Bitcoin Fundamental Briefing, January 2023

ARE THINGS GOING TO CHANGE?

Since the beginning of the January Bitcoin and other crypto assets show great upside performance, so that market participants start asking – wether the bottom is achieved and market is in the stage of direction changing? There are many reasons to think so. Inflation shows decreasing for 2nd consecutive month, job market is constantly strong, GDP numbers stand positive. Analysts oftener start talking about Fed pivoting and Inflation peaking.

Besides, amount of positive things have happened in crypto industry as well. FTX tragedy is appearing to be not as devastating, as $5 Bln is returned to investors and additionally 700 Mln is under confiscation from S. B-Fried in favor of the clients. Now speech is going about even FTX could keep working. This has brought euphoria to the markets and we already see BTC above 20K area. But how reliable this rally is? Can’t it turn down as fast as it has started? That’s the question that we try to answer here.

MARKET OVERVIEW

Bitcoin rallied to its highest levels since August ahead of celebrations for the Lunar New Year holiday throughout Asia, surging at the start of the weekend for a second straight time.

The largest cryptocurrency rose as much as 2.1% to $22,786, the highest level since Aug. 18. This comes amid more predictions that the cryptocurrency market has passed its lows, and at the start of the Lunar New Year holiday celebrated across much of Asia, also often referred to as Chinese New Year.

Bitcoin has rallied to start 2023 — it and Ether are up more than 35% — amid a more promising macro picture. US short-term inflation expectations fell in early January to the lowest in almost two years, providing a bigger-than-expected boost to consumer sentiment, according to the University of Michigan’s preliminary survey reading. The Federal Reserve is on track to downshift to smaller interest-rate increases following the further cooling in prices, though it’s likely to keep hiking until pressures show more definitive signs of slowing.

Still, even bulls express some caution. Sean Farrell, head of digital asset strategy at Fundstrat, predicts that Bitcoin will rise to $35,000 to $44,000 this year, and that Ether will hit $2,400 to $3,200 — but he’s still advising that there could be trouble in the markets with issues like turbulence at Digital Currency Group still looming large.

“Despite our view that the absolute lows for the majors are in, we still believe there are some near-term risks to remain cognizant of,” Farrell wrote in a note Friday. “These include additional fallout from DCG, one more swipe at risk assets at the next FOMC meeting, and the fact that despite the recent rally, we are still amidst what we would consider an on-chain bear market.”

Bitcoin Outpaces Gold in 2023?

