FXCM Discusses Impact of U.S. Exit

NEW YORK, Feb. 12, 2017 (GLOBE NEWSWIRE) -- FXCM Inc. (NASDAQ:FXCM) ("FXCM" or the "Company") today provided additional information regarding the costs associated with its U.S. retail foreign exchange activities, which it has agreed to sell to GAIN Capital Holdings, Inc. ("GAIN"). None of FXCM's costs will be transferring to GAIN and FXCM expects significant cost savings from the wind down of its U.S. retail foreign exchange operations.

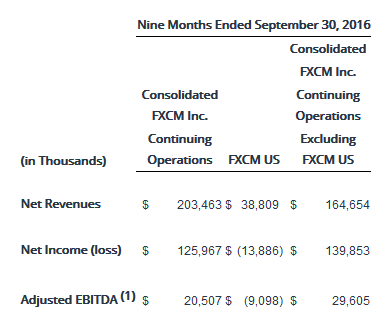

The table below provides information on net revenues, net income, and Adjusted EBITDA* for FXCM's U.S. subsidiary, Forex Capital Markets LLC, and the rest of its continuing operations for the nine months ended September 30, 2016 (unaudited):

Even without its U.S. customers, FXCM remains one of the largest global retail foreign exchange brokers, and FXCM anticipates that the increased focus on serving its international global customer base will drive growth and continued profitability improvement.

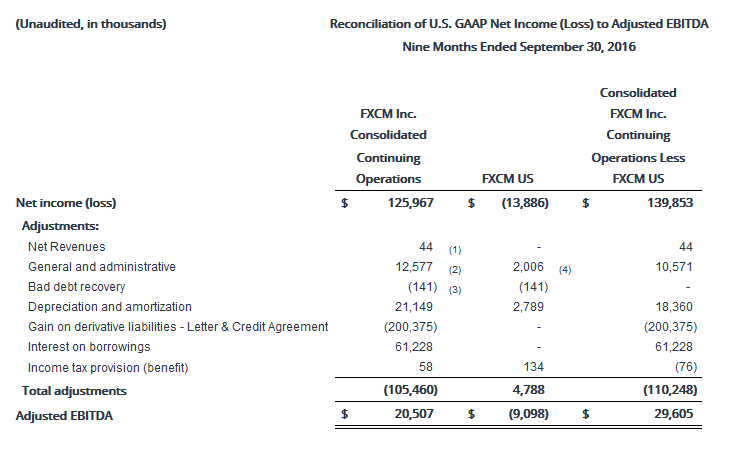

* Adjusted EBITDA is a non-GAAP measure that is not prepared under any comprehensive set of accounting rules or principles and does not reflect all of the amounts associated with the Company's results of operations as determined in accordance with U.S. GAAP. The Company believes this non-GAAP measure, when presented in conjunction with the comparable U.S. GAAP measure, is useful to investors in better understanding its financial performance as seen through the eyes of management and facilitates comparisons of historical operating trends across several periods. The Company believes that investors use Adjusted EBITDA as a supplemental measure to evaluate the overall operating performance of companies in its industry that present similar measures, although the methods used by other companies in calculating Adjusted EBITDA may differ from the Company's method, even if similar terms are used to identify such measure. Adjusted EBITDA provides the Company with an understanding of the results from the primary operations of its business by excluding the effects of certain gains, losses or other charges that do not reflect the normal earnings of its core operations or that may not be indicative of its future outlook and prospects. Adjusted EBITDA does not represent and should not be considered as a substitute for net income or net income attributable to FXCM Inc., each as determined in accordance with U.S. GAAP. Please refer to the following table for a reconciliation of Adjusted EBITDA to net income.

(1) Represents a $0.1 million charge for tax receivable agreement payments.

(2) Represents the provision for debt forgiveness of $8.2 million against the notes receivable from the non-controlling members of Lucid, $5.4 million of professional fees, including fees related to the Leucadia restructuring transaction, stockholder rights plan and investigations into historical trade execution practices, partially offset by $1.0 million of insurance recoveries to reimburse for costs incurred related to the January 15, 2015 SNB event and the cybersecurity incident.

