Beyond Gold and Silver. Exploring other precious metals.

Precious and base metals are traded on the world’s largest exchanges. Gold (XAU) and silver (XAG) are the most popular instruments. It’s not surprising that the majority of novice traders trade these two metals primarily, missing out on excellent opportunities to trade other metals.

Experienced traders, on the other hand, seek profit-making opportunities trading platinum, palladium, nickel, zinc, aluminum and copper. The most popular are platinum and copper. Two metals with completely different trading characteristics, which makes them an ideal choice for long-term and short-term traders.

Platinum and copper – brief characteristics

Both metals have the following similarities:

- The prices for these metals are settled twice a day, at 9:45 and 14:00 on the London Stock Exchange. The fixed price is the reference price and is the same for all market participants.

- They are both traded as futures on world stock exchanges: London (LPPM), Chicago (CME), Moscow (MICEX) and Tokyo (Topix).

That’s it for the similarities.

From the trading point of view, platinum, thanks to its low volatility and limited supply in the market (platinum futures turnover reaches more than 2 thousand lots per day), is excellent for long-term investment, portfolio diversification and as a safe haven asset during major economic changes. It can be also easily analyzed using the fundamental analysis.

Copper is, on the contrary, a speculative metal, which is sold in thousands of tons and is not meant for long-term investments. High liquidity makes copper an excellent asset for day trading. In addition, the copper pattern repeats itself, so this instrument can be well predicted using technical analysis.

Traditionally, both of these metals are traded on the exchanges in the form of futures. But since the minimum transaction volume on such exchanges is too high for most traders, there are reliable brokers which offer the opportunity to buy CFDs on platinum and copper. Trading these futures contracts and using the leverage, traders can buy these metals in sufficient volume, even with a small capital.

Now, we’ll look at each of these metals separately, their properties, the current market situation and give some useful trading tips.

Platinum

Platinum – the name is derived from the Spanish term platina, meaning “little silver”’.

It is a precious silvery-white metal, first encountered by the Spanish in South America in the 16th century.

This metal is also mined in Russia and North America. However, in none of these countries platinum is found in its native form. It is usually alloyed with other precious and non-precious metals. Due to such limited and complicated production, only 5 million troy ounces of platinum are mined worldwide annually, which is 17 times less than the annual gold production and 100 times less than silver.

Platinum is the main member of the platinum-group elements, which also include palladium, ruthenium, rhodium, iridium and osmium. Its physical and chemical properties make it one of the most important metals for industrial use.

It is actively used in the chemical, oil, medical, jewelry and computer industries. Thanks to its corrosion resistance, platinum is as an excellent conductor for electronic applications. At the same time, catalytic converters for the automotive industry account for nearly 40% of global gross platinum demand. That’s why changes in the car industry strongly affect platinum prices.

Current market situation

Platinum is one of the most valuable, sought-after metals, along with gold, silver, palladium, nickel and copper.

Paired with the dollar it’s abbreviated as the XPT/USD with the standard trade volume of 1000 troy ounces:

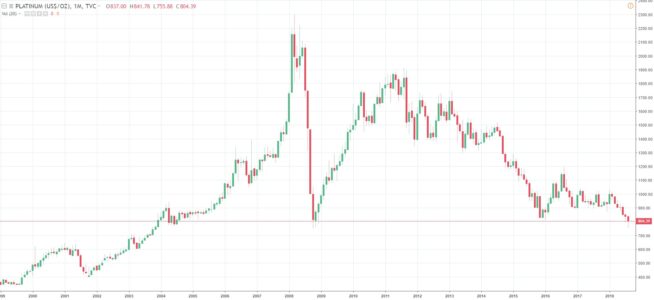

Since it’s not a speculative asset, technical analysis data should be considered for a longer time frame: 1D, 1W, 1M. The screenshot provides technical analysis for a period of one month.

As we can see, platinum demonstrates the bearish trend, and for two and a half years from December 2015 to August 2018 the price is trading close to a strong support of 820.

This strong 820 support level should hold back further downward movement. As a result, the price is likely to grow to a resistance level of 1005 by the end of 2018 and with good drivers for growth, it can reach 1180.

Fundamental factors suggest further growth too. The reason for the downtrend observed since the beginning of 2011 was the general decrease in precious metals prices. Besides, since the beginning of 2015 the price was also held back by three other more important factors:

- South Africa recovered its platinum mining, which has lead to the platinum surplus in the market.

- The Volkswagen emissions scandal caused fears that auto sales would decline, and as 40% of platinum is associated with the auto industry, this affected the platinum prices too.

- Taking into account weak Chinese jewelry demand and a decrease in oil prices, where platinum is also used, the flat is a very good indicator.

But the problems are now behind. The indicators for all major industries demonstrate growth:

- Car manufacturers increased the share of cars with a gasoline engine in 2016-17, which led to platinum demand growth.

- The increase in demand is also clearly seen looking at the indicator of supply and demand, according to which platinum surplus in 2018 is expected at 25 thousand ounces. This is ten times lower than the surplus in the previous year.

- Due to the closure of some mines in South Africa and the platinum production decline in Russia amid the sanctions, production is expected to decrease by 4%.

All these factors say in favor of platinum growth. If we also keep in mind that this metal fell harder than other precious metals and that palladium now costs more, which can turn the attention of car manufacturers back to platinum, we can expect platinum to commence the uptrend. The only factor, which can hold back further growth, is the growing popularity of environmentally friendly electric cars.

What drives platinum prices and how to trade it

First of all, you should pay your attention to medium and long-term trading. Therefore, it is better to use fundamental analysis and take into account the main factors that affect the prices:

- Supply and demand levels. Since platinum is a rare metal, its reserves and demand in the market affect the prices directly.