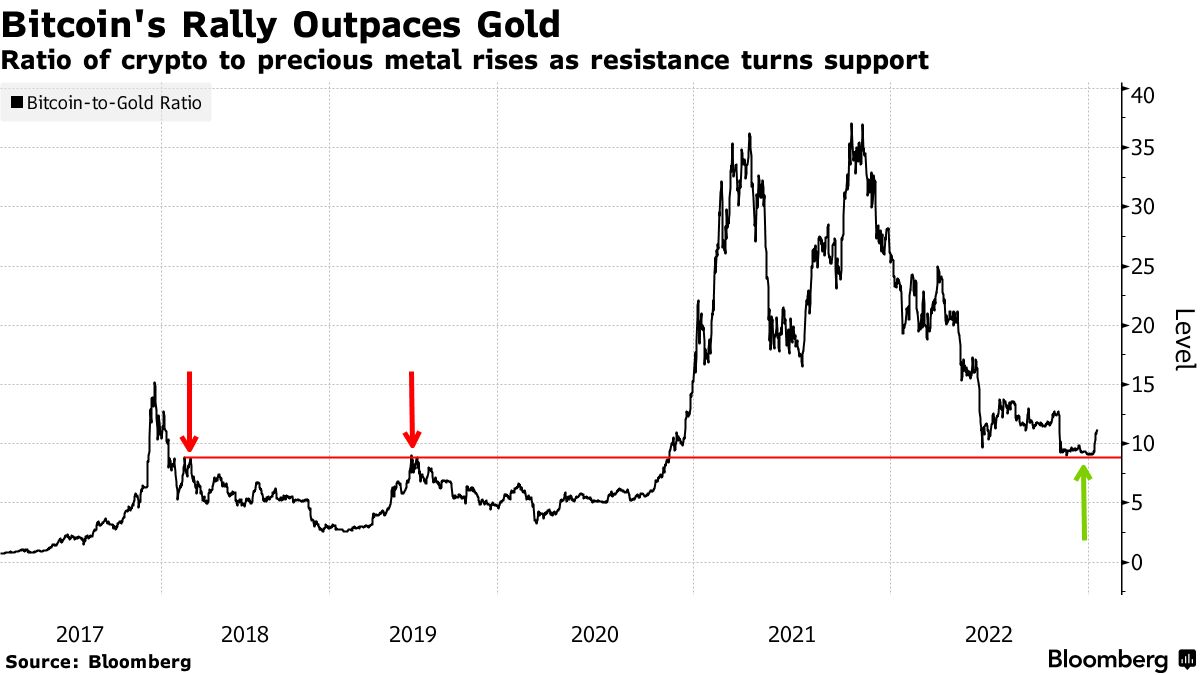

Some traders are taken by euphoria and started the same old song about bitcoin advantage of the gold. This myth was crushed in recent two years, but recent BTC rally again triggers the same talks.

Bitcoin has not only started the new year with a rally, its gains have outpaced those of gold. That’s reversed — at least temporarily — part of the 76% decline in the Bitcoin-to-gold ratio over 12 months through November, a period during which the cryptocurrency tumbled into a bear market. The gauge actually found a low two months ago and drifted sideways, taking support at resistance formerly seen in 2018 and 2019. The jump so far in 2023 signals that the barrier has now turned into a significant support area.

US short-term inflation expectations fell in early January to the lowest in nearly two years, providing a bigger-than-expected boost to consumer sentiment, according to the University of Michigan’s preliminary survey reading. A separate report showed consumer prices rising 6.5% in the 12 months through December, marking the slowest inflation rate in more than a year.

The Federal Reserve is on track to downshift to smaller interest-rate increases following the further cooling in prices, though it’s likely to keep hiking until pressures show more definitive signs of slowing. That’s helped boost risk assets like the Nasdaq 100 stock index, which has gained for six straight days.

The upward moves have caught shorts by surprise — crypto short liquidations above 17K level have topped $100 million in five of the past six days, according to data from Coinglass. Saturday’s total was the highest, topping $449 million.

The upward trajectory could inject even further optimism into a market that’s been struggling to find good news in recent months.

“Declining CPI coupled with the announcement that the FTX liquidators have recovered $5 billion in liquid assets have given crypto markets plenty of factors to forget the macro picture, which is still bearish,” said Hayden Hughes, chief executive officer of social-trading platform Alpha Impact. “Markets have plenty of positive momentum heading into the next FOMC meeting later this month.”

