FxGrow Support

Recruit

- Messages

- 58

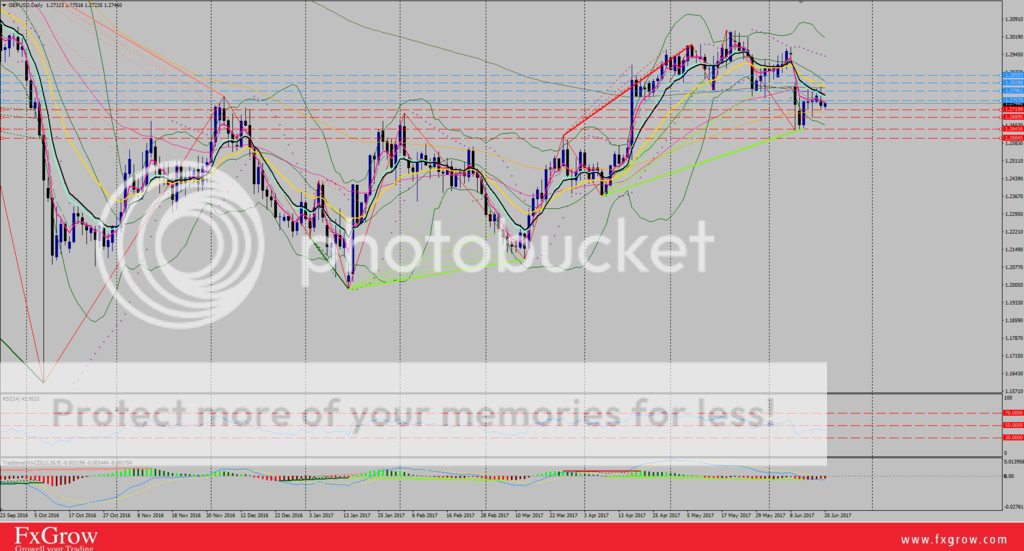

FxGrow Daily Technical Analysis – 13th June, 2017

By FxGrow Research & Analysis Team

Gold Technical Overview Ahead Of U.S Data

Currently gold is trading 1263 after plunging today to 1261.68 low and peeking to 1267.12. Overall, signs of bearish momentum persists for the precious metal but U.S data today and major FOMC statement tomorrow will give a better outlook on how gold will trade for the coming days. Closing above 1265 (R1) with a penetration for R2 1269.50 will re-embrace bullish momentum with additional attacks towards R3 at 1274.17.

The other scenario (currently preferable), gold broke below 1265 and tested first support level at 1261.54, in case of penetration, next ...

For more in depth Research & Analysis please visit FxGrow.https://goo.gl/VF1EEp

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.

By FxGrow Research & Analysis Team

Gold Technical Overview Ahead Of U.S Data

Currently gold is trading 1263 after plunging today to 1261.68 low and peeking to 1267.12. Overall, signs of bearish momentum persists for the precious metal but U.S data today and major FOMC statement tomorrow will give a better outlook on how gold will trade for the coming days. Closing above 1265 (R1) with a penetration for R2 1269.50 will re-embrace bullish momentum with additional attacks towards R3 at 1274.17.

The other scenario (currently preferable), gold broke below 1265 and tested first support level at 1261.54, in case of penetration, next ...

For more in depth Research & Analysis please visit FxGrow.https://goo.gl/VF1EEp

Note: This analysis is intended to provide general information and does not constitute the provision of INVESTMENT ADVICE. Investors should, before acting on this information, consider the appropriateness of this information having regard to their personal objectives, financial situation or needs. We recommend investors obtain investment advice specific to their situation before making any financial investment decision.