Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

Fundamentals

We've got bulk of important data this week, including GDP in EU and US, PCE etc. But, by our view not them have become the hot topic. We think that First Republic Bank collapse and J. Biden 2-nd term intention announcement are most important events. Below we explain why.

Market overview

First is, let's briefly run through recent GDP data and other statistics. The U.S. dollar rose on Friday after data showed inflation grew in March, though at a slower pace, keeping the Federal Reserve still firmly on track to raise interest rates at next week's monetary policy meeting.

Friday's data showed the personal consumption expenditures (PCE) price index edged 0.1% higher in March after rising 0.3% in February. In the 12 months through March, the PCE price index increased 4.2% after climbing 5.1% in February. Excluding the volatile food and energy components, the PCE price index inched up 0.3% after increasing at the same rate in February. The so-called core PCE price index gained 4.6% on a year-on-year basis in March after rising 4.7% in February.

Following the inflation data, the rate futures market has priced in a 90% chance of a 25 basis-point hike next week. A separate report on Friday showing the final University of Michigan consumer sentiment reading of 63.5 in April, up from a three-month low 62 in March, added to dollar gains. U.S. consumers' one-year inflation outlook was 4.6 this month from 3.6 in March, further underpinned rate hike expectations, boosting the dollar as well.

Economic data painted a mixed picture for growth and inflation across the euro zone, raising uncertainty around the size of the European Central Bank's expected interest rate hike next week. Preliminary data showed gross domestic product in the euro zone expanded by 0.1% in the first quarter. Largest EU economy, Germany, shows 0% GDP growth.

The advance estimate of first-quarter gross domestic product (GDP) showed a 1.1% annualized rate during the period. Economists polled by Reuters had forecast GDP rising at a 2.0% rate. However, investors focused on the quarterly inflation number within the GDP report. Core personal consumption expenditure prices rose 4.9% in the first three months of the year, higher than the 4.7% consensus and up from the fourth quarter figure.

With the GDP release there are two most important moments. First is the components. And we have two major factors that have made the shape of final GDP numbers. This is Households consumption and Investments. consumer activity in Q1 2023 was the strongest in two years, forming a positive contribution to GDP at the level of 2.5 percentage points. This is at odds with the operational data on household incomes and expenditures, where there is mainly stagnation at the occupied borders. The current contribution of 2.5% is a high level. From 2014 to 2019, on the trajectory of the consumer boom, the contribution of consumer spending was 1.8 percentage points to GDP.

For the first time since Q4 2021, the demand for goods began to grow – a significant contribution of 1.5 pp, and services contributed 1 pp to the quarterly GDP growth.

Investments made a negative contribution to 2.3 p.p. Thus, the main negative contribution is stocks. The decrease in inventories makes a negative contribution to GDP, because it means that consumption by households, businesses and the state from stocks was greater than their recovery through production. This explains deflation in production sphere (drop in PPI), deterioration of whosale inventories and drop of manufacturing and production.

We also have a big doubts concerning consumption jump. As we've mentioned above, it contradicts to personal income and expenditures data. Also we have relative indicators that just confirm our doubts. As we've mentioned in Telegram - when the dynamics of freight traffic starts to diverge strongly from the dynamics of GDP It is a reason to be nervous.

The reason is simple - such a discrepancy either means a change in the trend of economic development (for example, material production is growing, services are falling, or vice versa), or this is again the statistical service repainting the window and taking up postscripts. Both things happen for a reason, so you need to look closely.

If during the pandemic and the logistics crisis it was clear why the turnover in the ports was falling, now everything looks a little strange: the logistics were repaired in the first approximation, in theory, take it and be happy. But no: a blockage of 30% of the peak values. If this is not some kind of random muck (a large port did not work, a strike, repairs, etc.), then only the option of a systemic decline in consumption remains. And, accordingly, the decline in real GDP. That is, the recession is already with us, and the political instructor from the BEA is lying about growth.

Of course, in theory there is such an option that the margins of economic agents have grown a lot: as a result, the physical volume of consumption has fallen, while GDP in money terms has remained the same, or even slightly increased. But it's unlikely to be honest. Firstly, in this case, GDP would have grown rather than physical volume falling, and secondly, with the slightest increase in margins, the market would have bubbled. In general, most likely we are again seeing art with GDP - it was not possible to draw a growth of 2%, but they pulled at least 1%

And, guys - take a look at stubborn deflator, not only core PCE, but GDP deflator as well. It is stubbornly high, despite all efforts from the Fed and 5% rate. This just stuns economists in the US. They do not understand what is going on, because the term "structural crisis" is from "eastern economy school" it doesn't exist in "western Economics theory", which has only monetary tools of inflation normalization.

Second is - stubborn US labor market. Significant economic downturn needed to bring inflation down to 2% target - Former U.S. Treasury Secretary Larry Summers said. In recent JPow interview to russian prankers he said two major things - at least two more rate hikes (i.e. May and June) and crash of job market is needed, which, in turn, doesn't exclude hike in July as well, until we see unemployment starts raising. This is drastically differ from market view now. And here we see huge potential for trading as USD appreciation might become full surprise for the market. First hit might happen as soon as on June meeting, 14th.