Still some concern exists…

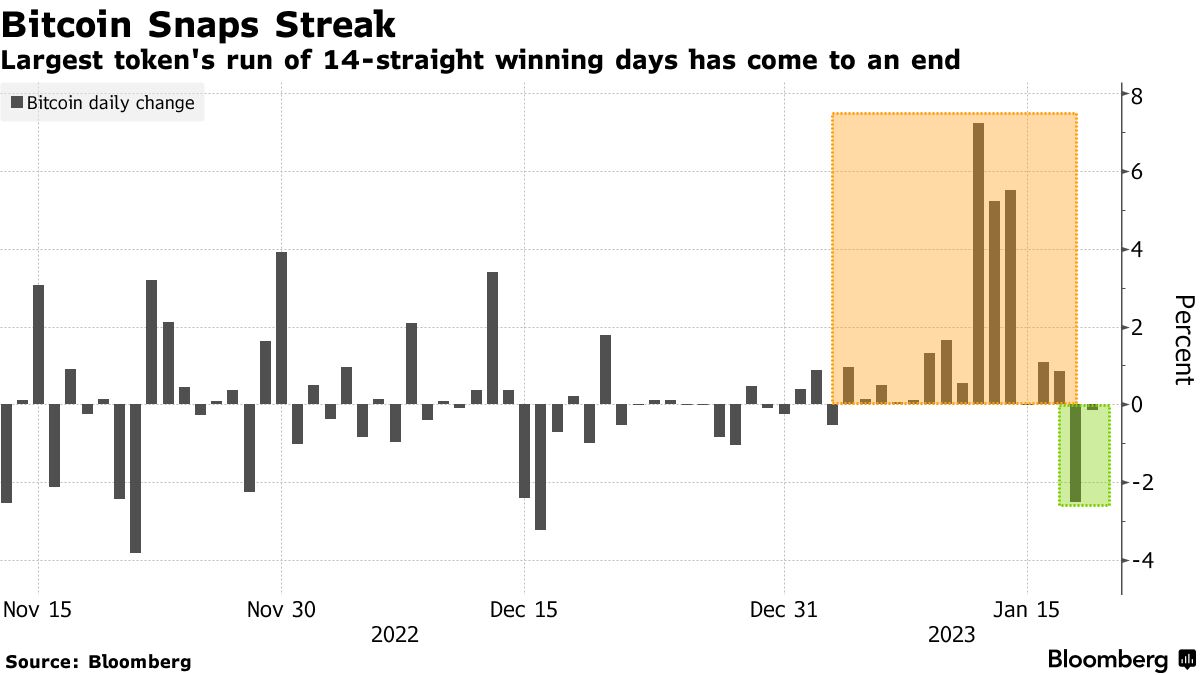

Bitcoin “has now become very overbought on a near-term basis” and is “getting ready for a short-term pullback,” said Matt Maley, chief market strategist at Miller Tabak + Co.

Bitcoin’s 14-day relative strength index has dropped from more than 90 but remains above 70, the threshold for so-called overbought conditions. For some strategists, that hints at the possibility of a pause in Bitcoin’s 2023 advance.

Shares fell and Treasuries rallied on Thursday on economic growth concerns, and that somber sentiment washed across digital assets too. The crypto sector also continues to grapple with the fallout of the collapse of the FTX exchange.

Genesis Global Capital — the lending unit of Digital Currency Group — is laying the groundwork for a bankruptcy filing as soon as this week, according to people with knowledge of the situation. DCG’s businesses are key cogs in the ailing digital-asset industry.

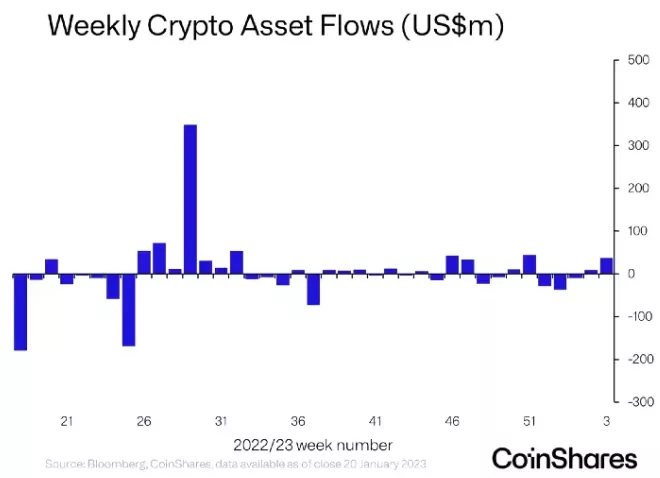

From January 14 to January 20, $37 million was received in cryptocurrency investment products. Two-thirds of this amount was formed by bearish bitcoin funds, CoinShares analysts write.