- Gold prices. Platinum prices correlate with gold prices, and the correlation is negative. When gold prices begin to rise, platinum immediately becomes cheaper and vice versa.

- Reports and news from platinum-producing companies. For example, if Norilsk Nickel, the world’s largest platinum producer announces changes to its senior management, which in its turn could affect production levels, such information will certainly influence platinum movement.

The above-mentioned factors don’t trigger any significant price changes separately. But if some of them turn out negative or positive at the same time, this may be a good sign for traders when to start trading platinum.

For those of you who are interested in day trading this precious metal, here are some useful tips:

- The best way to trade platinum CFDs is by opening trades within the day, particularly in the hours when the prices are fixed, which is between 9:45 and 2 pm.

- We recommend using Japanese candles with charts frames not less than four hours in your analysis, as well as SMA or EMA indicators.

Following these suggestions and using the fundamental analysis will help you successfully trade platinum at almost any period.

Copper

Copper is widely used in core industries. This metal is a good conductor of electricity, so it’s often used in the electrical sector (terminals, wiring, etc.), in the car industry and transportation equipment manufacturing.

If we take into account the constantly growing construction, as well as the constantly expanding range of electrical goods, we should be able to imagine the huge volumes used on the everyday basis. This means that there is a constant demand for copper from both developed and developing countries, and therefore it will always remain in demand.

At the same time, it is worth keeping in mind that the economic situation in the main consuming countries has a strong impact on copper quotes. For example, if China, the major copper consumer and the largest producer of wiring, electronics and other products where this metal is used as the main component, unexpectedly demonstrates signs of economic slowdown, it will definitely affect copper prices, because the demand will decrease, and supply will remain at the existing level.

Besides the economic conditions of the consumer countries, there are many other factors, which influence copper prices, that’s why copper is highly volatile and the instrument is considered a risky asset. We recommend day trading this instrument only if you are an experienced trader.

Current market situation

Copper futures are traded under ticker symbol HG:

The weekly chart indicates an ambiguous situation.

Copper price has been holding above the 3.0000 mark for 9 consequent months. It has recently broken the trendline and approached this key support level, which can lead to either of the two possible scenarios:

- The price bounces from 2.7000 support and heads back to the 3.0000-3.3000 range. By the end of 2018, it may even reach the 3.5000 mark.

- The price breaks the 2.7000 support, plummets back to the previous support of 2.5000 and keeps in this range until the end of the year.

The fundamental analysis says in favor of copper’s strengthening:

- China’s GDP registered growth by 6.9% in the first half of the year, exceeding the forecasts. In addition, despite lending restrictions in major Chinese cities, the real estate market is expanding twice as fast. This means that copper consumption should also increase which in its turn will result in rising prices for this metal. According to experts, growth should increase by about 2%.

- The steady growth of electric vehicles. To produce this type of cars, manufacturers need 83 kg of copper against 23 kg used in ordinary cars. Therefore, the demand for copper should significantly increase. In a long-term perspective, the growing market for electric vehicles is expected to fuel a nine-fold increase in copper demand in the next 10 years, to 1.74 million tons against 185 thousand tons in the previous year.

Whether these long-term prospects are real, we can only wonder. Moreover, many experts disagree. The one thing they concur in is that copper will continue to oscillate in the range of 2.5 – 3.5 dollars in the near future, which means that short-term traders will have a lot of opportunities to earn trading copper within this range, without fears of sharp and strong growth.

What drives copper prices

As we have mentioned earlier , copper is well suited for technical analysis, which allows traders to trade its CFDs with practically no fundamental data. We recommend paying attention not only to prices inside the day but also to the weekly and monthly quotes – it will give a more complete understanding of what is happening in the market.

Professionals don’t recommend trading this metal on the first Friday of the month and when important economic indicators are released because in a short-term copper is highly sensitive to overall fiscal policy. For example, if raw materials and commodities fall in price, copper loses value too.

At the same time, you shouldn’t completely ignore the fundamental data. Copper is strongly influenced by many different factors:

- The demand for copper from the consumer countries and as a consequence their main economic indicators.

- Situation in the construction sector.

- Decrease in supply. This includes the number of mining companies, statements from the large enterprises about the opening or closure of copper mines, downtime as a result of miners’ strikes.

- Increase or decrease in customs duties.

- The situation in Chile. The country is the main copper producer, it’s necessary to monitor its economic situation, particular attention should be paid to the devaluation of the Chilean peso and reports of earthquakes that could affect the work of mines.

Trading copper, it’s also important to account for seasonal fluctuation. Despite the global events and technical analysis’ indicators, the demand for copper, and therefore its prices, steadily increase every year in the period from mid-November and until the end of April. At the same time, from August to November, copper faces a regular selloff, and the prices usually plummet.

These indicators depend mainly on climate conditions, regular orders from manufacturers and the actions of investment funds. But the main factor is regularity – so, in order to consistently earn money from trading copper, it must be taken into account.

Should you consider adding platinum and copper to your trading instruments?

Many traders are used to trading gold and silver and completely forget about platinum and copper. As we can see from the analysis above, both of these metals have good predictability in long and short-term time periods and are also worth to be considered.

At the same time, studying the properties and trading platinum and copper opens up massive opportunities to trade interrelated instruments – for example, stocks of mining companies or consumer companies. By trading all these instruments and, first of all, platinum and copper, traders can earn on any trading interval.

All you need is just to spend a little more time, do your own detailed research on these metals, and the profit will not keep you waiting.

Author Profile

AMarkets CFD & Forex Online Broker

To open real account with AMarkets, Click Here.

To learn more about AMarkets, Click Here.

To contact AMarkets, Click Here.

Info

560 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023