Admiral Markets

AdmiralMarkets.com Representative

- Messages

- 95

Thin Economic Calendar To Restrict Big Forex Moves

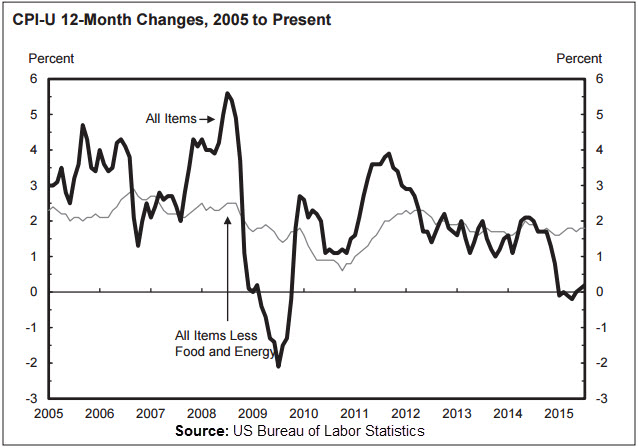

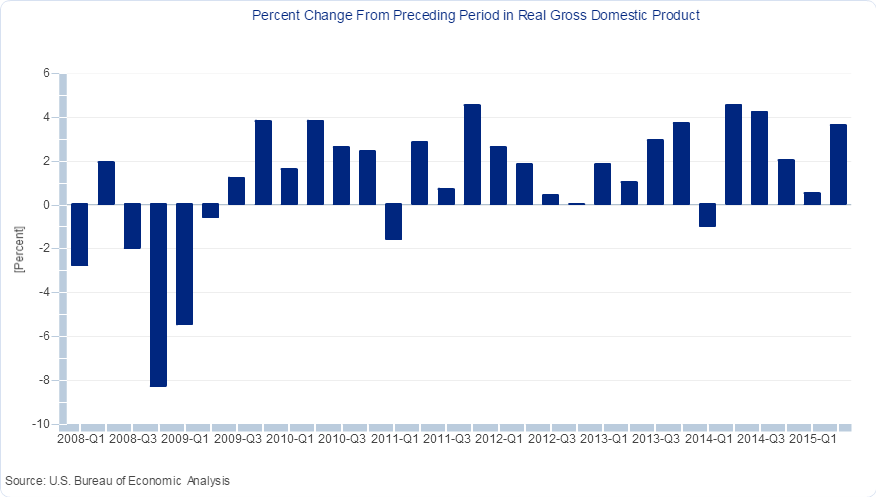

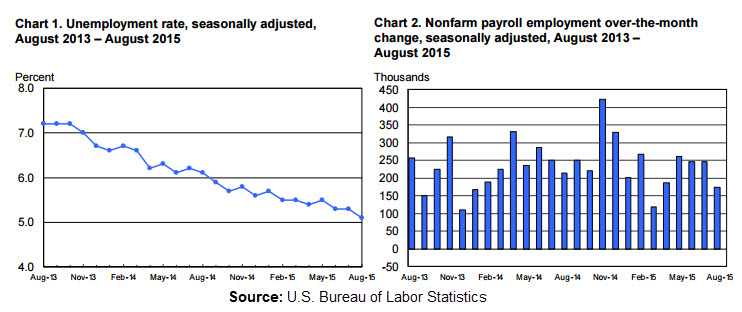

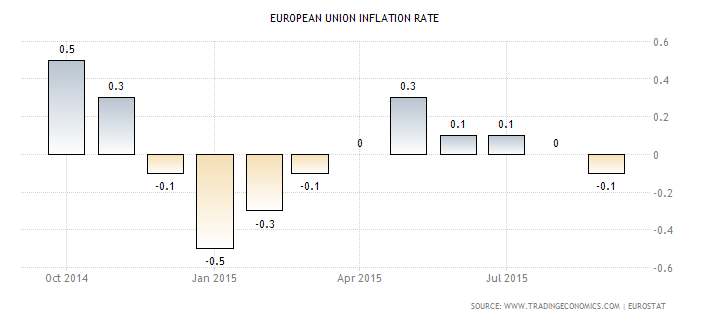

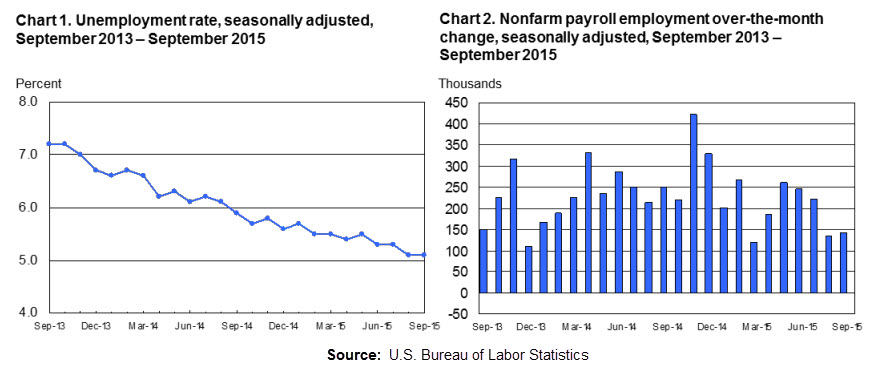

Even if the US NFP disappointed market players during its Friday's release, seven year low unemployment rate and improving wage details helped greenback index (I.USDX) secure another positive weekly closing. The Euro witnessed considerable declines after the ECB President signaled that renewed threat of downside risk to the economy could force the central bank in extending its QE while downgraded growth and inflation forecasts provided additional damages to the regional currency. Further, weaker Manufacturing and Services PMIs dragged down the GBP against majority of its counterparts while pessimism over China kept hurting the commodity basket and the antipodeans, namely AUD, NZD and CAD.

Having witnessed considerable forex moves during last week, fewer economic details are scheduled during the current holiday-shortened-week that starts with US and Canadian Labor Day on Monday. Though, China is back after its four day off with revised down GDP numbers for 2014. Hence, Chinese Inflation details and Australian labor market figures, coupled with monetary policy meetings by the RBNZ, BoC and BoE, are likely to continue fueling forex market liquidity. Moreover, US PPI and Preliminary reading of UoM Consumer Sentiment, with monthly reading of UK Manufacturing Production and Trade Balance are some other stats that could make market players busy during the current week. It should also be noted that there isn't any major details out of the Europe this week except Tuesday's German Trade Balance.

Fewer US Details to Track

In addition to the Thursday's weekly Jobless Claims, monthly readings of PPI and Preliminary UoM Consumer Sentiment, scheduled for Friday, are the only US releases scheduled during the current week. While the Jobless Claims and Consumer Sentiment are both likely to remain near to their previous numbers, PPI is expected to mark first negative number, -0.1%, in four months and could drag down the greenback if it meets consensus. Last week's US job numbers magnified uncertainty relating to timing of the Federal Reserve's interest rate hike and market players are more likely to keep observing minor details, in dearth of the major ones, ahead of the September 17 FOMC to determine near-term USD moves.

Australian Labor Market Details and Chinese Inflation Numbers To Determine AUD Moves