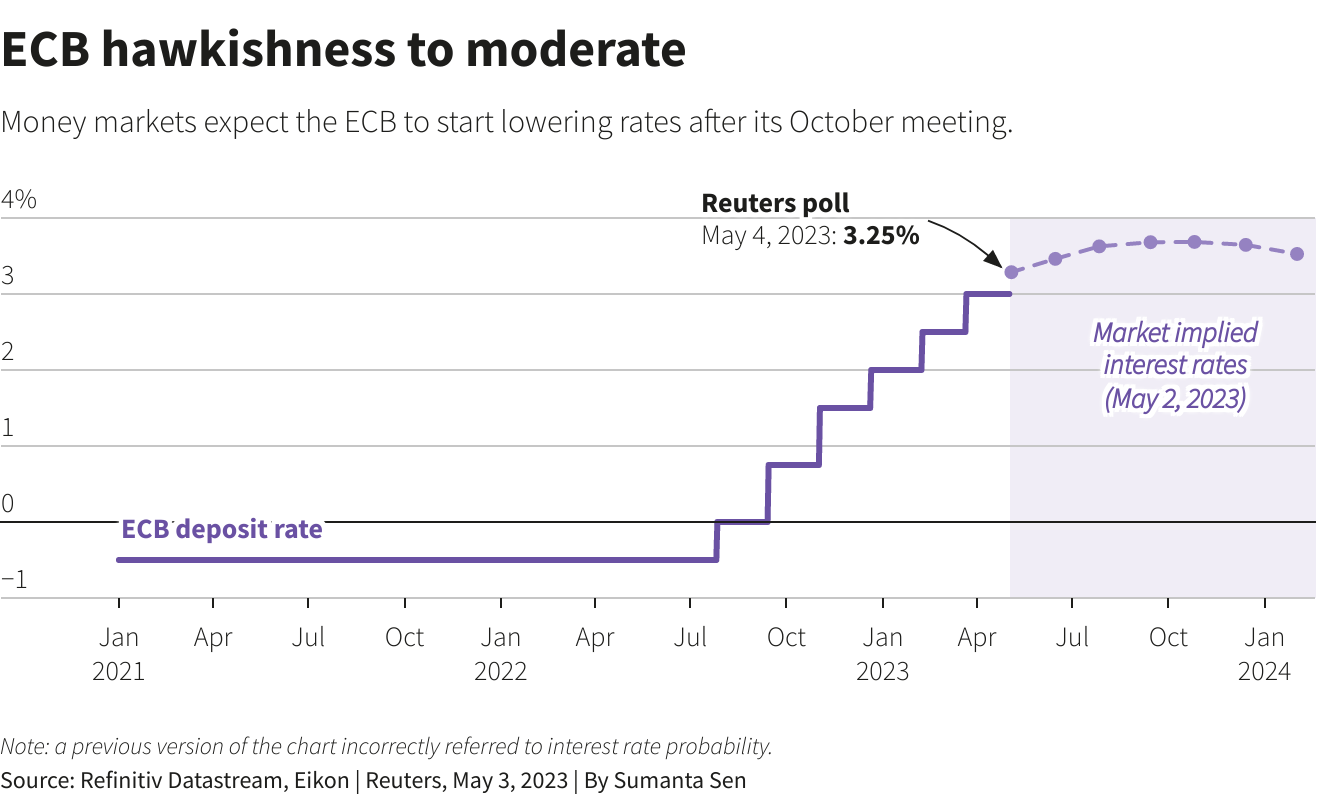

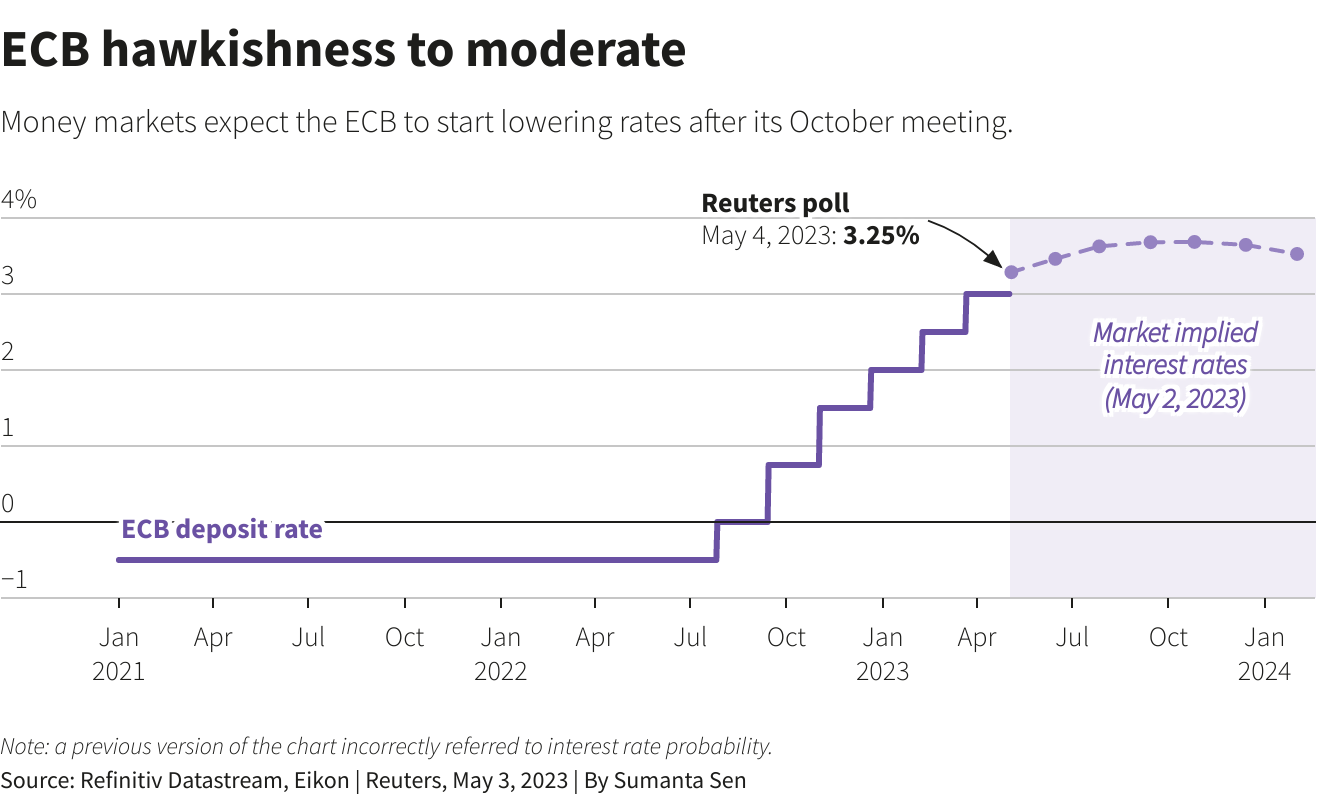

In EU, situation is opposite - everybody expects strong ECB steps against inflation, expecting 3 more 25 points rate hike, and maybe 50 points change next week. 12 respondents (of 69) expect a 50 basis point move next week.

