SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

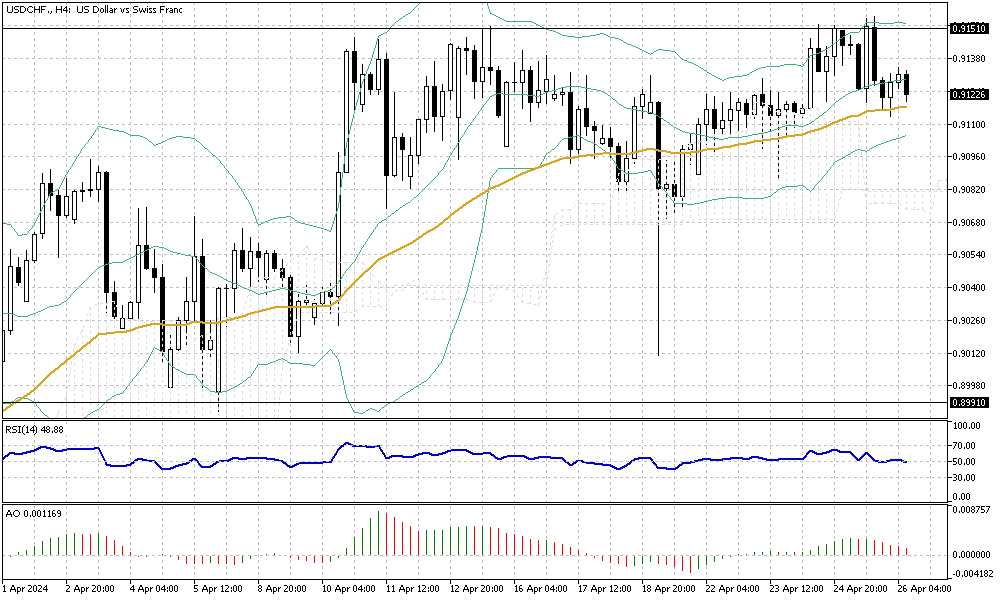

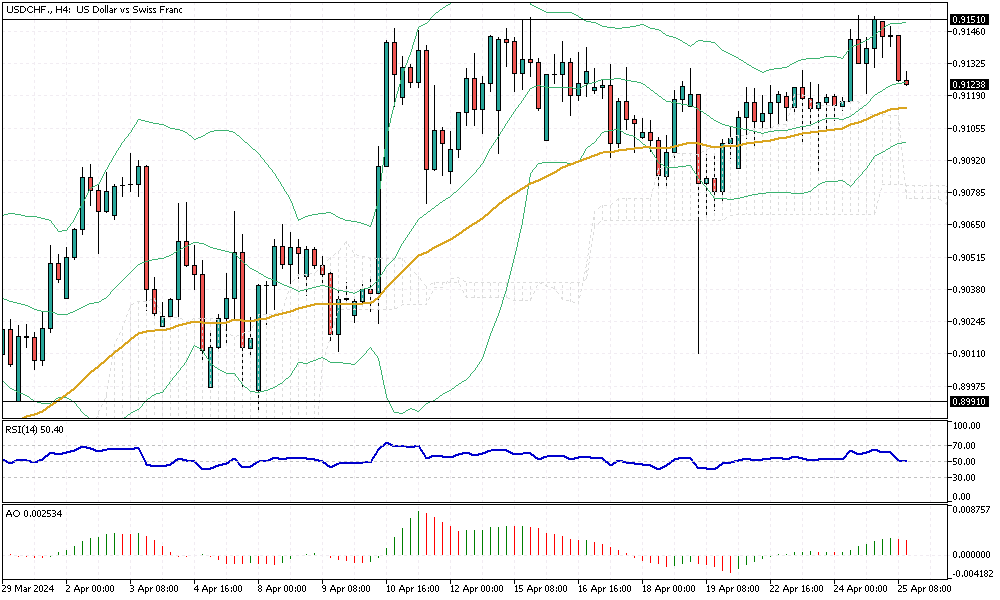

Swiss Franc Recovers Amid Policy Changes and Low Inflation

The Swiss franc has stabilized around 0.91 against the USD, recovering from significant losses earlier in the year that pushed it to a six-month low. This happened due to major differences in the monetary policies anticipated for the U.S. and Switzerland. In March, Switzerland saw its lowest inflation in over two years, dropping to 1%. This supports the Swiss National Bank's (SNB) claim that inflation pressures are easing.

Amid low business confidence and falling retail sales, the SNB is expected to increase interest rates in its June meeting. After the SNB's surprising rate cut in March—the first central bank to do so amid global inflation concerns—the franc had fallen sharply.

Additionally, the lower inflation forecast has enabled the central bank to ease its support of the franc. Consequently, foreign currency reserves have grown for the third consecutive month since hitting a seven-year low in November.

Amid low business confidence and falling retail sales, the SNB is expected to increase interest rates in its June meeting. After the SNB's surprising rate cut in March—the first central bank to do so amid global inflation concerns—the franc had fallen sharply.

Additionally, the lower inflation forecast has enabled the central bank to ease its support of the franc. Consequently, foreign currency reserves have grown for the third consecutive month since hitting a seven-year low in November.