syamfx2020

Recruit

- Messages

- 0

China’s economy slipped into deflation as consumer prices contracted for the first time in more than two years. Deflation is the opposite of inflation, in other words, a decrease in the prices of goods and services. The decline in exports and the ongoing problems in the real estate market are the reasons behind China's economy entering deflation.

The Consumer Price Index, the main gauge of inflation, declined by 0.3 percent in July after remaining flat the previous month, according to China’s National Bureau of Statistics. The producer price index (PPI) fell by 4.4% in July, producer prices are the prices that manufacturers charge for their products.

China has recently eased its monetary policy, which could weaken its own currency and increase inflation again in the future.

EQUITIES

US stock futures traded flat as investors grew more cautious about placing aggressive bids ahead of the US inflation data later this week to guide the economic and monetary policy outlook. On Tuesday the Wall Street ended slightly lower after Moody’s recent downgrade of several US banks curbed the enthusiasm for riskier investments.

OIL

Crude oil prices returned back to multi-month highs following the previous session's pullback after Saudi Arabia reaffirmed its commitment to extend voluntary output cuts through September on Tuesday. On the other hand, the API inventory data showed the US crude inventories increased by 4.067 million barrels in the week that ended August 4th, 2023, after declining by 15.4 million barrels in the previous week.

CURRENCIES

In the currency market, EURUSD continues to swing between losses and gains this week. The currency pair rebounded back to above 1.0980 after hitting a fresh weekly low of 1.0930 on Tuesday. However, the momentum on the upside has slowed down, the market breadth remains intact and there is no indication of profit booking or reversal emerging from the highs. Meantime, the US dollar index traded in a narrow range Wednesday morning as traders and investors are waiting for fresh US economic data.

GOLD

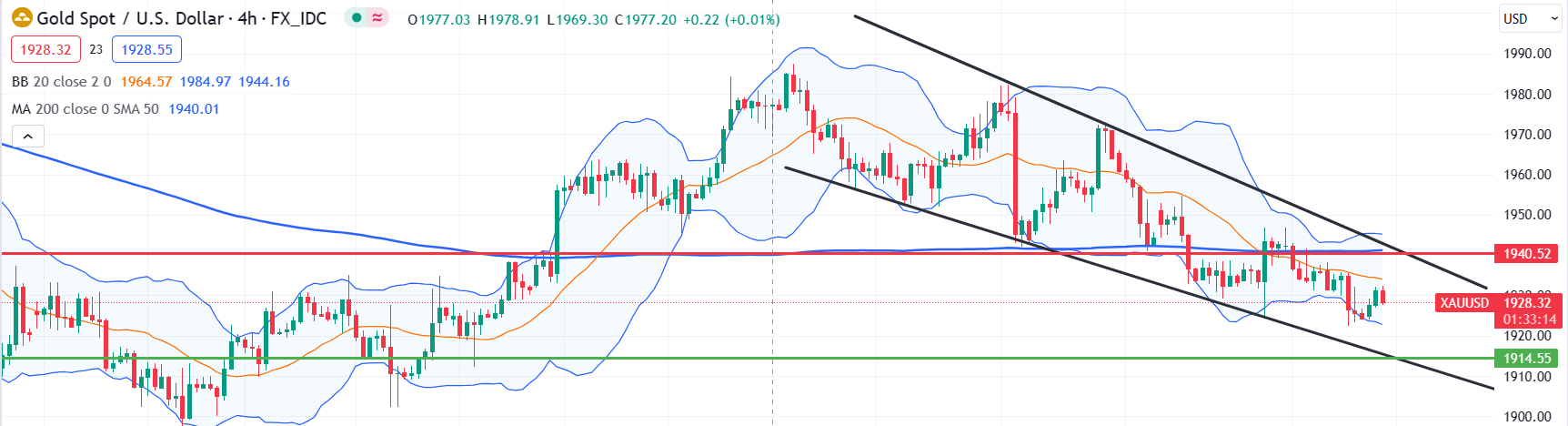

The precious metal responded positively to China’s deflation data and rebounded back to $1930. However, the upside momentum remains limited as buying volume pressure is very limited as investors awaiting key US inflation data this week. Moving ahead, there is no major economic data scheduled for today, so today again the trend of the metal would largely depend on the trend of the dollar index.