Medians showed the deposit rate peaking at 3.50% in June while in a March poll it was seen topping out at 3.75% in Q3. Still, a significant minority, 30 of 68, had the rate at 3.75% or higher by year-end. The common currency was rewarded by the ECB's hawkish outlook - predicted to strengthen around 2% to $1.12 in 12 months, according to a separate Reuters poll. But for the truth sake, there are a lot of opponents to this idea, suggesting drop to parity closer to the end of the summer.

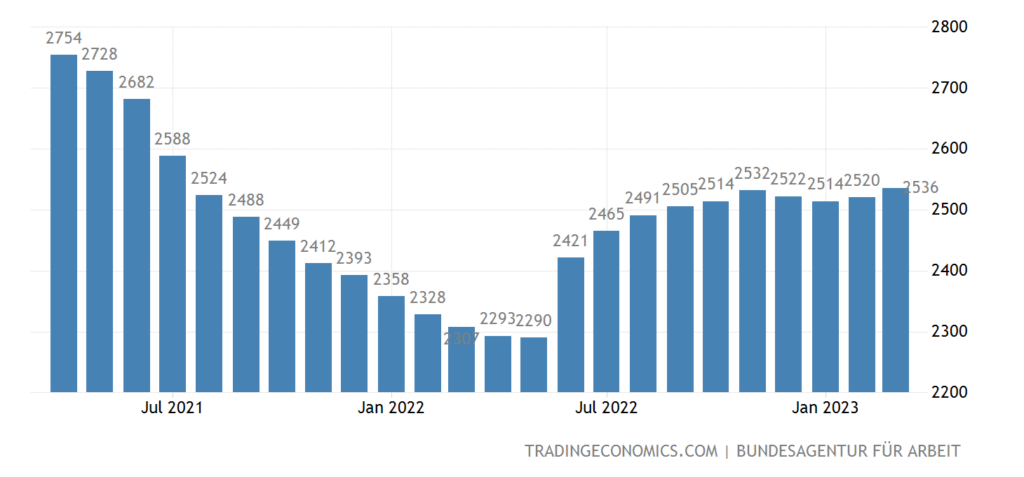

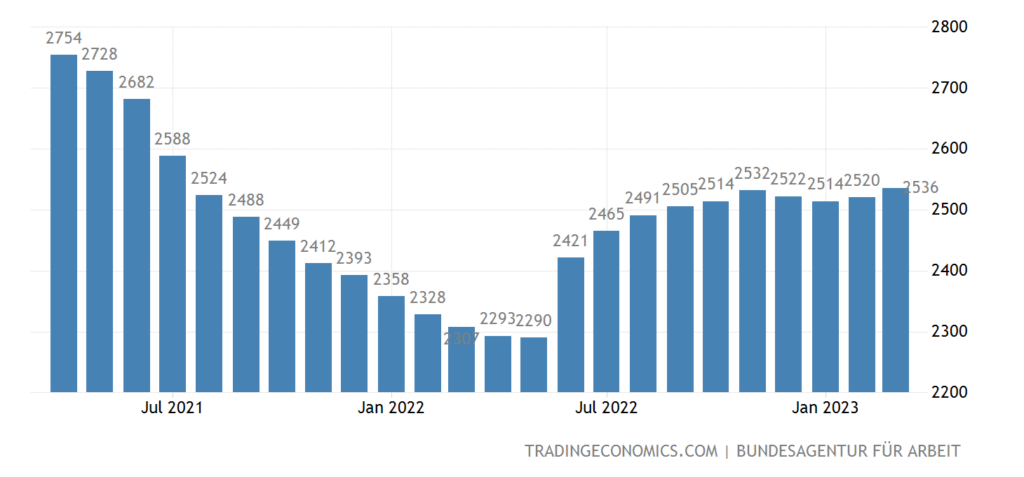

EU statistics is not impressive. GDP is stumbled, especially in Germany. Unemployment is raising together with decreasing of industrial production and now is at highest level in 2 years. This is indirect sign of government subsidy support of social sphere.

The same problems now on real estate market - Percentage of frozen residential construction in Germany. "Due to rapidly rising construction costs and higher financing rates, many housing projects are no longer profitable and have been shelved or canceled entirely" - Institute for Economic Research

European commercial real estate investment fell to its lowest in 11 years in the first quarter of 2023, MSCI Real Assets said on Thursday, as investors spooked by higher interest rates and the economic outlook put acquisition plans on ice. The number of offices sold - Europe's largest real estate sector - fell to its lowest on record, while the volume of transactions slumped to a 13-year low of 10.8 billion euros. A recent JP Morgan investor survey cited commercial real estate as the most likely cause of the next financial crisis.

And just to remind you - in June EU commercial banks have to repay around EUR 300 Bln to ECB in CV19 support programme - the liquidity that was provided in 2021. Many countries, especially Italy will have to get it back, but at significantly higher rate. This put the shadow on ECB action after June meeting, and I wouldn't surprise if they stop at 3.5% rate level, whatever core inflation will be. This is another factor that could drastically change EUR/USD balance in June.

FIRST REPUBLIC BANK JOURNEY

Now we're coming to most important thing by our view. As you understand, the issue, in general is not about FRB itself, but in wider precedent and possible ways of its solution. The most obvious conclusion that we could make is banking crisis is not over - it continues. FRB has lost $100 Bln of deposits - 58% of all deposits just in a three weeks. But, this is only the top of the iceberg. Most interesting the earning statement that FRB released right before "bad things" was going to happen.