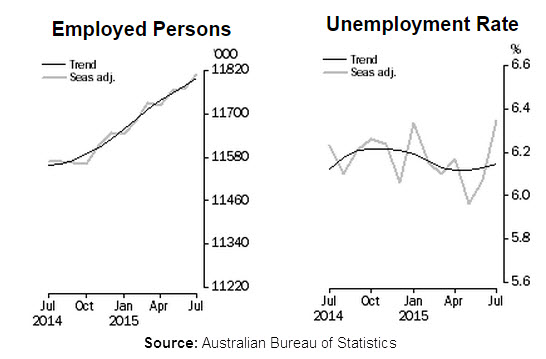

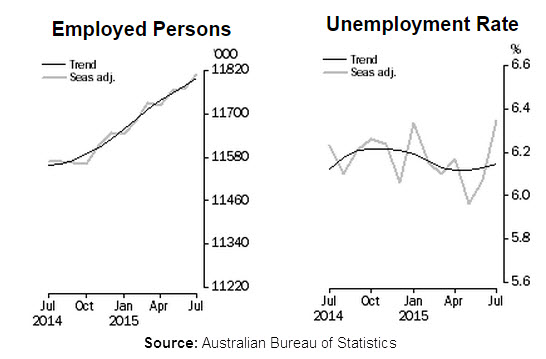

After the RBA held its interest rates unchanged for the fourth consecutive month, disappointing details of GDP and Retail Sales, coupled with recent down-gradation of Chinese GDP, increases the importance of Australian job numbers and Chinese Inflation marks to help forecast RBA's next move in its October 06 meeting.

Pessimism over China, Australia's largest trading partner, seems failed to show clear impact on Australian labor market off-late wherein the Employment Change recently marked considerably good number while the Unemployment rate rose to six month highs. Hence, Thursday's labor market details would be crucial to foresee near-term AUD moves. The Employment Change is expected to rise only by 5.2K against its previous 38.5K while the Unemployment rate can shrink a bit to 6.2% from 6.3% prior. Further, indices for Consumers and Business Sentiment, scheduled for Tuesday and Wednesday respectively, are additional details that can help better predict the AUD moves. With the recent negativity, both the indices, namely NAB Business Confidence and Westpac Consumer Sentiment, are more likely to print disappointing numbers, providing additional damages to the Australian Dollar.

Moreover, Chinese Trade Balance, scheduled for Tuesday release, coupled with CPI and PPI, scheduled for Thursday, become additional details to base AUD trades on. Even if the CPI reading is likely to test highest level in a year, by printing 1.9% mark, the PPI bears the pessimistic consensus of plunging to nearly six years' low to -5.6%. Moreover, the Trade balance is likely registering improve trade surplus to 48.6B versus 43.0B prior.

With the on-going raft of Chinese pessimism, leading to commodity declines, disappointing numbers from Australian labor market and China could force the RBA to lift its four month old impasse over monetary policy during October 06 meeting with an interest rate cut, providing considerable downside to the Australian Dollar.

Some Central Bankers To Add Market Liquidity

Although, Bank of Canada (BoC) and the Bank of England (BoE) are less likely to alter their current monetary policies during the their meetings on Wednesday and Thursday respectively, the Reserve Bank of New Zealand (RBNZ) is expected to cut its benchmark interest rate for the third time this year on its Thursday meeting and could zoom the market liquidity. Moreover, the minutes of BoE meeting, scheduled to release during Thursday as well, would also reveal members favoring monetary policy alternation and could add forex volatility.

With the RBNZ's sustained view of keep cutting the interest rates, considering commodity declines, the NZD is more likely to extend its downside while an additional number in MPC members favoring BoE monetary policy change, mainly the interest rate change, could make the GBP recover some of its recent looses. Moreover, the BoC isn't expected to change its current monetary policy after it recently cut the interest rate in July and can become more of a non-event unless there is a surprise rate cut, making CAD vulnerable to plunge against majority of its counterparts.

Rest of the Globe Details

Other than the headline events, Japanese Current Account and Final GDP q/q, scheduled for Tuesday release, coupled with monthly details of UK Manufacturing Production and Trade Balance, scheduled for release on Wednesday, are some other economics that could make the forex players busy during the week.

Off-late, the Japanese currency have been strengthening due to increased safe haven demand and increase in current account surplus, against the 1.25T consensus and 1.30T prior, could add more strength to the JPY. Moreover, improvement in Final GDP figure, against -0.4% initial forecast and 1.0% growth in Q1 2015, can provide considerable strength to the Japanese currency.

At the UK front, Manufacturing Production is expected to maintain its 0.2% growth rate and the Trade deficit is likely widened to -9.5B against -9.2B. Should these stats meet consensus, the pound bears could find additional reason to sell the UK currency.

