victoriajensen

Private, 1st Class

- Messages

- 1,117

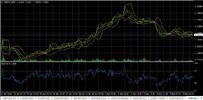

Consolidation continued today and the pair is still testing 1.1400. If it breaks below it next target will be around 1.1350. On the other hand, if it bounces off the support it will likely start climbing towards 1.1500 or even 1.1600 again.