Report shows that in principle it is impossible to rely on bank statements in the context of "Statements of income", assessing the potential risks of banks, Despite the fact that FRB was almost destroyed in March (only big whales and FDIC have saved it) , the bank reported a profit of 229 million compared to 364 million a year earlier. The problem is that the bank has accumulated super-expensive loans at rates of 4.8%, having a weighted average yield on loans of 3.73%, and on securities of 3.08%, forming a huge gap in profitability between liabilities and assets, which in the short term will lead to huge losses:

FDR is a 14th largest bank in the US. And here I ask you - what do you think, how different situation stands in all other mid and small-sized banks in the US? The answer is nohow. They are the same 100%. But the major problem is - all mid class business are based on loans from small and mid sized regional banks. Big banks are investing, managing assets and funds, accumulating "liquidity creams" while small banks are doing hard day by day loan job with small and mid size companies across the US. And now all of them are at risk -

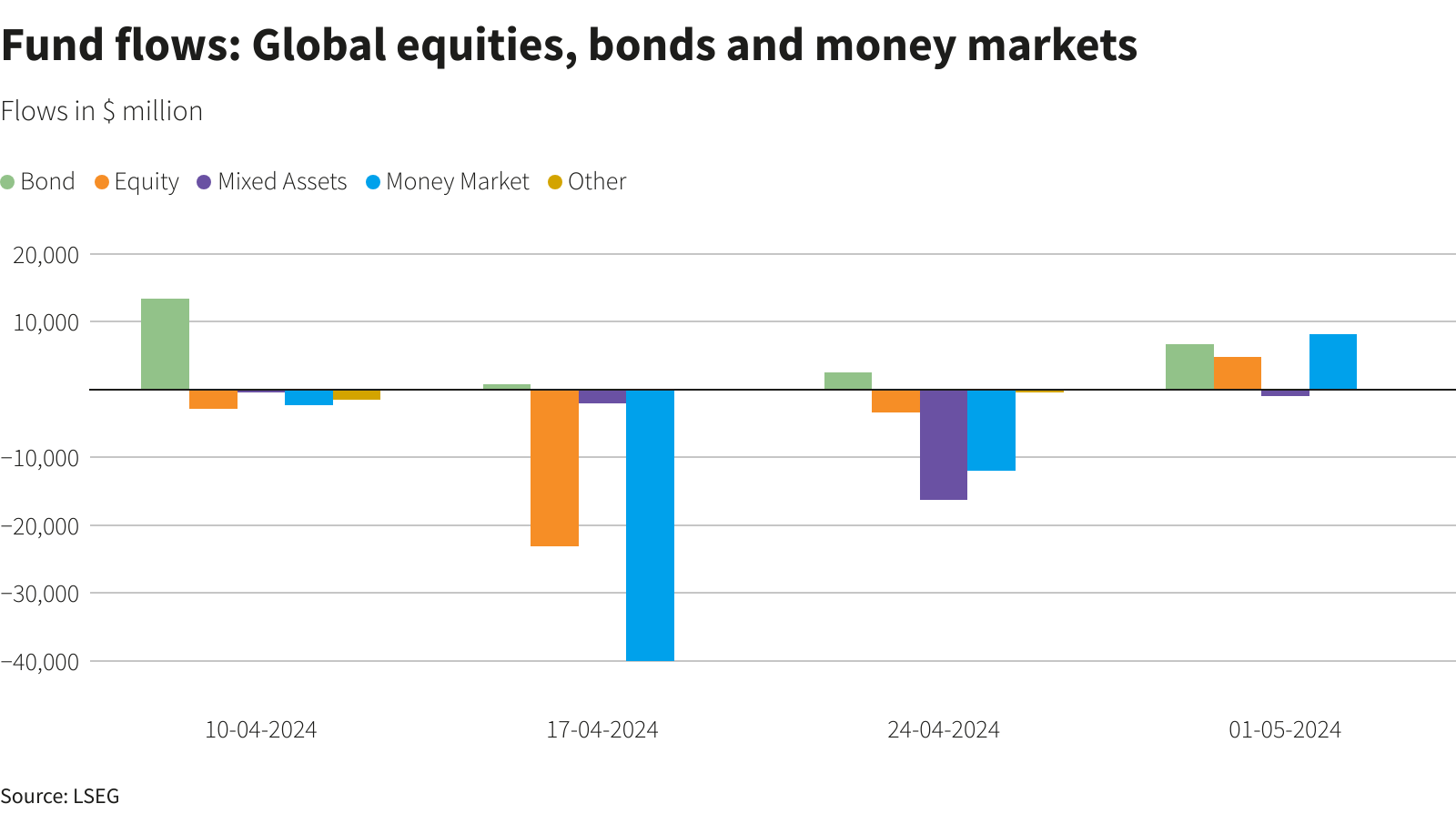

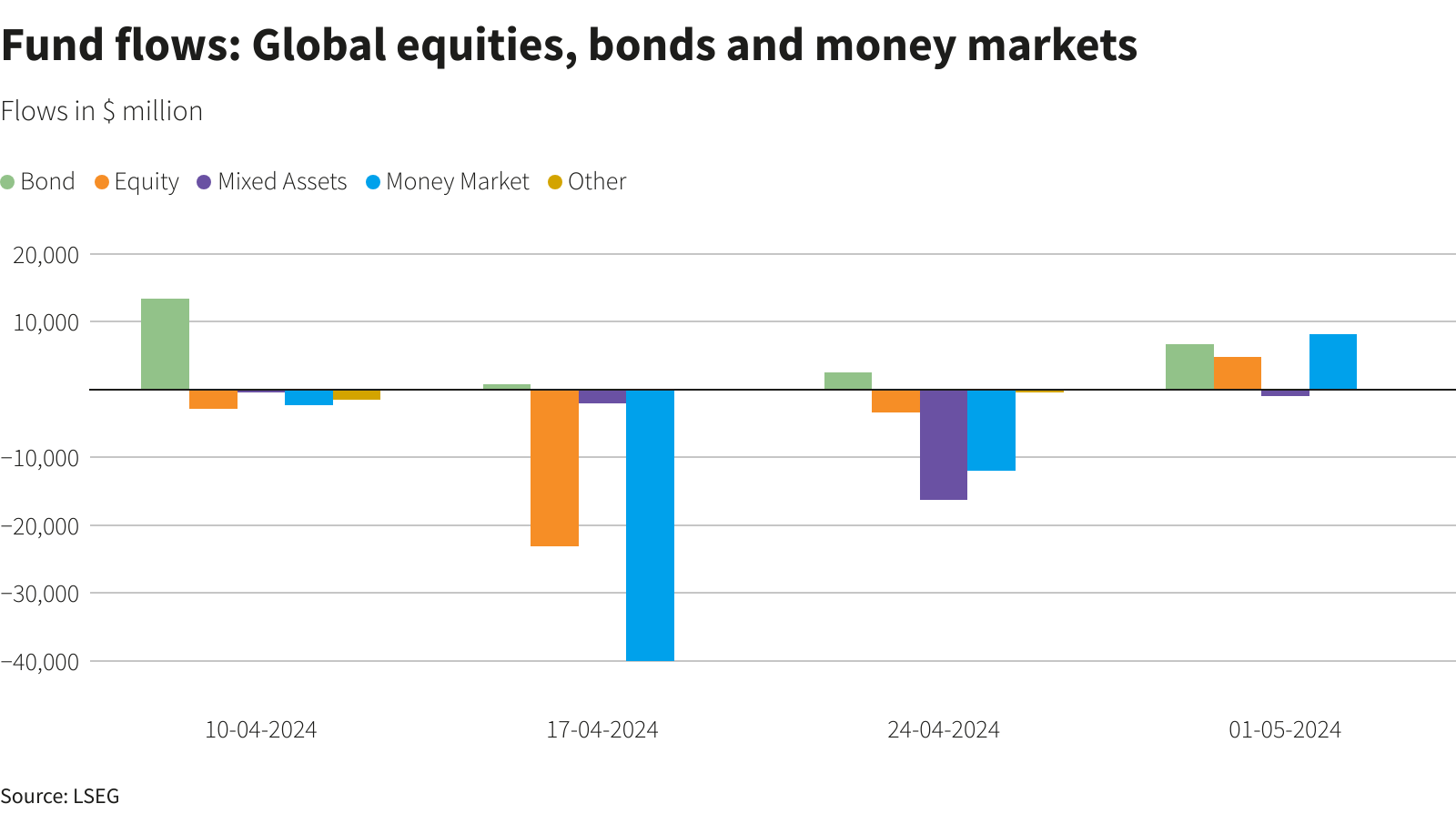

Deposits at commercial U.S. banks dipped in the week ended April 19, signaling no fresh worries about bank safety of the kind that drove sharp outflows in the week immediately following the collapse of Silicon Valley Bank, data released on Friday by the Federal Reserve showed. Investors put their cash in the relative safety of global money market funds in the seven days to April 26, on worries over a slowdown in global economic activity with the recent decline in U.S. companies' quarterly earnings feeding pessimism. Data from Refinitiv Lipper showed investors purchased a net $42.68 billion worth of money market funds in the week to April 26, taking the cumulative inflows for the year to a massive $427.4 billion.

Yes, maybe we have not so strong pace, as in the beginning, but trend holds. Besides, recent Fed statistics shows that request on support from the banks has not become weaker. Demand for funds remains and all programmes have shown surplus.

And now the cherry on the pie - they do not know what to do with this. Once again they would like to ride on the backs of big banks - either provide funds to FDIC for insurance the collapse or buy FRB bonds above the market value and get the same loss. Choose your poison by yourself. With this kind of solution options hardly they could go too far.

