5 Forex Scams Used in EAs, Indicators and Signals - Fake MyFxBook Accounts Scam

Today, we will be discussing fake Myfxbook accounts scam.

I know that many of you believe that if a trading strategy or bot is verified by Myfxbook and shows an upward equity curve, good percentage, and profits, then it must be the “real deal.” You may even think that you’ve found the Holy Grail and that you’ll be rich next month.

Myfxbook is one of the best verification and strategy analysis services. It’s a great tool that I use literally every day. Unfortunately, sellers of trading tools devise all kinds of tricks to outsmart beginners; even experienced traders are fooled sometimes. I have been fooled many times on Myfxbook. A Myfxbook account may look legit at first glance, but when you have a closer look, you realize that it’s fake.

In this article, I will explain how sellers fabricate Myfxbook accounts and reveal the tricks they use to mislead people into thinking that an account is real when it’s actually a demo.

How do you know that a Myfxbook account is fake?

-

Check for unverified claims.

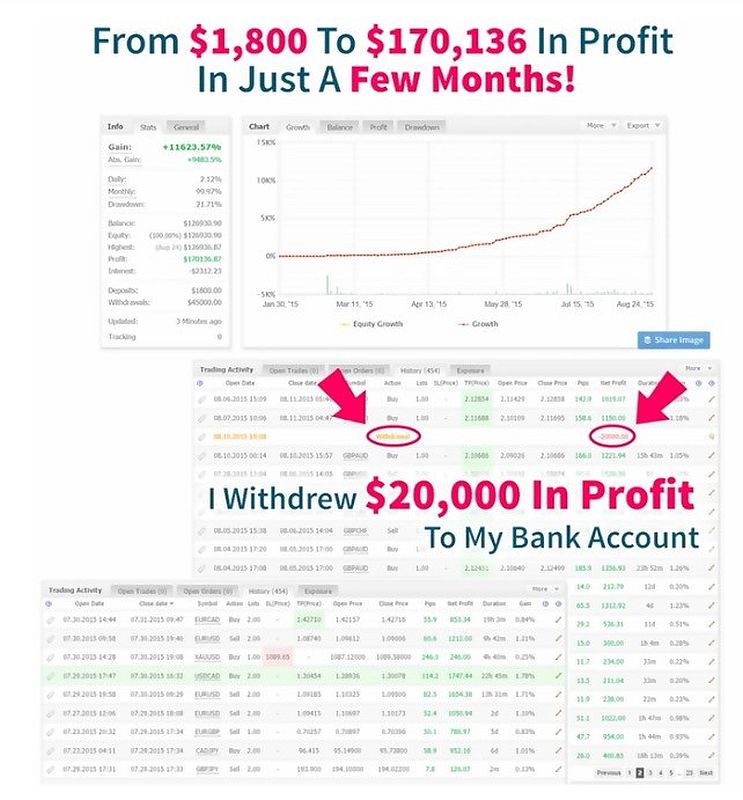

I did a Google search for trading bots and chose one of the first links that popped up. When I clicked on it, I came across the following screenshot:

As you can see, the sellers of this trading bot promise huge profits in a few months, and claim $20,000 in withdrawals. They also show a list of profitable trades. Everything looks great, including the smooth, upward equity graph.

It looks like they got rich between January and August starting with $1,800. However, this is only a screenshot, and there’s no way to verify any of their claims. All this could be fabricated, or they could be showing someone else’s Myfxbook account. Maybe they’ve had only 11.6% growth and changed the numbers. With tools like Photoshop, all these numbers and results can be fabricated; it’s not difficult when you know what to do and how to do it.

Watch Fake MyFxBook Accounts Forex Scam Video #6

-

Check the links to Myfxbook.

