honeill

Sergeant

- Messages

- 1,126

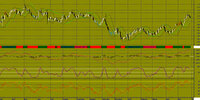

On yesterday session, the EURUSD initially tried to rise but found enough resistance at 1.1237 to erase all its gains and closed near the low of the day, however managed to close within Wednesday’s range, which suggests being slightly on the bearish side of neutral.

The currency pair is trading above the 10, 50, and 200-day moving averages that should provide dynamic support.

The key levels to watch are: a Fibonacci extension at 1.1291, a daily resistance at 1.1237, the 10-day moving average at 1.1180 (support), a daily support at 1.1097, previous wing high at 1.1021 (support) and a key level at 1.0970 (support).

The currency pair is trading above the 10, 50, and 200-day moving averages that should provide dynamic support.

The key levels to watch are: a Fibonacci extension at 1.1291, a daily resistance at 1.1237, the 10-day moving average at 1.1180 (support), a daily support at 1.1097, previous wing high at 1.1021 (support) and a key level at 1.0970 (support).