So, J. Yellen, J. Powell and the FDIC are back to coordinating the "rescue" of First Republic Bank...trying to sell "...attract more parties to the rescue, including banks and private equity firms...", but it seems that nobody wants to participate (after JPM and Co. under the request of Yellen have already plunged into $ 30 billion), as a result, it is being discussed that the bank will move under the FDIC control. True, the FDIC balance sheet is not rubber - then you need to quickly sell the portfolio ($ 173 billion) at discounts and take losses. They have not enough free funds to rescue FRB and keep all trash bonds that they have accumulated already, rescuing SVB and other banks...

In general, the story around the bank is enchanting and absurd ... one of the decisions that was discussed was that FRB would sell bonds and assets from its balance sheet to other banks above their value, and they would take the loss ... because if it falls, there will be a loss more. As a result, the more they rush about, the more they get confused. We'll be watching with interest how it ends... but I expect nothing good from this story. It shows that problem is in banking system, not with particular banks.

The Fed has poured $350 billion into the banking sector since the beginning of the year to save it from collapse. However, it is now clear that these efforts are clearly not enough. After all , the total losses of banks due to rising rates and stopping the printing press exceed 2 trillion dollars . And another 200 US banks could follow the path of SVB and First Republic.

It is especially bad for medium and small banks that lose capitalization on the fund due to a long-term revaluation of their profitability + are exposed to all sorts of unpleasant risks, such as loans for commercial real estate. They make up about 40% of total lending to small US banks, compared to about 13% on the balance sheets of the largest lenders.

Well, raise the rates on deposits? Not an option: Market rates have skyrocketed so fast that banks are stupidly unable to make money by offering savings rates above 4% to savers because their assets (loans/collateral) have not shifted to a higher rate of return. This is a direct consequence of the ZIRP and NIRP era in the dollar system.

Reduced lending, especially from the regional sector, is what will undermine economic growth. Recession, depression, budget deficit, horror-horror and so on. Taken together, these banks, unlike large banks, really support small and medium-sized businesses as we've said above, and this is about half of the entire economy, at least in terms of labor force.

Therefore , the banking crisis may well get even worse - putting America on the brink of recession . And if the peak of the crisis falls on the pre-election year 2024, then this will add even more instability to the already stormy presidential race - and greatly complicate the Democrats' attempts to stay in power. But this is a different story that we will cover tomorrow in Gold weekly report.