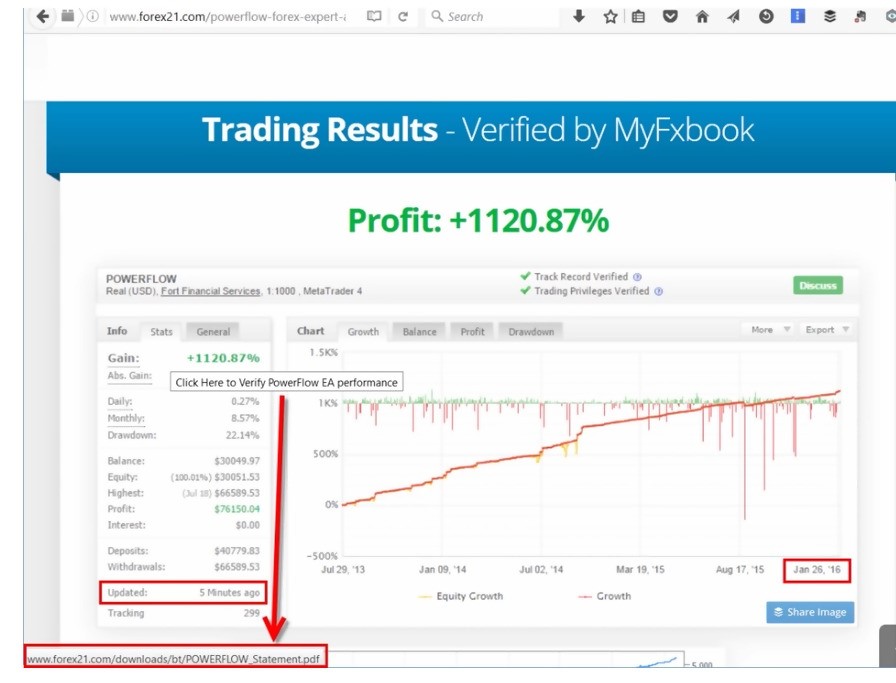

Next time you land on a site that shows Myfxbook results, make sure there is a clickable link to a real Myfxbook account. In the image below, you can see an example of a real Myfxbook account.

It’s a screenshot from my web browser with a real “myfxbook.com” link. The domain name should always be exactly like this; if it’s not, chances are you are on a website with a similar domain or subdomain name. This is how people are fooled into thinking they are inside Myfxbook. Make sure that the results are on the real Myfxbook platform.

Let’s look at another example from another website. I have nothing against these sellers, and they seem to be a reputable company with trading tools that appear to be useful. However, when I look at their results, which they claim have been verified on Myfxbook, it’s not a link to a real Myfxbook account; it’s a PDF document that looks like it was saved from Myfxbook. But there is no proof of that. If it’s not on Myfxbook, there’s no way of knowing that it came from Myfxbook.

Even if this trading record was verified, we’re in October, and they stopped trading in January. So I have to ask: “Why are they not trading? Why they are not showing recent results?” The most likely reason is that their tool does not work.

-

Check if the Myfxbook account is active.

