Jason Rogers

FXCM Representative

- Messages

- 517

S&P 500 May Have Set Significant Top

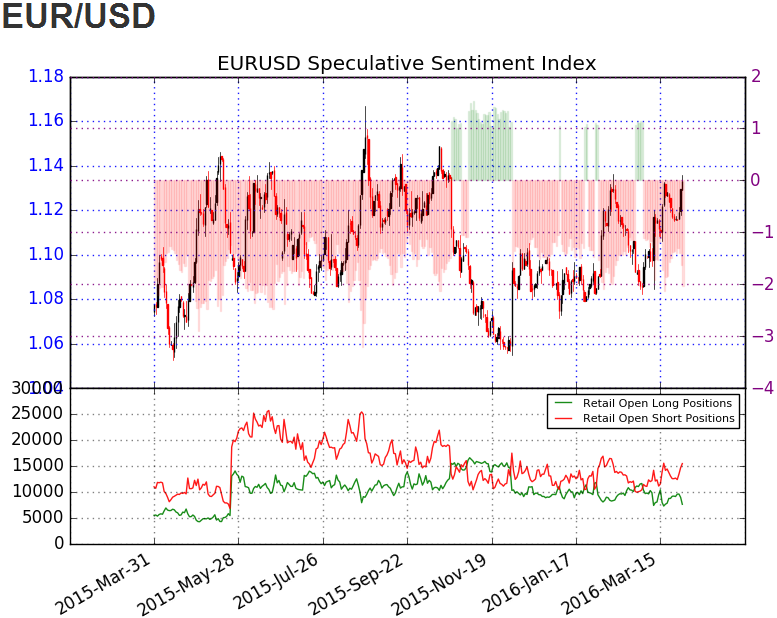

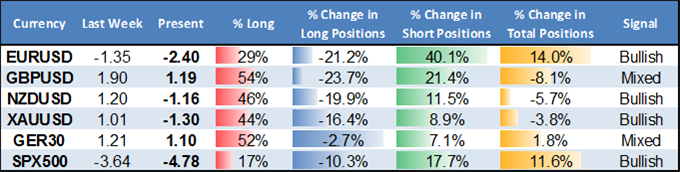

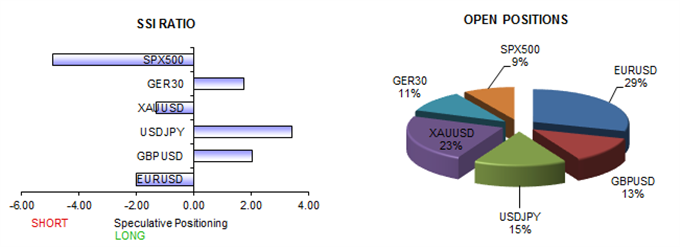

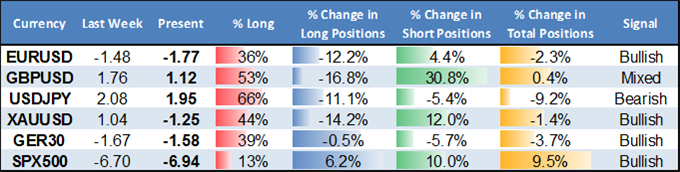

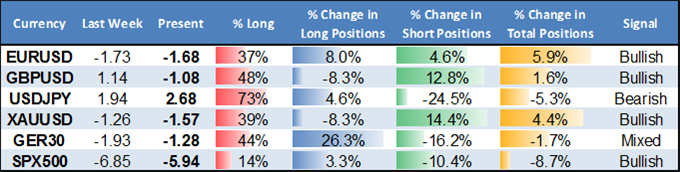

Quantitative strategist David Rodriguez had this to say about the S&P 500 (tradable as the SPX500 on our platform:

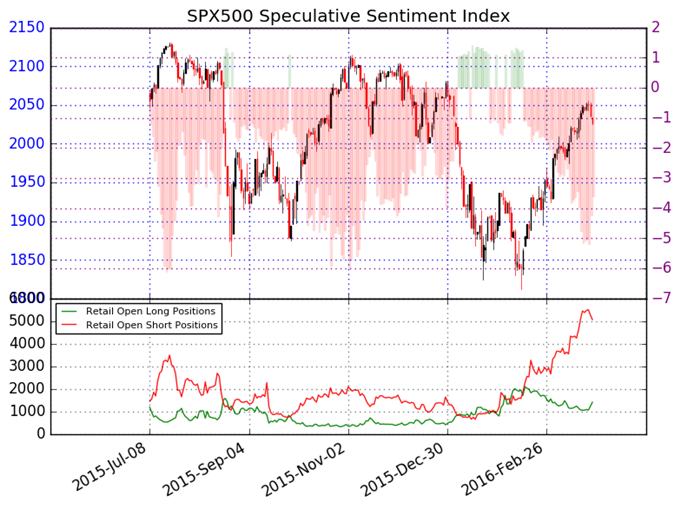

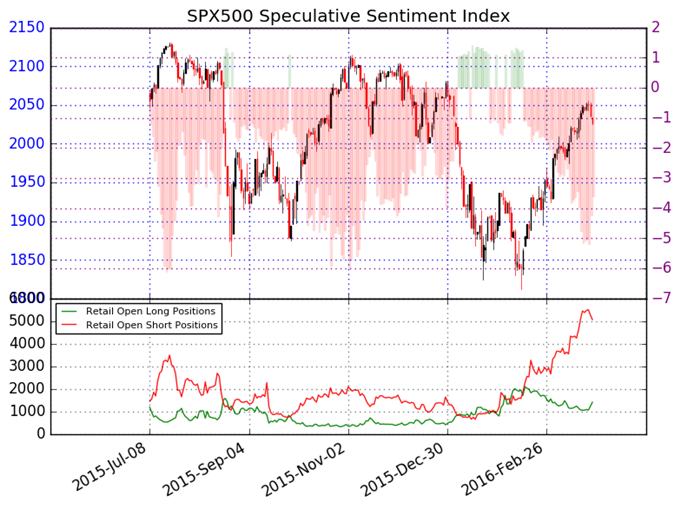

"The US S&P 500 looks at considerable risk of reversal as retail traders pull back from a potentially significant sentiment extreme. It was only two days ago when we noted a record net-short position in the SPX500, and indeed we’ve since seen traders pull back as the index has reversed.

"Traders are often their most short at important market tops, but these are by definition only clear in hindsight. The potential sentiment extreme and subsequent pullback suggests that we have indeed seen a fairly significant market top."

You can read his complete Weekly Speculative Sentiment Index (SSI) report at DailyFX.com

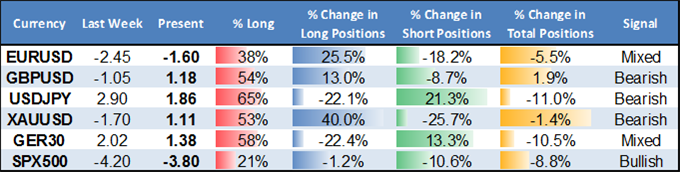

Quantitative strategist David Rodriguez had this to say about the S&P 500 (tradable as the SPX500 on our platform:

"The US S&P 500 looks at considerable risk of reversal as retail traders pull back from a potentially significant sentiment extreme. It was only two days ago when we noted a record net-short position in the SPX500, and indeed we’ve since seen traders pull back as the index has reversed.

"Traders are often their most short at important market tops, but these are by definition only clear in hindsight. The potential sentiment extreme and subsequent pullback suggests that we have indeed seen a fairly significant market top."

You can read his complete Weekly Speculative Sentiment Index (SSI) report at DailyFX.com