By the way, against the background of a sharp increase in interest payments on US Treasuries, and political fuss over the debt ceiling to save troubled banks may simply be no one and nothing to do. This is actually the main danger. In general, separately, neither the banking, nor the budget, nor the debt crises of the USA and the EU would be terrible. But all together, they may simply not have time to cope. After all, the global crisis is just the synchronization of several unfavorable trends, and at the breakeven point.

LIQUIDITY DRAUGHT and DEBT CEIL SAGA

While the Fed and US Treasury already have a headache of banking sector rescue, the liquidity is keep drawing. M2 supply has dropped to the levels have not seen since 1959. So, they are still struggle against inflation. More bank crashes and bailouts in the US? There is an opinion that everything is much worse. The current performance of the economy, inflation and Fed policy no longer matter. Here's what's next:

All reasonable experts agree that the X-date of the US debt ceiling is approaching and does not bode well. It's all about tax revenue, which collapsed in the current period. We've talked about last week. US Treasury misses ~35% of average tax income in IQ 2023. But so far, this process has only been visible in the debt markets, where the structure of short-term rates has been broken and the overnight rate index (OIS) has been shaking. The financial markets grew like crazy, while the insiders unloaded in the meantime.

Liquidity is depleted: the money supply (M2) is shrinking for the first time in the last 60 years against the backdrop of continued QT + about 90% market probability of another 25 bp rate hike. This means that any negative event in the markets will trigger self-sustaining sell-offs. Of course, lending to the economy continues to tighten and shrink in order to somehow reduce the losses of the banking sector. Depositors have been leaving banks on an expedited basis since last November -- this is not an isolated SVB case. US bank deposit rates at 0% now have to compete like never before with market rates such as money market funds at 4.5% and above.

The US House of Representatives passed a bill to raise the national debt limit. The plan to increase the national debt was previously published by the Speaker of the House of Representatives, Republican Kevin McCarthy. According to it, the debt limit will be raised by $1.5 trillion, but spending cuts of $4.5 trillion will be required. Expert tells that this bill has no chances to pass the Senate. White House press secretary Karine Jean-Pierre ruled out that President Joe Biden would sign the legislation.

Meantime, economists consider what will happen to the US economy in case of default? Consulting company RSM US predicts unemployment to rise to 12% in the first 6 months, GDP to fall by 10% and recover only by 2025, and inflation to rise to double digits during the year. But, something tells me that consequences will be much worse, except if it will be temporal, technical default.

We've got bulk of important data this week, including GDP in EU and US, PCE etc. But, by our view not them have become the hot topic. We think that First Republic Bank collapse and J. Biden 2-nd term intention announcement are most important events. Below we explain why.

Market overview

First is, let's briefly run through recent GDP data and other statistics. The U.S. dollar rose on Friday after data showed inflation grew in March, though at a slower pace, keeping the Federal Reserve still firmly on track to raise interest rates at next week's monetary policy meeting.

Friday's data showed the personal consumption expenditures (PCE) price index edged 0.1% higher in March after rising 0.3% in February. In the 12 months through March, the PCE price index increased 4.2% after climbing 5.1% in February. Excluding the volatile food and energy components, the PCE price index inched up 0.3% after increasing at the same rate in February. The so-called core PCE price index gained 4.6% on a year-on-year basis in March after rising 4.7% in February.

"You probably need a much bigger slowing in the growth rate to get the Fed comfortable that it’s succeeded in its mission; it's not there yet," said Joseph Lavorgna, chief U.S. economist at SMBC Nikko Securities in New York. "It doesn't change the outlook (for policymakers next week)."

Following the inflation data, the rate futures market has priced in a 90% chance of a 25 basis-point hike next week. A separate report on Friday showing the final University of Michigan consumer sentiment reading of 63.5 in April, up from a three-month low 62 in March, added to dollar gains. U.S. consumers' one-year inflation outlook was 4.6 this month from 3.6 in March, further underpinned rate hike expectations, boosting the dollar as well.

Economic data painted a mixed picture for growth and inflation across the euro zone, raising uncertainty around the size of the European Central Bank's expected interest rate hike next week. Preliminary data showed gross domestic product in the euro zone expanded by 0.1% in the first quarter. Largest EU economy, Germany, shows 0% GDP growth.

"We think the balance of probabilities is gradually shifting in the dollar's favour," wrote Jonathan Petersen, senior market economist at Capital Economics in a research note. "The 'goldilocks' regime of stronger activity data outside of the U.S. seems to be fading, and we anticipate the dollar benefiting from safe-haven demand once the global growth picture starts to deteriorate more substantially in coming months."

The advance estimate of first-quarter gross domestic product (GDP) showed a 1.1% annualized rate during the period. Economists polled by Reuters had forecast GDP rising at a 2.0% rate. However, investors focused on the quarterly inflation number within the GDP report. Core personal consumption expenditure prices rose 4.9% in the first three months of the year, higher than the 4.7% consensus and up from the fourth quarter figure.

A separate report from the Labor Department on Thursday showed initial claims for state unemployment benefits decreased 16,000 to a seasonally adjusted 230,000 for the week ending April 22. Economists had expected 248,000 claims in the latest week. The report suggested a still-tight labor market and also underpinned next week's rate increase expectations."The weaker growth outlook is telling us that the Fed is going to struggle to keep on hiking interest rates without crushing the economy," said Amo Sahota, director at FX consulting firm Klarity FX in San Francisco. But the conundrum of what to do with inflation is still persistent. The Fed has been telling us that for a long time. So that (core PCE) number just hardened the fact that we're going to have a rate hike next week," he added.

With the GDP release there are two most important moments. First is the components. And we have two major factors that have made the shape of final GDP numbers. This is Households consumption and Investments. consumer activity in Q1 2023 was the strongest in two years, forming a positive contribution to GDP at the level of 2.5 percentage points. This is at odds with the operational data on household incomes and expenditures, where there is mainly stagnation at the occupied borders. The current contribution of 2.5% is a high level. From 2014 to 2019, on the trajectory of the consumer boom, the contribution of consumer spending was 1.8 percentage points to GDP.