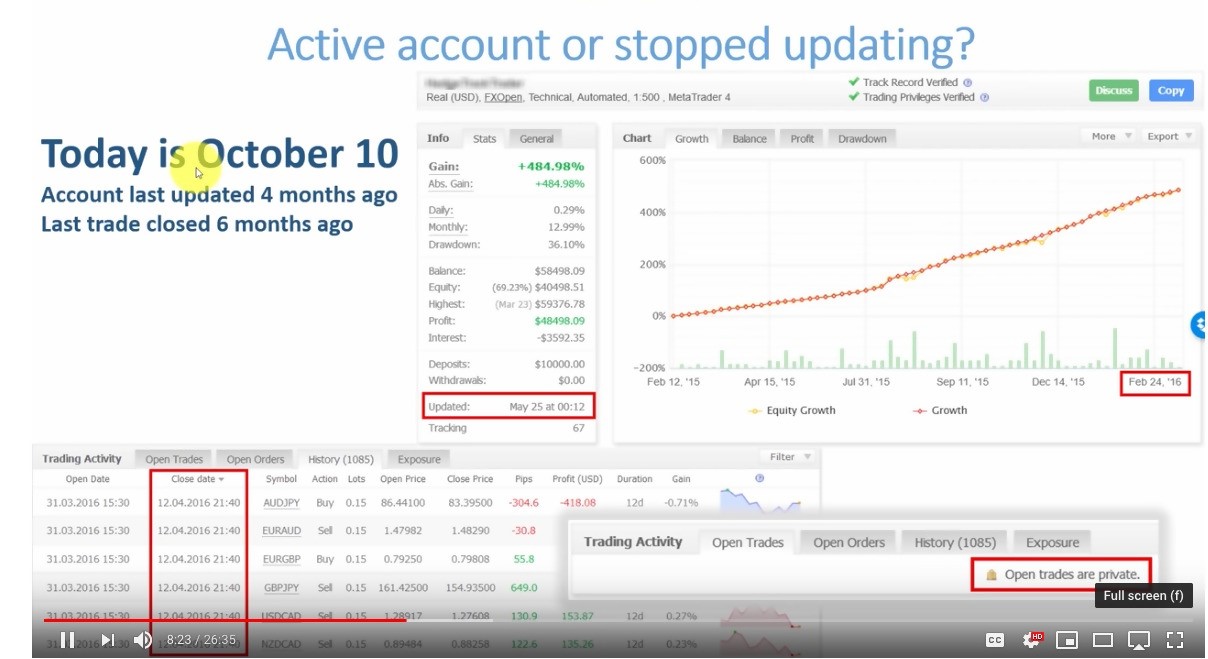

This example is quite common: The seller’s website shows Myfxbook results, maybe even gives a link to Myfxbook, but when you visit their Myfxbook account, you see that trading stopped months ago. In the screenshot below, you can see that they stopped all trades in April and their account was last updated in May; in other words, all the trades were closed one month later.

They have open trades, but they are private. My guess is that they have many open trades that went into a drawdown. To avoid looking bad on Myfxbook, they stopped updating it before the account crashed or whatever the case was. Imagine how bad they would look if they showed one significant drawdown or several recurring ones. Regardless of what the story is, I would treat this as very suspicious. I don’t know whether seasoned traders would take the chance on something like this, but newbies can be fooled. So, always check when the last trades were closed and if the account is active.

There’s another clue that this strategy went into loss. They show 69% equity; it means the account equity dropped down to 69% which means their open trades are currently down by 31%. Most people would not notice that, focusing their attention only the green numbers and nice equity curve. Beware of this trick, and always check if the account is active.

-

Make sure it’s not a backtest.

