Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,093

USD/CAD: the pair is correcting 11.09.2017

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

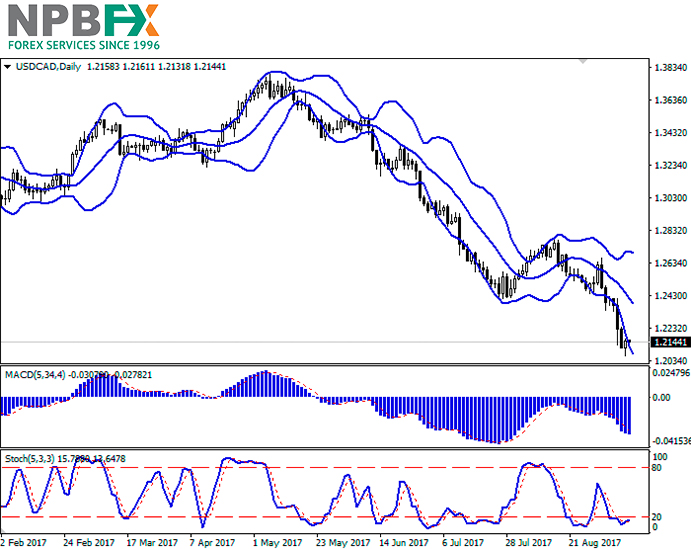

US dollar is developing corrective dynamics in the short term, updating record-setting minimums in the end of the previous week. The reasons that have put utmost pressure on the instrument include Canadian labor market report. In August Canadian economy grew by 22.2K workplaces which was better than expected by analysts (+19.0K). The level of unemployment suddenly decreased from 6.3% to 6.2%.

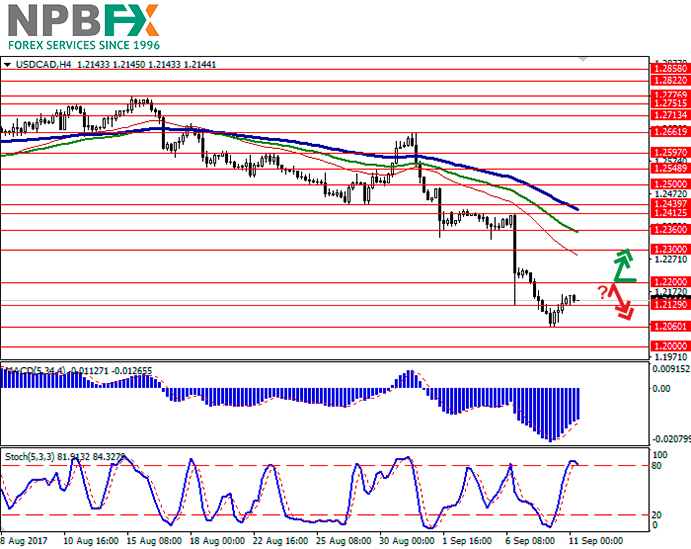

During the morning session on September 11 the pair is showing mixed dynamics as traders are waiting for new drivers in the market. No interesting macroeconomic statistics from the USA and Canada is expected on Monday.

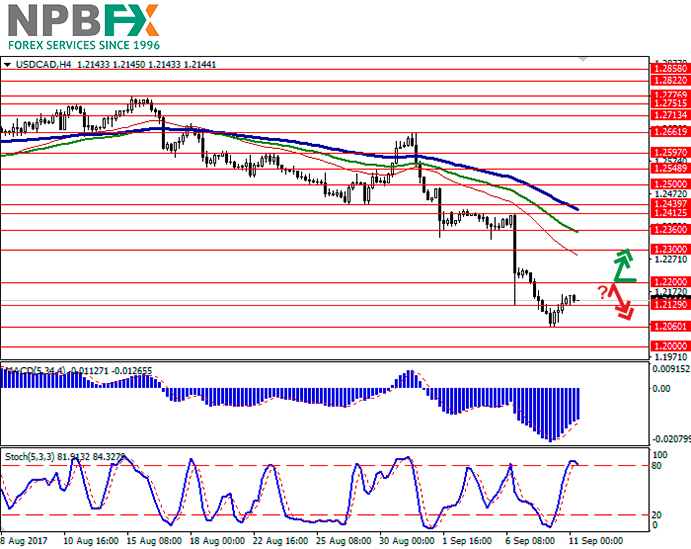

Support and resistance

Bollinger Bands on D1 chart demonstrate stable decrease. The price range is widening. MACD is going down preserving a sell signal (being located under the signal line). Stochastic is trying to form a growth signal and is about to leave the oversold area.