For the first time since Q4 2021, the demand for goods began to grow – a significant contribution of 1.5 pp, and services contributed 1 pp to the quarterly GDP growth.

Investments made a negative contribution to 2.3 p.p. Thus, the main negative contribution is stocks. The decrease in inventories makes a negative contribution to GDP, because it means that consumption by households, businesses and the state from stocks was greater than their recovery through production. This explains deflation in production sphere (drop in PPI), deterioration of whosale inventories and drop of manufacturing and production.

We also have a big doubts concerning consumption jump. As we've mentioned above, it contradicts to personal income and expenditures data. Also we have relative indicators that just confirm our doubts. As we've mentioned in Telegram - when the dynamics of freight traffic starts to diverge strongly from the dynamics of GDP It is a reason to be nervous.

The reason is simple - such a discrepancy either means a change in the trend of economic development (for example, material production is growing, services are falling, or vice versa), or this is again the statistical service repainting the window and taking up postscripts. Both things happen for a reason, so you need to look closely.

If during the pandemic and the logistics crisis it was clear why the turnover in the ports was falling, now everything looks a little strange: the logistics were repaired in the first approximation, in theory, take it and be happy. But no: a blockage of 30% of the peak values. If this is not some kind of random muck (a large port did not work, a strike, repairs, etc.), then only the option of a systemic decline in consumption remains. And, accordingly, the decline in real GDP. That is, the recession is already with us, and the political instructor from the BEA is lying about growth.

Of course, in theory there is such an option that the margins of economic agents have grown a lot: as a result, the physical volume of consumption has fallen, while GDP in money terms has remained the same, or even slightly increased. But it's unlikely to be honest. Firstly, in this case, GDP would have grown rather than physical volume falling, and secondly, with the slightest increase in margins, the market would have bubbled. In general, most likely we are again seeing art with GDP - it was not possible to draw a growth of 2%, but they pulled at least 1%

And, guys - take a look at stubborn deflator, not only core PCE, but GDP deflator as well. It is stubbornly high, despite all efforts from the Fed and 5% rate. This just stuns economists in the US. They do not understand what is going on, because the term "structural crisis" is from "eastern economy school" it doesn't exist in "western Economics theory", which has only monetary tools of inflation normalization.

Second is - stubborn US labor market. Significant economic downturn needed to bring inflation down to 2% target - Former U.S. Treasury Secretary Larry Summers said. In recent JPow interview to russian prankers he said two major things - at least two more rate hikes (i.e. May and June) and crash of job market is needed, which, in turn, doesn't exclude hike in July as well, until we see unemployment starts raising. This is drastically differ from market view now. And here we see huge potential for trading as USD appreciation might become full surprise for the market. First hit might happen as soon as on June meeting, 14th.

In EU, situation is opposite - everybody expects strong ECB steps against inflation, expecting 3 more 25 points rate hike, and maybe 50 points change next week. 12 respondents (of 69) expect a 50 basis point move next week.

"Even though headline inflation will come down further, sufficient pipeline pressure in services and stubbornly high core inflation argue in favour of more rate hikes and a 'high for longer' approach," said Carsten Brzeski at ING, who doesn't see a rate cut until the second half of 2024. "The ECB will not consider any reversal of the current stance until both projected and actual inflation are clearly moving towards 2% again."

Medians showed the deposit rate peaking at 3.50% in June while in a March poll it was seen topping out at 3.75% in Q3. Still, a significant minority, 30 of 68, had the rate at 3.75% or higher by year-end. The common currency was rewarded by the ECB's hawkish outlook - predicted to strengthen around 2% to $1.12 in 12 months, according to a separate Reuters poll. But for the truth sake, there are a lot of opponents to this idea, suggesting drop to parity closer to the end of the summer.

EU statistics is not impressive. GDP is stumbled, especially in Germany. Unemployment is raising together with decreasing of industrial production and now is at highest level in 2 years. This is indirect sign of government subsidy support of social sphere.

The same problems now on real estate market - Percentage of frozen residential construction in Germany. "Due to rapidly rising construction costs and higher financing rates, many housing projects are no longer profitable and have been shelved or canceled entirely" - Institute for Economic Research

European commercial real estate investment fell to its lowest in 11 years in the first quarter of 2023, MSCI Real Assets said on Thursday, as investors spooked by higher interest rates and the economic outlook put acquisition plans on ice. The number of offices sold - Europe's largest real estate sector - fell to its lowest on record, while the volume of transactions slumped to a 13-year low of 10.8 billion euros. A recent JP Morgan investor survey cited commercial real estate as the most likely cause of the next financial crisis.

And just to remind you - in June EU commercial banks have to repay around EUR 300 Bln to ECB in CV19 support programme - the liquidity that was provided in 2021. Many countries, especially Italy will have to get it back, but at significantly higher rate. This put the shadow on ECB action after June meeting, and I wouldn't surprise if they stop at 3.5% rate level, whatever core inflation will be. This is another factor that could drastically change EUR/USD balance in June.

FIRST REPUBLIC BANK JOURNEY

Now we're coming to most important thing by our view. As you understand, the issue, in general is not about FRB itself, but in wider precedent and possible ways of its solution. The most obvious conclusion that we could make is banking crisis is not over - it continues. FRB has lost $100 Bln of deposits - 58% of all deposits just in a three weeks. But, this is only the top of the iceberg. Most interesting the earning statement that FRB released right before "bad things" was going to happen.