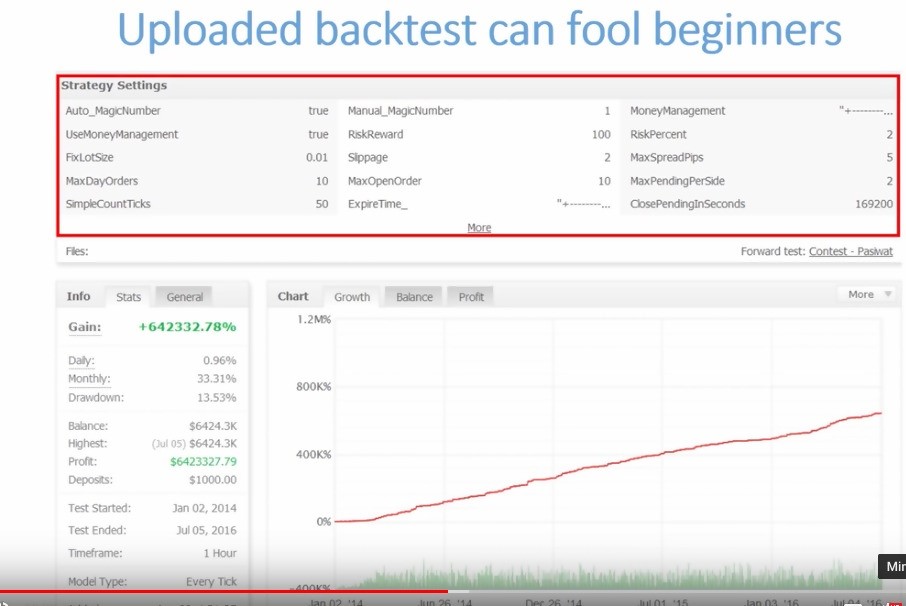

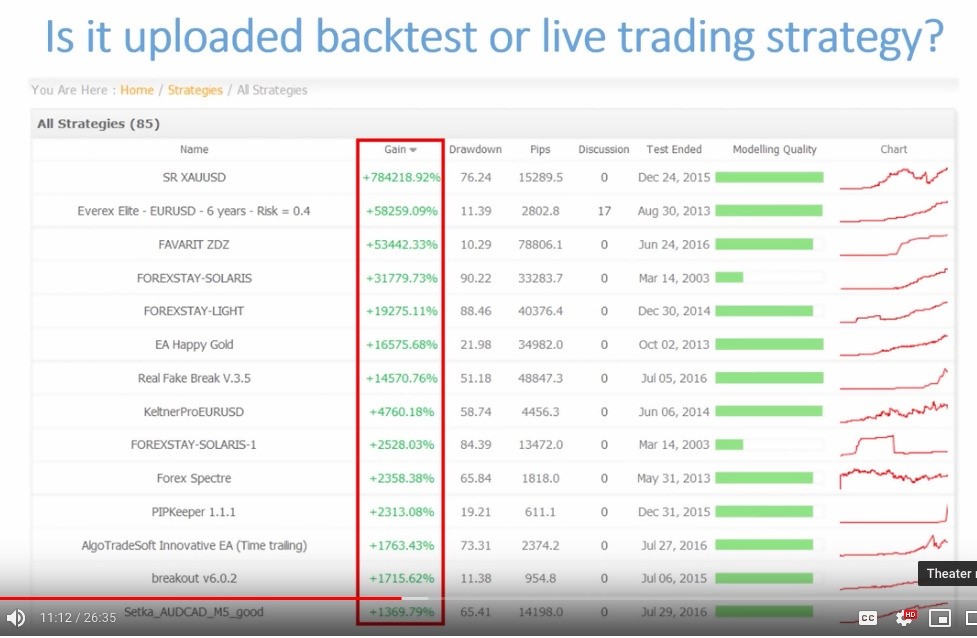

If you see a nice strategy on Myfxbook, check if it’s an uploaded backtest or a live strategy. I would never take backtest results seriously because I have no way of knowing how accurate they are or how they were created. However, while I was doing research for this presentation by visiting various forums, I realized that many people cannot differentiate between real trading accounts, demo accounts, and backtests, which can be fabricated even more easily than live trading accounts. (For more information on backtests, see the previous article [LINK].)

Be aware that, on Myfxbook, there are backtests as well; in fact, it’s a great tool to analyze your backtests. In the above screenshot, you can see an example of an uploaded backtest. All backtests have a panel called “Strategy Settings” at the top. Any time you see that panel above the results, it means it’s a backtest.

Next to the backtest, there is often a forward test. Click on it, and have a look. In my experience, most backtests stop performing well in the forward tests. Always pay attention to this.

-

Check “Track Record” and “Trading privileges.”

Always check whether the “Track Record” and “Trading Privileges” are verified – this is very important. If you’re analyzing a strategy in your own account, then you don’t need to verify them, unless you are trying to prove that your strategy is good or you plan to sell it. It doesn’t make sense showing it to others unless these things verified.