Investors have invested $25.5 million in this type of products (the maximum inflow since July 2022), only $5.7 million in traditional instruments based on the first cryptocurrency.

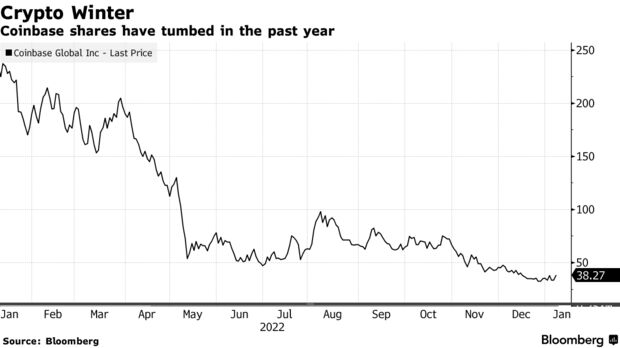

Coinbase Global Inc. is firing about 950 employees, or 20% of its workforce, as the worsening crypto slump spurs another round of layoffs at the biggest US digital-asset exchange.

“This is the first time we’ve seen a crypto cycle coincide with a broader economic downturn,” Armstrong wrote in the blog. “We also reduced headcount last year as the market started to correct, and in hindsight, we could have cut further at that time.”

Crypto exchange Huobi is planning to lay off 20% of its workforce, as a months-long rout in digital asset prices continues to disrupt many of the industry’s largest companies. Huobi’s workforce reduction comes as the exchange suffers continued outflows.

Regulatory issues

Some analysts also suggest that crypto market ignores the bigger picture of regulatory issues. In the first few weeks of 2023, watchdogs have done a lot. On Jan. 3, a joint statement by US bank regulators warned the industry of crypto risks creeping into the banking system. Then came a $100 million settlement with Coinbase Global Inc. over weak internal controls, a lawsuit against the Winklevoss twins’ Gemini and broker Genesis for allegedly selling unregistered securities, and a $45 million settlement with lending platform Nexo (which has ceased US operations). Subpoenas are flying.

The wheels of justice turn slowly — the Gemini and Genesis complaint came too late for customers fighting to get back $900 million in trapped funds — but they’re accelerating now. Regulators like the SEC rightly feel vindicated by the past year’s events, which saw a widespread loss of faith in crypto fail to snowball into a wider economic crisis. The collapse of FTX demonstrated the industry’s failings but also the benefits of a tough regulatory line on exchanges, such as when the SEC intervened behind the scenes in 2021 to ward Coinbase off launching its own crypto-lending product.

Regulators with long memories are keeping an active eye on banks’ crypto exposure as the real risk gauge. Silvergate Capital Corp., already crushed by its exposure to FTX, seems to have gotten the message and written down the value of stablecoin assets it bought from Meta Platforms Inc.’s Diem — worth almost $200 million at the time — to basically nothing.

Regulation has critics. But money laundering, fraud, market manipulation and tax evasion aren’t risks that just fix themselves. As the European Central Bank’s Fabio Panetta has pointed out, regulators see the costs to society of unregulated digital assets as high and requiring more action. The crackdown is clearly just getting started; those who are keen to dive back into crypto, even having just taken a bath, should take note.

FUNDAMENTALS

Glassnode: An Opportunity, or a Trap?

The recent market rally has pushed BTC prices above $23k, and has surprised many investors. However, alongside higher prices, comes an increased motivation for holders and miners to take exit liquidity, especially after the prolonged and painful bear of 2022.

The recent surge to $23K has pushed this metric to > 97.5% in profit for the first time since the ATH in November 2021. Given this substantial spike in profitability, the probability of sell pressure sourced from STHs (Short-term Holders) is likely to grow accordingly.

The sustainability of the current rally can be considered a balance between inflowing and newly deployed demand, meeting the supply drawn out of investor wallets by these higher prices.