“Original analysis is provided by Admiral Markets”

Even if the US NFP disappointed market players during its Friday's release, seven year low unemployment rate and improving wage details helped greenback index (I.USDX) secure another positive weekly closing. The Euro witnessed considerable declines after the ECB President signaled that renewed threat of downside risk to the economy could force the central bank in extending its QE while downgraded growth and inflation forecasts provided additional damages to the regional currency. Further, weaker Manufacturing and Services PMIs dragged down the GBP against majority of its counterparts while pessimism over China kept hurting the commodity basket and the antipodeans, namely AUD, NZD and CAD.

Having witnessed considerable forex moves during last week, fewer economic details are scheduled during the current holiday-shortened-week that starts with US and Canadian Labor Day on Monday. Though, China is back after its four day off with revised down GDP numbers for 2014. Hence, Chinese Inflation details and Australian labor market figures, coupled with monetary policy meetings by the RBNZ, BoC and BoE, are likely to continue fueling forex market liquidity. Moreover, US PPI and Preliminary reading of UoM Consumer Sentiment, with monthly reading of UK Manufacturing Production and Trade Balance are some other stats that could make market players busy during the current week. It should also be noted that there isn't any major details out of the Europe this week except Tuesday's German Trade Balance.

Fewer US Details to Track

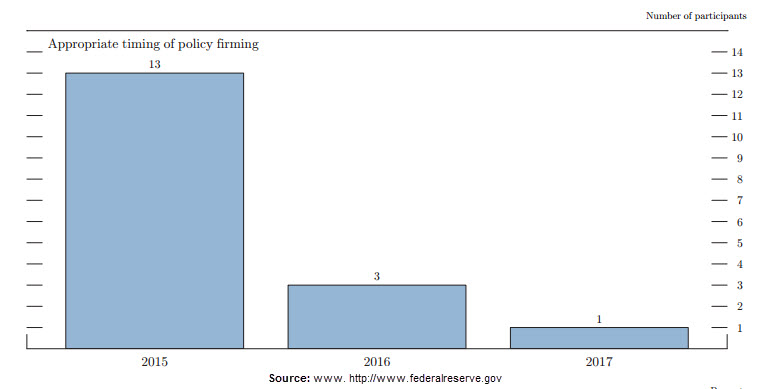

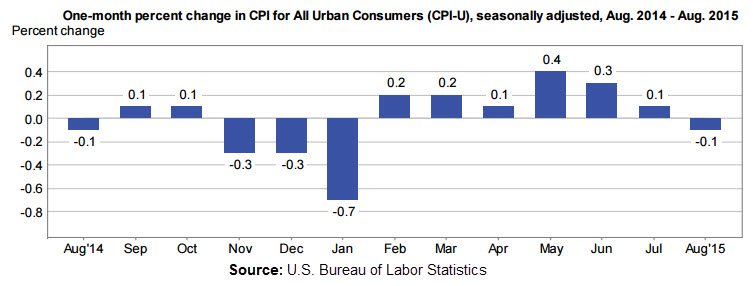

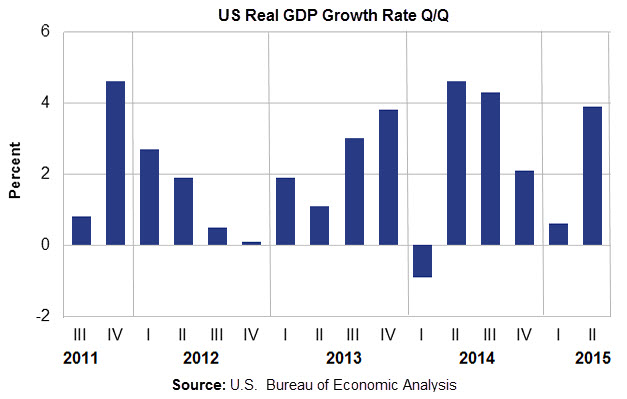

In addition to the Thursday's weekly Jobless Claims, monthly readings of PPI and Preliminary UoM Consumer Sentiment, scheduled for Friday, are the only US releases scheduled during the current week. While the Jobless Claims and Consumer Sentiment are both likely to remain near to their previous numbers, PPI is expected to mark first negative number, -0.1%, in four months and could drag down the greenback if it meets consensus. Last week's US job numbers magnified uncertainty relating to timing of the Federal Reserve's interest rate hike and market players are more likely to keep observing minor details, in dearth of the major ones, ahead of the September 17 FOMC to determine near-term USD moves.