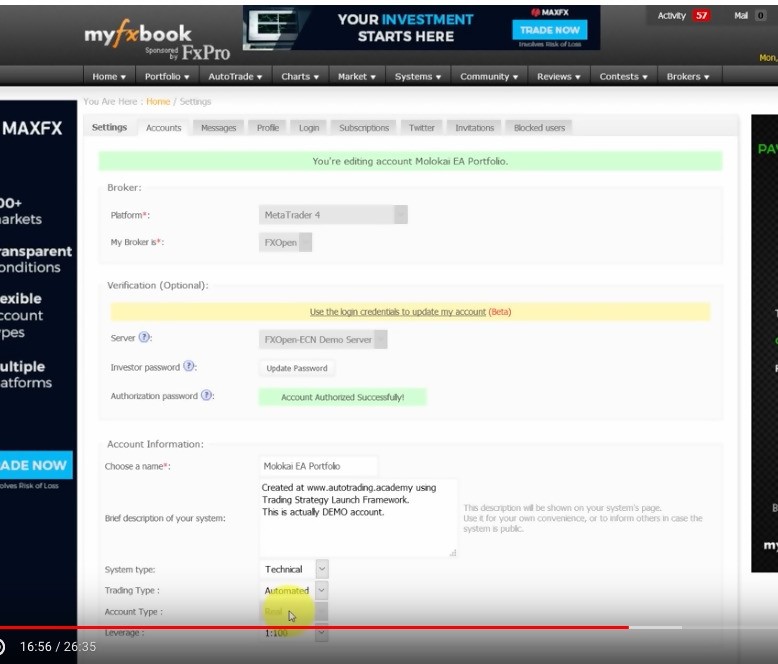

Here’s an example from my Myfxbook account. I uploaded this strategy from my FXOpen demo trading account but set it as a real account – Myfxbook allows you to switch the setting from real to demo and vice versa. If you verify the “Trading Privileges” – which is possible after you give Myfxbook investor password, Myfxbook claims that it detects whether the account is real or a demo and switches automatically to the correct setting. So, I was expecting Myfxbook to detect that it was a demo account, but it did not. This means someone can fool people that their demo account is real.

I used to think that “Trading Privileges” means that the trader owns the account and that it’s real; now I’m beginning to think that it means that the trader has full access to this MetaTrader4 account and nothing more. In other words, they can trade in it personally, or have someone trade on their behalf using their main MetaTrader4 password.

The above screenshot shows a real trading account with verified “Trading Privileges.” However, when I switch to the “Settings” window, I see that it’s a demo account; it’s connected to the FXOpen Demo Server. And I cannot change it back to demo; the option is disabled. I do not want to fool anyone, I wrote into the “Comments” field that this is a demo account.

So, remember, even if you see that an account is real and that trading privileges are verified, that may not be true. This Myfxbook bug might be fixed by now, but you never know.