Despite the recovery from a historically undervalued condition, remarkably, the volume of coins aged more than 6 months (Old-Supply) 🔵 has increased by 301k BTC since early December. This divergence highlights the strength of the HODLing conviction via the recent market rally.

In other words, the supply held by HODLers has shifted from a contraction of -314k BTC/month following FTX collapsing, to an expansion at a rate of +100k BTC/month.

Similar to the short-term holders, Miners have also taken advantage of the recent price appreciation to shore up their balance sheets. With a notable recovery in miner USD-denominated revenues, the resulting behavior shift has switched from accumulation of +8.5k BTC/month, to distribution of -1.6k BTC/month. Miners have spent some -5.6k BTC since 8-Jan and have experienced a net balance decline YTD.

Glassnode Conclusion

The recent price recovery from the December lows to over $23.2k has significantly improved investor profitability across the board. Consulting the price models, we can see that the recent rally has reclaimed several cost-basis models and pushed the proposition of supply held at a profit into the more favourable territory.

However, higher prices and the allure of profits after an extended bear market tend to motivate supply to re-enter liquid circulation. Analysis of cohort behavior shows that short-term holders and miners have been motivated by the opportunity to liquidate a portion of their holdings.

On the contrary, the supply held by long-term holders continues to grow, which can be argued to be a signal of strength and conviction across this cohort. Given the effect of long-term holders on the macro trend, watching their spending is likely a key toolset to track over the coming weeks.

Mike McGlone, Bloomberg Intelligence –

The first cryptocurrency forms the bottom in the same way as it was before the beginning of the bullish phase in 2019. A significant difference lies in the tightening of monetary policy in the world.

Four years ago, there was a widespread reduction in interest rates by monetary regulators. At the moment, they are still raising them, the specialist said.

“Then the Fed had already started easing, and we held the bottom and broke higher. […] Right now they are aggressively tightening [policy]. Give him [bitcoin] some time. In general, yes, a bullish picture,” McGlone explained.

The expert predicted the departure of the Nasdaq Composite index below the 200-day moving average. This may delay the rise in price of digital gold.

“Liquidity is still declining. If Nasdaq collapses, everything will crumble. Bitcoin will become part of this [process],” the expert warned.

According to McGlone, investors have entered an “unprecedented” environment — when there are rebounds in the bear market, and the Fed simply says: “Sorry, we are taking the punch bowl [low interest rates] and we will not return it.”

Bernstein analysts Gautam Chhugani and Manas Agrawal were cautious, saying the likelihood of the rally continuing is slim with no signs of “any new capital allocations to sustain this rally.”

“As we interact with multiple institutional players, we do believe institutional capital will start positioning themselves in crypto in 2023, as crypto heads towards a more regulated asset class,” the analysts wrote in a note.

The crypto market is “firmly split between those who believe this is a bear market rally driven by short covering and those who feel that current prices simply represent a normalization after the chaos of late 2022,” according to Farthing.

Most close opinion to our view is from Lyn Alden who suggests that it is naive to assume that the good times will continue unchecked. The reason, she says, lies with the United States lawmakers and the Federal Reserve.

“I expect the BTC bottom to be a process,” she summarized about the current state of Bitcoin. “BTC prices are heavily tied to liquidity conditions, and liquidity conditions have been improving since Q4 2022.”

That recovery has effectively removed any trace of the FTX debacle from the chart, with BTC/USD now circling its highest levels since mid-August.

“The FTX/Alameda collapse pulled down the industry in the second half of Q4 even as many other assets rallied (equities, gold, etc), and now it seems that BTC is playing a bit of catch-up, and getting back to where it would have been without the FTX/Alameda collapse occurring,” Alden continued.

What could lie beyond that “catch-up,” however, could be less savory for bulls. The Fed is currently conducting quantitative tightening (QT), removing liquidity from the economy to fight inflation after several years of mass liquidity injections, which began in March 2020.

These are being mitigated thanks to U.S. domestic politics, but later on, the status quo could shift back to the kind of restrictive mood seen throughout Bitcoin’s bear market year of 2022.

