Marker

FreshForex Representative

- Messages

- 16

FX: what is the dollar's outlook?

As you can see, the last week all G10 currencies grew against dollar. AUD and NZD took leading positions as the currencies sensitive towards the risk. The last week, S & P 500 grew to the record-making High point, which accompanies amendmends in the FRS policy. In particular, over this year, Aussie was one of the weakest currencies against USD, which explains why delay in narrowing by FRS acted as a strong impetus for AUD. British pound grew a lot because of positive economic data of the last week. EUR was in the middle probably because it was close to a key resistance February High point 1,3710, which can draw attention of the European Central Bank; in February, 2013, the EuCB induced a sharp drop of EURUSD on this level. Thus, investors may feel nervous and make decisions to close profits instead of opening long positions on fresh High points.

Forecast for the week 21 – 25 October, 2013

Where the USD will go to at last?

After smash losses of the previous week, we can see that dollar is trying to compensate a part of them taking a special advantage from possible surprise news of economic data this week.

Nevertheless, it is probable that delay in narrowing made by the FRS is the strongest driving force for dollar in the nearest term. FRS representative Fisher (“hawk”) noted that he will not vote for narrowing this month because of the vague data and difficulties related to obtaining economic reports of the USA.

But December narrowing is also under threat after just a temporary raising of debt ceiling till January and February. If economic outlook is clear and economy demonstates stability, FRS can reject narrowing purchase of assets during the next round of negotiations. Though legislation on raising ceiling debt and financial provision of the Government was adopted, FRS will keep in mind that 144 Republicans voted against and in the future the deal may face a serious resistance.

At this moment, an overall picture can be weak for USD, but this week is crucial for the US currency and future FRS policy. This week we will start getting delayed economic report, and the crucial one is NFP September report. Though this information is a little out-of-date now, it is still important. The market expects for the growth from 180K to 152K in August, which can induce relief rally of USD, because it is assumed that the US economy was in a better state to sustain storm of recent finance and state shutdown. As per Moody's agency's estimation, this quarther economic growth may miss up to 0.6%.

So, until we evidence growth of economic data, it is hard to understand, how USD can behave in a medium term.

We will finally start getting economic data from the USA, because government officials will get back to work from vacancy. We will get some key releases the next week including NFP September report and the report on unemployment level (the 22th of October). Other main data will include retail sales (21st) and durable goods orders (25th). The full schedule of reports including delayed reports can be found through the link: FreshForex - Calendar of Forex market events, Forex calendar.

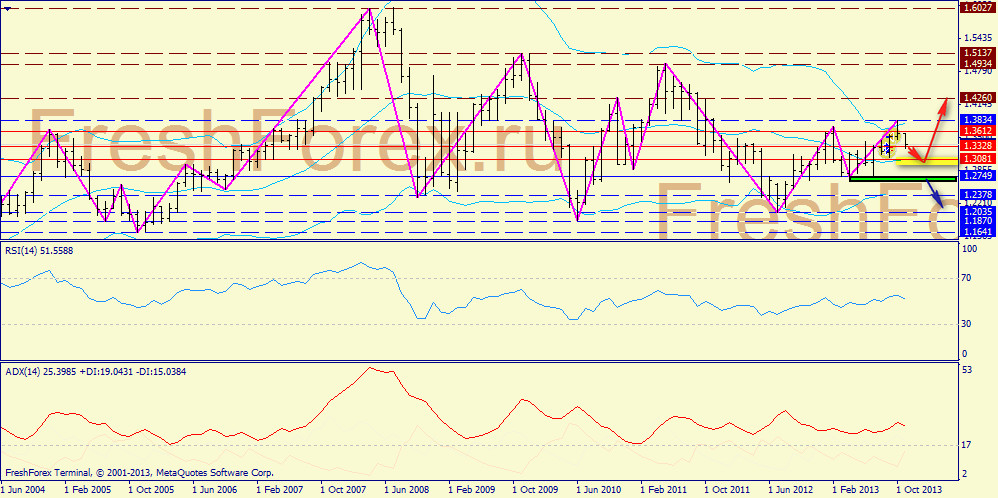

EUR/USD

Europe: issues with Greece budget will get back to focus of attention.

The last week, Euro zone took a back seat, because its budget process grasped a much less attention that the American one. It does not mean that there are no problems through. The fight between Greece and IMF-ECB-EU trip took place. Upon that, EU is looking for extra austerity measures for Greece to provide 2 – 3 bln Euro and plug a budget hole for 2014. The issue for Greek government is that it does not promise austerity trying to retain support in the society and relief economic pressure. Economy of Greece marks 5-years' recession, but this year it showed certain positive signs of growth, and government does not stand for further toughening.

Thus, its destiny may be decided in Berlin, where Merkel still fights for coalition and negotiations around coalition may take one more month to last. It is unlikely that Merkel will be generous to Greece. Euro bonds are still far to be realized, and Germany hardly yeilds its rights to Greek debts. So, a togh contradiction between Greece and above-mentioned trip can be predicted for the nearest months.