-

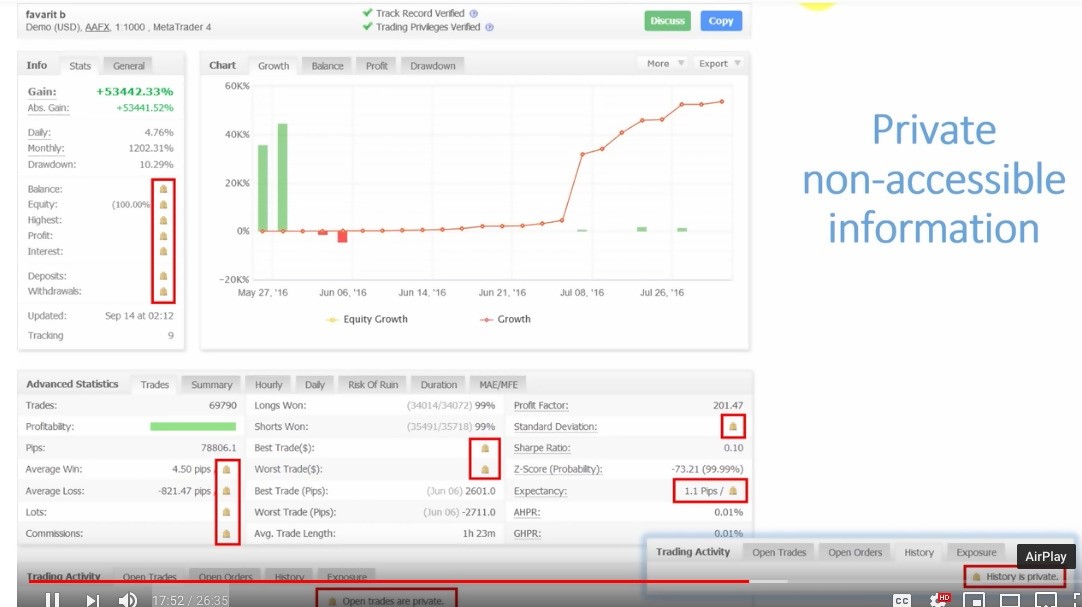

Be wary of private information.

Always avoid Myfxbook accounts with private and non-accessible information. I don’t mind seeing private open orders (meaning pending orders which have not been triggered), because if someone is showing open orders in Myfxbook account, other people may copy them.

In the above screenshot, balance, equity, and highest point are hidden. All they show are enormous gains. If I had such a trading strategy, I would be retired and living on a tropical island. Imagine what a monthly 1,200% profit can do for you even if you started with a $1,000 investment!

I’m sure they are hiding that information for a reason. Perhaps they started with $10 and got lucky on their first few trades, then risked with large lots. That’s a good reason to hide their history and lot sizes. They may be hiding their open trades because they are running in loss.

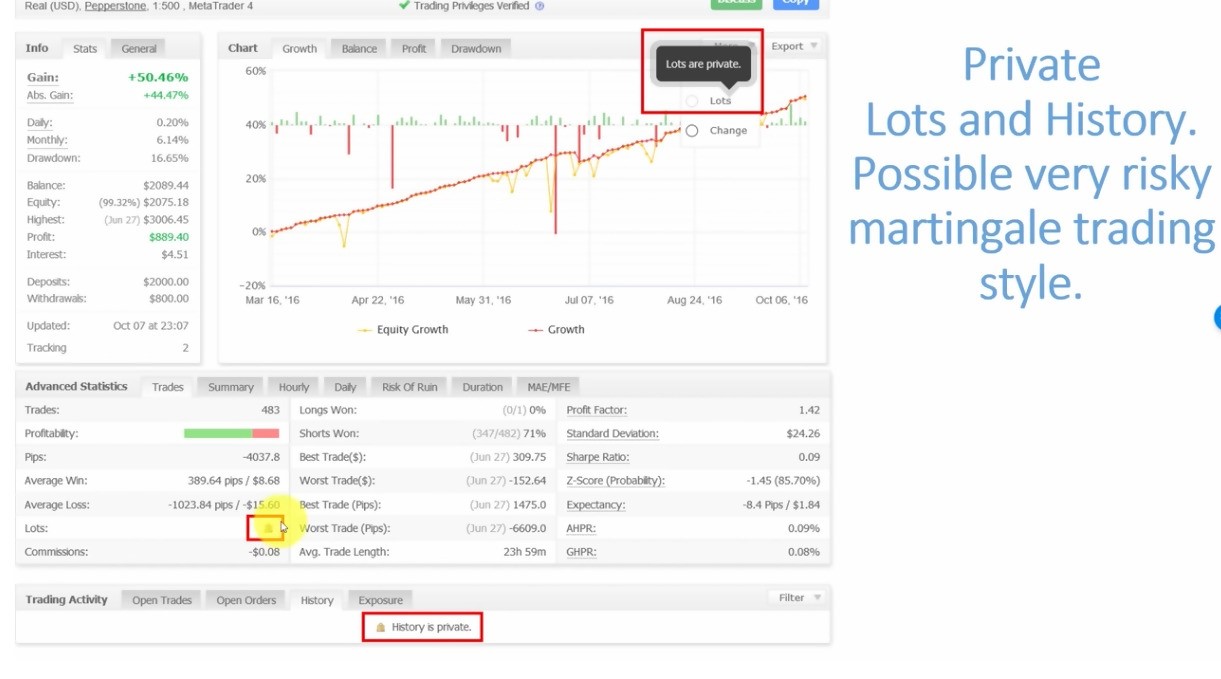

Don’t trust anything you see in a Myfxbook account with private information – even if one small thing is hidden, as in the example below. Here they show everything, balance, and profits, except history and lot sizes. The only reason I can think of why anyone would hide lot sizes is because they are using a Martingale strategy or something similar.