“There is considerable danger ahead of for the second half of 2023,” Alden explained. Liquidity conditions are good right now in part because the U.S. Treasury is drawing down its cash balance to avoid going over the debt ceiling, and this pushes liquidity into the financial system. So, the Treasury has been offsetting some of the QT that the Federal Reserve is doing. Once the debt ceiling issue gets resolved, the Treasury will be refilling its cash account, which pulls liquidity out of the system. At that point, both the Treasury and Fed will be sucking liquidity out of the system, and that would create a vulnerable time for risk assets in general including BTC.”

In the long term, however, Alden is confident that Bitcoin will recover from its recent lows for good.

“I do think this is a deep value accumulation zone for BTC with a 3-5 year view, but traders should be aware of the liquidity risks in the second half of this year,” she concluded.

Although this last view of Lyn Alden is very close to our one, but still we’re watching a bit deeper on this problem and need to explain few things.

FPA FUNDAMENTAL VIEW

Above we’ve heard few things that we’re agree with. First is, as Glassnode said – let’s see whether rising demand is able to absorb supply from those who tries to us current bounce to sell BTC. Yes, this is mostly tactical issue, not purely fundamental, but it could show how serious buyers are, and probably could clarify the participation of institutional investors with this rally. Whether any big companies return to market or, rally is going only on a households’ shoulders. This is important conclusion that we could make soon.

Second thing that we agree with is from Mike McGlone. Indeed, currently we have absolutely different environment compares to any previous BTC rally. Right now Fed is tightening, but not easing. And although BTC market is ready to grow – high rates that Fed intends to hold for long term and even to increase more definitely will become a headwind to BTC performance. Finally Lyn Adlen explains the same issue with a bit more details.

But there are many other fundamental reasons to have doubts on BTC rally. We consider them below. They are not new. Those of you who read our weekly fundamental reports on Forex and Gold markets should know them. But first, let’s take a look at technical picture.

