Jason Rogers

FXCM Representative

- Messages

- 517

New Zealand Dollar Losses Forecast to Continue

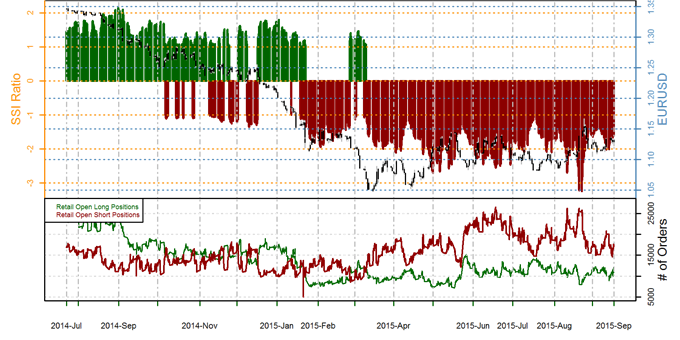

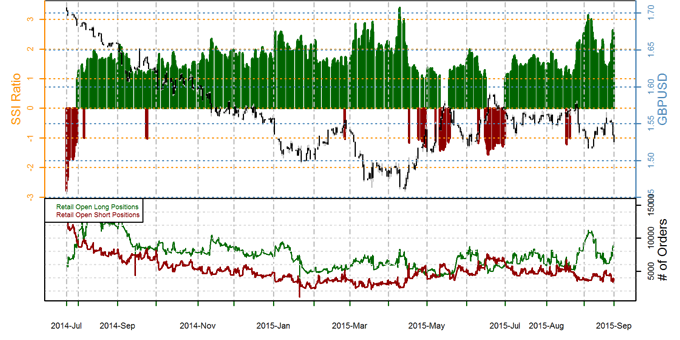

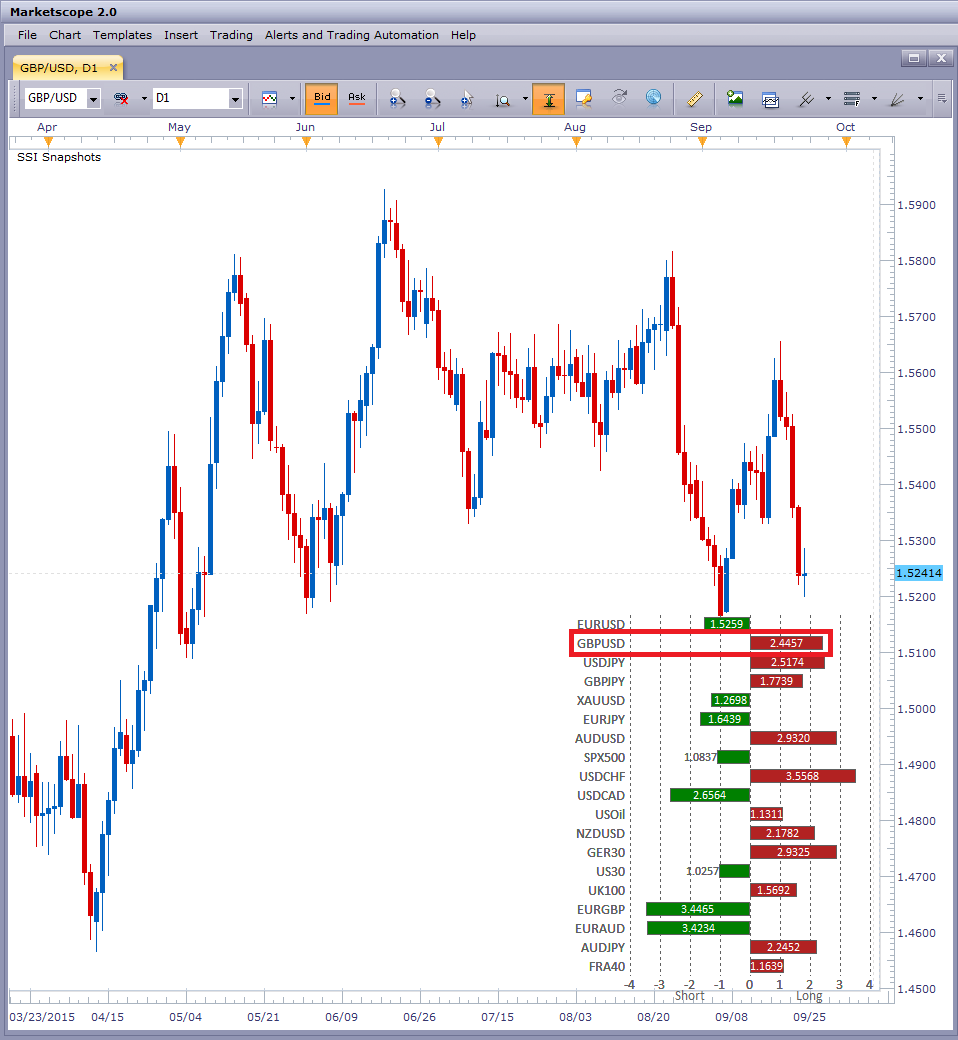

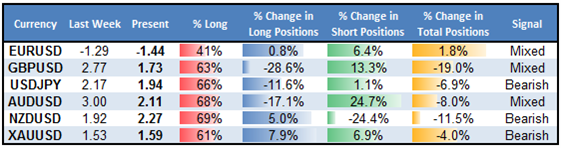

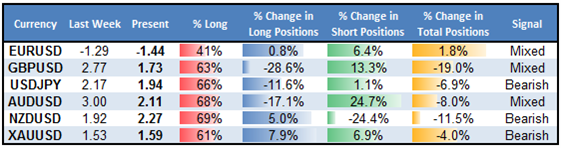

The week before the Federal Reserve meets for its highly anticipated September policy meeting, the retail crowd is already scaling back long US Dollar exposure. Accordingly, our AUD/USD, EUR/USD, and GBP/USD forecasts have been neutralized ahead of what should be a tense week in the run up to the September 17 meeting.

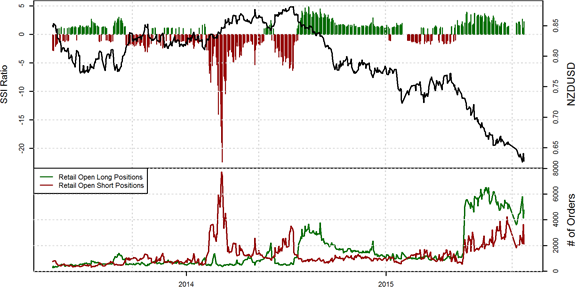

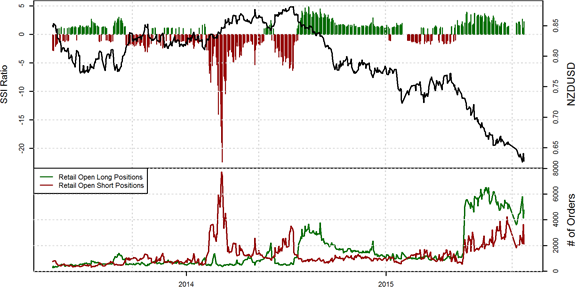

However, the ratio of long to short positions in NZD/USD stands at 2.27 as 69% of traders are long. Yesterday the ratio was 1.14; 53% of open positions were long. Long positions are 15.3% higher than yesterday and 5.0% above levels seen last week. Short positions are 42.0% lower than yesterday and 24.4% below levels seen last week.

The Speculative Sentiment Index (SSI) is a contrarian indicator to price action, so the fact that the majority of traders are long gives signal that the NZD/USD may continue lower. The trading crowd has grown further net-long from yesterday and last week. The combination of current sentiment and recent changes gives a further bearish trading bias.

The week before the Federal Reserve meets for its highly anticipated September policy meeting, the retail crowd is already scaling back long US Dollar exposure. Accordingly, our AUD/USD, EUR/USD, and GBP/USD forecasts have been neutralized ahead of what should be a tense week in the run up to the September 17 meeting.

Weekly Summary of Forex Trader Sentiment and Changes in Positioning

However, the ratio of long to short positions in NZD/USD stands at 2.27 as 69% of traders are long. Yesterday the ratio was 1.14; 53% of open positions were long. Long positions are 15.3% higher than yesterday and 5.0% above levels seen last week. Short positions are 42.0% lower than yesterday and 24.4% below levels seen last week.

The Speculative Sentiment Index (SSI) is a contrarian indicator to price action, so the fact that the majority of traders are long gives signal that the NZD/USD may continue lower. The trading crowd has grown further net-long from yesterday and last week. The combination of current sentiment and recent changes gives a further bearish trading bias.