You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

flags and pennants

- Thread starter Arafx

- Start date

GeekyForex

Private

- Messages

- 11

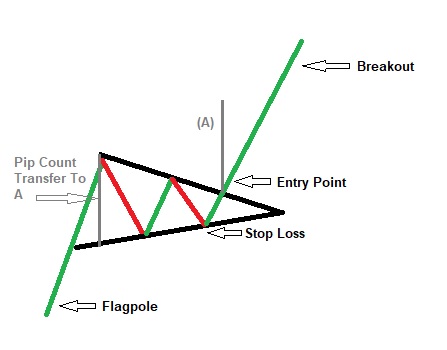

The pennant pattern is a powerful chart formation that often occurs during periods of consolidation in the Forex market. It represents a brief pause or temporary cessation of price movement before the continuation of an existing trend. Just like its namesake, the shape resembles a small flag on top of a pole.What are some best practices for setting entry and exit points when trading flags and pennants?

This pattern is formed when there is a sharp and significant price move, followed by a period of consolidation where prices trade within converging trendlines. These trendlines form the upper and lower boundaries of the pennant pattern and are usually drawn as diagonal lines as shown below:

The entry point is where the breakout from the consolidation occurs and the stop loss order should be placed tight to the bottom of where the breakout starts as shown above.

Similar threads

- Replies

- 0

- Views

- 44

- Replies

- 0

- Views

- 22

- Replies

- 0

- Views

- 32