Economic Outlook

Moving ahead today, the important events to watch:

Canada – Building permits: GMT – 12:30

US – EIA crude inventories: GMT – 14:30

Technical Outlook and Review

EURUSD: From a technical perspective, the 1.0930/10 area of confluence has recently been held as a firm support, failure to defend the mentioned support levels has the potential to drag the pair further towards the 1.0870 support zone. On the upper side, in case the pair manages to regain upside momentum, it will head towards the immediate resistance of 1.1010 and then 1.1040.

The important levels to watch for today: Support- 1.0940 and 1.0900 Resistance- 1.1000 and 1.1040.

GOLD: Technically, the immediate outlook seems slightly neutral as the latest decline back to $1922 was met with fresh buying. Today, the first nearest support level is located at $1922. In case it breaks below this level, it will head towards the next support level which is located near 1918/16. On the upper side, 1935 will act as an immediate and strong hurdle while 1942 will be a critical resistance zone because, above this, bulls are likely to dominate.

The important levels to watch for today: Support- 1922 and 1916 Resistance- 1935 and 1942.

Quote of the day – “Based on my own personal experience – both as an investor in recent years and an expert witness in years past – rarely do more than three or four variables really count. Everything else is noise.” – Martin Whitman.

Read more - https://gulfbrokers.com/en/daily-market-report-701

The Consumer Price Index, the main gauge of inflation, declined by 0.3 percent in July after remaining flat the previous month, according to China’s National Bureau of Statistics. The producer price index (PPI) fell by 4.4% in July, producer prices are the prices that manufacturers charge for their products.

China has recently eased its monetary policy, which could weaken its own currency and increase inflation again in the future.

EQUITIES

US stock futures traded flat as investors grew more cautious about placing aggressive bids ahead of the US inflation data later this week to guide the economic and monetary policy outlook. On Tuesday the Wall Street ended slightly lower after Moody’s recent downgrade of several US banks curbed the enthusiasm for riskier investments.

OIL

Crude oil prices returned back to multi-month highs following the previous session's pullback after Saudi Arabia reaffirmed its commitment to extend voluntary output cuts through September on Tuesday. On the other hand, the API inventory data showed the US crude inventories increased by 4.067 million barrels in the week that ended August 4th, 2023, after declining by 15.4 million barrels in the previous week.

CURRENCIES

In the currency market, EURUSD continues to swing between losses and gains this week. The currency pair rebounded back to above 1.0980 after hitting a fresh weekly low of 1.0930 on Tuesday. However, the momentum on the upside has slowed down, the market breadth remains intact and there is no indication of profit booking or reversal emerging from the highs. Meantime, the US dollar index traded in a narrow range Wednesday morning as traders and investors are waiting for fresh US economic data.

GOLD

The precious metal responded positively to China’s deflation data and rebounded back to $1930. However, the upside momentum remains limited as buying volume pressure is very limited as investors awaiting key US inflation data this week. Moving ahead, there is no major economic data scheduled for today, so today again the trend of the metal would largely depend on the trend of the dollar index.

Economic Outlook

Moving ahead today, the important events to watch:

Canada – Building permits: GMT – 12:30

US – EIA crude inventories: GMT – 14:30

Technical Outlook and Review

EURUSD: From a technical perspective, the 1.0930/10 area of confluence has recently been held as a firm support, failure to defend the mentioned support levels has the potential to drag the pair further towards the 1.0870 support zone. On the upper side, in case the pair manages to regain upside momentum, it will head towards the immediate resistance of 1.1010 and then 1.1040.

The important levels to watch for today: Support- 1.0940 and 1.0900 Resistance- 1.1000 and 1.1040.

GOLD: Technically, the immediate outlook seems slightly neutral as the latest decline back to $1922 was met with fresh buying. Today, the first nearest support level is located at $1922. In case it breaks below this level, it will head towards the next support level which is located near 1918/16. On the upper side, 1935 will act as an immediate and strong hurdle while 1942 will be a critical resistance zone because, above this, bulls are likely to dominate.

The important levels to watch for today: Support- 1922 and 1916 Resistance- 1935 and 1942.

Quote of the day – “Based on my own personal experience – both as an investor in recent years and an expert witness in years past – rarely do more than three or four variables really count. Everything else is noise.” – Martin Whitman.

Read more - https://gulfbrokers.com/en/daily-market-report-701