Sive Morten

Special Consultant to the FPA

- Messages

- 18,760

Guys, we have technical problems with uploading charts on server, so, I will put them here as attachments. Sorry for any inconvenience.

Fundamentals

dollar traded mixed on Friday after weaker-than-expected headline U.S. fourth-quarter gross domestic product data, which included the fastest pace of consumer spending since 2006 and left intact market expectations of long-term greenback gains.

U.S. economic activity in the fourth quarter rose 2.6 percent, below economists' consensus forecast of 3 percent and nearly half of the third quarter's 5 percent rate.

While the U.S. Federal Reserve is still expected to begin raising interest rates later this year, the contrast with loosening monetary policies elsewhere in the world is becoming even more stark.

"That monetary divergence continues to dominate foreign exchange markets. The fundamental case for dollar strength is still in place as a long-term theme," said Brian Daingerfield, currency strategist at the Royal Bank of Scotland in Stamford, Connecticut.

The U.S. dollar index advanced for a seventh straight month in January, marking the longest streak of monthly gains since the greenback was floated as a fiat currency in 1971. On the day however, the index was off 0.10 percent.

Market positioning against the euro has built up over the last six months in expectation that the European Central Bank would embark on aggressive monetary easing policies. That scenario played out last week when the ECB announced a 1 trillion-euro quantitative easing plan.

While that ultimately justifies selling pressure on the euro, the unwinding of short-euro positions is creating some buying of the currency, at least in the short term.

"The long-term position for the euro is decisively lower, but we seem to be consolidating short-euro positions here before the downtrend resumes," Daingerfield said.

In contrast to the U.S. economy's growth, albeit slightly lower in the first look at fourth-quarter activity, Canada's economy shrank unexpectedly in November by 0.2 percent, prompting market talk that the Bank of Canada will cut interest rates in March for the second time in six weeks.

"The data in hand do support the Bank of Canada's very bearish interpretation of the impact of lower oil (prices) on the Canadian economy," said Bill Adams, an economist at PNC Financial Services Group.

Currently guys, GBP shows some interesting action and this weekly research we dedicate to Cable.

CFTC data shows that open interest that has dropped significantly on Scotland voting – now was restored at almost previous levels. Open interest mostly has grown on short positions. Picture of speculative positions looks obvious – solid increasing of shorts while longs stand anemic. At the same time, if you will take a look at commercial positions (hedgers) you will see interesting detail. While there is no surprise in solid part on commercial longs – they just a mirror of speculative shorts, even by chart shape, we see increasing of commercial shorts, but non-commercial longs (speculative bulls) stand flat or even decrease. It could be a sign that bearish sentiment becomes softer. May be it will not lead to reversal, but retracement is possible. It seems that market is tired a bit from endless drop.

Open interest:

View attachment cftc_gbp_oi_20_01_15.bmp

Shorts:

View attachment cftc_gbp_shorts_20_01_15.bmp

Longs:

View attachment cftc_gbp_longs_20_01_15.bmp

Technicals

Monthly

Right in the beginning of our weekly research I would like to show you monthly chart and analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

https://www.forexpeacearmy.com/forex-forum/forex-military-school-complete-forex-education-pro-banker/30110-chapter-16-part-v-trading-elliot-waves-page-7-a.html

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support-resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now.

Trend is bearish here, but GBP is not at oversold. Right now market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. This is an area where market has stopped last time. Monthly chart give us just single AB-CD pattern with nearest target at 0.618 extension – 1.3088. Still, here we have another one non-Fib orienteer – lower border of current consolidation. If we will treat it as sideways action then lower border will stand ~1.42-1.43 area. But first we need to get over current support level and see what market could give us here.

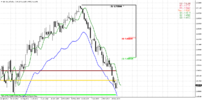

Weekly

Here guys we see nothing special – no patterns, divergences etc. Here it is even useless to plot January monthly pivots since cable has passed through all of them. So, I’ve drawn new - February pivots here…

Still weekly chart tells us that market is oversold at monthly strong support and this could be treated as weekly bullish DiNapoli “Stretch” pattern. Second is – we have perfect thrust down that could become a source of multiple patterns and setups in the future, if upward retracement will happen.