.com

Info

559 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023