The only way to survive the massive equity drops that you see in the above screenshot is bigger lot sizes, for example, if you go into a drawdown and have one last lucky try. If it hits profit, the account can recover from all those open positions in loss. Then you can close them and continue trading.

If people saw huge lot sizes, they would know that it’s foolish to use this strategy. But if the sellers keep their history and lots private, they can trick people. The bottom line is that if something private, they are trying to hide something ugly.

-

Check metrics like “Gain” vs. “Absolute Gain.”

Make sure you look at metrics like “Gain” and “Absolute Gain.” This would not fool everyone, but newbie traders might be misled.

In the screenshot below you can see an example from one of my trading accounts. I wasn’t trying to fool anyone but, when this happened naturally, I understood what “Gain” and “Absolute Gain” mean.

You can see that my “Gain” is 103%. Since I doubled my account in one year, I deposited another $100 into this account, so now it shows deposits of $200. My “Gain” stayed the same because it was real – I started with $100 and I doubled it. Now, it shows an “Absolute Gain” of 59%. That’s because it recalculated the “Gain” to include the new deposit.

Always keep in mind that “Gain” shows the first growth from the initial deposit and that “Absolute Gain” shows the growth from the deposit currently available in the account. This is how people can trick others into thinking that they have excellent trading results.

In closing...

I will wrap up with a summary of the signs and clues that a Myfxbook account may be fake:

- Don’t trust a non-clickable screenshot of Myfxbook portfolio.

- Don’t trust an account that has not been updated for a long time.

- Don’t trust an account that has been updated recently but trading ended months ago.

- Don’t trust an account when “Track Record” and “Trading Privileges” are not verified.

- Don’t trust it if Myfxbook says that it’s a real account when “Trading Privileges” are not verified. It could be a demo.

- Don’t trust it if information like balance, equity, profit, lots, open trades, and history are hidden.

- If “Gain” and “Absolute Gain” do not match, this may indicate fake results or a lucky shot in a $10 or $50 account. Ask the seller why “Gain” and “Absolute Gain” do not match.

- If you see an account that uses a “Custom Start Date,” this may indicate that the results are fake. However, a “Custom Start Date” might be used not necessarily to fool anyone. It might be that the trader could not open a new trading account – for example, Hot Forex has a 5 real trading account limit. Or it could be that the account has not been used for months and then the trader starter using a different strategy.

When you are checking the things on this list, keep in mind that the last two clues do not necessarily mean that it’s a fake Myfxbook account, unless these things were done intentionally to fool people.

I hope that you’ve found this article helpful and that you’ll join me for the next one where I look at MT4 Expert Advisor Scams.

Editor's Note: The original video on this page was produced by Rimantas Petrauskas. The text version was prepared by the FPA. The text follows the primary concepts in the video, but has a number of differences in wording.Comments

1. Demos were phased out years ago. The FPA checks to make certain all submitted accounts are real. If a broker offers cent accounts, the FPA checks to verify the exact amount of money deposited.

2. The only things which can be hidden are the name on the account, the account number, pending trades, and open trades. To prevent hidden open trades from being used to leave trades open forever, the FPA always displays floating profit/loss. Lot size, deposit size, whether stop losses are used, and more are all displayed and can never be hidden.

3. If an account doesn't trade for an extended period, the FPA contacts the company to ask what's going on. If the account continues to not trade, the test is stopped.

4. There is no option for a custom start date. The start date is when the account is opened.

5. If a company has other tests which are in major drawdown or which failed, the minimum balance for submitting new tests goes up. This applies whether those tests are active or stopped.