Technical outlook

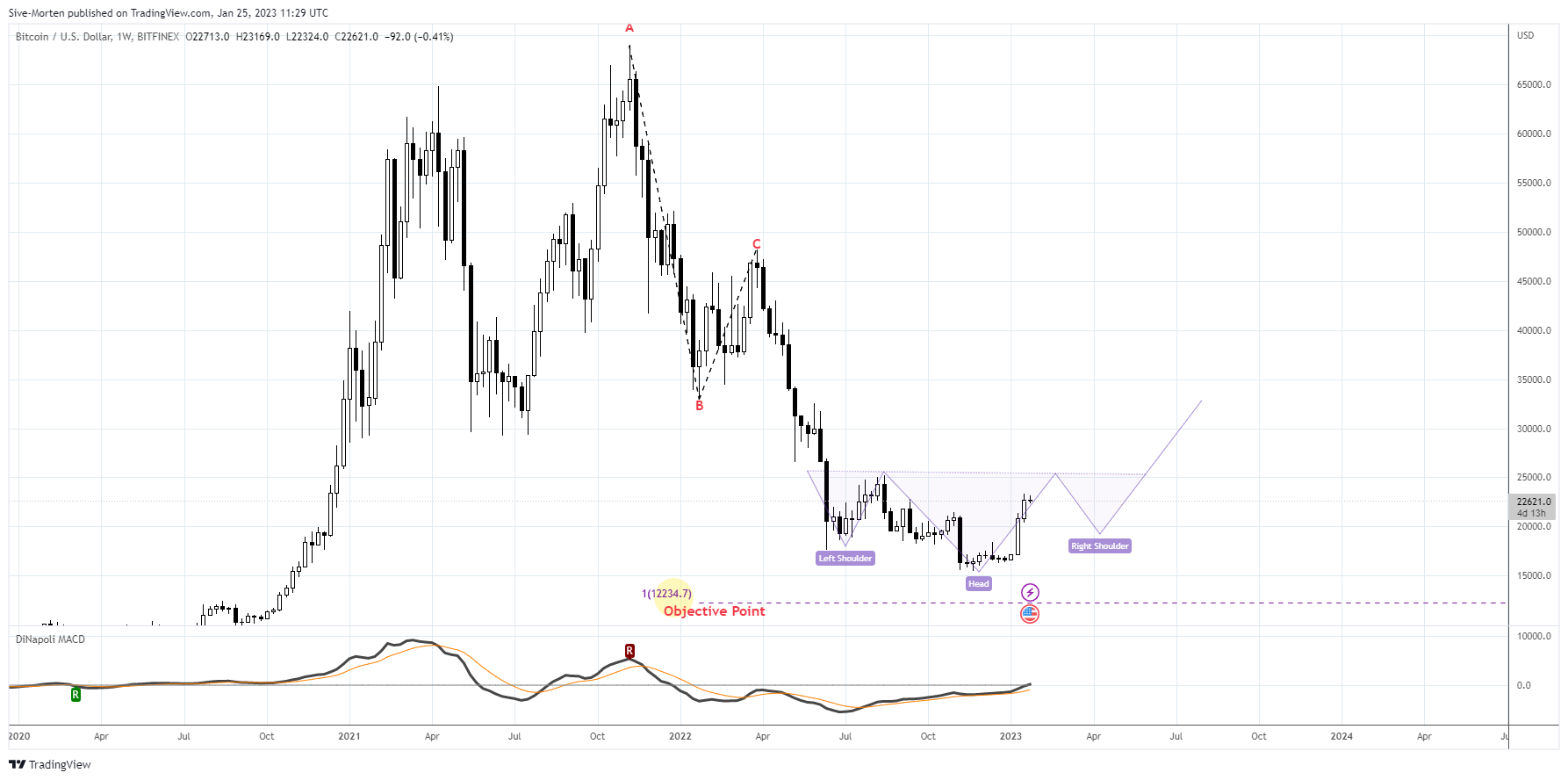

Here you could see how small still the bounce in a monthly scale. Long term trend remains bearish (red line) until 45-48K area around major 5/8 Fib level. It means that any action below this level will be still a retracement. To change long term background market has to break all major Fib levels and turn trend into bullish. On a way up we also have few other resistance levels, and the strongest one is 35.7K – 38K. This is Fib Confluence resistsance area (combination of two Fib levels) and Yearly Pivot resistance 1 (YPR1), which actually also could be used as an indicator. According to Pivot points framework, if YPR holds the price action – this is still a retracement, not a new trend direction.

At the same time, in shorter-term period, we have no objection from tactical upside action. Market could climb higher, because technical processes with money supply in US should continue for few months more. US Treasury still has around 350-400 Bln on Fed deposit account which is a potential source for markets support. In 2022 US Treasury has spent around $600-650 Bln. So the rest should be enough until late Spring to support markets.

As a result, BTC could form a reverse H&S pattern, for example. First target could lead BTC right to 28-30K resistance area on monthly chart, while next one, 1.618 extension perfectly agrees with mentioned above 36-38K area. Only if BTC will break this level up, it will be possible to speak about new long-term upside tendency.

Now let’s turn to major thing, why we do not take an idea of upside reversal (and soft landing) in US economy in general and BTC market in particular. Because we see mismatch and contradictions in all major spheres (and not only in US)- Inflation, Consumption, Job market, Real Estate market, Leading indicators and Sentiment.

Idea of upside economy reversal should be accompanied by corresponding change in major indicators. Right now we see only slowdown of nominal inflation, but here is also not everything is simple. Here is we could see that core inflation rate is decreasing, and, at first glance it should be a signal of economy conditions improving, “soft landing” and turn to growth…

But if we take a look statistics of economical activity we do not see any signs of improvement by far. Retail Sales drop for ~1% 2 month in a flow, that suggest 12% annual decrease. And take a look – this has happened in two most “active” months of Thanksgiving and Christmas. Industrial production and Manufacturing are also decreasing.