Meanwhile, European Central Bank will watch as EURUSD approaches its February High 1.3710, at which ECB successfully seized Euro. The threat of abnormally strong Euro can make European Central Bank to be vigilant this week. We think, 1.40 is a too high level for Euro, and any sign of weakness in October PMI index released this week can make EUB interfere either limit EUR rate by declaring so. As surrender of EURUSD is not expected, we can see drop down to 1.3590 — as the nearest support zone.

Key releases of data from Euro zone the next week include: October PMI (on 24th ), which is expected to continue a steady uprise. German IFO (on 25th ) is expected to reach the highest level from the 1st quarter of 2012. Decision on Norwegian and Sweden rates (both are made on 24th ) also worth attention, it is expected that both states will keep rates on the same level for one more month.

More reports

As you can see, the last week all G10 currencies grew against dollar. AUD and NZD took leading positions as the currencies sensitive towards the risk. The last week, S & P 500 grew to the record-making High point, which accompanies amendmends in the FRS policy. In particular, over this year, Aussie was one of the weakest currencies against USD, which explains why delay in narrowing by FRS acted as a strong impetus for AUD. British pound grew a lot because of positive economic data of the last week. EUR was in the middle probably because it was close to a key resistance February High point 1,3710, which can draw attention of the European Central Bank; in February, 2013, the EuCB induced a sharp drop of EURUSD on this level. Thus, investors may feel nervous and make decisions to close profits instead of opening long positions on fresh High points.

Forecast for the week 21 – 25 October, 2013

Where the USD will go to at last?

After smash losses of the previous week, we can see that dollar is trying to compensate a part of them taking a special advantage from possible surprise news of economic data this week.

Nevertheless, it is probable that delay in narrowing made by the FRS is the strongest driving force for dollar in the nearest term. FRS representative Fisher (“hawk”) noted that he will not vote for narrowing this month because of the vague data and difficulties related to obtaining economic reports of the USA.

But December narrowing is also under threat after just a temporary raising of debt ceiling till January and February. If economic outlook is clear and economy demonstates stability, FRS can reject narrowing purchase of assets during the next round of negotiations. Though legislation on raising ceiling debt and financial provision of the Government was adopted, FRS will keep in mind that 144 Republicans voted against and in the future the deal may face a serious resistance.

At this moment, an overall picture can be weak for USD, but this week is crucial for the US currency and future FRS policy. This week we will start getting delayed economic report, and the crucial one is NFP September report. Though this information is a little out-of-date now, it is still important. The market expects for the growth from 180K to 152K in August, which can induce relief rally of USD, because it is assumed that the US economy was in a better state to sustain storm of recent finance and state shutdown. As per Moody's agency's estimation, this quarther economic growth may miss up to 0.6%.

So, until we evidence growth of economic data, it is hard to understand, how USD can behave in a medium term.

We will finally start getting economic data from the USA, because government officials will get back to work from vacancy. We will get some key releases the next week including NFP September report and the report on unemployment level (the 22th of October). Other main data will include retail sales (21st) and durable goods orders (25th). The full schedule of reports including delayed reports can be found through the link: FreshForex - Calendar of Forex market events, Forex calendar.

EUR/USD

Europe: issues with Greece budget will get back to focus of attention.

The last week, Euro zone took a back seat, because its budget process grasped a much less attention that the American one. It does not mean that there are no problems through. The fight between Greece and IMF-ECB-EU trip took place. Upon that, EU is looking for extra austerity measures for Greece to provide 2 – 3 bln Euro and plug a budget hole for 2014. The issue for Greek government is that it does not promise austerity trying to retain support in the society and relief economic pressure. Economy of Greece marks 5-years' recession, but this year it showed certain positive signs of growth, and government does not stand for further toughening.

Thus, its destiny may be decided in Berlin, where Merkel still fights for coalition and negotiations around coalition may take one more month to last. It is unlikely that Merkel will be generous to Greece. Euro bonds are still far to be realized, and Germany hardly yeilds its rights to Greek debts. So, a togh contradiction between Greece and above-mentioned trip can be predicted for the nearest months.

Meanwhile, European Central Bank will watch as EURUSD approaches its February High 1.3710, at which ECB successfully seized Euro. The threat of abnormally strong Euro can make European Central Bank to be vigilant this week. We think, 1.40 is a too high level for Euro, and any sign of weakness in October PMI index released this week can make EUB interfere either limit EUR rate by declaring so. As surrender of EURUSD is not expected, we can see drop down to 1.3590 — as the nearest support zone.

Key releases of data from Euro zone the next week include: October PMI (on 24th ), which is expected to continue a steady uprise. German IFO (on 25th ) is expected to reach the highest level from the 1st quarter of 2012. Decision on Norwegian and Sweden rates (both are made on 24th ) also worth attention, it is expected that both states will keep rates on the same level for one more month.

More reports