Dear Traders,

Once upon a time a 5 years old boy named James (but everyone called him Jim anyway) decided to launch a little startup. We can not say that selling peanuts and collecting empty soda bottles made him a billionaire, but clever investing style did.

Born in

1942 Jim Rogers remains

one of the most well-known and respected investors for the last 50 years. His interests have never been limited to investing only: he is also a famous businessman, financial commentator and author of many books about finance (“A bull in China”, “Hot Commodities”, “Adventure Capitalist”, etc.). What is the secret of Jim Roger’s amazing success?

Being a student at Yale and Oxford later on, Jim had studied various subjects, including economics, philosophy and politics, which allowed him to get an amazing perspective on what has been going on in the world. In 1964 he became a Wall Street man, where he first learned about stocks and bonds.

During his Wall Street years, Jim Rogers was working with another famous investor George Soros, with whom they founded

the Quantum Fund, which was one of the first international funds. In 1970-80s it’s portfolio gained 4200%, while the S&P raised for 47%.

“I can remember the exact day of my first million dollars’ net worth. It was in November 1977. I was 35. I knew I needed more than that to do what I wanted when I was 37 – the age I decided to stop working to seek adventure”.

After that mind-blowing result, Rogers decided to take a break and went to travel around the world on his motorcycle. Later on, he has done it a couple of times more, for which he was picked up in the Guinness Books of World Records. He has also written a bestselling book about investing and his bike adventures (“Investment Biker”).

In

1998 Jim Rogers founded

the Rogers International Commodity Index (RICI). It represents the value of a basket of commodities consumed in the global economy, ranging from agricultural to energy and metal products. Jim Roger prefers to invest in real goods, commodities raw materials and natural resources.

Speaking about Jim Roger’s trading strategy, it can be defined as

“buy low and sell high”. To implement it you need to find something low priced and unpopular among other investors, but with the visible positive changes. Don’t rush into buying it right away, do you homework carefully. When you finally buy it, hold on to it until the shares will rise to the highest levels (“bubbles”). Everyone else will try to buy it and you will be able to make most of it. Be patient, if your homework is done, it will trigger eventually.

Jim Rogers does not believe in technical analysis and in trader’s skills of predicting the future. He only uses charts to check out the past and use serious fundamental reasons in his trading style, getting involved only in long term trades.

“Swim your own races” he once said. Maybe this is one Jim Roger’s best pieces of advice, because it’s very important to develop your own trading style, not copy other traders ways, but patiently evolve and complete your own.

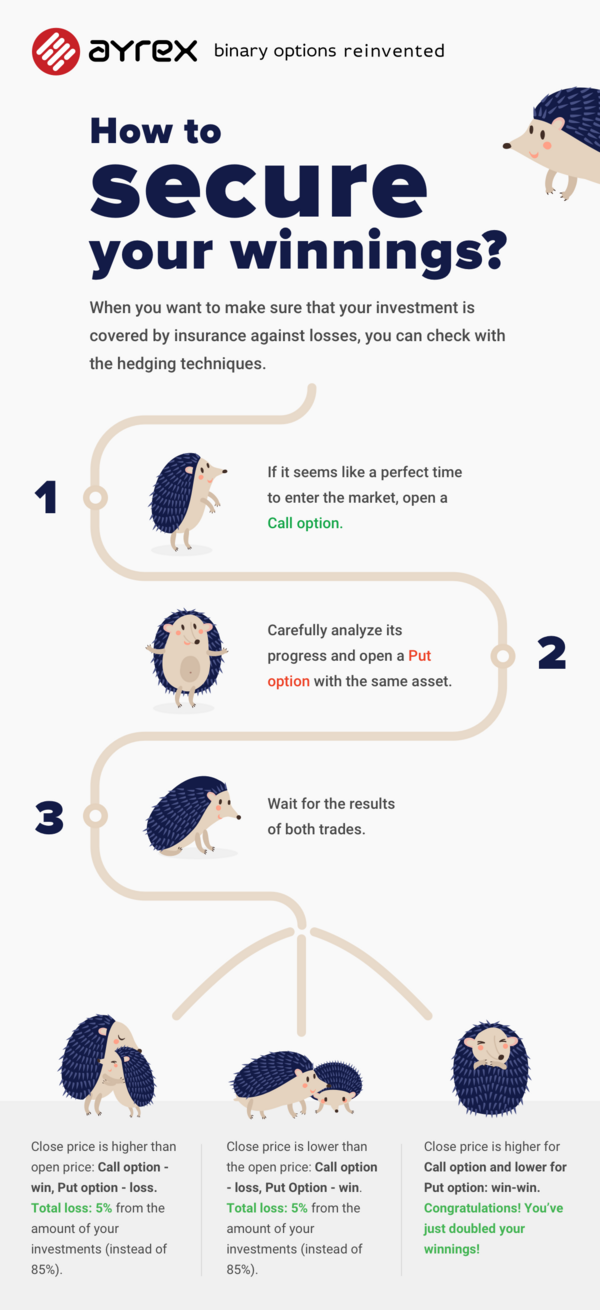

Start your own trading history with Ayrex!

Sincerely yours,

Start your own trading history with Ayrex!

Sincerely yours,

Ayrex Team.