In EU situation is slightly worse. If US inflation shows some signs of peaking, EU one is not. All other stuff stands the same – drop of consumption, production, activity and sentiment. Also pay attention to few numbers of a job markets – wage and vacancies decrease as well.

Big tech companies start massive layoffs. And this is not only in technical sector.

People are loosing wealth and consumption power, trying to live in the “habit” way, loosing their savings and taking too many consumer loans.

Meantime, real US wage lags to inflation rate:

Another myth is a strength of the job market in US. Although we see positive NFP numbers month by month, there are some mismatches in related indicators. For example hourly wages – the price of labor – grew at the slowest annual pace in 16 months and has dropped by a full percentage point since the end of the first quarter of 2022. Weekly average earnings gained 3.1%, the slowest pace since May 2021.

It is difficult to explain, how we could combine higher employment with shorter average work week? So, we’re hiring to make people work less? How we could combine constant rising of continues claims in recent 3-4 months, decreasing of the vacancies amount with the new jobs created at high tempo? If we have so perfect job market with near the “soft landing” for Fed, why employees report on 364K job cuts in 2022 – 13% above 2021 and the 2nd worst result in 30 years?

Finally let’s take a look at cross sector statistics. US recently has significantly improved Trade Balance. It dropped to “just 60 Bln”, and becomes almost two times smaller. But this is not because of increasing national economy capacity. This is because of drastic cut of import (take a look again at China chart above). This is deflationary sign and sign of drop in economy, as people start consume less. This is also confirms by other countries, for example Taiwan export has dropped for 12.1% in December – 4th month in a row, which is perfectly agrees with the US Trade balance dynamic.

Why all markets, including BTC are rising now?

On the charts below you could see that QT efforts has led to contraction of money supply approximately for ~ $400-500 Bln. But Fed has compensated this step by using of US Treasury account and has spent approximately the same sum to support economy. This money at the final point has appeared on the accounts of Commercial Banks and have been distributed into loans for companies and households. It means that Fed is drying liquidity by one hand but providing it by another. In fact no tightening has happened, but Fed has spent 2/3 of US Treasury reserves in 2022

Now Fed has only around 360 Bln left on a balance to support markets.

Jurrien Timmer, director of global macro at Fidelity Investments, tells – we’re worry that inflation remains around 4-5% ignoring any Fed efforts to cut it more, and the risk is that the Fed will go to around 5% in the next three months or so.

But the problem that Fed can’t stay for too long around 5% rate. Despite what inflation will be, it will have to start easing either in a way of rate cut or in a way of QE money printing. Whatever scenario they will choose – real interest rates will drop.

Conclusion

The crisis is not just developing, it is developing very consistently and confidently. At the same time, the decrease in inflation does not have any positive effect, it is largely a deflationary effect associated with a decline in the economy and demand. Well, even taking into account the obvious decline, which cannot be hidden, inflation is still quite high.

Wide statistics measures do not support idea of “soft landing” and upside US economy reversal. It is only on the surface we have dropping CPI, Mortgage rate and stable NFP. In reality we have drop of consumption, destruction of Real Estate market and rising layoffs with shorting of the average work week. All these stuff is inconsistent with idea of “soft landing” and “growing economy”

Fed intends to keep hawkish policy as long as it could. By our view, they have time until late Spring to keep rates high. Up to this moment, Fed cash reserves will exhaust and they will lose ability to support markets by liquidity injections, using corporate loans. US economy deterioration effect should become more evident to this moment.

They will have to make difficult choice – either to turn back to QE in whatever shape it will take, or, keep rates high and totally crush the economy, putting majority into poverty. Both ways will be devastating for non-interest bearing markets. This explains why we’re sceptic now on idea of real upside reversal on BTC, although do not exclude some continuation of current upside tendency.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

620 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023