Resistance levels: 1.2200, 1.2300, 1.2360, 1.2412, 1.2439.

Support levels: 1.2129, 1.2060, 1.2000.

Trading tips

Long positions may be opened above the level of 1.2200 with targets at 1.2300, 1.2360 and stop-loss at 1.2120, 1.2100. The period of implementation is 2 days.

Alternatively, short positions may be opened after the reversal of he price near 1.2200 with target 1.2000 and stop-loss at 1.2275, 1.2300. The period of implementation is 2-3 days.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy USD/CAD and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CAD for a better understanding of the current market situation and more efficient trading.

Current trend

US dollar is developing corrective dynamics in the short term, updating record-setting minimums in the end of the previous week. The reasons that have put utmost pressure on the instrument include Canadian labor market report. In August Canadian economy grew by 22.2K workplaces which was better than expected by analysts (+19.0K). The level of unemployment suddenly decreased from 6.3% to 6.2%.

During the morning session on September 11 the pair is showing mixed dynamics as traders are waiting for new drivers in the market. No interesting macroeconomic statistics from the USA and Canada is expected on Monday.

Support and resistance

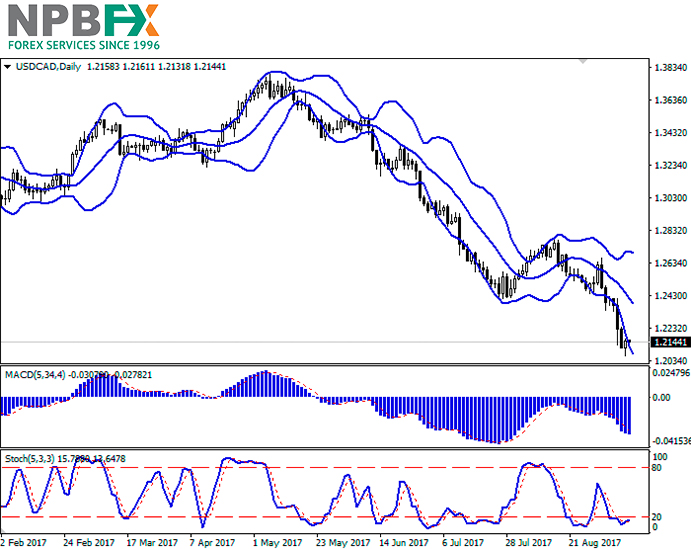

Bollinger Bands on D1 chart demonstrate stable decrease. The price range is widening. MACD is going down preserving a sell signal (being located under the signal line). Stochastic is trying to form a growth signal and is about to leave the oversold area.

Resistance levels: 1.2200, 1.2300, 1.2360, 1.2412, 1.2439.

Support levels: 1.2129, 1.2060, 1.2000.

Trading tips

Long positions may be opened above the level of 1.2200 with targets at 1.2300, 1.2360 and stop-loss at 1.2120, 1.2100. The period of implementation is 2 days.

Alternatively, short positions may be opened after the reversal of he price near 1.2200 with target 1.2000 and stop-loss at 1.2275, 1.2300. The period of implementation is 2-3 days.

Use more opportunities of the NPBFX analytical portal: trading signals

Make right trade decisions on sell or buy USD/CAD and other popular instruments using trading signals on the NPBFX portal. All registered users have free access to signals from the top 10 trading indicators (MA10, BBands, Ichimoku, Stochastic, ZigZag, etc.) with also general recommendations on the portal.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CAD and trade efficiently with NPBFX.