acetraderfx

AceTrader.com Representative

- Messages

- 1,109

WEEKLY TECHNICAL OUTLOOK ON EUR/USD

Last Update At 14 Apr 2014 00:17GMT

Trend Daily Chart

Sideways

Daily Indicators

Rising

21 HR EMA

1.3875

55 HR EMA

1.3864

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

34

14 HR DMI

-ve

Daily Analysis

Consolidation with downside bias

Resistance

1.3948 - Mar 17 high

1.3906 - Last Fri's high

1.3864 - Last Fri's low, now res

Support

1.3838 - Today's low in NZ

1.3780 - Last Wed's low

1.3748 - Last Mon's high

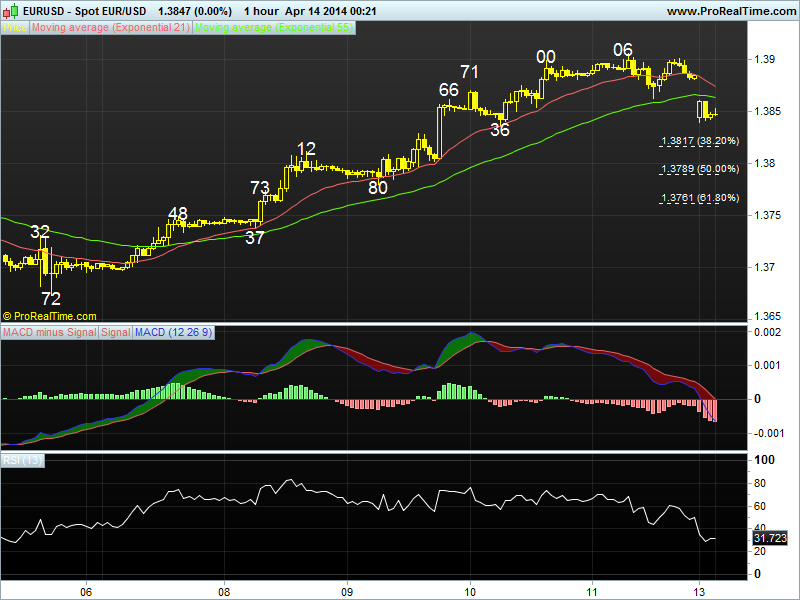

. EUR/USD - 1.3850... Euro climbed strongly last week due to dlr's broad-based weakness, price rose for 5 consecutive days fm Mon's 1.3696 low to 1.3906 on Fri b4 retreating to 1.3864 on profit-taking. Euro gapped-down to 1.3838 in NZ Mon after w/end euro-bearish comments fm ECB President Draghi b4 stabilising.

. Looking at the bigger picture, last week's breach of pivotal res at

1.3877 (Mar 24 high) to 1.3906 confirms early correction fm Mar 2-1/2 year peak at 1.3967 has ended at 1.3672 (Apr 4 low) n as daily oscillators are currently rising, suggesting price is en route to re-test said 2014 top. A daily close abv 1.3967 wud confirm MT uptrend fm 1.2042 (Jul 2012) has resumed n further gain to 'psychological' res at 1.4000 wud follow, break wud extend gain twd 1.4052 (the 50% projection of MT intermediate rise fm 1.2745-1.3894 measured fm 1.3477) but reckon 1.4100 wud hold n yield retreat later this month.

. Today, as the retreat fm Fri's high of 1.3906 to 1.3838 (NZ) suggests

near term upmove fm 1.3672 has made a temporary top, selling on recovery for a retracement twd 1.3780 is cautiously favoured but 1.3761 (61.8% r) shud contain weakness n bring rebound later. Only abv 1.3906 wud extend gain twd 1.3948.

Last Update At 14 Apr 2014 00:17GMT

Trend Daily Chart

Sideways

Daily Indicators

Rising

21 HR EMA

1.3875

55 HR EMA

1.3864

Trend Hourly Chart

Sideways

Hourly Indicators

Falling

13 HR RSI

34

14 HR DMI

-ve

Daily Analysis

Consolidation with downside bias

Resistance

1.3948 - Mar 17 high

1.3906 - Last Fri's high

1.3864 - Last Fri's low, now res

Support

1.3838 - Today's low in NZ

1.3780 - Last Wed's low

1.3748 - Last Mon's high

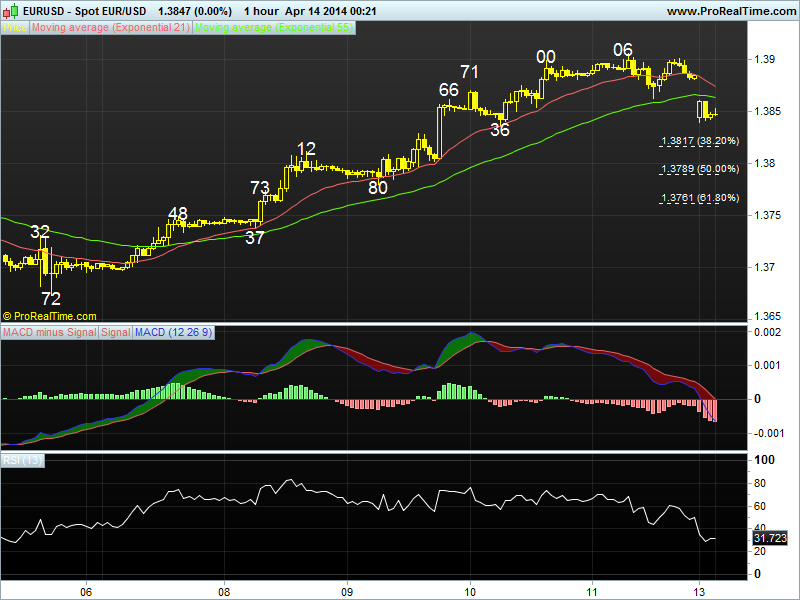

. EUR/USD - 1.3850... Euro climbed strongly last week due to dlr's broad-based weakness, price rose for 5 consecutive days fm Mon's 1.3696 low to 1.3906 on Fri b4 retreating to 1.3864 on profit-taking. Euro gapped-down to 1.3838 in NZ Mon after w/end euro-bearish comments fm ECB President Draghi b4 stabilising.

. Looking at the bigger picture, last week's breach of pivotal res at

1.3877 (Mar 24 high) to 1.3906 confirms early correction fm Mar 2-1/2 year peak at 1.3967 has ended at 1.3672 (Apr 4 low) n as daily oscillators are currently rising, suggesting price is en route to re-test said 2014 top. A daily close abv 1.3967 wud confirm MT uptrend fm 1.2042 (Jul 2012) has resumed n further gain to 'psychological' res at 1.4000 wud follow, break wud extend gain twd 1.4052 (the 50% projection of MT intermediate rise fm 1.2745-1.3894 measured fm 1.3477) but reckon 1.4100 wud hold n yield retreat later this month.

. Today, as the retreat fm Fri's high of 1.3906 to 1.3838 (NZ) suggests

near term upmove fm 1.3672 has made a temporary top, selling on recovery for a retracement twd 1.3780 is cautiously favoured but 1.3761 (61.8% r) shud contain weakness n bring rebound later. Only abv 1.3906 wud extend gain twd 1.3948.

Last edited by a moderator: