Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,098

USD/CHF: wave analysis on 22/05/2017

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CHF for a better understanding of the current market situation and more efficient trading.

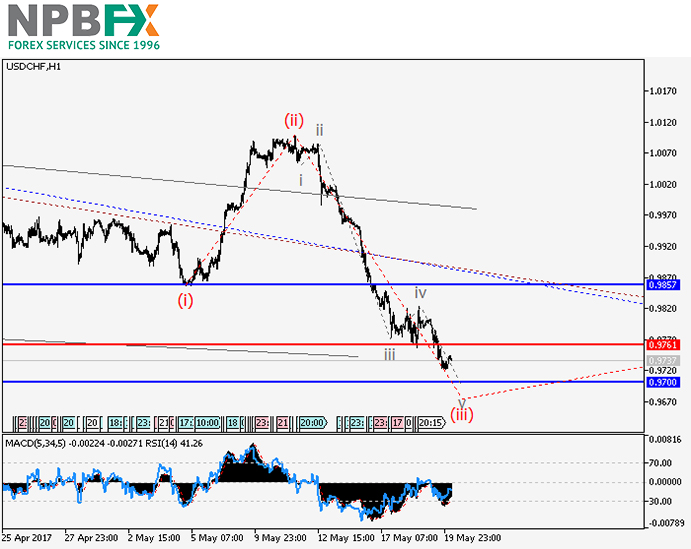

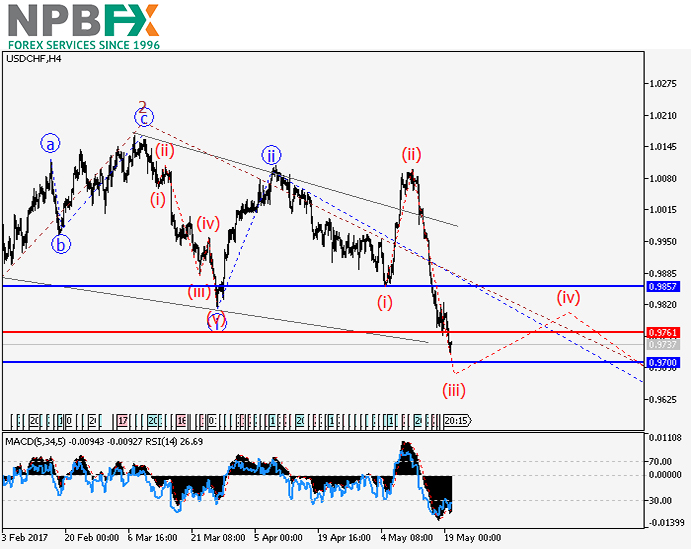

Current trend

The trend is downward.

On the 4-hour chart the downward trend within the third wave 3 of the highest level is forming. Locally the downward momentum as a third wave of the lower level (iii) of iii of 3 is developing. If the assumption is correct, the pair will lower to the level of 0.9700. The level of 0.9760 is critical for this scenario.

Trading scenario

Sell the pair from the correction below the level of 0.9760 with the target at 0.9700.

Alternative scenario

The breakout and the consolidation of the price above the level of 0.9760 will let the pair to grow to the level of 0.9860.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy USD/CHF and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CHF for a better understanding of the current market situation and more efficient trading.

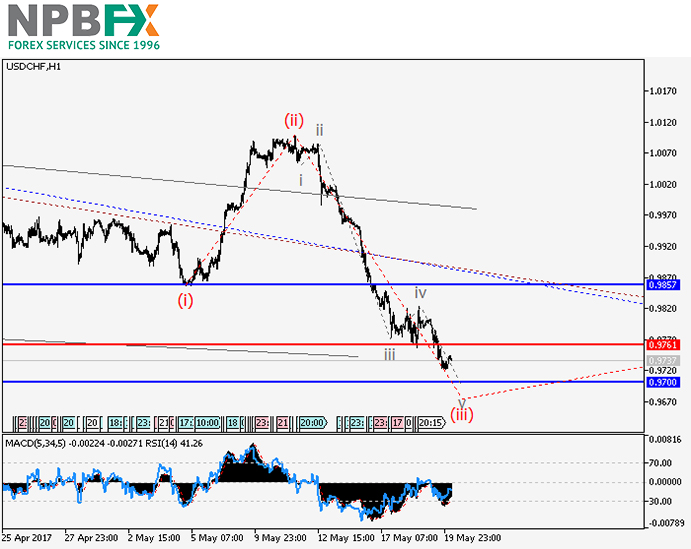

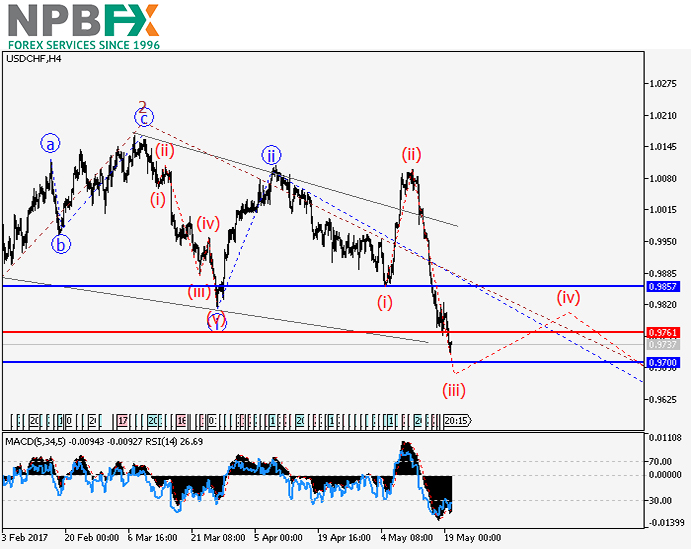

Current trend

The trend is downward.

On the 4-hour chart the downward trend within the third wave 3 of the highest level is forming. Locally the downward momentum as a third wave of the lower level (iii) of iii of 3 is developing. If the assumption is correct, the pair will lower to the level of 0.9700. The level of 0.9760 is critical for this scenario.

Trading scenario

Sell the pair from the correction below the level of 0.9760 with the target at 0.9700.

Alternative scenario

The breakout and the consolidation of the price above the level of 0.9760 will let the pair to grow to the level of 0.9860.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy USD/CHF and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.