6. Because some companies were trying to manipulate results with carefully calculated deposits and withdrawals, the FPA uses a time-weighted system to minimize the impact of deposits and withdrawals on trading statistics.

7. Tests cannot later be "made private" once they are listed.

1. Demos were phased out years ago. The FPA checks to make certain all submitted accounts are real. If a b..

Thanks for this information. I really need to find some time and upload my strategies on FPA testing system too.

I really love no. 2. It's good to know you protect traders by hiding their pending orders/open positions and at the same time protect investors by showing them floating Profit/Loss. I think that's the way to go!

I have tried to repeat this again with another account and it did not work. So it could be Myfxbook fixed this already. But still we do not know how many accounts there can be actually demo accounts even if they appear as real accounts.

My thoughts exactly. The fact that they have changed that account to DEMO later kind of tells they are working on such things.

But still uncertainty does not go anywhere and we cannot be sure 100% anymore whether real accounts on Myfxbook are really real accounts.

Thank you for your comment. I am glad you like my work ;-)

Thanks, Dave. You too have a great Xmas holiday ;-)

1. Demos were phased out years ago. The FPA checks to make certain all submitted accounts are real. If a b..

Just gotta be careful with the last two.

Many thanks for the useful information. I’m always impressed about how you show the importance of many small details. I’ve been wondering the difference between gains and absolute gains, for example.

All the Best!

The difference in Gain and Abs. Gain appears when account is funded with more money later after some trading is done already.

Imagine if you double your $100 account bringing account balance to $200 total and then you fund additional $10k.

For many people it might look that you've doubled your 10k account, but it's actually not the case.

Hope it helps.

The difference in Gain and Abs. Gain appears when account is funded with more money later after some trading is done already.

Imagine if you double your $100 account bringin..

Dear Mr.Rimantas

Myfxbook risk disclosoure says the live account results will be always muchworser than demo ones, i am afraid from this.

Is it advisible to use myfxbook auto trade systems?

Myfxbook risk disclosoure says the live account results will be always muchworser than demo ones, i am afraid from this.

Is it advisible to use myfxbook auto trade systems?

I haven't used their autotrade systems, so honestly I cannot comment on this. I cannot recommend anything I didn't use myself.

It's quite usual thing that in the "sandbox" (or demo account) things tend to go easier comparing with live trading environment. And Myfxbook is required to explain this, because there's such possibility that live account will perform worse than demo account.

It's quite usual thing that in the "sandbox" (or demo account) things ten..

Thanks a lot for your prompt response,

Sorry for bothering you,

For auto trading, do you know other options than myfxbook,

From your company do you have any autotrading systems?

Sorry for bothering you,

For auto trading, do you know other options than myfxbook,

From your company do you have any autotrading systems?

To be honest, I trust only automated systems created by myself. And I actually teach the creation process in Autotrading Academy's famous "Trading Strategy Launch Framework" training program. You can learn about it in our webinar.

Webinar about Algotrading strategy development without programming.

I do have my own automated systems too, but I mostly use them on my own trading accounts. However I have a few available to public.

PM me for more information.

nice to know.

Where can I see live test results of his software? Is it available for demo testing on my trading platform? (tickmill or hotforex).

I know some really easy ways to tell apart cr@p from good software in 2-3 days of trading. Let me know if its available for test

Me and some friends are about to put significant money into a bot listed on myfxbook that looks good. Most checks out but I am just wondering about the "verified" status. It has hourly trading updates ( I have been testing with $10K for 6 weeks now and it is working) the only point of concern is that the history is NOT checked as verified. Is this cause for concern or reason to RUN? THANKS

No matter how tempting some service (EA, signal, whatever) is, no matter what evidence it has of success, always start out on demo or with a VERY small live account and observe carefully until you are SURE that the product does what it claims without pulling any surprise stunts like being a Martingale when price moves hard against open positions.