Australian Labor Market Details and Chinese Inflation Numbers To Determine AUD Moves

After the RBA held its interest rates unchanged for the fourth consecutive month, disappointing details of GDP and Retail Sales, coupled with recent down-gradation of Chinese GDP, increases the importance of Australian job numbers and Chinese Inflation marks to help forecast RBA's next move in its October 06 meeting.

Pessimism over China, Australia's largest trading partner, seems failed to show clear impact on Australian labor market off-late wherein the Employment Change recently marked considerably good number while the Unemployment rate rose to six month highs. Hence, Thursday's labor market details would be crucial to foresee near-term AUD moves. The Employment Change is expected to rise only by 5.2K against its previous 38.5K while the Unemployment rate can shrink a bit to 6.2% from 6.3% prior. Further, indices for Consumers and Business Sentiment, scheduled for Tuesday and Wednesday respectively, are additional details that can help better predict the AUD moves. With the recent negativity, both the indices, namely NAB Business Confidence and Westpac Consumer Sentiment, are more likely to print disappointing numbers, providing additional damages to the Australian Dollar.

Moreover, Chinese Trade Balance, scheduled for Tuesday release, coupled with CPI and PPI, scheduled for Thursday, become additional details to base AUD trades on. Even if the CPI reading is likely to test highest level in a year, by printing 1.9% mark, the PPI bears the pessimistic consensus of plunging to nearly six years' low to -5.6%. Moreover, the Trade balance is likely registering improve trade surplus to 48.6B versus 43.0B prior.

With the on-going raft of Chinese pessimism, leading to commodity declines, disappointing numbers from Australian labor market and China could force the RBA to lift its four month old impasse over monetary policy during October 06 meeting with an interest rate cut, providing considerable downside to the Australian Dollar.

Some Central Bankers To Add Market Liquidity

Although, Bank of Canada (BoC) and the Bank of England (BoE) are less likely to alter their current monetary policies during the their meetings on Wednesday and Thursday respectively, the Reserve Bank of New Zealand (RBNZ) is expected to cut its benchmark interest rate for the third time this year on its Thursday meeting and could zoom the market liquidity. Moreover, the minutes of BoE meeting, scheduled to release during Thursday as well, would also reveal members favoring monetary policy alternation and could add forex volatility.

With the RBNZ's sustained view of keep cutting the interest rates, considering commodity declines, the NZD is more likely to extend its downside while an additional number in MPC members favoring BoE monetary policy change, mainly the interest rate change, could make the GBP recover some of its recent looses. Moreover, the BoC isn't expected to change its current monetary policy after it recently cut the interest rate in July and can become more of a non-event unless there is a surprise rate cut, making CAD vulnerable to plunge against majority of its counterparts.

Rest of the Globe Details

Other than the headline events, Japanese Current Account and Final GDP q/q, scheduled for Tuesday release, coupled with monthly details of UK Manufacturing Production and Trade Balance, scheduled for release on Wednesday, are some other economics that could make the forex players busy during the week.

Off-late, the Japanese currency have been strengthening due to increased safe haven demand and increase in current account surplus, against the 1.25T consensus and 1.30T prior, could add more strength to the JPY. Moreover, improvement in Final GDP figure, against -0.4% initial forecast and 1.0% growth in Q1 2015, can provide considerable strength to the Japanese currency.

At the UK front, Manufacturing Production is expected to maintain its 0.2% growth rate and the Trade deficit is likely widened to -9.5B against -9.2B. Should these stats meet consensus, the pound bears could find additional reason to sell the UK currency.

“Original analysis is provided by Admiral Markets”