Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,095

USD/JPY: wave analysis 18.12.2017

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/JPY for a better understanding of the current market situation and more efficient trading.

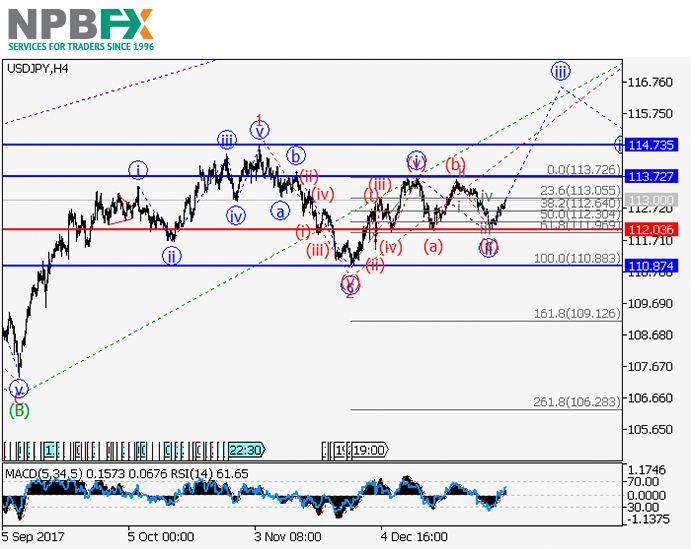

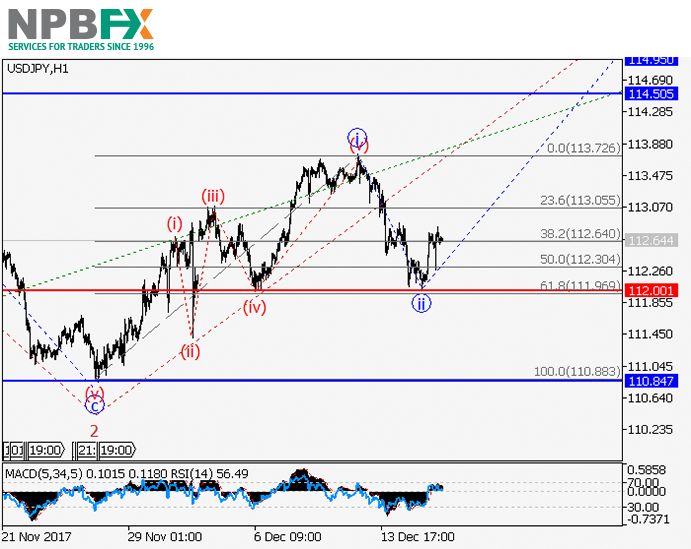

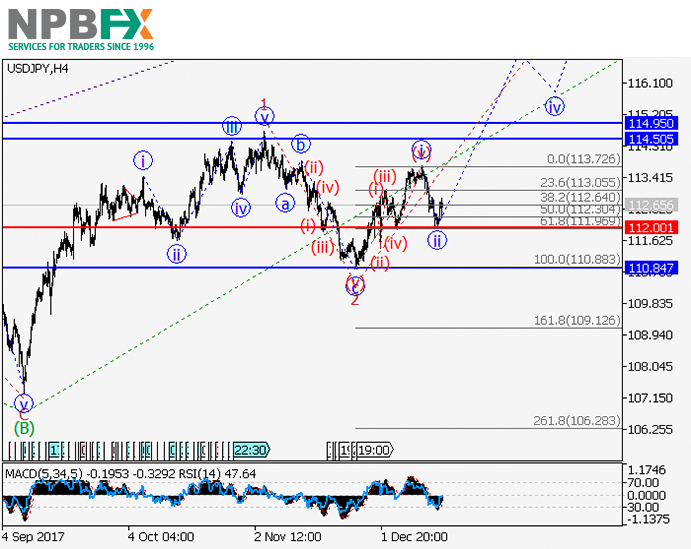

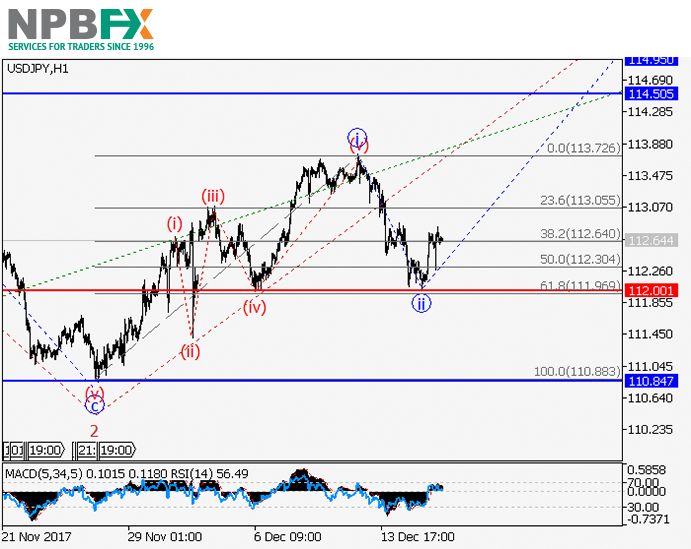

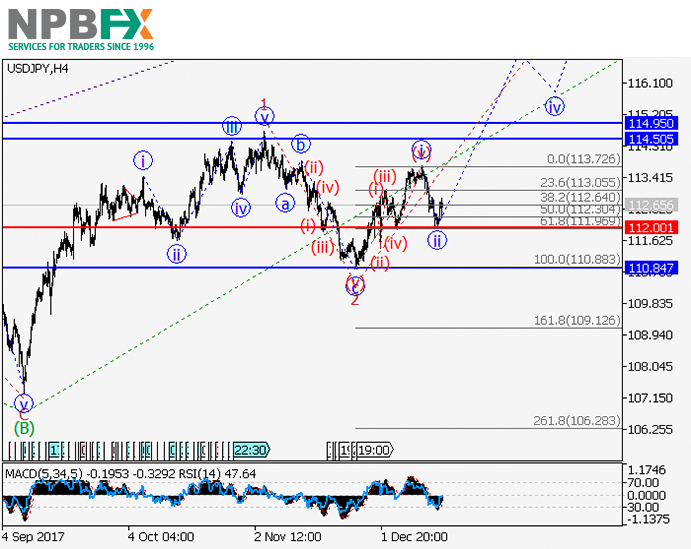

Current trend

The trend is upward.

On the 4-hour chart the wave C of the higher level, within which the formation of the wave 3 of C has begun, is developing. At the moment the first wave of the lower level i of 3 has formed, and the downward correction ii of 3 has ended. If the assumption is correct, the pair will grow to the levels of 114.50–114.95. The level of 112.00 is critical for this scenario.

Main scenario

Long positions will become relevant during the correction, above the level of 112.00 with the targets at 114.50–114.95.

Alternative scenario

The breakdown and the consolidation of the price below the level of 112.00 will let the pair go down to the level of 110.84.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/JPY for a better understanding of the current market situation and more efficient trading.

Current trend

The trend is upward.

On the 4-hour chart the wave C of the higher level, within which the formation of the wave 3 of C has begun, is developing. At the moment the first wave of the lower level i of 3 has formed, and the downward correction ii of 3 has ended. If the assumption is correct, the pair will grow to the levels of 114.50–114.95. The level of 112.00 is critical for this scenario.

Main scenario

Long positions will become relevant during the correction, above the level of 112.00 with the targets at 114.50–114.95.

Alternative scenario

The breakdown and the consolidation of the price below the level of 112.00 will let the pair go down to the level of 110.84.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/JPY and trade efficiently with NPBFX.