Report shows that in principle it is impossible to rely on bank statements in the context of "Statements of income", assessing the potential risks of banks, Despite the fact that FRB was almost destroyed in March (only big whales and FDIC have saved it) , the bank reported a profit of 229 million compared to 364 million a year earlier. The problem is that the bank has accumulated super-expensive loans at rates of 4.8%, having a weighted average yield on loans of 3.73%, and on securities of 3.08%, forming a huge gap in profitability between liabilities and assets, which in the short term will lead to huge losses:

FDR is a 14th largest bank in the US. And here I ask you - what do you think, how different situation stands in all other mid and small-sized banks in the US? The answer is nohow. They are the same 100%. But the major problem is - all mid class business are based on loans from small and mid sized regional banks. Big banks are investing, managing assets and funds, accumulating "liquidity creams" while small banks are doing hard day by day loan job with small and mid size companies across the US. And now all of them are at risk -

Deposits at commercial U.S. banks dipped in the week ended April 19, signaling no fresh worries about bank safety of the kind that drove sharp outflows in the week immediately following the collapse of Silicon Valley Bank, data released on Friday by the Federal Reserve showed. Investors put their cash in the relative safety of global money market funds in the seven days to April 26, on worries over a slowdown in global economic activity with the recent decline in U.S. companies' quarterly earnings feeding pessimism. Data from Refinitiv Lipper showed investors purchased a net $42.68 billion worth of money market funds in the week to April 26, taking the cumulative inflows for the year to a massive $427.4 billion.

Yes, maybe we have not so strong pace, as in the beginning, but trend holds. Besides, recent Fed statistics shows that request on support from the banks has not become weaker. Demand for funds remains and all programmes have shown surplus.

And now the cherry on the pie - they do not know what to do with this. Once again they would like to ride on the backs of big banks - either provide funds to FDIC for insurance the collapse or buy FRB bonds above the market value and get the same loss. Choose your poison by yourself. With this kind of solution options hardly they could go too far.

So, J. Yellen, J. Powell and the FDIC are back to coordinating the "rescue" of First Republic Bank...

In general, the story around the bank is enchanting and absurd ... one of the decisions that was discussed was that FRB would sell bonds and assets from its balance sheet to other banks above their value, and they would take the loss ... because if it falls, there will be a loss more. As a result, the more they rush about, the more they get confused. We'll be watching with interest how it ends... but I expect nothing good from this story. It shows that problem is in banking system, not with particular banks.

The Fed has poured $350 billion into the banking sector since the beginning of the year to save it from collapse. However, it is now clear that these efforts are clearly not enough. After all , the total losses of banks due to rising rates and stopping the printing press exceed 2 trillion dollars . And another 200 US banks could follow the path of SVB and First Republic.

It is especially bad for medium and small banks that lose capitalization on the fund due to a long-term revaluation of their profitability + are exposed to all sorts of unpleasant risks, such as loans for commercial real estate. They make up about 40% of total lending to small US banks, compared to about 13% on the balance sheets of the largest lenders.

Well, raise the rates on deposits? Not an option: Market rates have skyrocketed so fast that banks are stupidly unable to make money by offering savings rates above 4% to savers because their assets (loans/collateral) have not shifted to a higher rate of return. This is a direct consequence of the ZIRP and NIRP era in the dollar system.

Reduced lending, especially from the regional sector, is what will undermine economic growth. Recession, depression, budget deficit, horror-horror and so on. Taken together, these banks, unlike large banks, really support small and medium-sized businesses as we've said above, and this is about half of the entire economy, at least in terms of labor force.

Therefore , the banking crisis may well get even worse - putting America on the brink of recession . And if the peak of the crisis falls on the pre-election year 2024, then this will add even more instability to the already stormy presidential race - and greatly complicate the Democrats' attempts to stay in power. But this is a different story that we will cover tomorrow in Gold weekly report.

By the way, against the background of a sharp increase in interest payments on US Treasuries, and political fuss over the debt ceiling to save troubled banks may simply be no one and nothing to do. This is actually the main danger. In general, separately, neither the banking, nor the budget, nor the debt crises of the USA and the EU would be terrible. But all together, they may simply not have time to cope. After all, the global crisis is just the synchronization of several unfavorable trends, and at the breakeven point.

LIQUIDITY DRAUGHT and DEBT CEIL SAGA

While the Fed and US Treasury already have a headache of banking sector rescue, the liquidity is keep drawing. M2 supply has dropped to the levels have not seen since 1959. So, they are still struggle against inflation. More bank crashes and bailouts in the US? There is an opinion that everything is much worse. The current performance of the economy, inflation and Fed policy no longer matter. Here's what's next:

All reasonable experts agree that the X-date of the US debt ceiling is approaching and does not bode well. It's all about tax revenue, which collapsed in the current period. We've talked about last week. US Treasury misses ~35% of average tax income in IQ 2023. But so far, this process has only been visible in the debt markets, where the structure of short-term rates has been broken and the overnight rate index (OIS) has been shaking. The financial markets grew like crazy, while the insiders unloaded in the meantime.

Liquidity is depleted: the money supply (M2) is shrinking for the first time in the last 60 years against the backdrop of continued QT + about 90% market probability of another 25 bp rate hike. This means that any negative event in the markets will trigger self-sustaining sell-offs. Of course, lending to the economy continues to tighten and shrink in order to somehow reduce the losses of the banking sector. Depositors have been leaving banks on an expedited basis since last November -- this is not an isolated SVB case. US bank deposit rates at 0% now have to compete like never before with market rates such as money market funds at 4.5% and above.

The US House of Representatives passed a bill to raise the national debt limit. The plan to increase the national debt was previously published by the Speaker of the House of Representatives, Republican Kevin McCarthy. According to it, the debt limit will be raised by $1.5 trillion, but spending cuts of $4.5 trillion will be required. Expert tells that this bill has no chances to pass the Senate. White House press secretary Karine Jean-Pierre ruled out that President Joe Biden would sign the legislation.

Meantime, economists consider what will happen to the US economy in case of default? Consulting company RSM US predicts unemployment to rise to 12% in the first 6 months, GDP to fall by 10% and recover only by 2025, and inflation to rise to double digits during the year. But, something tells me that consequences will be much worse, except if it will be temporal, technical default.