(3) Represents the net bad debt recovery related to client debit balances associated with the January 15, 2015 SNB event.

(4) Represents $2.4 million of professional fees relating to investigations into historical trade execution practices partially offset by $0.4 million of insurance recoveries to reimburse for costs incurred related to the January 15, 2015 SNB event and the cybersecurity incident.

Disclosure Regarding Forward-Looking Statements

In addition to historical information, this release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and/or the Private Securities Litigation Reform Act of 1995, which reflect FXCM's current views with respect to, among other things, its operations and financial performance in the future. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about FXCM's industry, business plans, management's beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, readers are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict including, without limitation, risks associated with FXCM's plans to shut down its US subsidiary and a potential sale of its US customer accounts, risks associated with FXCM's strategy to focus on its operations outside the United States, risks associated with the events that took place in the currency markets on January 15, 2015 and their impact on FXCM's capital structure, risks associated with FXCM's ability to recover all or a portion of any capital losses, risks relating to the ability of FXCM to satisfy the terms and conditions of or make payments pursuant to the terms of the finance agreements with Leucadia, as well as risks associated with FXCM's obligations under its other financing agreements, risks related to FXCM's dependence on FX market makers, market conditions, risks associated with FXCM's litigation with the National Futures Association and the Commodity Futures Trading Commission or any other potential litigation or regulatory inquiries to which FXCM may become subject, risks associated with potential reputational damage to FXCM resulting from FXCM's plans to shut down its US subsidiary, and those other risks described under "Risk Factors" in FXCM Inc.'s Annual Report on Form 10-K, FXCM Inc.'s latest Quarterly Report on Form 10-Q, and other reports or documents FXCM files with, or furnishes to, the SEC from time to time, which are accessible on the SEC website at sec.gov. This information should also be read in conjunction with FXCM's Consolidated Financial Statements and the Notes thereto contained in FXCM's Annual Report on Form 10-K, FXCM Inc.'s latest Quarterly Report on Form 10-Q, and in other reports or documents FXCM files with, or furnishes to, the SEC from time to time, which are accessible on the SEC website at sec.gov.

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this release and in our SEC filings. FXCM Inc. undertakes no obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

About FXCM Inc.

FXCM Inc. (NASDAQ:FXCM) is a publicly traded company which owns 50.1% of FXCM Group, LLC (FXCM Group).

FXCM Group is a holding company of Forex Capital Markets LLC, (FXCM US), Forex Capital Markets Limited, inclusive of all EU branches (FXCM UK), FXCM Australia Pty. Limited, (FXCM AU), and all affiliates of aforementioned firms, or other firms under the FXCM group of companies [collectively "FXCM"]. FXCM Group is owned and operated by FXCM Inc. (NASDAQ:FXCM) and Leucadia National Corporation (NYSE:LUK). Leucadia National Corporation is a multi-billion dollar diversified holding company engaged through its consolidated subsidiaries in a variety of businesses.

FXCM is a leading provider of online foreign exchange (FX) trading, CFD trading, spread betting and related services. The company's mission is to provide global traders with access to the world's largest and most liquid market by offering innovative trading tools, hiring excellent trading educators, meeting strict financial standards and striving for the best online trading experience in the market. Clients have the advantage of mobile trading, one-click order execution and trading from real-time charts. In addition, FXCM offers educational courses on FX trading and provides trading tools proprietary data and premium resources. FXCM Pro provides retail brokers, small hedge funds and emerging market banks access to wholesale execution and liquidity, while providing high and medium frequency funds access to prime brokerage services via FXCM Prime.

Trading foreign exchange and CFDs on margin carries a high level of risk, which may result in losses that could exceed your deposits, therefore may not be suitable for all investors.

Read full disclaimer.

Jaclyn Sales, 646-432-2463

Vice-President, Corporate Communications

jsales@fxcm.com

investorrelations@fxcm.com