Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,097

USD/CHF: wave analysis 07.03.2018

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CHF for a better understanding of the current market situation and more efficient trading.

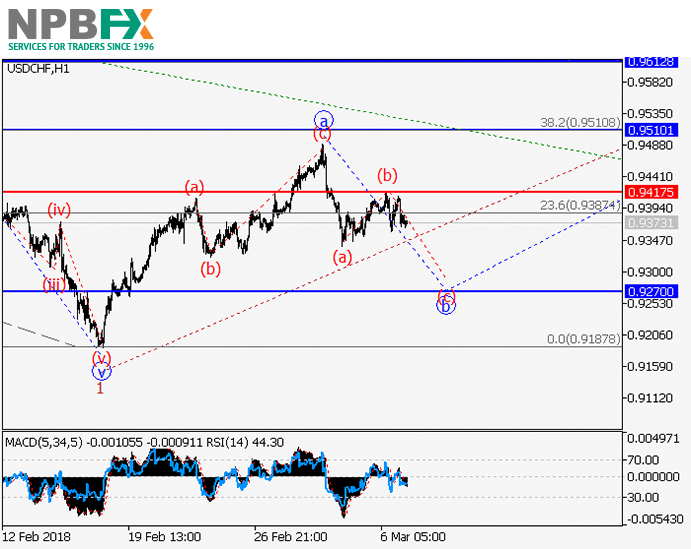

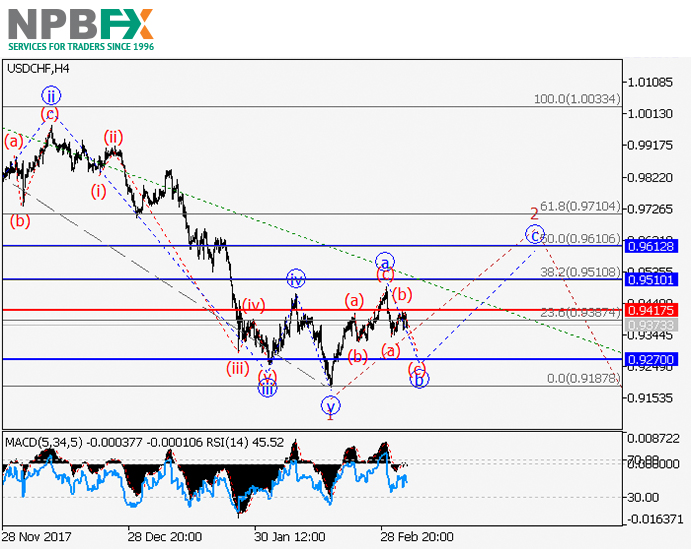

Current trend

The pair can decrease.

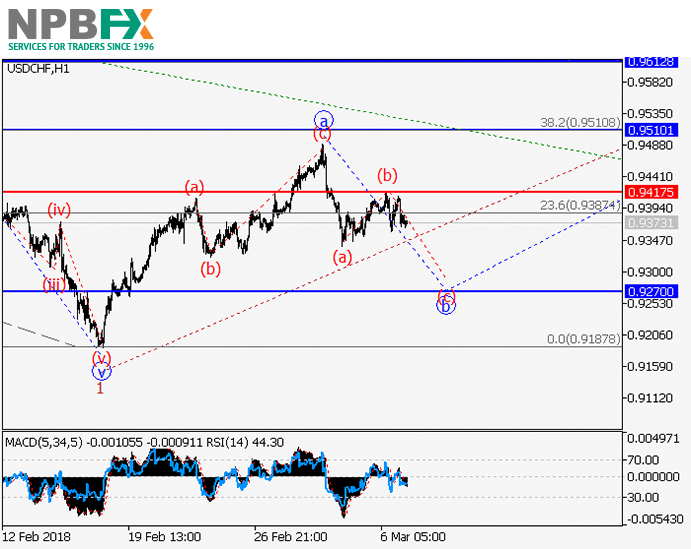

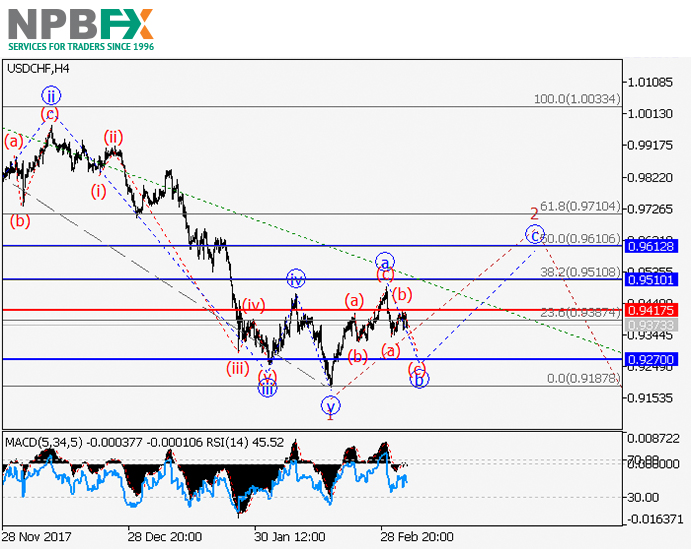

On the 4-hour chart, the upward correction is developing as a wave 2 of (3) of the higher level. Now the wave a of 2 has formed, and the wave b of 2 is developing. If the assumption is correct, the pair will fall to the level of 0.9270. The level of 0.9417 is critical for this scenario.

Main scenario

Short positions will become relevant below the level of 0.9417 with the target at 0.9270.

Alternative scenario

The breakout and the consolidation of the price above the level of 0.9417 will let the pair grow to the levels of 0.9510–0.9612.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on the USD/CHF for a better understanding of the current market situation and more efficient trading.

Current trend

The pair can decrease.

On the 4-hour chart, the upward correction is developing as a wave 2 of (3) of the higher level. Now the wave a of 2 has formed, and the wave b of 2 is developing. If the assumption is correct, the pair will fall to the level of 0.9270. The level of 0.9417 is critical for this scenario.

Main scenario

Short positions will become relevant below the level of 0.9417 with the target at 0.9270.

Alternative scenario

The breakout and the consolidation of the price above the level of 0.9417 will let the pair grow to the levels of 0.9510–0.9612.

Use more opportunities of the NPBFX analytical portal: glossary

Beginning traders certainly face a lot of specialized concepts and lexicon on FOREX, which are often not fully been understood. Swap, tick, hedge, margin calls are often unfamiliar to beginning traders. But the lack of knowledge of these fundamentals make a competent market vision impossible. So glossary on the NPBFX analytical portal could be an excellent helper in this case, which contains all the main definitions with explanations in a compact and accessible form. All concepts are arranged in alphabetical order, so that you can easily and quickly find and explore a new concept for yourself.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on USD/CHF and trade efficiently with NPBFX.